Anthem Blue Cross PPO High Deductible HSA Plan - Judy Madrigal ...

Anthem Blue Cross PPO High Deductible HSA Plan - Judy Madrigal ...

Anthem Blue Cross PPO High Deductible HSA Plan - Judy Madrigal ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

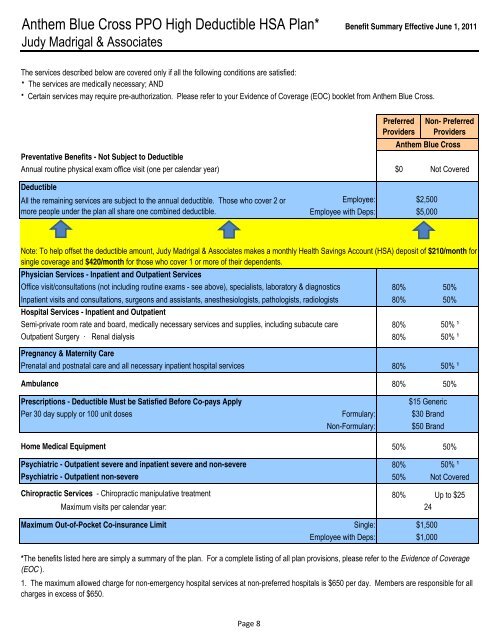

<strong>Anthem</strong> <strong>Blue</strong> <strong>Cross</strong> <strong>PPO</strong> <strong>High</strong> <strong>Deductible</strong> <strong>HSA</strong> <strong>Plan</strong>* Benefit Summary Effective June 1, 2011<br />

<strong>Judy</strong> <strong>Madrigal</strong> & Associates<br />

The services described below are covered only if all the following conditions are satisfied:<br />

· The services are medically necessary; AND<br />

· Certain services may require pre-authorization. Please refer to your Evidence of Coverage (EOC) booklet from <strong>Anthem</strong> <strong>Blue</strong> <strong>Cross</strong>.<br />

Preferred<br />

Providers<br />

Non- Preferred<br />

Providers<br />

<strong>Anthem</strong> <strong>Blue</strong> <strong>Cross</strong><br />

Preventative Benefits - Not Subject to <strong>Deductible</strong><br />

Annual routine physical exam office visit (one per calendar year) $0 Not Covered<br />

<strong>Deductible</strong><br />

All the remaining services are subject to the annual deductible. Those who cover 2 or<br />

more people under the plan all share one combined deductible.<br />

Employee:<br />

Employee with Deps:<br />

$2,500<br />

$5,000<br />

Note: To help offset the deductible amount, <strong>Judy</strong> <strong>Madrigal</strong> & Associates makes a monthly Health Savings Account (<strong>HSA</strong>) deposit of $210/month for<br />

single coverage and $420/month for those who cover 1 or more of their dependents.<br />

Physician Services - Inpatient and Outpatient Services<br />

Office visit/consultations (not including routine exams - see above), specialists, laboratory & diagnostics 80% 50%<br />

Inpatient visits and consultations, surgeons and assistants, anesthesiologists, pathologists, radiologists 80% 50%<br />

Hospital Services - Inpatient and Outpatient<br />

Semi-private room rate and board, medically necessary services and supplies, including subacute care 80% 50% ¹<br />

Outpatient Surgery · Renal dialysis 80% 50% ¹<br />

Pregnancy & Maternity Care<br />

Prenatal and postnatal care and all necessary inpatient hospital services 80% 50% ¹<br />

Ambulance 80% 50%<br />

Prescriptions - <strong>Deductible</strong> Must be Satisfied Before Co-pays Apply<br />

Per 30 day supply or 100 unit doses<br />

Formulary:<br />

Non-Formulary:<br />

$15 Generic<br />

$30 Brand<br />

$50 Brand<br />

Home Medical Equipment 50% 50%<br />

Psychiatric - Outpatient severe and inpatient severe and non-severe 80% 50% ¹<br />

Psychiatric - Outpatient non-severe 50% Not Covered<br />

Chiropractic Services - Chiropractic manipulative treatment 80% Up to $25<br />

Maximum visits per calendar year:<br />

24<br />

Maximum Out-of-Pocket Co-insurance Limit<br />

Single:<br />

Employee with Deps:<br />

$1,500<br />

$1,000<br />

*The benefits listed here are simply a summary of the plan. For a complete listing of all plan provisions, please refer to the Evidence of Coverage<br />

