financial stability report - Banka Qendrore e Republikës së Kosovës

financial stability report - Banka Qendrore e Republikës së Kosovës financial stability report - Banka Qendrore e Republikës së Kosovës

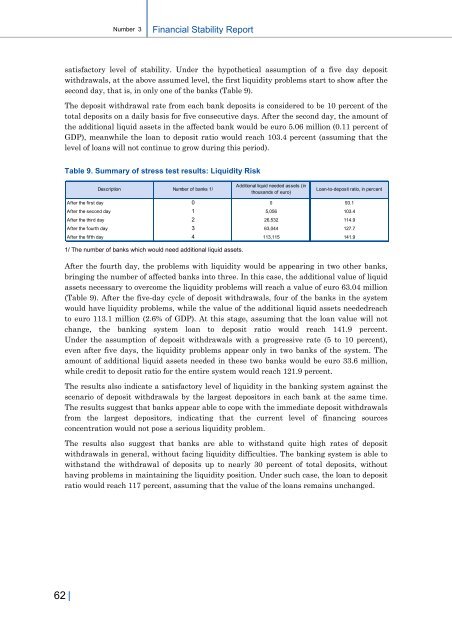

Number 3 Financial Stability Report satisfactory level of stability. Under the hypothetical assumption of a five day deposit withdrawals, at the above assumed level, the first liquidity problems start to show after the second day, that is, in only one of the banks (Table 9). The deposit withdrawal rate from each bank deposits is considered to be 10 percent of the total deposits on a daily basis for five consecutive days. After the second day, the amount of the additional liquid assets in the affected bank would be euro 5.06 million (0.11 percent of GDP), meanwhile the loan to deposit ratio would reach 103.4 percent (assuming that the level of loans will not continue to grow during this period). Table 9. Summary of stress test results: Liquidity Risk Description Number of banks 1/ Additional liquid needed assets (in thousands of euro) Loan-to-deposit ratio, in percent After the first day After the second day After the third day After the fourth day After the fifth day 0 0 93.1 1 5,056 103.4 2 26,532 114.9 3 63,044 127.7 4 113,115 141.9 1/ The number of banks which would need additional liquid assets. After the fourth day, the problems with liquidity would be appearing in two other banks, bringing the number of affected banks into three. In this case, the additional value of liquid assets necessary to overcome the liquidity problems will reach a value of euro 63.04 million (Table 9). After the five-day cycle of deposit withdrawals, four of the banks in the system would have liquidity problems, while the value of the additional liquid assets neededreach to euro 113.1 million (2.6% of GDP). At this stage, assuming that the loan value will not change, the banking system loan to deposit ratio would reach 141.9 percent. Under the assumption of deposit withdrawals with a progressive rate (5 to 10 percent), even after five days, the liquidity problems appear only in two banks of the system. The amount of additional liquid assets needed in these two banks would be euro 33.6 million, while credit to deposit ratio for the entire system would reach 121.9 percent. The results also indicate a satisfactory level of liquidity in the banking system against the scenario of deposit withdrawals by the largest depositors in each bank at the same time. The results suggest that banks appear able to cope with the immediate deposit withdrawals from the largest depositors, indicating that the current level of financing sources concentration would not pose a serious liquidity problem. The results also suggest that banks are able to withstand quite high rates of deposit withdrawals in general, without facing liquidity difficulties. The banking system is able to withstand the withdrawal of deposits up to nearly 30 percent of total deposits, without having problems in maintaining the liquidity position. Under such case, the loan to deposit ratio would reach 117 percent, assuming that the value of the loans remains unchanged. 62 |

