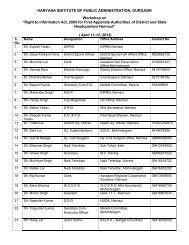

Duties and Responsibilities of DDOs - HIPA

Duties and Responsibilities of DDOs - HIPA

Duties and Responsibilities of DDOs - HIPA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Duties</strong> <strong>and</strong> <strong>Responsibilities</strong> <strong>of</strong><br />

<strong>DDOs</strong><br />

Lalit Kumar<br />

Asst. Pr<strong>of</strong>. (FFM)<br />

<strong>HIPA</strong>

At the end <strong>of</strong> the session, the trainees<br />

will be able to<br />

• Underst<strong>and</strong> the role <strong>of</strong> DDO in Government’<br />

financial system<br />

• List out the duties <strong>of</strong> <strong>DDOs</strong><br />

• Indentify the responsibilities <strong>of</strong> <strong>DDOs</strong><br />

• Describe the skills required to fulfill the duties<br />

<strong>and</strong> responsibilities

Financial Management in Govt Organizations<br />

Financial Management involves raising <strong>of</strong> funds <strong>and</strong> their use in an Economical,<br />

Efficient, <strong>and</strong> Effective manner to achieve organizational objectives <strong>and</strong> targets.<br />

Cost Control<br />

Pricing <strong>of</strong> products <strong>and</strong><br />

Services<br />

Inventory Management<br />

Valuation <strong>of</strong> Assets <strong>and</strong><br />

Liabilities<br />

Financial Policies<br />

including Dep. Policy<br />

Budgeting<br />

Accounting <strong>and</strong><br />

Auditing<br />

Contract Management :<br />

Purchases, Vendor<br />

selection, Monitoring<br />

<strong>and</strong> implementation<br />

Management <strong>of</strong><br />

Surplus funds or<br />

Writing <strong>of</strong>f losses

Where the DDO st<strong>and</strong>s in State<br />

Financial System?<br />

• In Haryana, the Finance Department deals in<br />

allocating annual Budget to various departments,<br />

managing their releases, monitoring expenditure,<br />

re-appropriation <strong>of</strong> funds, interaction with<br />

Treasuries <strong>and</strong> Accounts <strong>and</strong> Accountant General,<br />

issuing Loans & Advances to employees <strong>of</strong> the<br />

State, Issuing instructions related to Pension, DA,<br />

Foreign tours, study abroad <strong>and</strong> on other<br />

Economy control measures, giving sanctions to<br />

new posts, vehicles to all the Departments.

Where the DDO st<strong>and</strong>s in State<br />

Financial System?<br />

• Accounts are an integral part <strong>of</strong> financial<br />

management <strong>of</strong> activities. On the basis <strong>of</strong><br />

accounts, the Government determines the<br />

shape <strong>of</strong> its monetary <strong>and</strong> fiscal policies. The<br />

accounts <strong>of</strong> Government are kept in three<br />

parts: -<br />

• Consolidated Funds <strong>of</strong> India<br />

• Contingency Funds <strong>of</strong> India<br />

• Public Account

Where the DDO st<strong>and</strong>s in State<br />

Financial System?<br />

• Consolidated Fund <strong>of</strong> India : All revenues received by the<br />

Government by way <strong>of</strong> taxes like Income Tax, Central Excise,<br />

Customs <strong>and</strong> other receipts flowing to the Government in<br />

connection with the conduct <strong>of</strong> Government business i.e.<br />

Non-Tax Revenues are credited into the Consolidated Fund<br />

constituted under Article 266 (1) <strong>of</strong> the Constitution <strong>of</strong><br />

India. Similarly, all loans raised by the Government by issue<br />

<strong>of</strong> Public notifications, treasury bills (internal debt) <strong>and</strong><br />

loans obtained from foreign governments <strong>and</strong> international<br />

institutions (external debt) are credited into this fund. All<br />

expenditure <strong>of</strong> the government is incurred from this fund<br />

<strong>and</strong> no amount can be withdrawn from the Fund without<br />

authorization from the Parliament.

Where the DDO st<strong>and</strong>s in State<br />

Financial System?<br />

• Contingency Fund <strong>of</strong> India : The Contingency Fund <strong>of</strong><br />

India records the transactions connected with<br />

Contingency Fund set by the Government <strong>of</strong> India<br />

under Article 267 <strong>of</strong> the Constitution <strong>of</strong> India. The<br />

corpus <strong>of</strong> this fund is Rs. 50 crores. Advances from the<br />

fund are made for the purposes <strong>of</strong> meeting unforeseen<br />

expenditure which are resumed to the Fund to the full<br />

extent as soon as Parliament authorizes additional<br />

expenditure. Thus, this fund acts more or less like an<br />

imprest account <strong>of</strong> Government <strong>of</strong> India <strong>and</strong> is held on<br />

behalf <strong>of</strong> President by the Secretary to the<br />

Government <strong>of</strong> India, Ministry <strong>of</strong> Finance, Department<br />

<strong>of</strong> Economic Affairs.

