Vat Actupdated - RS Goyal & Associates

Vat Actupdated - RS Goyal & Associates

Vat Actupdated - RS Goyal & Associates

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

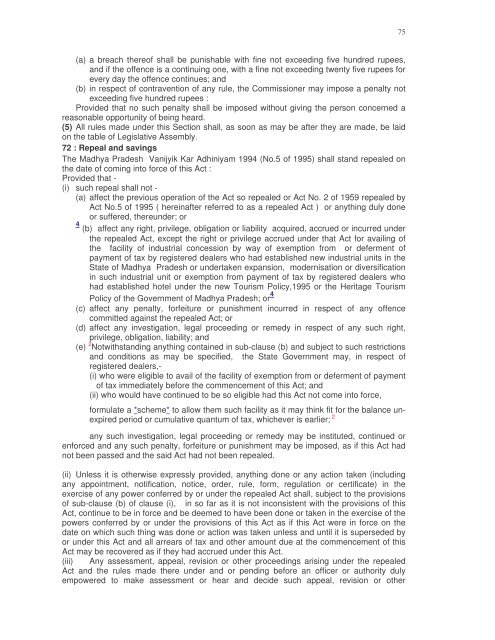

75<br />

(a) a breach thereof shall be punishable with fine not exceeding five hundred rupees,<br />

and if the offence is a continuing one, with a fine not exceeding twenty five rupees for<br />

every day the offence continues; and<br />

(b) in respect of contravention of any rule, the Commissioner may impose a penalty not<br />

exceeding five hundred rupees :<br />

Provided that no such penalty shall be imposed without giving the person concerned a<br />

reasonable opportunity of being heard.<br />

(5) All rules made under this Section shall, as soon as may be after they are made, be laid<br />

on the table of Legislative Assembly.<br />

72 : Repeal and savings<br />

The Madhya Pradesh Vanijyik Kar Adhiniyam 1994 (No.5 of 1995) shall stand repealed on<br />

the date of coming into force of this Act :<br />

Provided that -<br />

(i) such repeal shall not -<br />

(a) affect the previous operation of the Act so repealed or Act No. 2 of 1959 repealed by<br />

Act No.5 of 1995 ( hereinafter referred to as a repealed Act ) or anything duly done<br />

or suffered, thereunder; or<br />

4 (b) affect any right, privilege, obligation or liability acquired, accrued or incurred under<br />

the repealed Act, except the right or privilege accrued under that Act for availing of<br />

the facility of industrial concession by way of exemption from or deferment of<br />

payment of tax by registered dealers who had established new industrial units in the<br />

State of Madhya Pradesh or undertaken expansion, modernisation or diversification<br />

in such industrial unit or exemption from payment of tax by registered dealers who<br />

had established hotel under the new Tourism Policy,1995 or the Heritage Tourism<br />

Policy of the Government of Madhya Pradesh; or 4<br />

(c) affect any penalty, forfeiture or punishment incurred in respect of any offence<br />

committed against the repealed Act; or<br />

(d) affect any investigation, legal proceeding or remedy in respect of any such right,<br />

privilege, obligation, liability; and<br />

(e) 2 Notwithstanding anything contained in sub-clause (b) and subject to such restrictions<br />

and conditions as may be specified, the State Government may, in respect of<br />

registered dealers,-<br />

(i) who were eligible to avail of the facility of exemption from or deferment of payment<br />

of tax immediately before the commencement of this Act; and<br />

(ii) who would have continued to be so eligible had this Act not come into force,<br />

formulate a *scheme* to allow them such facility as it may think fit for the balance unexpired<br />

period or cumulative quantum of tax, whichever is earlier; 2<br />

any such investigation, legal proceeding or remedy may be instituted, continued or<br />

enforced and any such penalty, forfeiture or punishment may be imposed, as if this Act had<br />

not been passed and the said Act had not been repealed.<br />

(ii) Unless it is otherwise expressly provided, anything done or any action taken (including<br />

any appointment, notification, notice, order, rule, form, regulation or certificate) in the<br />

exercise of any power conferred by or under the repealed Act shall, subject to the provisions<br />

of sub-clause (b) of clause (i), in so far as it is not inconsistent with the provisions of this<br />

Act, continue to be in force and be deemed to have been done or taken in the exercise of the<br />

powers conferred by or under the provisions of this Act as if this Act were in force on the<br />

date on which such thing was done or action was taken unless and until it is superseded by<br />

or under this Act and all arrears of tax and other amount due at the commencement of this<br />

Act may be recovered as if they had accrued under this Act.<br />

(iii) Any assessment, appeal, revision or other proceedings arising under the repealed<br />

Act and the rules made there under and or pending before an officer or authority duly<br />

empowered to make assessment or hear and decide such appeal, revision or other

![levy of tax under vat 9b an stamp duty simultaneously[1] - RS Goyal ...](https://img.yumpu.com/45559052/1/158x260/levy-of-tax-under-vat-9b-an-stamp-duty-simultaneously1-rs-goyal-.jpg?quality=85)

![[2012] 54 VST 26 (P and H) - RS Goyal & Associates](https://img.yumpu.com/38348208/1/190x245/2012-54-vst-26-p-and-h-rs-goyal-associates.jpg?quality=85)

![[2012] 47 vst 116 (cestat) - RS Goyal & Associates](https://img.yumpu.com/38348091/1/190x245/2012-47-vst-116-cestat-rs-goyal-associates.jpg?quality=85)

![[2012] 47 VST 379 (Ker) - RS Goyal & Associates](https://img.yumpu.com/38348087/1/190x245/2012-47-vst-379-ker-rs-goyal-associates.jpg?quality=85)