Annual Report 2010 03 August 2011 - Banka Qendrore e ...

Annual Report 2010 03 August 2011 - Banka Qendrore e ...

Annual Report 2010 03 August 2011 - Banka Qendrore e ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong><br />

CBK<br />

54 |<br />

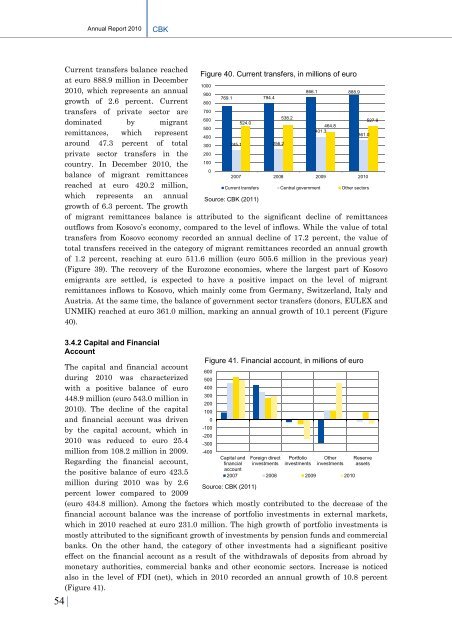

Current transfers balance reached<br />

Figure 40. Current transfers, in millions of euro<br />

at euro 888.9 million in December<br />

1000<br />

<strong>2010</strong>, which represents an annual<br />

866.1 888.9<br />

900<br />

769.1 794.4<br />

growth of 2.6 percent. Current 800<br />

transfers of private sector are 700<br />

600<br />

538.2<br />

527.9<br />

dominated by migrant<br />

524.0<br />

464.8<br />

500<br />

401.3<br />

remittances, which represent<br />

361.0<br />

400<br />

around 47.3 percent of total 300 245.1 256.2<br />

private sector transfers in the 200<br />

100<br />

country. In December <strong>2010</strong>, the<br />

0<br />

balance of migrant remittances<br />

2007 2008 2009 <strong>2010</strong><br />

reached at euro 420.2 million,<br />

Current transfers Central government Other sectors<br />

which represents an annual<br />

Source: CBK (<strong>2011</strong>)<br />

growth of 6.3 percent. The growth<br />

of migrant remittances balance is attributed to the significant decline of remittances<br />

outflows from Kosovo’s economy, compared to the level of inflows. While the value of total<br />

transfers from Kosovo economy recorded an annual decline of 17.2 percent, the value of<br />

total transfers received in the category of migrant remittances recorded an annual growth<br />

of 1.2 percent, reaching at euro 511.6 million (euro 505.6 million in the previous year)<br />

(Figure 39). The recovery of the Eurozone economies, where the largest part of Kosovo<br />

emigrants are settled, is expected to have a positive impact on the level of migrant<br />

remittances inflows to Kosovo, which mainly come from Germany, Switzerland, Italy and<br />

Austria. At the same time, the balance of government sector transfers (donors, EULEX and<br />

UNMIK) reached at euro 361.0 million, marking an annual growth of 10.1 percent (Figure<br />

40).<br />

3.4.2 Capital and Financial<br />

Account<br />

The capital and financial account<br />

during <strong>2010</strong> was characterized<br />

with a positive balance of euro<br />

448.9 million (euro 543.0 million in<br />

<strong>2010</strong>). The decline of the capital<br />

and financial account was driven<br />

by the capital account, which in<br />

<strong>2010</strong> was reduced to euro 25.4<br />

million from 108.2 million in 2009.<br />

Regarding the financial account,<br />

the positive balance of euro 423.5<br />

million during <strong>2010</strong> was by 2.6<br />

percent lower compared to 2009<br />

Figure 41. Financial account, in millions of euro<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

-100<br />

-200<br />

-300<br />

-400<br />

Capital and<br />

financial<br />

account<br />

Foreign direct<br />

investments<br />

Portfolio<br />

investments<br />

Other<br />

investments<br />

2007 2008 2009 <strong>2010</strong><br />

Source: CBK (<strong>2011</strong>)<br />

Reserve<br />

assets<br />

(euro 434.8 million). Among the factors which mostly contributed to the decrease of the<br />

financial account balance was the increase of portfolio investments in external markets,<br />

which in <strong>2010</strong> reached at euro 231.0 million. The high growth of portfolio investments is<br />

mostly attributed to the significant growth of investments by pension funds and commercial<br />

banks. On the other hand, the category of other investments had a significant positive<br />

effect on the financial account as a result of the withdrawals of deposits from abroad by<br />

monetary authorities, commercial banks and other economic sectors. Increase is noticed<br />

also in the level of FDI (net), which in <strong>2010</strong> recorded an annual growth of 10.8 percent<br />

(Figure 41).