Question Booklet - Sunway College

Question Booklet - Sunway College

Question Booklet - Sunway College

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

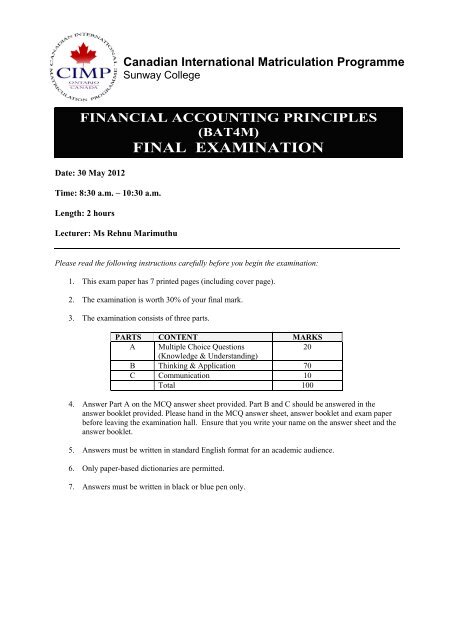

Canadian International Matriculation Programme<br />

<strong>Sunway</strong> <strong>College</strong><br />

FINANCIAL ACCOUNTING PRINCIPLES<br />

(BAT4M)<br />

FINAL EXAMINATION<br />

Date: 30 May 2012<br />

Time: 8:30 a.m. – 10:30 a.m.<br />

Length: 2 hours<br />

Lecturer: Ms Rehnu Marimuthu<br />

Please read the following instructions carefully before you begin the examination:<br />

1. This exam paper has 7 printed pages (including cover page).<br />

2. The examination is worth 30% of your final mark.<br />

3. The examination consists of three parts.<br />

PARTS CONTENT MARKS<br />

A Multiple Choice <strong>Question</strong>s<br />

20<br />

(Knowledge & Understanding)<br />

B Thinking & Application 70<br />

C Communication 10<br />

Total 100<br />

4. Answer Part A on the MCQ answer sheet provided. Part B and C should be answered in the<br />

answer booklet provided. Please hand in the MCQ answer sheet, answer booklet and exam paper<br />

before leaving the examination hall. Ensure that you write your name on the answer sheet and the<br />

answer booklet.<br />

5. Answers must be written in standard English format for an academic audience.<br />

6. Only paper-based dictionaries are permitted.<br />

7. Answers must be written in black or blue pen only.

PART A: MULTIPLE CHOICE QUESTIONS (K/U)<br />

-----------------------------------<br />

Please shade the correct answer on the answer sheet provided.<br />

(20 Marks)

-----Page 4<br />

PART B: THINKING & APPLICATION<br />

-----------------------------------<br />

<strong>Question</strong> 1<br />

Richie operates Richie Rich Company. The trial balance of Richie Rich Company has the<br />

following accounts at its year-end, December 31, 2009:<br />

($)<br />

Accounts Payable 46,660<br />

Accounts Receivable 32,350<br />

Accumulated Depreciation – Building 25,340<br />

Accumulated Depreciation – Office Equipment 15,400<br />

Advertising Expense 15,930<br />

Allowance for Doubtful Accounts 1,294<br />

Bad Debts Expense 944<br />

Bank 25,500<br />

Building 102,640<br />

Depreciation Expense – Building 1,740<br />

Depreciation Expense – Office Equipment 4,400<br />

Insurance Expense 5,700<br />

Interest Expense 5,880<br />

Interest Revenue 7,056<br />

Merchandise Inventory 17,100<br />

Office Equipment 71,640<br />

Purchases 428,820<br />

Purchase Discounts 15,700<br />

Purchase Returns and Allowances 12,300<br />

Richie, Capital 113,000<br />

Richie, Drawings 9,000<br />

Salaries Expense 43,200<br />

Salaries Payable 1,840<br />

Sales 542,194<br />

Sales Discounts 2,500<br />

Sales Returns and Allowances 7,190<br />

Utilities Expense 6,250<br />

Other additional information:<br />

1. Merchandise inventory on December 31, 2009, is $22,220.<br />

2. Salaries expense is 50% selling and 50% administrative.<br />

3. Insurance expense is 60% selling and 40% administrative.<br />

4. Depreciation on building, depreciation on office equipment and utilities expense are<br />

administrative expenses.<br />

5. Advertising expense is a selling expense.<br />

6. Richie Rich Company uses a periodic inventory system.<br />

Instructions:<br />

a) Prepare the multiple-step income statement for the year ended 31 December 2009.<br />

(30 marks)

-----Page 5<br />

<strong>Question</strong> 2<br />

The balance sheet of Cluster Company shown below does not balance.<br />

CLUSTER COMPANY<br />

Balance Sheet as at December 31, 2010<br />

Assets<br />

Cash 6,700<br />

Accounts Receivable 400<br />

Supplies 1,200<br />

Unearned Revenue 3,018<br />

Equipment 15,000<br />

26,318<br />

Liabilities<br />

Accounts Payable 1,510<br />

Owner’s Equity<br />

Cluster, Capital 18,390<br />

19,900<br />

Each of the listed accounts has a normal balance per the general ledger. An examination of<br />

the ledger and journal reveals the following errors:<br />

1. A cash purchase of equipment for $693 was posted as a debit to Equipment for $693<br />

and credit to Accounts Payable for $639.<br />

2. A cash purchase of supplies for $700 was journalised and posted as a debit to<br />

Supplies for $70 and a credit to Cash for $70.<br />

3. A debit posting for salaries for $900 was made twice.<br />

4. A debit posting to accounts receivable for $500 was omitted.<br />

5. A payment to accounts payable for $491 was credited to Cash for $491 and debited to<br />

Accounts Receivable for $419.<br />

6. The withdrawal of $110 cash for Cluster’s personal use was debited to Office<br />

Expense for $110 and credited to Cash $110.<br />

Instructions:<br />

a) Prepare a correct balance sheet.<br />

(23 marks)

-----Page 6<br />

<strong>Question</strong> 3<br />

Muffin Ltd had a beginning inventory of 200 units at a cost of $12 per unit on 1 August.<br />

During the month, the following purchases and sales were made.<br />

Purchases<br />

Sales<br />

August 4 250 units at $13 August 7 150 units<br />

August 15 350 units at $15 August 11 100 units<br />

August 28 200 units at $14 August 17 300 units<br />

August 24 200 units<br />

Muffin Ltd uses a periodic inventory system.<br />

Instructions:<br />

a) Determine ending inventory and cost of goods sold under (i) average cost, (ii) FIFO,<br />

and (iii) LIFO.<br />

(17 marks)<br />

PART C: COMMUNICATION<br />

-----------------------------------<br />

(10 marks)<br />

1) What is the difference between accrued revenues and unearned revenues? (2 marks)<br />

2) A classmate is considering dropping his accounting class because he cannot<br />

understand the rules of debits and credits. In your opinion, can the student be<br />

successful in the course without an understanding of the rules of debits and credits?<br />

(4 marks)<br />

3) FIFO and LIFO are two different costing methods. Both methods report cost of goods<br />

sold, ending inventory, net income and income tax expense differently in the period of<br />

inflation. Explain the differences of both methods.<br />

(4 marks)