0771 Leisure Winter 07 AW.indd - HLL Humberts Leisure

0771 Leisure Winter 07 AW.indd - HLL Humberts Leisure

0771 Leisure Winter 07 AW.indd - HLL Humberts Leisure

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong><br />

chartered surveyors | international leisure business consulting<br />

<strong>Winter</strong> 20<strong>07</strong>/Spring 2008<br />

leisure<br />

The leisure property<br />

market following<br />

the Sub-Prime<br />

collapse (p21)<br />

Sounds Good - Alan<br />

Saunders Associates<br />

lends an ear to<br />

noise issues (p28)<br />

Pub visionaries in<br />

their own words<br />

(p23)<br />

and on the cover...<br />

Nonsuch Bay, Antigua (p12)<br />

Pub focus (p22)<br />

Wood Street, Cardiff (p14)<br />

www.humberts-leisure.com

From the Chairman<br />

Our Chairman and<br />

founder celebrates<br />

a milestone in the<br />

history of <strong>HLL</strong><br />

<strong>Humberts</strong> <strong>Leisure</strong>.<br />

Established originally as <strong>Humberts</strong> Landplan 30 years<br />

ago, <strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong> is the result of a management<br />

buyout in 1991 from the old firm of <strong>Humberts</strong>, itself<br />

established in 1842. As 2008 commences I reflect on my<br />

involvement, from the outset, in <strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong>’s<br />

march ever onward and upward. Today we provide,<br />

probably, the most diversified specialist leisure property<br />

service to our loyal and ever expanding client base.<br />

Many achievements over the last 30 years have been leading<br />

edge, but one deserves special mention – the launch of<br />

<strong>Leisure</strong> and Media Venture Capital Trust Plc with J O<br />

Hambro Capital Management which was nominated<br />

“pick of the specialist VCTs” by analyst Best Invest. Now<br />

fully invested and about to enter its run-off period, <strong>HLL</strong><br />

<strong>Humberts</strong> <strong>Leisure</strong> was one of the first firms of Chartered<br />

Surveyors to launch such a leisure driven venture.<br />

We continue to advance our skills across the 10 principal<br />

leisure and hotel sectors acting as consultants and advisers<br />

to owners, corporates and City institutions combining<br />

within one unique practice specialist Chartered Surveyors,<br />

Accountants, Planners, hotel and business consultants, real<br />

estate transactional specialists and management surveyors.<br />

In this issue of <strong>Leisure</strong> we celebrate an eclectic range of<br />

topics sharing with you a taste of the diversity that is <strong>HLL</strong><br />

<strong>Humberts</strong> <strong>Leisure</strong>.<br />

If we can assist you, now or in the future, please contact me<br />

personally or any one of our sector specialists.<br />

Good Reading!<br />

Nigel Talbot-Ponsonby FRICS,<br />

Executive Chairman, London.<br />

e: ntp@humberts-leisure.com t: +44 (0)20 7629 6700<br />

12 Bolton Street Mayfair London W1J 8BD<br />

t: +44 (0)20 7629 6700 f: +44 (0)20 7409 0475<br />

2 <strong>Winter</strong> 20<strong>07</strong>/Spring 2008<br />

Specialist advice to help protect investments<br />

in the Urban <strong>Leisure</strong> sector!

<strong>Winter</strong> 20<strong>07</strong>/Spring 2008<br />

04 News<br />

12 Featured properties<br />

12 Nonsuch Bay<br />

A little piece of paradise in Antigua.<br />

14 Wood Street, Cardiff<br />

Operator sought for an exceptional development.<br />

16 Studley Wood GC and Middleton Hall GC<br />

Golf clubs on the move.<br />

17 Forest Hill GC and The Ridge GC<br />

New courses on the market.<br />

18 Domaine du Grand Mayne<br />

A model vineyard business in Bergerac sold.<br />

19 Cascade Springs<br />

A clearly superior lifestyle business opportunity.<br />

20 Taxing times<br />

Sarah Cardew of Penningtons Solicitors looks at the<br />

withdrawal of Taper Relief.<br />

21 The Sub-Prime Collapse<br />

John Anderson casts an eye to the future of the market.<br />

22 Focus on Pubs<br />

A section devoted to the pub and licensed property<br />

market including: Market conditions; SA Brains brave pub<br />

redevelopment; rent review advice; Tony Carson and Mark<br />

Jones share their experiences; plus Pub is the Hub’s approach<br />

to supporting rural services.<br />

28 Sounds good<br />

Ed Clarke of Alan Saunders Associates looks at noise.<br />

30 Energy Performance of Buildings<br />

Ben Allen outlines this new EU directive.<br />

32 Planning Reform Bill<br />

Rachel Whaley examines the impact of the new Bill.<br />

34 Planning Gain Supplement abandoned<br />

Simon Davis on the Government’s planning u-turn.<br />

36 www.lodgesales.com<br />

A look at the Lodge Sales Service nine months on.<br />

38 Planning<br />

Recent successes of the Planning and Public Sector<br />

Development team.<br />

39 Why choose <strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong>?<br />

www.humberts-leisure.com<br />

<strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong> 3

News<br />

consultancy<br />

Palazzo Pauly, Venice<br />

Palazzo Pauly Private Owners Club is a Private Residence Club located only steps away<br />

from Venice’s renowned Piazza San Marco. The three historical and magnificent Palazzos<br />

comprising what is now Palazzo Pauly were formerly the historic Venetian Headquarters<br />

of the Pauly Glass Company. The Palazzo boasts 26 luxury residences featuring all<br />

modern facilities, extensive Club benefits and traditional English butler service. The global<br />

membership of 260 members will acquire co-ownership of the Palazzo in perpetuity.<br />

CCA International is a world leader in the Private Club industry and has been selected as the<br />

long term operator. Opening of the Club is foreseen in the autumn of 2008.<br />

Contact<br />

Nigel Talbot-Ponsonby FRICS, London<br />

e: ntp@humberts-leisure.com t: +44 (0)20 7629 6700<br />

valuation<br />

under offer<br />

under offer<br />

Northern<br />

Racing<br />

<strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong> valued the<br />

portfolio of 9 Northern Racing horse<br />

race circuits located throughout the UK<br />

following the acquisition of the portfolio by<br />

Aldersgate (a Reuben Brothers Company).<br />

We continue to provide professional<br />

services to the Company.<br />

Contact<br />

Martin Brister FRICS, Winchester<br />

e: martin.brister@humberts-leisure.com<br />

t: +44 (0)1962 835 960<br />

Peter Haigh BSc FRICS, London<br />

e: peter.haigh@humberts-leisure.com<br />

t: +44 (0)20 7629 6700<br />

Little Cumbrae,<br />

Firth of Clyde<br />

■ An historic island of some 277 hectares<br />

(684 acres) in the Firth of Clyde. Large<br />

12 bedroom mansion house, boathouse<br />

and jetty, 2 cottages, 13th century keep,<br />

lighthouse complex with 3 vacant houses<br />

■ Potential for alternative uses including<br />

lodge development, marina and hotel/<br />

restaurant - stp<br />

Guide £2.5 million<br />

Contact<br />

Peter Smith BA(Hons) MRICS, Skipton<br />

e: peter.smith@humberts-leisure.com<br />

t: +44 (0)1756 799 271<br />

Marina Pavilion,<br />

Hastings<br />

<strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong> confirms that a<br />

