TA/DA and Journey - HIPA

TA/DA and Journey - HIPA

TA/DA and Journey - HIPA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>TA</strong>/<strong>DA</strong> <strong>and</strong><br />

<strong>Journey</strong><br />

Dr. Rekha Shrivastava

1. <strong>TA</strong>- Travelling Allowance-<br />

• Travelling Allowance is an allowance granted to<br />

a Govt. Employee to meet the personnel<br />

expenditure on travelling where a duty is<br />

performed.<br />

• <strong>TA</strong> is admissible to GS for any purposeful<br />

journey i.e.<br />

- whether on official tour<br />

- or on transfer<br />

- or to appear for an departmental<br />

examination

2. Daily Allowance-<br />

• It is a contingent expenditure such as expenditure on<br />

food, breakfast, lunch, dinner etc.<br />

• <strong>DA</strong> may be drawn upto 10 days only<br />

• However, the Competent Authority may grant the<br />

Individual exemption if it is in the interest of public<br />

service.<br />

• If a Govt. Employee on tour is allowed free board &<br />

lodging at the expense of Central & State Govt. He may<br />

draw only 1/4 th of the <strong>DA</strong> admissible at particular station.<br />

• However, if either boarding or lodging is allowed free, the<br />

Govt. Employee may draw <strong>DA</strong> at ½ of the admissible<br />

rate.<br />

• Day means - a calendar day beginning <strong>and</strong> ending at<br />

mid-night.

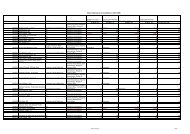

Revised Rates of Travelling Allowance<br />

A. Pay Range<br />

Grade-I<br />

Grade-II<br />

Grade-III<br />

Grade-IV<br />

Office drawing Grade Pay of Rs. 10,000 or<br />

above <strong>and</strong> those who are in the pay b<strong>and</strong> of<br />

HAG+ or above<br />

Officers drawing Grade Pay of Rs. 8,900 to<br />

9,800.<br />

Officers drawing Grade Pay of Rs. 4,600 to<br />

8,800.<br />

Officials/Officers drawing Grade Pay of Rs.<br />

2,500 to 4,200.

C. Rate(s) of Daily Allowance:<br />

(i) The revised rate(s) of daily allowance for different places<br />

would be as under:<br />

Grade<br />

Gr. I (Gr. Pay 10000<br />

<strong>and</strong> above)<br />

Gr. II<br />

(Gr. Pay 8900-9800)<br />

Gr.III<br />

(Gr. Pay 4600-8800)<br />

Gr. IV<br />

(Gr. Pay 2500-4200)<br />

In any town/city in<br />

Haryana including<br />

Ch<strong>and</strong>igarh<br />

Rs. 300/- per day<br />

Rs. 240/- per day<br />

Rs. 200/- per day<br />

Rs. 160/- per day<br />

In any town/city<br />

outside<br />

Haryana/Ch<strong>and</strong>igarh<br />

Rs. 500/- per day<br />

Rs. 400/- per day<br />

Rs. 300/- per day<br />

Rs. 200/- per day

(ii) In the case of travel by Government<br />

vehicle/staff car, half/full daily allowance will<br />

be admissible for a period of absence<br />

mentioned below:-<br />

(i) Where absence from<br />

Headquarters is for less than 06<br />

hours<br />

(ii) Where absence from<br />

Headquarter is for 06 hours or<br />

more but less than 12 hours<br />

(iii)<br />

Where absence is for more than<br />

12 hours but less than 24 hours<br />

No<br />

allowance<br />

Half<br />

allowance<br />

Full<br />

allowance<br />

daily<br />

daily<br />

daily

D. Entitlement of Reimbursement of Hotel<br />

Charges/Commercial Guest Houses accommodation plus<br />

Daily Allowance at any place in the country outside<br />

Haryana/Ch<strong>and</strong>igarh<br />

Grade<br />

Gr. I (Gr. Pay 10000<br />

<strong>and</strong> above)<br />

Gr. II<br />

(Gr. Pay 8900-9800)<br />

Gr.III<br />

(Gr. Pay 4600-8800)<br />

Gr. IV<br />

(Gr. Pay 2500-4200)<br />

Entitlement of Reimbursement of Hotel<br />

Charges/Commercial Guest Houses<br />

accommodation plus Daily Allowance.<br />

Upto Rs. 5,000/- per day plus <strong>DA</strong> of Rs.<br />

500/- per day<br />

Upto Rs. 4,000/- per day plus <strong>DA</strong> of Rs.<br />

400/- per day<br />

Upto Rs. 3,000/- per day plus <strong>DA</strong> of RS.<br />

300/- per day<br />

Upto Rs. 2,000/- per day plus <strong>DA</strong> of Rs.<br />

160/- per day

3. Daily Allowance during Holidays-<br />

• <strong>DA</strong> is not admissible for Sunday or<br />

other holidays.<br />

• However, if a GS is actually in Camp<br />

on such a holiday, he can draw <strong>DA</strong>.<br />

4. Casual Leave taken while on tour<br />

• Any GS who takes CL when on tour<br />

whether for full day or half day is not<br />

entitled to draw <strong>DA</strong> for such day or<br />

days.