(EOC ).<br />

1. The maximum allowed charge for non-emergency hospital services at non-preferred hospitals is $650 per day. Members are responsible for all<br />

charges in excess of $650.<br />

Page 8

Eligible <strong>HSA</strong> Expenses and OTC Products<br />

• Acupuncture<br />

• Alcoholism treatment<br />

• Allergy shots and testing<br />

• Ambulance (ground or air)<br />

• Artificial limbs<br />

• Blind services and equipment<br />

• Car controls for handicapped*<br />

• Chiropractor services<br />

• Coinsurance and deductibles<br />

• Contact lenses<br />

• Crutches, wheelchairs, walkers<br />

• Deaf services -- hearing aid/batteries,<br />

hearing aid animal & care, lip reading<br />

expenses, modified telephone, etc.<br />

• Dental treatment<br />

• Dentures<br />

• Diagnostic tests<br />

• Doctor’s fees<br />

• Drug addiction treatment & facilities<br />

• Drugs (prescription)<br />

Eligible <strong>HSA</strong> Healthcare Expenses<br />

Please note that this list is not intended to be comprehensive tax advice.<br />

For more detailed information, please consult IRS Publication 502 or see your tax advisor.<br />

• Eye examinations and eyeglasses<br />

• Home health and/or hospice care<br />

• Hospital services<br />

• Insulin<br />

• Laboratory fees<br />

• LASIK eye surgery<br />

• Medical alert (bracelet, necklace)<br />

• Medical monitoring and testing<br />

devices*<br />

• Nursing services<br />

• Obstetrical expenses<br />

• Occlusal guards<br />

• Operations and surgeries (legal)<br />

• Optometrists<br />

• Orthodontia<br />

• Orthopedic services<br />

• Osteopaths<br />

• Oxygen/oxygen equipment<br />

• Physical exams (except for employment-related<br />

physicals)<br />

*if prescribed for a particular ailment or medical condition; provider letter required<br />

Important Change Regarding Over-the Counter (OTC) Medications<br />

Starting January 1, 2011, OTC medications will require a doctor’s prescription to be eligible for <strong>HSA</strong> reimbursement.<br />

As a result, OTC medications cannot be purchased using a debit card after 12/31/10 unless dispensed by a<br />

pharmacy the same as a standard prescription. If a manual claim is submitted for purchase of an OTC medication after<br />

12/31/10, a prescription receipt must be included with the claim in order to receive reimbursement.<br />

Non-medicated OTC products (gauze pads, diabetes test strips, saline solution, etc.) are not affected by this change in the<br />

law. You can continue to receive <strong>HSA</strong> reimbursement for such items after 12/31/10 in the same manner you do now.<br />