preferred tenant has been selected for a<br />

consented new restaurant development<br />

scheme in Hastings.<br />

■ Nightclub/function rooms & café proposed<br />

■ Street level 3,222 sq.ft.<br />

■ Beach level 9,236 sq.ft.<br />

Contact<br />

Alex Campbell BA(Hons) MA, London<br />

e: alex.campbell@humberts-leisure.com<br />

t: +44 (0)20 7629 6700<br />

4 <strong>Winter</strong> 20<strong>07</strong>/Spring 2008

valuation & consultancy<br />

Amberley Castle,<br />

West Sussex<br />

The Cummings family has sold the 900 year-old Amberley Castle<br />

into the Von Essen group. Amberley Castle offers magnificent<br />

public rooms, 19 luxurious bedrooms/suites and 2 restaurants. <strong>HLL</strong><br />

<strong>Humberts</strong> <strong>Leisure</strong> provided the Cummings family with valuation<br />

and consultancy advice.<br />

Contact<br />

Nigel Talbot-Ponsonby FRICS, London<br />

e: ntp@humberts-leisure.com t: +44 (0)20 7629 6700<br />

valuation<br />

Hazlehead Golf Course,<br />

Scotland,<br />

comes up trumps!<br />

News<br />

Following the recent proposals by The Trump Organisation for a<br />

new 36 hole golf resort 12 miles north of Aberdeen (which were<br />

supported by Aberdeen City Council, and initially rejected by<br />

Aberdeenshire Council) <strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong> has been appointed<br />

by Aberdeen City Council to provide advice on the proposed long<br />

term lease over Hazlehead Golf Course. Hazlehead offers three<br />

picturesque courses and a pitch and putt course. The premier No.<br />

1 Course is arguably one of the best in the North East, if not in<br />

Scotland and was designed by Alister MacKenzie, the golf architect<br />

better known for designing Augusta National in America.<br />

Ben Allen BSc (Hons) MRICS who heads <strong>Humberts</strong> <strong>Leisure</strong> Golf<br />

agency team commented ‘We are delighted to have been appointed<br />

by Aberdeen City Council. Our experience in letting many other<br />

municipal golf facilities, not least the renowned Richmond Park Golf<br />

Course on behalf of The Royal Parks, places us in good stead to<br />

assist with this prestigious assignment. We look forward to marketing<br />

this historic property during 2008’.<br />

Contact<br />

Ben Allen BSc(Hons) MRICS, Winchester<br />

e: ben.allen@humberts-leisure.com t: +44 (0)1962 835 960<br />

Martin Brister FRICS, Winchester<br />

e: martin.brister@humberts-leisure.com t: +44 (0)1962 835 960<br />

Are you ready for the<br />

non-domestic<br />

rating revaluation 2010?<br />

How time flies! It seems no time at all since the last non domestic<br />

rating revaluation in April 2005, but already the Valuation Office<br />

Agency (VOA) is gearing up for the next revaluation in 2010.<br />

Whilst the 2010 Rating List will not come into force until 1st April<br />

2010, it will be based upon values as at 1st April 2008 known as the<br />

antecedent valuation date or AVD.<br />

Many leisure categories of non domestic property are valued having<br />

regard to receipts information with the 20<strong>07</strong> season being the most<br />

relevant as it immediately proceeds the AVD.<br />

Aldourie Castle,<br />

Inverness<br />

<strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong> provided business plan and valuation advice<br />

for a hotel, lodge and mixed use scheme at this historic property set<br />

in 500 acres on the shores of Loch Ness.<br />

Contact<br />

Nigel Talbot-Ponsonby FRICS, London<br />

e: ntp@humberts-leisure.com t: +44 (0)20 7629 6700<br />

Peter Haigh BSc FRICS, London<br />

e: peter.haigh@humberts-leisure.com t: +44 (0)20 7629 6700<br />

Nigel Mills MBHA, Brighton<br />

e: nigel.mills@humberts-leisure.com t: +44 (0)1273 325 911<br />

<strong>Leisure</strong> properties such as holiday caravan parks, golf courses,<br />

hotels, tourist attractions and theme parks will be required to<br />

provide details of trading receipts to the VOA on the official<br />

“Request for Information”.<br />

These forms are long and time consuming to compile, but there is<br />

a Civil Penalty for failure to complete the return or for providing<br />

false information.<br />

<strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong> has considerable experience in these matters,<br />

and is available to offer assistance to clients who require professional<br />

advice regarding the supply of confidential information, the provision of<br />

which will directly influence the eventual Rating Valuation.<br />

Contact<br />

Peter Boghurst MRICS, Brighton<br />

e: peter.boghurst@humberts-leisure.com t: +44 (0)1273 325 911<br />

www.humberts-leisure.com<br />

<strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong> 5

News<br />

<strong>HLL</strong> Director<br />

leads planners in<br />

the South East<br />

Martin Taylor, <strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong>’s<br />

Director of Planning and Public Sector<br />

Development, has been elected as Chair of<br />

the Royal Town Planning Institute South<br />

East Region for 2008. The RTPI is the<br />

institute representing professional planners<br />

in the British Isles. The South East is the<br />

largest regional branch covering an area<br />

from Milton Keynes down to Southampton<br />

and across to Dover.<br />

Martin will represent planners in the region<br />

and chair the Regional Board and Activities<br />

Committee responsible for organising<br />

a CPD programme of seminars and<br />

conferences to keep the region’s planners<br />

up-to-date with the latest planning policy,<br />

legislation, and good practice.<br />

Martin says “It’s a great honour to be elected<br />

as Chair and to represent the region’s planning<br />

professionals at a time when there is a great<br />

deal of pressure on planners to deliver the<br />

government housing agenda. Obviously, with a<br />

background in economic development, tourism,<br />

and leisure, I will be seeking every opportunity<br />

to remind my co-professionals that in<br />

developing new communities and regenerating<br />

old ones it is just as important to plan for new<br />

business development, leisure time, and visitors<br />

in order to create exciting vibrant communities<br />

rather than soulless residential suburbs or town<br />

centres which are deserted at night.”<br />

Contact<br />

Martin Taylor BA(Hons) BTP MRTPI MIED MTS, Brighton<br />

t: +44 (0)1273 325 911<br />

Viability<br />

Assessments<br />

<strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong>’s Planning and<br />