5. Conveyance charges<br />

• If a GS is sent on duty to a place at some<br />

distance, the person is allowed the actual<br />

expenditure spent in travelling (eg. Hiring<br />

conveyance etc.)<br />

• However, it is permissible only, if the Head of<br />

the office certifies-<br />

- that the expenditure was actually incurred.<br />

- that it was unavoidable.<br />

- that it is within the prescribed limit<br />

- that no other remuneration will be allowed.

6. Travelling Allowance for <strong>Journey</strong><br />

A. Under rule 2.53 of the Pb. <strong>TA</strong> rules, <strong>TA</strong> is<br />

not admissible if a journey is undertaken<br />

to join the first appointment or for<br />

procuring the Medical Certificate of<br />

fitness on first entry into service.<br />

B. <strong>TA</strong> may also be allowed to a pensioner or<br />

a retrenched employee when reappointed<br />

to a Govt. Serviced by the<br />

Appointing Authority at tour rates.<br />

However, nothing is allowed for halts<br />

during journey.

B. Entitlement of Mode of <strong>Journey</strong> while on tour within<br />

India/out of India<br />

Grade<br />

Gr. I (Gr. Pay<br />

10000 <strong>and</strong> above)<br />

Gr. II<br />

(Gr. Pay 8900-<br />

9800)<br />

<strong>Journey</strong> by Air<br />

1<br />

First class it out of<br />

India.<br />

Business/Club Class if<br />

within India<br />

By Sea or River<br />

Steamer<br />

2<br />

By Train<br />

Highest Class AC Ist class or<br />

Executive Class<br />

3<br />

By Road<br />

4<br />

AC Bus<br />

including<br />

Volvo<br />

Economy Class (within Highest Class AC Ist class or AC Bus<br />

or out of India) Executive Class including<br />

Volvo<br />

Gr.III<br />

(Gr. Pay 4600-<br />

8800)<br />

Economy Class (within<br />

or out of India) subject<br />

to prior approval of<br />

Admn. Secrecy/HOD<br />

for each <strong>Journey</strong><br />

If 2 Classes by<br />

lower, if 3 by<br />

middle, if 4<br />

classes by third<br />

class.<br />

Gr. IV<br />

(Gr. Pay 2500-<br />

4200)<br />

Economy Class (Out of<br />

India only)<br />

As above to Gr.<br />

III employees<br />

AC III tier or Non<br />

AC chair car<br />

Ordinary<br />

Bust/Deluxe<br />

Bus

B. Entitlement of <strong>Journey</strong> by road by a Mode other than<br />

Public Transport while on tour within India:-<br />

Grade<br />

Gr. I (Gr. Pay<br />

10000 <strong>and</strong><br />

above)<br />

Gr. II<br />

(Gr. Pay 8900-<br />

9800)<br />

Gr.III<br />

(Gr. Pay 4600-<br />

8800)<br />

Gr. IV<br />

(Gr. Pay 2500-<br />

4200)<br />

<strong>Journey</strong> by<br />

Taxi/Auto rickshaw<br />

1<br />

By own<br />

conveyance<br />

2<br />

By Road Mileage<br />

AC Taxi By own Car Rs. 10/- pkm (for<br />

own Car/AC taxi Rs.<br />

8/- pkm for Non-Ac<br />

Taxi.<br />

AC Taxi By own Car Rs. 10/- pkm (for<br />

own Car/AC taxi Rs.<br />

8/- pkm for Non-Ac<br />

Taxi.<br />

Non AC Taxi (with<br />

prior approval of the<br />

Admn. Secy/ HOD<br />

for each journey)<br />

At prescribed rates<br />

of autorickshaw<br />

when journey is<br />

actually performed<br />

by autorickshaw with<br />

prior approval of the<br />

HOD for each<br />

journey.<br />

By own Car<br />

(with prior<br />

approval of the<br />

Admn. HOD for<br />

each journey)<br />

By own<br />

Scooter/motor<br />

cycle (with prior<br />

approval of the<br />

Admn. HOD for<br />

each journey)<br />

3<br />

Rs. 6/- pkm (for on<br />

scooter/motorcycle<br />

or by autorickshaw)<br />

Rs. 6/- pkm (for own<br />

Scooter/Motor<br />

cycle or by<br />

autorickshaw<br />

Local <strong>Journey</strong> within<br />

or out side the state<br />

4<br />

AC/Non AC Taxi<br />

charges of upto 50<br />

kms. Per day for travel<br />

within the city.<br />

AC/Non AC Taxi<br />

charges of upto 50<br />

kms. Per day for travel<br />

within the city.<br />

Travel charges @ 6/-<br />

PKM limited to Rs.<br />

100/- per day for travel<br />

within the city.<br />

Travel charges @ 6/-<br />

pkm limited to Rs. 100/-<br />

