financial stability report - Banka Qendrore e Republikës së Kosovës

financial stability report - Banka Qendrore e Republikës së Kosovës

financial stability report - Banka Qendrore e Republikës së Kosovës

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Number 3<br />

Financial Stability Report<br />

from 10.6 percent in the last quarter of 2011 to 11.3 percent in the second quarter of 2012.<br />

Spain, Greece, and Portugal besides leading the list regarding unemployment rate, are also<br />

the countries in which unemployment has increased mostly in the first half of 2012<br />

compared to 2011 (Figure 2). On the other hand countries like Germany and Austria in<br />

addition to having the lowest level of unemployment rate are among the countries that<br />

have managed to further decrease the unemployment rate in the first half of 2012.<br />

The slowdown in export growth in the global level in 2012 is expected to result in the<br />

deterioration of the current account. Export of goods in the global level is expected to grow<br />

by 7.3 percent in 2012 compared with the growth rate of 7.9 percent in 2011. The increase<br />

of exports is expected to experience a larger slowdown in the eurozone countries (from 6.1<br />

percent in 2011 to 1.4 percent in 2012) and in the U.S. (from 7.4 percent in 2011 to 4.2<br />

percent in 2012), while the average growth rate of exports in all other countries of the world<br />

is expected to have a slight decrease (from 8.0 percent in 2011 to 7.8 percent in 2012).<br />

Despite this, the eurozone is expected to increase the level of the current account surplus<br />

from 0.4 percent in 2011 to 1.1 percent of GDP in 2012, and the United States is expected to<br />

have the same degree of current account deficit as in the previous year 3.1 percent of GDP,<br />

while the current account surplus is expected to decline in developing countries from 1.9<br />

percent in 2011 to 1.3 percent of GDP in 2012.<br />

Box 1. The performance of the foreign banking groups operating in<br />

Kosovo 1<br />

ProCredit Holding – PCH (Germany)<br />

ProCredit Holding’s main <strong>financial</strong> indicators marked a significant increase in 2011, despite the fact<br />

that the growth rate in the global<br />

economy declined, and most of the<br />

Eurozone countries experienced<br />

recession. The value of total assets at<br />

the end of 2011 amounted to euro 5.49<br />

billion, marking an increase of 5.9<br />

percent compared to 2010. Gross loans<br />

to non-<strong>financial</strong> sector, which account<br />

for the largest share of PCH’s assets,<br />

reached a value of euro 4 billion as a<br />

result of 10.3 percent annual growth,<br />

while the value of deposits amounted to<br />

euro 3.4 billion, recording growth of 5.9<br />

percent compared with the previous<br />

year.<br />

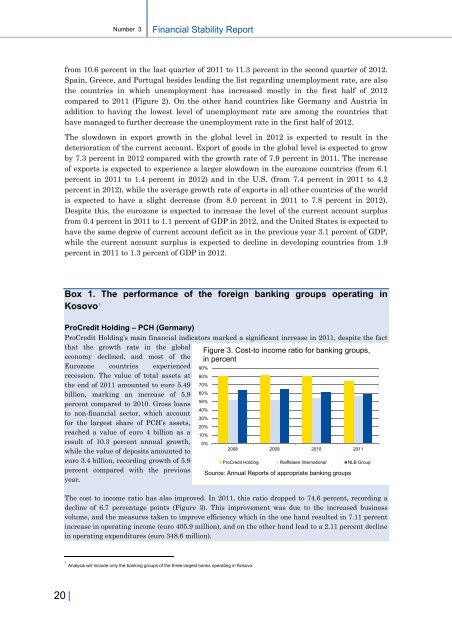

Figure 3. Cost-to income ratio for banking groups,<br />

in percent<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

2008 2009 2010 2011<br />

ProCredit Holding Raiffeisen International NLB Group<br />

Source: Annual Reports of appropriate banking groups<br />

The cost to income ratio has also improved. In 2011, this ratio dropped to 74.6 percent, recording a<br />

decline of 6.7 percentage points (Figure 3). This improvement was due to the increased business<br />

volume, and the measures taken to improve efficiency which in the one hand resulted in 7.11 percent<br />

increase in operating income (euro 405.9 million), and on the other hand lead to a 2.11 percent decline<br />

in operating expenditures (euro 348.6 million).<br />

1 Analysis will include only the banking groups of the three largest banks operating in Kosovo.<br />

20 |