Public Sector Development team has<br />

considerable experience in undertaking<br />

need and viability assessments for new lodge<br />

and holiday resort developments to support<br />

planning applications and appeals. Recent<br />

work includes:<br />

■ An assessment of the market need for<br />

a new timber holiday lodge resort in<br />

Warwickshire.<br />

■ An appraisal of the likely demand for a<br />

major lodge-based holiday centre on the<br />

West Cumbrian coast;<br />

■ An assessment of the need for upmarket<br />

timber lodges at a number of locations in<br />

and around the proposed South Downs<br />

National Park;<br />

For planning matters relating to all types of<br />

leisure property, please contact our specialist<br />

Planning and Public Sector Development team.<br />

Contact<br />

Martin Taylor BA(Hons) BTP MRTPI MIED MTS, Brighton<br />

t: +44 (0)1273 325 911<br />

Peter Sharp BA(Hons) MBHA, Brighton<br />

t: +44 (0)1273 325 911<br />

for sale<br />

Marina Marco,<br />

Korcula Island, Croatia<br />

Korcula Island, the 6th largest of the Croatian Dalmatian Archipelago, is the proposed<br />

location for Marina Marco – an exciting mixed use leisure development based around a<br />

marina that is being marketed by <strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong>.<br />

Korcula Island lies some 4 Kms off the mainland coast in the Adriatic Sea, once described<br />

as being ‘paradise on earth’ by George Bernard Shaw. The nearest international airports with<br />

direct flights from the UK are from Split in the north and Dubrovnic to the south.<br />

The proposed Marina Marco scheme comprises an outstanding luxury resort development<br />

to include a 4/5 star hotel with full leisure facilities, holiday apartments, a deep-water marina<br />

and associated bars restaurants and shops to be developed along the boardwalk adjacent to<br />

the waterfront. The apartments are ‘dual key’ which allows the hotel to include these rooms<br />

in their bedroom inventory when not occupied by the owners and provides an income stream<br />

to the apartment owners when not occupied by them. The marina is likely to have up to 149<br />

deep water berths, although the UMP Zoning allows for up to 200 berths.<br />

The property is to be sold freehold with vacant possession. Offers in the region of<br />

€12,500,000 are invited for the property.<br />

Contact<br />

Nigel Talbot-Ponsonby FRICS, London e: ntp@humberts-leisure.com t: +44 (0)20 7629 6700<br />

Andrew Bates MRICS, Winchester e: andrew.bates@humberts-leisure.com t: +44 (0)1962 835 960<br />

New face in the<br />

Planning team<br />

Rachel Whaley BSc(Hons) DipTP MRTPI has joined <strong>HLL</strong><br />

<strong>Humberts</strong> <strong>Leisure</strong> as Senior Planner, to strengthen the planning<br />

team operating from the Northern office based at Skipton<br />

near Leeds. Rachel brings 14 years local authority experience,<br />

predominantly dealing with developments in the countryside, most<br />

recently within the Yorkshire Dales National Park, and is therefore well equipped to provide<br />

advice and assistance on planning matters, helping to achieve successful developments<br />

in even the most sensitive of landscapes. Rachel will be covering Yorkshire, the Northern<br />

regions, Scotland and North Wales, working alongside John Anderson BSc FRICS.<br />

Contact<br />

Rachel Whaley BSc(Hons) DipTP MRTPI, Skipton<br />

e: rachel.whaley@humberts-leisure.com t: +44 (0)1756 799 271<br />

John Anderson BSc FRICS, Skipton<br />

e: john.anderson@humberts-leisure.com t: +44 (0)1756 799 271<br />

6 <strong>Winter</strong> 20<strong>07</strong>/Spring 2008

News<br />

site requirement<br />

sold<br />

sold<br />

Kidspace<br />

Adventures<br />

■ Sites of approximately 20,000 sq.ft. +<br />

leasehold or freehold. Must be suitable for<br />

use as a Children’s Play Centre (D2 use)<br />

■ Greater London<br />

■ Retail/leisure parks units, redundant<br />

nightclubs, former bowling alleys or<br />

stand-alone industrial units considered.<br />

Car parking essential<br />

■ Large open plan space ideally on single<br />

floor. Minimum Eaves height of 6.5<br />

metres over most of area<br />

Contact<br />

Gavin Brent BSc MRICS, London<br />

e: gavin.brent@humberts-leisure.com<br />

t: +44 (0)20 7629 6700<br />

Brimham Rocks<br />

Cottages, Yorks<br />

<strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong> confirms the sale<br />

of Brimham Rocks Cottages in North<br />

Yorkshire. The property comprises a<br />

four star holiday cottage complex with<br />

10 cottages and a substantial 4 bedroom<br />

farmhouse, set within the glorious<br />

Nidderdale Area of Outstanding Natural<br />

Beauty overlooking the famous Brimham<br />

Rocks. The sale generated considerable<br />

interest in the market as properties of<br />

this type rarely come to the market in the<br />

Yorkshire Dales.<br />

Contact<br />

Richard Baldwin BSc(Hons) MRICS, Skipton<br />

e: richard.baldwin@humberts-leisure.com<br />

t: +44 (0)1756 799 271<br />

Long Sutton Golf<br />

Club, Somerset<br />

■ 18 hole 6,352 yard (par 71) golf course<br />

■ 12 bay driving range<br />

■ Substantial well-appointed clubhouse<br />

■ PP for 38 bedroom golf lodge<br />

■ Turnover c. £1.0 million<br />

■ Acquired by GCH Golf Ltd<br />

Guide £2.5 million<br />

Contact<br />

Ben Allen BSc(Hons) MRICS, Winchester<br />

e: ben.allen@humberts-leisure.com<br />

t: +44 (0)1962 835 960<br />

Martin Brister FRICS, Winchester<br />

e: martin.brister@humberts-leisure.com<br />

t: +44 (0)1962 835 960<br />

to let<br />

let<br />

under offer<br />

First Floor Cinema,<br />

Catford<br />

■ Occupying the first floor/circle level<br />

■ Capacity for approximately 200 cinema<br />

style seats<br />

■ Densely populated location with busy<br />

main road frontage<br />

■ Refurbished shell available on flexible<br />

terms<br />

Contact<br />

Alex Campbell BA(Hons) MA, London<br />

e: alex.campbell@humberts-leisure.com<br />

t: +44 (0)20 7629 6700<br />

Loch Fyne come<br />

to South Wales!<br />

<strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong> acting for private<br />

clients has successfully negotiated a lease<br />

deal with Loch Fyne Restaurants at the<br />

Mulligans site in Cowbridge in the Vale of<br />

Glamorgan. This will be the seafood chain’s<br />

first site in South Wales. The unit will be<br />

totally refurbished and will reopen in Late<br />

spring 2008. This deal confirms the level<br />

of demand in the casual dining market for<br />

good quality sites.<br />

Contact<br />

Peter Constantine BSc(Hons) FRICS, Chepstow<br />

e: peter.constantine@humberts-leisure.com<br />

t: +44 (0)1291 627 813<br />

Weir Wood<br />

Reservoir<br />

Long leasehold leisure investment<br />

opportunity.<br />

<strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong> was instructed by<br />