Eligible <strong>HSA</strong> OTC Medications and Products<br />

• Physical therapy<br />

• Psychiatric care, psychologists, psychotherapists<br />

• Radial keratotomy<br />

• Schools (special, relief, or handicapped)<br />

• Sexual dysfunction treatment<br />

• Smoking cessation<br />

• Surgical fees<br />

• Television or telephone for the hearing<br />

impaired<br />

• Therapy treatments*<br />

• Transportation (essentially and primarily<br />

for medical care; limits apply)<br />

• Vaccinations<br />

• Vitamins (prescription only)*<br />

• Weight loss programs*<br />

• X-rays<br />

ELIGIBLE NOW, BUT WILL REQUIRE<br />

PRESCRIPTION TO REMAIN ELIGIBLE<br />

AFTER 12/31/10:<br />

• Acne medications & treatments<br />

• Allergy & sinus, cold, flu & cough<br />

remedies (antihistimines, decongestants,<br />

cough syrups, cough drops,<br />

nasal sprays, medicated rubs, etc.)<br />

• Antacids & acid controllers (tablets,<br />

liquids, capsules)<br />

• Antibiotic & antiseptic sprays, creams<br />

& ointments<br />

• Anti-diarrheals<br />

• Anti-fungals<br />

• Anti-gas & stomach remedies<br />

• Anti-itch & insect bite remedies<br />

• Anti-parasitics<br />

• Digestive aids<br />

• Baby care (diaper rash ointments,<br />

teething gel, rehydration fluids, etc.)<br />

• Contraceptives (condoms, gels,<br />

foams, suppositories, etc.)<br />

• Eczema & psoriasis remedies<br />

• Eye drops, ear drops, nasal sprays<br />

• First aid kits<br />

• Hemorrhoidal preparations<br />

• Hydrogen peroxide, rubbing alcohol<br />

• Laxatives<br />

• Medicated bandaids & dressings<br />

• Motion sickness remedies<br />

• Nicotine medications (smoking cessation<br />

aids)<br />

• Pain relievers (aspirin, ibuprofen,<br />

acetaminophen, naproxen, etc.)<br />

• Sleep aids & sedatives<br />

• Wart removal remedies, corn patches<br />

Page 9<br />

ELIGIBLE NOW AND WILL REMAIN<br />

ELIGIBLE AFTER 12/31/10 WITH NO<br />

PRESCRIPTION REQUIRED:<br />

• Braces & supports<br />

• Contact lens solution<br />

• Diabetic testing supplies & equipment<br />

• Durable medical equipment (power<br />

chairs, walkers, wheelchairs, CPAP<br />

equipment & supplies, etc.)<br />

• Home diagnostic (pregnancy tests,<br />

ovulation kits, thermometers, blood<br />

pressure monitors, etc.)<br />

• Non-medicated bandaids, rolled<br />

bandages & dressings<br />

• Reading glasses<br />

All OTC items listed are examples.

NON-ELIGIBLE <strong>HSA</strong> Expenses and OTC Products<br />

NON-ELIGIBLE <strong>HSA</strong> Healthcare Expenses<br />

• Advance payment for services to be rendered<br />

• Automobile insurance premium allocable to medical<br />

coverage<br />

• Boarding school fees<br />

• Body piercing<br />

• Bottled water<br />

• Chauffeur services<br />

• Controlled substances<br />

• Cosmetic surgery and procedures<br />

• Cosmetic dental procedures<br />

• Dancing lessons<br />

• Diapers for Infants<br />

• Diaper service<br />

• Ear piercing<br />

• Electrolysis<br />

• Fees written off by provider<br />

• Food supplements<br />

• Funeral, cremation, or burial expenses<br />

• Hair transplant<br />

• Herbs & herbal supplements<br />

• Household & domestic help<br />

• Health programs, health clubs, and gyms<br />

• Illegal operations and treatments<br />

• Illegally procured drugs<br />

• Insurance premiums (not reimburseable under FSA…<br />

only PRA)<br />

• Long-term care services<br />

• Maternity clothes<br />

• Medical savings sccounts<br />

• Premiums for life insurance, income protection, disability,<br />

loss of limbs, sight or similar benefits<br />

• Personal items<br />

• Preferred provider discounts<br />

• Social activities<br />

• Special foods and beverages<br />

• Swimming lessons<br />

• Tattoos/tattoo removal<br />

• Teeth whitening<br />

• Transportation expenses to & from work<br />

• Travel for general health improvement<br />

• Uniforms<br />

• Vitamins & supplements without prescription<br />

NON-ELIGIBLE <strong>HSA</strong> Over-the-Counter Products<br />

The following are examples of OTC medications & products which are NOT eligible for <strong>HSA</strong> reimbursement.<br />

Additional items will join this list effective January 1, 2011, due to changes in the law brought about by the Patient<br />

Protection and Affordable Care Act (PPACA) of 2010.<br />

• Aromatherapy<br />

• Baby bottles & cups<br />

• Baby oil<br />

• Baby wipes<br />

• Breast enhancement system<br />

• Cosmetics (including face cream & moisturizer)<br />

• Cotton swabs<br />

• Dental floss<br />

• Deodorants & anti-perspirants<br />

• Dietary supplements<br />

• Feminine care items<br />

• Fiber supplements<br />

• Food<br />

• Fragrances<br />

• Hair regrowth preparations<br />

• Herbs & herbal supplements<br />

• Hygiene products & similar items<br />

• Low-carb & low-fat foods<br />

• Low calorie foods<br />

• Lip balm<br />

• Medicated shampoos & soaps<br />

• Petroleum jelly<br />

• Shampoo & conditioner<br />

• Spa salts<br />

• Suntan lotion<br />

• Toiletries (including toothpaste)<br />

• Vitamins & supplements without prescription<br />

• Weight loss drugs for general well-being<br />

Page 10