Annual Report 2010 03 August 2011 - Banka Qendrore e ...

Annual Report 2010 03 August 2011 - Banka Qendrore e ...

Annual Report 2010 03 August 2011 - Banka Qendrore e ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong><br />

CBK<br />

5.3. Asset Management<br />

Asset Management and CBK Investment Policy<br />

Pursuant to its Law (Article 1, paragraph 1.6), CBK is authorized to act as a fiscal agent of<br />

the Government, whereas pursuant to Law on Public Finance Management and<br />

Responsibilities (Article 7), CBK is authorized to invest the Government assets. This form<br />

of financial investments enables the return on investments, generating assets paid from<br />

interest, which are then collected in Kosovo Consolidated Budget.<br />

In practice, deposited funds mainly belong to Government institutions, Ministry of<br />

Economy and Finance (budget revenues), Privatization Agency of Kosovo (PAK) as well as<br />

financial institutions (mandatory liquidity reserves).<br />

Management of Treasury<br />

investments is done by CBK in<br />

cooperation with Treasury through<br />

Liquidity Committee which meets<br />

on regular monthly basis. PAK<br />

started time bank deposits with<br />

maturity up to one year as of<br />

<strong>August</strong> <strong>2010</strong>. These investments<br />

are carried out in accordance with<br />

Investment Policy and Interest<br />

Rate Policy approved by the CBK<br />

Board. CBK is also in charge of<br />

management of funds deposited by<br />

public agencies, financial<br />

institutions and donor organizations.<br />

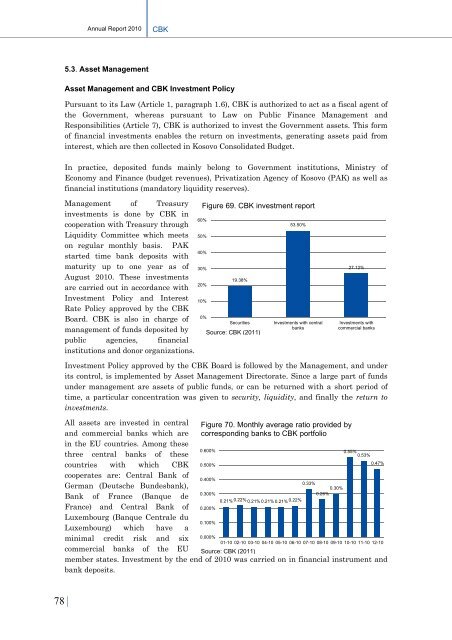

Figure 69. CBK investment report<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

19.38%<br />

Securities<br />

Source: CBK (<strong>2011</strong>)<br />

53.50%<br />

Investments with central<br />

banks<br />

27.12%<br />

Investments with<br />

commercial banks<br />

Investment Policy approved by the CBK Board is followed by the Management, and under<br />

its control, is implemented by Asset Management Directorate. Since a large part of funds<br />

under management are assets of public funds, or can be returned with a short period of<br />

time, a particular concentration was given to security, liquidity, and finally the return to<br />

investments.<br />

All assets are invested in central<br />

and commercial banks which are<br />

in the EU countries. Among these<br />

three central banks of these<br />

countries with which CBK<br />

cooperates are: Central Bank of<br />

German (Deutsche Bundesbank),<br />

Bank of France (Banque de<br />

France) and Central Bank of<br />

Luxembourg (Banque Centrale du<br />

Luxembourg) which have a<br />

minimal credit risk and six<br />

commercial banks of the EU<br />

Figure 70. Monthly average ratio provided by<br />

corresponding banks to CBK portfolio<br />

0.600%<br />

0.500%<br />

0.400%<br />

0.300%<br />

0.200%<br />

0.100%<br />

0.000%<br />

0.21% 0.22% 0.21% 0.21% 0.21% 0.22% 0.33%<br />

0.30%<br />

0.26%<br />

0.55% 0.53%<br />

0.47%<br />

01-10 02-10 <strong>03</strong>-10 04-10 05-10 06-10 07-10 08-10 09-10 10-10 11-10 12-10<br />

Source: CBK (<strong>2011</strong>)<br />

member states. Investment by the end of <strong>2010</strong> was carried on in financial instrument and<br />

bank deposits.<br />

78 |