Southern Water Services Ltd to market the<br />

long leasehold interest in the recreational<br />

area of Weir Wood Reservoir, subject to the<br />

existing sailing and fishing leases.<br />

Contact<br />

Alex Campbell BA(Hons) MA, London<br />

e: alex.campbell@humberts-leisure.com<br />

t: +44 (0)20 7629 6700<br />

www.humberts-leisure.com<br />

<strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong> 7

News<br />

Cleethorpes, Lincolnshire<br />

Colchester Castle<br />

Regeneration Spearheads<br />

Hotel Development<br />

<strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong> is<br />

increasingly being asked by<br />

both public and private sector<br />

clients to analyse and assess<br />

the current provision of hotel<br />

accommodation and conference<br />

facilities in an identified area, in<br />

order to assess the opportunities<br />

and capacities for growth and<br />

development.<br />

One of <strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong>’s Planning and Public Sector Development team’s most<br />

recent assignments was on behalf of Colchester Borough Council. Colchester is set to<br />

undergo significant transformation through a number of regeneration initiatives and <strong>HLL</strong><br />

<strong>Humberts</strong> <strong>Leisure</strong> was retained to assess possible gaps in the market, identify opportunities<br />

for hotel development and evaluate a number of potential sites which would be suitable that<br />

match both market and planning criteria. Our report is proving to be invaluable to both<br />

developers looking to invest in Colchester as well as informing the Council’s emerging LDF.<br />

<strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong> has subsequently been retained to actively market potential sites and<br />

find suitable operators.<br />

The team has recently been appointed to undertake a similar study for North East<br />

Lincolnshire, which includes Grimsby and Cleethorpes. North East Lincolnshire is also set to<br />

undergo significant regeneration, which could be a catalyst for hotel development and we are<br />

currently assessing future opportunities. Other such studies in the recent past have included<br />

work in Newquay, East Cambridgeshire and Boston.<br />

Contact<br />

Nigel Mills MBHA, Brighton<br />

e: nigel.mills@humberts-leisure.com t: +44 (0)1273 325 911<br />

Martin Taylor BA(Hons) BTP MRTPI MIED MTS, Brighton<br />

e: martin.taylor@humberts-leisure.com t: +44 (0)1273 325 911<br />

<strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong> heads up a<br />

powerful group to maximise service<br />

to hotel developers and operators<br />

In a new initiative, this respected group of companies have formed a marketing consortium<br />

for the hotels sector whereby, through quarterly meetings and regular discussions, they<br />

maximise their market contacts. More importantly, in an increasingly competitive market<br />

place, it ensures that the team can truly provide a one stop shop to developers and operators.<br />

By teaming up with similar companies who consider client service, to be as important as we<br />

do, we have established a powerful group able to provide a full service to the market.<br />

Contact<br />

Tim Smith BSc(Hons) MRICS, London<br />

e: tim.smith@humberts-leisure.com t: +44 (0)20 7629 6700<br />

8 <strong>Winter</strong> 20<strong>07</strong>/Spring 2008

News<br />

sold<br />

The White Horse<br />

Chilgrove, West Sussex<br />

“Places of this quality, style and long-standing<br />

reputation just don’t come on to the market. This is<br />

a rare opportunity; it is a gem of the South”<br />

<strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong> is delighted to announce contracts have been<br />

exchanged (November 20<strong>07</strong>) for the sale of this outstanding country<br />

pub, restaurant and boutique hotel to an exceptional operator who aims<br />

to maximise the turnover of this well known and loved Sussex hostelry.<br />

The freehold property, extending to approximately 0.49 hectares<br />

(1.2 acres), was offered for sale as a going concern, with a manager<br />

and full staff complement in situ, with significant potential for<br />

further development of the business.<br />

Planning and listed building consents have been granted for seven<br />

additional en-suite letting rooms, a conservatory extension to the<br />

restaurant, an extension to the bar, a larger store area, and<br />

additional parking.<br />

Contact<br />

Tim Smith BSc(Hons) MRICS, London<br />

e: tim.smith@humberts-leisure.com t: +44 (0)20 7629 6700<br />

Boutique<br />

hotel<br />

opportunity,<br />

City of<br />

London<br />

<strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong> has been instructed to sell a stunning<br />

Listed building in the heart of the City. Renowned hotel architects,<br />

Reardon Smith, have judged that a boutique hotel of circa 89<br />

bedrooms can be created in the existing building. This property<br />

represents an outstanding opportunity to create a spectacular<br />

upmarket hotel in a prime location.<br />

Contact<br />

Tim Smith BSc(Hons) MRICS, London<br />

e: tim.smith@humberts-leisure.com t: +44 (0)20 7629 6700<br />

A conference for all<br />

(Ho)seasons<br />

This year <strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong> was honoured to be chosen as<br />

main sponsors at the second annual Hoseasons conference which<br />

was held in early November at Holburne Naish Holiday Park,<br />

situated between the South Coast and the New Forest.<br />

The Holiday Property team were out in force for the event, and not<br />

only enjoyed main stand position but Peter Smith from our Northern<br />

office spoke on the current state of the lodge sales market. In all the<br />

event provided an excellent opportunity for <strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong><br />

to promote its specialist valuation, planning and agency expertise as<br />

well as highlight the new website-based lodge sales service, which<br />

is proving to be very popular amongst lodge owners and potential<br />

purchasers alike.<br />

The well-attended conference of over 350 lodge park owners and<br />

operators also heard Alison Rice, a journalist and broadcaster,<br />

speaking somewhat controversially on the ‘UK Holiday Market (a<br />

view from the media)’ and Philip Hesketh, professional speaker and<br />

author, who entertained the delegates with a quirky (and surprisingly<br />

relevant) look at ‘The Rise and Fall of the Roman Empire’.<br />

Hoseasons are to be congratulated on putting together a professional<br />

and informative programme which included their own detailed<br />

analysis of current market trends and future growth prospects for the<br />

holiday letting sector, combined with various practical workshops,<br />

plenty of networking opportunities and topped off with a sparkling<br />

dinner and awards ceremony.<br />

Regrettably, no one from <strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong> was available to<br />

