financial stability report - Banka Qendrore e Republikës së Kosovës

financial stability report - Banka Qendrore e Republikës së Kosovës

financial stability report - Banka Qendrore e Republikës së Kosovës

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Number 3<br />

Financial Stability Report<br />

capacity of the insurances companies to withstand the potential losses, was 83.7 percent,<br />

compared with 81.1 percent in June 2011. 15 This ratio is higher in the first half of 2012 due<br />

to a faster growth rate of the capital, compared with the growth rate of the technical<br />

reserves.<br />

While the balance sheet of the insurance companies in the first half of 2012 indicates an<br />

expansion in the insurance industry activity, the analysis of the revenues and expenditures<br />

indicates a decline in performance of this industry. This is because the net profit of the<br />

insurance companies, which represents one the main performance indicators, recorded a<br />

value of euro 0.6 million, which is around half of the value of the last year’s net profit,<br />

registered in June 2011.<br />

The lower net profit in the first<br />

half of 2012, also reflected in the<br />

deterioration of the two other<br />

performance indicators, namely,<br />

Return on Average Assets (ROAA)<br />

and Return on Average Equity<br />

(ROAE). In June 2012, ROAA was<br />

0.6 percent, compared with the 1.2<br />

percent in June 2011. The ROAE<br />

indicator followed a similar trend,<br />

declining to 1.4 percent, compared<br />

with the 3 percent in June 2011. 16<br />

45<br />

38.0%<br />

40%<br />

35.3% 35.2%<br />

40<br />

35%<br />

33.1<br />

34.8<br />

35<br />

39.6<br />

38.1<br />

30%<br />

16 The ROAA and ROAE indicators are annualised.<br />

30<br />

25<br />

24.2%<br />

25%<br />

20%<br />

20<br />

15<br />

13.2 13.4<br />

13.9 15%<br />

10<br />

8.0<br />

10%<br />

5<br />

5%<br />

0<br />

0%<br />

June 2009 June 2010 June 2011 June 2012<br />

Received premiums Paid claims Claims/primiums (right axis)<br />

Source: CBK (2012)<br />

Figure 65. Structure of received primiums of the<br />

insurance companies<br />

29.8%<br />

13.3%<br />

56.9%<br />

TPL polocies Border policies Other<br />

15 The technical reserves are necessary to ensure a permanent fulfilment of the liabilities of the insurance companies against the policy holders, until the<br />

expiration of the insurance agreement.<br />

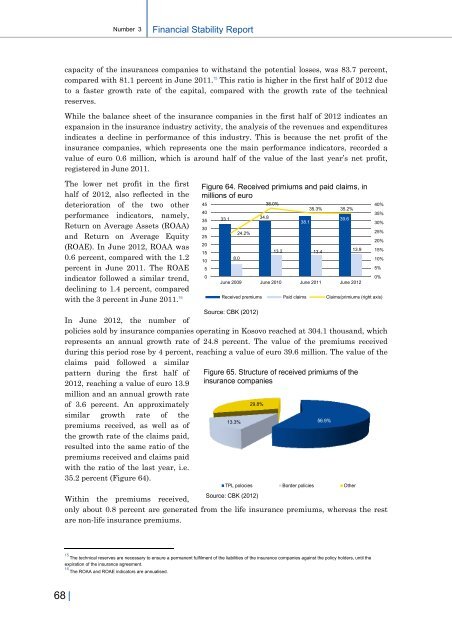

In June 2012, the number of<br />

policies sold by insurance companies operating in Kosovo reached at 304.1 thousand, which<br />

represents an annual growth rate of 24.8 percent. The value of the premiums received<br />

during this period rose by 4 percent, reaching a value of euro 39.6 million. The value of the<br />

claims paid followed a similar<br />

pattern during the first half of<br />

2012, reaching a value of euro 13.9<br />

million and an annual growth rate<br />

of 3.6 percent. An approximately<br />

similar growth rate of the<br />

premiums received, as well as of<br />

the growth rate of the claims paid,<br />

resulted into the same ratio of the<br />

premiums received and claims paid<br />

with the ratio of the last year, i.e.<br />

35.2 percent (Figure 64).<br />

Figure 64. Received primiums and paid claims, in<br />

millions of euro<br />

Source: CBK (2012)<br />

Within the premiums received,<br />

only about 0.8 percent are generated from the life insurance premiums, whereas the rest<br />

are non-life insurance premiums.<br />

68 |