per day for travel within<br />

the city.

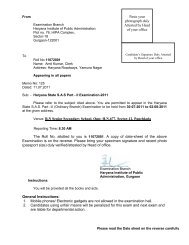

7. <strong>Journey</strong> for Examination<br />

A GS is entitled to draw <strong>TA</strong> at tour rates for<br />

to <strong>and</strong> fro (the place at which he appears<br />

for exam) only if it is-<br />

• A departmental examination<br />

• Any other exam specified by the<br />

competent authority.<br />

• <strong>TA</strong> not to be drawn more than twice for<br />

any particular examination.

8. <strong>Journey</strong> on Retirement<br />

• A Govt. Servant on retirement may<br />

be allowed fair according to his<br />

entitlement at that time.<br />

• He may draw the fair in respect of<br />

self <strong>and</strong> members of his family.<br />

• Plus the actual cost of transporting.<br />

• From the last station of his duty to<br />

his home town.

Admissible Concession for <strong>Journey</strong> of GS<br />

1. By the shortest route from the last place of duty to his<br />

home town<br />

2. The place declared by the GS would be treated as<br />

his home town for the purpose of leave travel<br />

concession (LTC)<br />

3. The place as his home town will be one which is<br />

entered in his service book or other service record.<br />

4. If a Govt. Employee wishes to settle down not in<br />

home town but some other place, he is permitted to<br />

avail the concession upto that place only.<br />

- Only if the amount reimbursable remains same or<br />

does not exceed to an amount which is<br />

admissible had he actually proceeded to his<br />

home town.

5. The concession will be admissible to the<br />

retired employee.<br />

6. <strong>TA</strong> can not be claimed <strong>and</strong> will not be<br />

payable in respect of the family members<br />

until the head of the family (him or her)<br />

actually moves.<br />

7. The family of retiring employee would be<br />

treated as accompanying him<br />

- if the family follows him within 06 months<br />

- or proceeds him by not more than 01<br />

month from the date of his retirement.

8. These concessions are not admissible to<br />

GS who<br />

- quit service by resignation or<br />

- who are dismissed or<br />

- removed from service or<br />

- who retired compulsorily<br />

- this will also not apply to a person who<br />

are not regular employees of the<br />

Haryana Govt. or<br />

- who are on contract or<br />

- who are otherwise paid

9. <strong>Journey</strong> to Give Evidence<br />

A Govt. Servant who is summoned by a court to give<br />

evidence of facts (that have come to his knowledge during his<br />

duties) in any criminal, civil or revenue case to which a Govt. is<br />

party.<br />

• May draw <strong>TA</strong> as for a journey as tour by attaching<br />

certificate of attendance granted either by the court or<br />

other authority who summons him.<br />

• However, if the state is not party, even then the <strong>TA</strong> will be<br />

paid by the summoning court- subject to the same rates<br />

<strong>and</strong> some conditions under the <strong>TA</strong> while on tour.<br />

• The GS will have to produce to the court duly signed<br />

certificate by the competent authority showing the rates<br />

of mileage <strong>and</strong> <strong>DA</strong> admissible to him for a journey on<br />

tour.<br />

• This will enable the court to determine the amount of <strong>TA</strong><br />

admissible to the said Govt. Servant.

10. <strong>Journey</strong> on a Training<br />

During a course of training irrespective of<br />

duration of training period, the Govt. Servant may<br />

draw<br />

• <strong>TA</strong> for the place of <strong>Journey</strong> to the place of<br />

training on tour rates.<br />

• <strong>TA</strong> may be allowed for tours to outstations<br />

from the training institutions as part of the<br />

training.<br />

• However, no <strong>TA</strong> is allowed for onward<br />

journeys. For example, if the probationers<br />

journey the training institutions direct on the<br />

first appointment to a Govt. Service.

THANK YOU