Financial Stability Report Number 3 6.6. Payments System and Banking System Infrastructure Safe and efficient payment systems are essential for the proper functioning of the financial system in the economy. Central Bank of the Republic of Kosovo (CBK) has continued its activities to promote a safe, reliable and efficient payment system in order to maintain financial stability in the country and avoid potential hazards that may threaten the payments system. Payment systems may face credit risk (the risk of financial loss as a consequence of the inability of participants in the system to meet their payment obligations at the time of settlement or in the future), liquidity risk (the financial losses incurred when payments are not settled at the expected time, but are expected to be settled in the near future), operational risk (technical malfunctions or operational errors can induce an increase of credit or liquidity risk) and systemic risk (the inability of one or more participants in the system to pay their obligations, or a disruption in the system itself can affect other participants’ ability to meet their payment obligations at the time of settlement). The stability of payment system is closely related to the stability of the financial system in the country. The recent financial crisis showed the significance of the payment systems in the context of financial system, when we consider the extent to which shocks spread through payments systems from one place to another. The financial crisis has demonstrated once again the degree of interdependence between payments systems globally, especially in the case of larger financial institutions. Therefore, payment systems should have a solid legal basis to ensure safe execution of payment transactions, as well as the mechanisms that control financial and operational risks that may impede the progress of the system. Building a payment system consistent with international standards offers the opportunity to manage individual payments with higher value, payments with higher priority or those payments that have the capacity to promote and transmit shocks in the system. Recent developments in the financial markets have influenced banks to take steps in establishing universal standards for supervising the systemically important payment systems. These systems are considered such mainly because of the type of payments they process, or because one or more participants in the system are considered to be systemically important. Currently, the CBK is the owner and operator of the only payment system in Kosovo, which is called the Electronic Interbank Clearing System (EICS). The advanced system called the RTGS (Real Time Gross Settlement), that mainly deals with large value payments and urgent payments among banks in the country and government institutions is in the initial stage of implementation. This system will empower payments in real time, thus minimizing the potential risk associated with possible delays in payments systems. Interbank payment system in Kosovo settles regular payments, priority payments, massive-regular payments, massive-priority payments, kos-giro, direct debit and securities. The priority payments may be individual payments but also high value payments used mainly for commercial emergency payments. Given that EICS processes all payments in the country, flaws or possible delays in the settlement process would have major consequences for the financial system in the country. Therefore, the CBK is committed to follow the international principles of the Committee on Payment and Settlement Systems (CPSS) for systemically important payment systems, in order to avoid potential hazards that may threaten payments system in the country, considering that EICS is the only | 63