enter the amusing human-hamster-ball-race-on-water competition<br />

at the pool, but as part of an ongoing training and familiarisation<br />

programme, the Holiday Property team enjoyed a pleasant stay in<br />

lodge accommodation for the duration of the conference.<br />

Contact<br />

Peter Smith BA(Hons) MRICS, Skipton<br />

e: peter.smith@humberts-leisure.com t: +44 (0)1756 799 271<br />

Emma Carling, Skipton<br />

e: emma.carling@humberts-leisure.com t: +44 (0)1756 799 271<br />

Paul Barnes BSc(Hons) MRICS, London<br />

e: paul.barnes@humberts-leisure.com t: +44 (0)20 7629 6700<br />

www.humberts-leisure.com<br />

<strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong> 9

News<br />

Holiday property<br />

<strong>HLL</strong>’s continued success in the dynamic and<br />

fast-moving holiday park & park home market<br />

To discuss your holiday park requirements in confidence, or for<br />

advice, information, professional services, consultancy and planning<br />

queries contact:<br />

Peter Smith BA(Hons) MRICS, Skipton (ref PRS)<br />

e: peter.smith@humberts-leisure.com t: +44 (0)1756 799 271<br />

John Mitchell BSc MRICS, London (ref JCM)<br />

e: john.mitchell@humberts-leisure.com t: +44 (0)20 7629 6700<br />

Paul Barnes BSc(Hons) MRICS, London (ref PGB)<br />

e: paul.barnes@humberts-leisure.com t: +44 (0)20 7629 6700<br />

Emma Carling, Skipton (ref ELC)<br />

e: emma.carling@humberts-leisure.com t: +44 (0)1756 799 271<br />

Richard Baldwin BSc(Hons) MRICS, Skipton (ref RNB)<br />

e: richard.baldwin@humberts-leisure.com t: +44 (0)1756 799 271<br />

John Anderson BSc FRICS, Skipton<br />

e: john.anderson@humberts-leisure.com t: +44 (0)1756 799 271<br />

Martin Reed MRICS IRRV, Brighton<br />

e: martin.reed@humberts-leisure.com t: +44 (0)1273 325 911<br />

Peter Boghurst MRICS, Brighton<br />

e: peter.boghurst@humberts-leisure.com t: +44 (0)1273 325 911<br />

Sold<br />

Badgers Retreat Holiday Park,<br />

Yorkshire<br />

An excellent opportunity to acquire a lodge<br />

park with a secluded countryside setting yet<br />

easily accessible from the A1. Comprising<br />

a total area of 8.9 hectares (22 acres) with planning consent for 50<br />

timber-clad units (to include 1 park owner/manager’s unit). 8 twin<br />

units and 15 fully serviced bases currently sited. Tremendous scope<br />

for further development. Sold freehold.<br />

Guide £2 million - Ref PRS/ELC t: +44 (0)1756 799 271<br />

Grosvenor Park,<br />

North Yorkshire<br />

A well located park home estate set in North<br />

Yorkshire. Site Licence for 55 park homes<br />

(38 twin units and 11 single units sited) with<br />

planning permission for 58. Approximately 1.51 ha/3.73 acres in<br />

total. Sold freehold.<br />

Guide £1.9 million - Ref PRS/ELC t: +44 (0)1756 799 271<br />

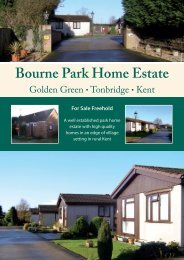

Bourne Park Home Estate,<br />

Kent<br />

Park home estate with planning consent and<br />

site licence for 29 homes, 24 sold freehold<br />

subject to service charge, with 5 twin units<br />

held on Mobile Home Act Agreements. 20<strong>07</strong> pitch fees of £1,460 per<br />