Where the DDO st<strong>and</strong>s in State<br />

Financial System?<br />

• Public Account: In the Public Account<br />

constituted under Article 266 (2) <strong>of</strong> the<br />

Constitution, the transactions relate to debt<br />

other than those included in the Consolidated<br />

Fund <strong>of</strong> India. The Debt, Deposits <strong>and</strong><br />

Advances in respect <strong>of</strong> which Government<br />

incurs a liability to repay the money received<br />

or has a claim to recover the amounts paid.

STATE FINANCIAL STRUCTURE<br />

CONSOLIDATED FUND OF THE STATE PUBLIC ACCOUNT<br />

OF STATE CONTINGENCY FUND OF THE STATE<br />

Exercising Authorities<br />

Governor<br />

Chief Minister<br />

Council <strong>of</strong> Ministers<br />

Administrative Department<br />

Head <strong>of</strong> Department<br />

Executive Officers:- Controlling Officer Head <strong>of</strong><br />

Office Drawing & Disbursing Officer (DDO)<br />

9

STATE FINANCIAL STRUCTURE<br />

CONSOLIDATED FUND OF THE STATE PUBLIC ACCOUNT<br />

OF STATE CONTINGENCY FUND OF THE STATE<br />

Compilation <strong>of</strong> Accounts<br />

Reserve Bank <strong>of</strong> India<br />

Accountant General, Hr.<br />

District Treasury<br />

Sub Treasury<br />

D.D.O.<br />

10

<strong>Duties</strong> & <strong>Responsibilities</strong> <strong>of</strong> Drawing<br />

& Disbursing Officers (<strong>DDOs</strong>)<br />

• Estimation/Collection <strong>of</strong> Revenue Receipts<br />

• Estimation <strong>and</strong> incurring <strong>of</strong> expenditure<br />

• Withdrawal <strong>of</strong> money <strong>and</strong> maintenance <strong>of</strong> Accounts<br />

• Maintenance <strong>of</strong> Cash Book<br />

• G.P.F. deposits <strong>and</strong> withdrawals<br />

• Reconciliation<br />

Receipts<br />

<strong>of</strong> figures <strong>of</strong> Expenditure <strong>and</strong><br />

• Deduction <strong>and</strong> deposits <strong>of</strong> Income Tax<br />

• Detection <strong>and</strong> follow-up Embezzlement/Frauds cases<br />

• Economy in Expenditure<br />

• Financial irregularities<br />

• Cannons <strong>of</strong> Financial Propriety

Estimates/ Collection <strong>of</strong> Receipt<br />

Monthly Consolidated Receipt from T.O. duly<br />

signed by him.<br />

Compared & reconcile Consolidated Receipt (CR)<br />

with Remittance Book.<br />

Submit Monthly/ quarterly returns <strong>of</strong> Receipts in<br />

BM-25.<br />

Report Correction classification – in Reports/<br />

returns.<br />

Money Collected must not be kept out <strong>of</strong> Treasury –<br />

Such sums be deposited in Treasury without delay.<br />

In reports/ returns such amount be shown in the<br />

month in which actually deposited in Treasury. The<br />

period to which it pertains does not matter.<br />

12

EXPENDITURE<br />

Withdrawal/ Incurring <strong>of</strong><br />

Expenditure/Maintenance <strong>of</strong> Accounts<br />

CHECKS FOR WITHDRAWALS<br />

1. Entry <strong>of</strong> all withdrawals in the prescribed<br />

Bill Register.<br />

2. Monthly Review <strong>of</strong> Bill register.<br />

3. Prepare Monthly Certificate <strong>of</strong> Drawls &<br />

Verification by the T.O.<br />

4. Reconciliation <strong>of</strong> discrepancies pointed out<br />

by T.O. <strong>and</strong> proper filing <strong>of</strong> Certificate.<br />

