NGS J13 - Remittance Advice

NGS J13 - Remittance Advice

NGS J13 - Remittance Advice

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

What's New<br />

How to Interpret the <strong>Remittance</strong> <strong>Advice</strong> for Adjustments Subject<br />

to MMA Section 935—Recovery Audit Contractor or Other<br />

Postpay Review<br />

This article will help you identify when a Section 935 recoupment is occurring. The Medicare Prescription Drug, Improvement,<br />

and Modernization (MMA) Act of 2003, Section 935, Limitation on Recoupment, affects recovery audit contractor (RAC) and<br />

other postpay review adjustments. It is important that you recognize these types of adjustments on your remittance advice<br />

and act accordingly when or if they occurs.<br />

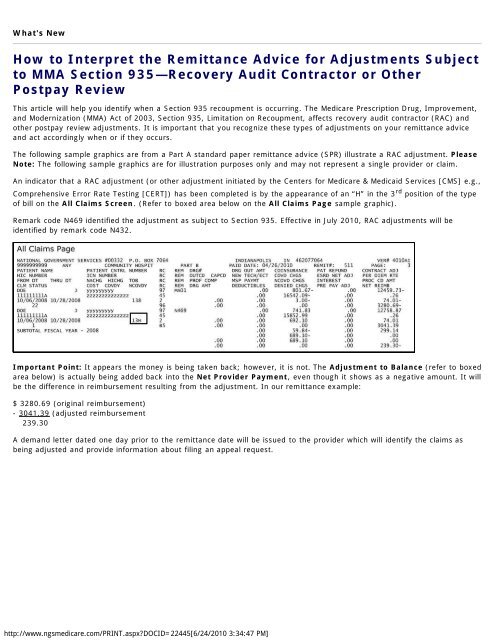

The following sample graphics are from a Part A standard paper remittance advice (SPR) illustrate a RAC adjustment. Please<br />

Note: The following sample graphics are for illustration purposes only and may not represent a single provider or claim.<br />

An indicator that a RAC adjustment (or other adjustment initiated by the Centers for Medicare & Medicaid Services [CMS] e.g.,<br />

Comprehensive Error Rate Testing [CERT]) has been completed is by the appearance of an “H” in the 3 rd position of the type<br />

of bill on the All Claims Screen. (Refer to boxed area below on the All Claims Page sample graphic).<br />

Remark code N469 identified the adjustment as subject to Section 935. Effective in July 2010, RAC adjustments will be<br />

identified by remark code N432.<br />

Important Point: It appears the money is being taken back; however, it is not. The Adjustment to Balance (refer to boxed<br />

area below) is actually being added back into the Net Provider Payment, even though it shows as a negative amount. It will<br />

be the difference in reimbursement resulting from the adjustment. In our remittance example:<br />

$ 3280.69 (original reimbursement)<br />

- 3041.39 (adjusted reimbursement<br />

239.30<br />

A demand letter dated one day prior to the remittance date will be issued to the provider which will identify the claims as<br />

being adjusted and provide information about filing an appeal request.<br />

http://www.ngsmedicare.com/PRINT.aspx?DOCID=22445[6/24/2010 3:34:47 PM]

If the provider has not filed a valid appeal request, the amount owed will be recouped on a remittance advice 41 days after<br />

the claim finalized (i.e., date of the demand letter). Providers will be able to identify that amount by reviewing the amount<br />

listed in the 935 withholding field as a positive. Note that the amount withheld will include interest if the recoupment occurs<br />

more than 30 days after the date of the demand letter.<br />

Posted 06/17/2010<br />

Note: Should you have landed here as a result of a search engine (or other) link, be advised that these files contain material which is copyrighted<br />

by the American Medical Association (AMA). You are forbidden to download the files unless you read, agree to and abide by the provisions of the<br />

copyright statement. Read the copyright statement now (you will be linked back to here).<br />

CPT codes, descriptions, and other data only are copyright 2009 American Medical Association (or such other date of publication of CPT). All rights<br />

reserved. Applicable FARS/DFARS apply.<br />

http://www.ngsmedicare.com/PRINT.aspx?DOCID=22445[6/24/2010 3:34:47 PM]