pitch exclusive of all services and Council Tax. Attractive location with<br />

excellent communication links with the M25 (J.5) about 13 miles and<br />

the M20 (J.4) about 9 miles. Sold freehold as a going concern.<br />

Guide £200,000 - Ref JCM/PGB t: +44 (0)20 7629 6700<br />

Under offer<br />

Three Star Park Home Estate,<br />

Bedfordshire<br />

A substantial park home estate in a prime<br />

location with considerable development<br />

potential. Currently 140 park homes (67<br />

twin and 73 single units), 5 residential chalets, central management<br />

office, shop and licensed club. In addition, 66 garages, workshop,<br />

open amenity/touring caravan storage area ripe for development. In all<br />

about 5.68 ha/14.03 acres. For sale freehold.<br />

Guide £6 million - Ref JCM/PGB t: +44 (0)20 7629 6700<br />

Willow Trees Holiday Park,<br />

Kent<br />

A profitable private owner holiday static<br />

park set in mature landscaped grounds<br />

overlooking the sea. The caravan park has<br />

planning consent for 82 static holiday caravans for use from 1 March<br />

to 31 October and a warden’s unit. Freehold.<br />

Guide £1.3 million - Ref JCM/PGB t: +44 (0)20 7629 6700<br />

Broughton Park Home Estate,<br />

Somerset<br />

A well-established residential park in an<br />

attractive rural location close to Taunton,<br />

presently developed with pitches for 22 twin<br />

mobile homes with good level of pitch fees. Main services and bulk<br />

LPG gas connected. M5 (J.25) about 3 miles. In all about 0.72 ha/<br />

1.79 acres of mature grounds. For sale freehold.<br />

Guide £795,000 - Ref JCM/PGB t: +44 (0)20 7629 6700<br />

Riverside Caravan Park,<br />

Isle of Wight<br />

An attractive static holiday park<br />

redevelopment opportunity in the popular<br />

resort of Sandown, close to the coast,<br />

comprising a bare site (with old bases and services) with valid<br />

planning consent and site licence for use as a holiday static park for<br />

up to 59 pitches with an 8 month season. 3-bed manager’s/owner’s<br />

bungalow, former licensed clubhouse, former shower/toilet block. In<br />

all about 1.1 ha/2.72 acres. Freehold.<br />

Guide £750,000 - Ref JCM/PGB t: +44 (0)20 7629 6700<br />

Forest Hill Park Estate,<br />

Kent<br />

Planning and site licence for 10 large<br />

holiday units. M20/M26 junctions within 3<br />

miles – central London about 30 miles. In<br />

all about 1.46 ha/3.6 acres of mature landscaped grounds. Freehold.<br />

Guide £575,000 - Ref JCM/PGB t: +44 (0)20 7629 6700<br />

10 <strong>Winter</strong> 20<strong>07</strong>/Spring 2008

On the market<br />

Woodlands Park,<br />

Kent<br />

A substantial mixed residential and holiday<br />

park with development potential in a<br />

prime location, with an owner’s/manager’s<br />

4 bedroom bungalow and separate field. Currently 119 park<br />

homes (planning for 125 homes), 25 holiday static units and 200<br />

touring units. Planning for further 55 holiday statics (subject to the<br />

reduction of touring pitches to 100). In all about 15 ha/37 acres,<br />

available as a whole or in 3 lots. For sale freehold.<br />

Guide price £7 million - Ref JCM/PGB t: +44 (0)20 7629 6700<br />

Carnaby Heritage Park,<br />

East Yorkshire<br />

A rare opportunity to acquire a newly<br />

constructed holiday bungalow development,<br />

close to the resort of Bridlington. Exceptional<br />

location close to the coast. 28 x 2 bedroom holiday bungalows and 3 x<br />

2 bedroom holiday apartments. Fully furnished show home. Suitable<br />

for individual sales, buy to let investors or holiday letting operators.<br />

Full vacant possession available. For sale freehold.<br />

Guide price £3.5 million - Ref PRS/ELC t: +44 (0)1756 799 271<br />

Land at Barefoots,<br />

Scottish Borders<br />

Outline planning consent for a proposed<br />

total of 20 dwellings. 3 to be affordable<br />

housing. Approximately 1.5ha/3.7 acres in<br />

total. For sale freehold.<br />

Guide price £1.5 million - Ref PRS t: +44 (0)1756 799 271<br />

Stone Valley Court PHE,<br />

Lincolnshire<br />

A well established park home estate in a<br />

town location with 26 homes - 25 privately<br />

owned, one on AST. Separate 4 bedroom<br />

bungalow let on AST. In all about 0.76 ha/1.80 acres.<br />

Guide price £1.15 million - Ref JCM/PGB t: +44 (0)20 7629 6700<br />

Bartington Hall PHE,<br />

Cheshire<br />

A well located park home estate in a highly<br />

sought-after village location. Site Licence for<br />

21 park homes, 11 twin and 10 single units<br />

sited. For sale freehold.<br />

Guide price £750,000 - Ref PRS/ELC t: +44 (0)1756 799 271<br />

Harbourside,<br />

Hampshire (To Let)<br />

Redevelopment opportunity - former<br />

holiday park adjacent to Langstone<br />

Harbour. In all about 1.89 ha/4.66 acres.<br />

Available to let on a new lease - Ref JCM/PGB t: +44 (0)20 7629 6700<br />

Two in a year<br />

News<br />

Large caravan parks are rarely brought to the market outside the<br />

large portfolios. Therefore it is a coincidence that two of the largest<br />

holiday parks on the Yorkshire coast, located only 3 Km apart,<br />

were both brought to the market and sold in 20<strong>07</strong> by <strong>HLL</strong><br />

<strong>Humberts</strong> <strong>Leisure</strong>.<br />

Far Grange Park was sold in January 20<strong>07</strong> to Bourne <strong>Leisure</strong>, as<br />

reported in the previous bulletin. In October 20<strong>07</strong>, Park Resorts<br />

acquired Skipsea Sands Holiday Park from United British Caravans.<br />

Skipsea Sands provides an excellent addition to the Park Resorts<br />

portfolio with over 700 caravan holiday home pitches, a modern hire<br />

fleet and excellent indoor leisure facilities. United British Caravans is<br />

the family company of Tom Lambert, recently Chairman of the<br />

National Caravan Council and a well known figure in the industry.<br />

Both sales were handled by the Skipton office of <strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong>.<br />

Contact<br />

John Anderson BSc FRICS, Skipton<br />

e: john.anderson@humberts-leisure.com t: +44 (0)1756 799 271<br />

valuation<br />

Lake District Portfolio<br />

sells for £125 million<br />

In a deal which has confirmed the strength of the mid-cap market in<br />

the leisure sector, despite the current uncertainties, Legal & General<br />

Ventures and Management have sold South Lakeland Group<br />

Limited to White Ocean <strong>Leisure</strong> Limited. The portfolio of 9 parks<br />

includes 3 of the finest Lake District holiday businesses including<br />

White Cross Bay <strong>Leisure</strong> Park and Fallbarrow Park, both of which<br />

enjoy frontage onto Lake Windermere.<br />

The vendors acquired the portfolio in 2006 from Pure <strong>Leisure</strong><br />

Group Limited. The management team led by Graham Hodgson has<br />

been retained with a strong mandate to grow the business further.<br />

It is understood the company is already looking at a number of<br />

potential acquisitions within the sector.<br />

<strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong> was retained by the company to provide<br />