- Page 13 and 14: Financial Stability Report Number 3

- Page 15 and 16: Financial Stability Report Number 3

- Page 17 and 18: Financial Stability Report Number 3

- Page 19 and 20: Financial Stability Report Number 3

- Page 21 and 22: Financial Stability Report Number 3

- Page 23 and 24: Financial Stability Report Number 3

- Page 25 and 26: Financial Stability Report Number 3

- Page 27 and 28: Financial Stability Report Number 3

- Page 29 and 30: Financial Stability Report Number 3

- Page 31 and 32: Financial Stability Report Number 3

- Page 33 and 34: Financial Stability Report Number 3

- Page 35 and 36: Financial Stability Report Number 3

- Page 37 and 38: Financial Stability Report Number 3

- Page 39 and 40: Financial Stability Report Number 3

- Page 41 and 42: Financial Stability Report Number 3

- Page 43 and 44: Financial Stability Report Number 3

- Page 45 and 46: Financial Stability Report Number 3

- Page 47 and 48: Financial Stability Report Number 3

- Page 49 and 50: Financial Stability Report Number 3

- Page 51 and 52: Financial Stability Report Number 3

- Page 53 and 54: Financial Stability Report Number 3

- Page 55 and 56: Financial Stability Report Number 3

- Page 57 and 58: Financial Stability Report Number 3

- Page 59 and 60: Financial Stability Report Number 3

- Page 61 and 62: Financial Stability Report Number 3

- Page 63: Financial Stability Report Number 3

- Page 67 and 68: Financial Stability Report Number 3

- Page 69 and 70: Financial Stability Report Number 3

- Page 71 and 72: Financial Stability Report Number 3

- Page 73 and 74: Financial Stability Report Number 3

- Page 75 and 76: Financial Stability Report Number 3

- Page 77 and 78: Financial Stability Report Number 3

- Page 79 and 80: Financial Stability Report Number 3

- Page 81 and 82: Financial Stability Report Number 3

- Page 83 and 84: Financial Stability Report Number 3

- Page 85 and 86: Financial Stability Report Number 3

- Page 87 and 88: Financial Stability Report Number 3

- Page 89 and 90: Financial Stability Report Number 3

- Page 91 and 92: Financial Stability Report Number 3

- Page 93 and 94: Financial Stability Report Number 3

- Page 95 and 96: Financial Stability Report Number 3

- Page 97 and 98: Financial Stability Report Number 3

- Page 99 and 100: Financial Stability Report Number 3

- Page 101 and 102: Financial Stability Report Number 3

- Page 103 and 104: Financial Stability Report Number 3

- Page 105 and 106: Financial Stability Report Number 3

- Page 107 and 108: Financial Stability Report Number 3

- Page 109 and 110: Financial Stability Report Number 3

- Page 111 and 112: Financial Stability Report Number 3

- Page 113 and 114: Financial Stability Report Number 3

Number 3<br />

Financial Stability Report<br />

satisfactory level of <strong>stability</strong>. Under the hypothetical assumption of a five day deposit<br />

withdrawals, at the above assumed level, the first liquidity problems start to show after the<br />

second day, that is, in only one of the banks (Table 9).<br />

The deposit withdrawal rate from each bank deposits is considered to be 10 percent of the<br />

total deposits on a daily basis for five consecutive days. After the second day, the amount of<br />

the additional liquid assets in the affected bank would be euro 5.06 million (0.11 percent of<br />

GDP), meanwhile the loan to deposit ratio would reach 103.4 percent (assuming that the<br />

level of loans will not continue to grow during this period).<br />

Table 9. Summary of stress test results: Liquidity Risk<br />

Description Number of banks 1/<br />

Additional liquid needed assets (in<br />

thousands of euro)<br />

Loan-to-deposit ratio, in percent<br />

After the first day<br />

After the second day<br />

After the third day<br />

After the fourth day<br />

After the fifth day<br />

0 0 93.1<br />

1 5,056 103.4<br />

2 26,532 114.9<br />

3 63,044 127.7<br />

4 113,115 141.9<br />

1/ The number of banks which would need additional liquid assets.<br />

After the fourth day, the problems with liquidity would be appearing in two other banks,<br />

bringing the number of affected banks into three. In this case, the additional value of liquid<br />

assets necessary to overcome the liquidity problems will reach a value of euro 63.04 million<br />

(Table 9). After the five-day cycle of deposit withdrawals, four of the banks in the system<br />

would have liquidity problems, while the value of the additional liquid assets neededreach<br />

to euro 113.1 million (2.6% of GDP). At this stage, assuming that the loan value will not<br />

change, the banking system loan to deposit ratio would reach 141.9 percent.<br />

Under the assumption of deposit withdrawals with a progressive rate (5 to 10 percent),<br />

even after five days, the liquidity problems appear only in two banks of the system. The<br />

amount of additional liquid assets needed in these two banks would be euro 33.6 million,<br />

while credit to deposit ratio for the entire system would reach 121.9 percent.<br />

The results also indicate a satisfactory level of liquidity in the banking system against the<br />

scenario of deposit withdrawals by the largest depositors in each bank at the same time.<br />

The results suggest that banks appear able to cope with the immediate deposit withdrawals<br />

from the largest depositors, indicating that the current level of financing sources<br />

concentration would not pose a serious liquidity problem.<br />

The results also suggest that banks are able to withstand quite high rates of deposit<br />

withdrawals in general, without facing liquidity difficulties. The banking system is able to<br />

withstand the withdrawal of deposits up to nearly 30 percent of total deposits, without<br />

having problems in maintaining the liquidity position. Under such case, the loan to deposit<br />

ratio would reach 117 percent, assuming that the value of the loans remains unchanged.<br />

62 |