Continued….<br />

13

CHECKS FOR WITHDRAWALS<br />

5. Expenditure strictly according to allotment<br />

under each Pry. Unit.<br />

6. Prompt attention to any warning from<br />

higher authorities against excess/irregular<br />

expenditure.<br />

7. For additional appropriation make reference<br />

to Controlling Officer/HOD.<br />

8. Each Bill in respective prescribed Form <strong>of</strong><br />

Bill- Pay, TA, Medical Re-imbursement<br />

9. Contingency bill in proper Pr<strong>of</strong>orma<br />

indicating object head/ codification.<br />

Continued….<br />

14

Cash Book<br />

1. Bound/ Machine numbered pages &<br />

Certificate<br />

2. Regular closing & correct checks <strong>of</strong> totals<br />

3. Verification cash Balance & recording <strong>of</strong><br />

Certificate at the end <strong>of</strong> Month<br />

4. Comparison <strong>of</strong> Challans & Entries in Cash<br />

Book with regards to Payment with<br />

Treasury<br />

5. No erasing/ No overwriting in cash Book<br />

6. Deposit <strong>of</strong> all receipts into Treasury on<br />

same day<br />

7. Safe custody <strong>of</strong> cash Book<br />

15

<strong>Responsibilities</strong> <strong>of</strong> DDO under IT Act<br />

<br />

<br />

<br />

Section – 200 – Fails to deduct – Penalty equal to<br />

sum<br />

Deducted but late deposit – 12% interest<br />

Deducted but not deposited – deposit from pocket<br />

+ 12% + imprisonment – Section – 276<br />

Deduction <strong>of</strong> Income Tax from Salary<br />

Deposit <strong>of</strong> Tax Deducted<br />

Penalty for failure to Tax deducted<br />

Furnishing <strong>of</strong> Certificate for Tax Deducted<br />

M<strong>and</strong>atory quoting <strong>of</strong> PAN & TAN<br />

Annual Return <strong>of</strong> TDS<br />

Other Aspects<br />

16

Canons <strong>of</strong> Financial Propriety<br />

1. Same vigilance should be exercised in respect<br />

<strong>of</strong> expenditure incurred from Government<br />

revenues, as a person <strong>of</strong> ordinary prudence<br />

would exercise in respect <strong>of</strong> expenditure <strong>of</strong> his<br />

own money.<br />

2. No authority should exercise its powers <strong>of</strong><br />

sanctioning expenditures to pass an order, which<br />

will be directly or indirectly to its own<br />

advantage.<br />

{PFR Vol. 1 Rule 2.10(a)}<br />

17

Canons <strong>of</strong> Financial Propriety<br />

3.Government revenues should not be utilized for<br />

the benefit <strong>of</strong> a particular person or section<br />

<strong>of</strong> the community unless:-<br />

i. The amount <strong>of</strong> expenditure involved in<br />

insignificant or<br />

ii. A claim for the amount could be enforced in<br />

court <strong>of</strong> law or;<br />

iii. The expenditure is in pursuance <strong>of</strong> recognized<br />

policy or custom.<br />

{PFR Vol. 1 Rule 2.10(a)}<br />

18

Canons <strong>of</strong> Financial Propriety<br />

4.No authority should sanction any expenditure<br />

which is likely to involve at a later date,<br />

expenditure beyond its own powers <strong>of</strong><br />

sanction.<br />

5.The amount <strong>of</strong> allowance, such as travelling<br />

allowance, granted to meet expenditure <strong>of</strong> a<br />

particular type should not, on the<br />

whole, be source <strong>of</strong> pr<strong>of</strong>it to the recipient.<br />

{PFR Vol. 1 Rule 2.10(a)}<br />

19

Skills required to fulfill <strong>Duties</strong> <strong>and</strong><br />

<strong>Responsibilities</strong><br />

• Knowledge <strong>of</strong> General System <strong>of</strong> Financial<br />

Management.<br />

• How to formulate <strong>and</strong> implement Budget.<br />

• How to supervise works accounts <strong>and</strong> Cash book.<br />

• Rules regarding procurement <strong>of</strong> Goods <strong>and</strong> Services.<br />

• Inventory Management.<br />

• Contract Management.<br />

• Grants-in- aid <strong>and</strong> Loans.<br />

• Budgeting <strong>and</strong> Accounting for Externally Aided<br />

projects. (for details)

Non-Financial <strong>Duties</strong><br />

• Punctuality, Discipline, Conduct<br />

• Devotion to Duty<br />

• Integrity<br />

• Impartially dealing <strong>of</strong> files <strong>and</strong> cases<br />

• Prompt disposal <strong>of</strong> files <strong>and</strong> Records<br />

Management<br />

• Time Management <strong>and</strong><br />

• Office Management

Questions?<br />

Thanks <strong>of</strong> careful attention!