vendor due diligence valuations for incorporation within the sale<br />

process, which was handled by Deloittes. This work followed a<br />

similar valuation exercise on other large deals within the sector<br />

during the year, in respect of Park Resorts and Weststar Holidays.<br />

Contact<br />

John Anderson BSc FRICS, Skipton<br />

e: john.anderson@humberts-leisure.com t: +44 (0)1756 799 271<br />

www.humberts-leisure.com<br />

<strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong> 11

Featured property | Nonsuch Bay<br />

Nonsuch Bay Paradise has<br />

Antigua is widely regarded as the emerging<br />

island of the Eastern Caribbean. Excellent<br />

transport links and stunning natural scenery have<br />

always made this a popular tourist destination<br />

and the island is undergoing rapid growth in<br />

infrastructure and amenities.<br />

Location<br />

Antigua is located in the middle of the<br />

Leeward Islands in the Eastern Caribbean,<br />

roughly 17 degrees north of the equator. To<br />

the south are the islands of Montserrat and<br />

Guadaloupe, and to the north and west are<br />

Nevis, St. Kitts, St. Barts, and St. Martin.<br />

Nonsuch Bay is a large sheltered bay<br />

situated on the east coast of the<br />

island. The bay forms a natural harbour<br />

considered by locals, yachtsmen and the<br />

more adventurous tourists to be one of<br />

the hidden treasures of the island. The<br />

tranquil waters are protected by a reef<br />

and are home to a variety of beaches and<br />

islands and their easterly location ensures<br />

a constant, cooling sea breeze.<br />

Antigua is the centre of sailing in the Caribbean, with English<br />

Harbour and Nelsons Dockyard alive with boats and their crews<br />

throughout the winter season. The island is also home to a<br />

surprising number of gourmet restaurants, often undiscovered by<br />

tourists but highly regarded by those ‘in the know’.<br />

The 40 acre site at Nonsuch Bay sets new standards in resort<br />

development on this rapidly emerging and eminently accessible<br />

Caribbean island. For many, the combination of direct beach<br />

access, waterfront living and breathtaking ocean views epitomise<br />

the Caribbean second home experience.<br />

Masterplan<br />

Construction at Nonsuch Bay is well under way with delivery of<br />

the first apartments and townhouses scheduled for early 2008.<br />

The focal point of the development will be the clubhouse, home<br />

to guest reception and concierge, a five star waterside restaurant,<br />

a breakfast and lunch bar and a stunning infinity pool wrapping<br />

around the headland. There will be two additional swimming<br />

pools, tennis courts and boat moorings.<br />

Within a very short drive or boat ride is the superb restaurant and<br />

boutique hotel at Harmony Hall, regarded by many as one of the<br />

best lunch venues in Antigua and the Caribbean. Harmony Hall is<br />

also the centre of the Antiguan arts community and the home to<br />

a new yacht club established to take advantage of the excellent<br />

sailing conditions in the bay.<br />

Nonsuch Bay is just 20 mins away from English<br />

Harbour and 25 mins from the airport.<br />

12 <strong>Winter</strong> 20<strong>07</strong>/Spring 2008

Featured property | Nonsuch Bay<br />

never looked better<br />

The Hughes Bay side of the development forms a natural<br />

amphitheatre and is home to the apartment buildings, which<br />

enjoy stunning views of Nonsuch Bay towards Bird Island and<br />

beyond. Crowning this feature are the villa plots which again offer<br />

quite exceptional coastal and inland views. To the front, adjacent<br />

to the beachfront apartments will be the fine dining restaurant<br />

and jetty.<br />

In contrast, Ayres Creek is the setting for a small, intimate cluster<br />

of townhouses which directly front the tranquil waters of the<br />

creek, the venue for a small number of private boat moorings. The<br />

westerly aspect of these homes affords beautiful views inland and<br />

of the setting sun across the island. To the rear of the townhouses<br />

it is proposed to locate the clubhouse and tennis courts.<br />

Properties<br />

Villas<br />

The elevations of the villa plots at Nonsuch Bay provide each<br />

property with stunning views either out to sea, across the bay<br />

itself or looking west over Ayres Creek towards the hills. Each of<br />

these plots provide a blank canvas to create your own home and<br />

La Perla together with architect Andrew Goodenough can be on<br />

hand to manage the project from inception to delivery. There is<br />

a stipulation that no more than 20% of each plot is built upon;<br />

decorative gardens surround the properties with the rest of each<br />

plot and the areas where they overlap left more natural, to create<br />

the atmosphere of a lovely tropical Eden.<br />

Townhouses<br />

The 15 three-bedroom townhouses in Nonsuch Bay have private<br />

plunge pools, and a generous living space of 220 sq.m. With most<br />

rooms of the townhouses opening onto a large terrace, your<br />

outdoor living space is extended by over half as much again. The<br />

graceful, curving layout of the townhouse community means you<br />

have a selection of views over the water, boat berths and towards<br />

the rolling hills from which to choose.<br />

This area will be the centre of activity for the sailing and boating<br />

community. Day sailing boats will be available for Nonsuch owners<br />

and guests to rent. Moorings will also be available to boat owners<br />

during their stay.<br />

Apartments<br />

Nonsuch Bay offers a variety of apartment types, ranging from<br />

one to three bedrooms (118 sq.m. to 326 sq.m. including terraces),<br />

to suit individual preferences. The apartment area forms a natural<br />

amphitheatre overlooking the bay towards the east. The sloping<br />

nature of the site is such that no one property has its views<br />

obscured by another. The individual buildings contain only a few<br />

apartments and are designed to maximise the intimate nature of<br />

the development and the privacy of the homeowners.<br />

Contact<br />

Robson Barnes t: +44 (0) 1483 242491<br />

or visit www.rbnonsuchbay.com<br />

Peter Smith BA(Hons) MRICS, Skipton<br />

e: peter.smith@humberts-leisure.com t: +44 (0)1756 799 271<br />

www.humberts-leisure.com<br />

<strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong> 13

Featured property | Wood Street, Cardiff<br />

The best resi scheme<br />

Operational partner sought for<br />

Wood Street a landmark development<br />

of serviced apartments/hotel suites<br />

in central Cardiff<br />

Opportunity<br />

<strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong> is instructed to offer the opportunity to<br />

operate a truly spectacular block of serviced apartments or hotel<br />

suites forming part of a 20 storey iconic development in the<br />

centre of Cardiff.<br />

The development comprising 220 apartments and<br />

up to 150 hotel suites has been described as the<br />

“best mixed use residential scheme” in Cardiff.<br />

An experienced operational partner of good covenant strength<br />

to match the high standards of the residential units is sought to<br />

enjoy the many benefits of this prestigious high rise development<br />

close to the main train station and Millennium Stadium.<br />

Location<br />

The development is situated in Wood Street in Central Cardiff<br />

within close proximity to the Millennium Stadium, the Central<br />

Square, and Cardiff Central Train Station. Cardiff (population<br />

305,353) is the capital of the Principality of Wales and home to the<br />

Welsh Assembly. The City is located some 152 miles from London;<br />

operator sought<br />

14 <strong>Winter</strong> 20<strong>07</strong>/Spring 2008

Featured property | Wood Street, Cardiff<br />

in Cardiff?<br />

114 miles from Birmingham; 45 miles from Bristol and 41 miles<br />

from Swansea and enjoys a prestigious list of companies who have<br />

made Cardiff their headquarters.<br />

The development<br />

The Wood Street re-development is part of several schemes in<br />

the centre of Cardiff aimed at regenerating and rejuvenating<br />

the city into a truly 21st Century capital. The views from the<br />

development are unrivalled with Cardiff city centre, the River<br />

Taff and Millennium Stadium all within a few minutes walk. The<br />

recently extended shopping facilities of St David’s Centre are<br />

within 10 minutes of the property. This hotel will be truly city<br />

centre adjacent to the main transport hub and within minutes<br />

walk of the rapidly expanding retail and leisure facilities Cardiff has<br />

to offer.<br />

The ground floor of the development will comprise circa 15,000 sq ft<br />

of retail units with residential apartments on the upper floors.<br />

It is envisaged that up to 150 hotel rooms will be created<br />

between floors 4 to 10 (inclusive) with a reception at the main<br />

entrance at ground floor level. The exact design and number of<br />

rooms is flexible as further floors can be incorporated into the<br />

hotel if required. At this stage the hotel<br />

mix is proposed as 21 suites, 84 studio<br />

apartments.<br />

Basis of disposal<br />

Our clients wish to retain the long<br />

leasehold interest in the whole property<br />

and would like to grant a lease or<br />

management contract over the completed<br />

development to an experienced operator.<br />

Planning permission for the scheme<br />

was granted in November 20<strong>07</strong>. The<br />

development is due to be completed in<br />

Q1 2010. For further information on Wood<br />

Street contact <strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong>.<br />

Contact<br />

Tim Smith BSc(Hons) MRICS, London<br />

e: tim.smith@humberts-leisure.com<br />

t: +44 (0)20 7629 6700<br />

www.humberts-leisure.com<br />

<strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong> 15

Featured property | Studley Wood & Middleton Hall Golf Clubs<br />

sold<br />

Studley Wood GC<br />

A magnificent parkland golf<br />

course with a fine pedigree.<br />

■ 18 hole 6,709 yard (par 73) Simon<br />

Gidman designed championship<br />

golf course, constructed to USGA<br />

specification<br />

■ Pavilion style clubhouse extending to<br />

approximately 829 sq.m. (8,925 sq.ft.)<br />

furnished, fitted and equipped to a high<br />

specification<br />

■ 15 bay golf practice range<br />

■ Purpose built greenkeeping complex<br />

■ Circa 76 hectares (170 acres)<br />

■ Commercial trading location in central southern England:<br />

Oxford – 10 mins<br />

M40 Motorway – 5 mins<br />

Central London – 1 hr 26 mins<br />

Birmingham (NEC) – 1 hr 20 mins<br />

■ Turnover circa £1,200,000 (including food and beverage)<br />

■ Franchised food and beverage operation<br />

■ Leasehold - rent £135,000 p.a.<br />

Guide £1.25 million<br />

www.studleywoodgolf.info<br />

Contact<br />

Ben Allen BSc(Hons) MRICS, Winchester e: ben.allen@humberts-leisure.com t: +44 (0)1962 835 960<br />

