Capital Improvement Plan (CIP) - City of Delaware

Capital Improvement Plan (CIP) - City of Delaware

Capital Improvement Plan (CIP) - City of Delaware

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

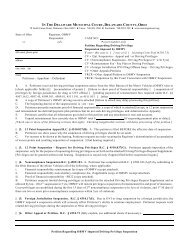

CAPITAL IMPROVEMENT PLAN<br />

FIRE IMPACT FEE FUND<br />

2009 - 2013<br />

2009 2010 2011 2012 2013<br />

BALANCES FORWARD 388,914 488,914 445,164 445,164 445,164<br />

REVENUES:<br />

Fire Impact Fees 200,000 165,000 140,000 140,000 0<br />

Bond Issue<br />

TOTAL REVENUE 200,000 165,000 140,000 140,000 0<br />

IMPACT FEE EXPENDITURES:<br />

Command Vehicle 25,000<br />

Training Vehicle 83,750<br />

Land Acquisition Area Substation 100,000 100,000<br />

Construction Station #3 $1,750,000<br />

Annual Debt Service 20yrs. 140,000 140,000 140,000<br />

Construction Station #4 $2,000,000<br />

Annual Debt Service 20yrs. 160,000<br />

TOTAL IMPACT FEE EXPENDITURES: 100,000 208,750 140,000 140,000 300,000<br />

IMPACT FEE BALANCE 488,914 445,164 445,164 445,164 145,164<br />

PURPOSE: The Fire <strong>Improvement</strong> Fund identifies future projects and equipment purchases<br />

necessary for operation <strong>of</strong> the <strong>City</strong>'s Fire/EMS Department. In 2001 the <strong>City</strong> enacted a Fire<br />

Facilities Development Impact Fee <strong>of</strong> $314 per single family residential unit and approximately<br />

$350 per 1000 s.f. <strong>of</strong> non-residential development. These funds must be spent on Fire/EMS<br />

equipment and facilities made necessary by the growth <strong>of</strong> the <strong>City</strong>. The impact fees cannot be<br />

spent on replacement <strong>of</strong> existing equipment or on replacement <strong>of</strong> equipment purchased with<br />

impact fee resources.<br />

FUNDING SOURCES: Fire Impact Fees.<br />

97