under offer<br />

Middleton Hall GC<br />

■ Practice facilities<br />

A mature parkland golf course in<br />

a popular tourist area, with an<br />

established trading record.<br />

■ 18 hole 5,785 yard (par 71) golf course<br />

constructed to USGA specification<br />

■ Pavilion style clubhouse furnished,<br />

fitted and equipped to a high<br />

specification<br />

■ Golf shop<br />

■ 10 bay floodlit golf driving range<br />

■ Purpose built greenkeeping complex<br />

■ Circa 40.5 hectares (100 acres)<br />

■ Commercial trading location in popular tourist area<br />

■ Close to Sandringham and the North Norfolk Coastline<br />

■ Established profitable business<br />

■ All aspects of the business in hand (excl golf shop)<br />

■ Freehold<br />

Guide £1.25 million<br />

Contact<br />

Ben Allen BSc(Hons) MRICS, Winchester e: ben.allen@humberts-leisure.com t: +44 (0)1962 835 960<br />

Paul Barnes BSc(Hons) MRICS, London e: paul.barnes@humberts-leisure.com t: +44 (0)20 7629 6700<br />

16 <strong>Winter</strong> 20<strong>07</strong>/Spring 2008

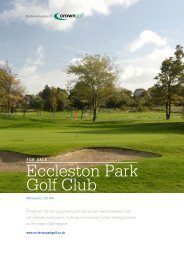

Featured property | Forest Hill & The Ridge Golf Clubs<br />

for sale<br />

Forest Hill GC<br />

An established and recently extended 18 hole<br />

proprietary golf course, with floodlit golf driving<br />

range, substantial clubhouse & new 9 hole short<br />

game course.<br />

■ 18 hole 6,491 yard (par 72) golf course<br />

■ 9 hole short course<br />

■ 26 bay floodlit golf driving range<br />

■ Practice facilities<br />

■ Well appointed 1,090 sq.m. (11,700 sq.ft.)<br />

clubhouse with function facilities<br />

■ Established, successful and growing business<br />

■ Commercial trading location close to Leicester and<br />

the M1 motorway<br />

■ Freehold<br />

Offers invited in excess of £2.25 million<br />

Contact<br />

Ben Allen BSc(Hons) MRICS, Winchester e: ben.allen@humberts-leisure.com t: +44 (0)1962 835 960<br />

Paul Barnes BSc(Hons) MRICS, London e: paul.barnes@humberts-leisure.com t: +44 (0)20 7629 6700<br />

for sale<br />

The Ridge GC<br />

A well presented 18 hole proprietary golf course,<br />

with a substantial clubhouse.<br />

■ 18 hole 6,242 yard (par 71) golf course<br />

■ 10 bay driving range<br />

■ Practice facilities<br />

■ Spacious clubhouse with leisure club &<br />

two bedroom apartment<br />

■ Established business with growth potential<br />

■ Commercial trading location close to Maidstone &<br />

M20 motorway<br />

■ Freehold<br />

Offers invited in excess of £1.75 million<br />

Contact<br />

Ben Allen BSc(Hons) MRICS, Winchester e: ben.allen@humberts-leisure.com t: +44 (0)1962 835 960<br />

Paul Barnes BSc(Hons) MRICS, London e: paul.barnes@humberts-leisure.com t: +44 (0)20 7629 6700<br />

www.humberts-leisure.com<br />

<strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong> 17

Featured property | Domaine du Grand Mayne<br />

‘Model’ Bergerac<br />

vineyard and UK<br />

business sold<br />

<strong>Humberts</strong> <strong>Leisure</strong> reports the sale of the Domaine du Grand Mayne vineyard located<br />

near Bergerac in south west France, together with its associated UK based business<br />

Wineshare. The property has been sold to a Hampshire vineyard owner following an open<br />

marketing campaign, which attracted interest from around the world.<br />

Domaine du Grand Mayne is a ‘model’ vineyard<br />

started from scratch some 20 years ago by husband<br />

and wife team Andrew and Edwina Gordon.<br />

The Gordon’s acquired a run down farm at Villeneuve de Duras, in the much sought after<br />

Appellation Contrôlée region of Côtes de Duras in 1985 and transformed it into a state of<br />

the art, award winning winery with the latest wine production and storage equipment. 34<br />

hectares (84 acres) are now planted with vines growing a variety of the classic grapes of<br />

the region, allowing the production of high quality red, white and rosé wines.<br />

Wineshare, the marketing arm of the vineyard, based in Dorking, Surrey, was launched<br />

in 1986 and was the first vineyard ‘rent a vine’ concept. Wineshare now has over 5,000<br />

members who account for circa 70% of the total production of Domaine du Grand Mayne,<br />

giving the vineyard a significant advantage over other vineyards in the region.<br />

The property included two farmhouses, a new 5 bedroom villa with a swimming pool, and<br />

a shop/visitor welcome centre with tasting room. The business achieved a turnover in the<br />

region of £1.7 million and was marketed with a £2.5 million guide price.<br />

Contact<br />

Nigel Talbot-Ponsonby FRICS, London<br />

e: ntp@humberts-leisure.com t: +44 (0)20 7629 670<br />

Glenn Hickman, London<br />

e: glenn.hickman@humberts-leisure.com t: +44 (0)20 7629 670<br />

sold<br />

18 <strong>Winter</strong> 20<strong>07</strong>/Spring 2008

Featured property | Cascade Springs<br />

for sale<br />

Cascade Springs Water<br />

Company & High Furze<br />

House – an ideal leisure<br />

lifestyle opportunity<br />

Set high in the hills overlooking the St Breock Downs, Cascade Springs Water Company is a unique business<br />

established by the current owners some 16 years ago. Cascade Springs supplies Cornish spring water to<br />

commercial, institutional and leisure business consumers throughout Devon and Cornwall from premises located<br />

in the former farmyard of High Furze House.<br />

Cascade Springs Water Company is located near Wadebridge, close to the Rock and Padstow honey pot and<br />

within easy reach of Newquay Airport. The Company is almost the perfect business model:<br />

■ A non-seasonal highly profitable business producing consistent EBITDA in excess of £150,000 per annum on a<br />

turnover of c. £645,000.<br />

■ Established, growing client base in defined geographical area with few competitors.<br />

■ Potential for future diversification (eg supplies of tea/coffee/consumables).<br />

■ Small, long serving, loyal work force.<br />

■ Minimal requirements for Director’s specialist/technical skill (all expertise bought in when<br />

occasionally required).<br />

■ Monday to Friday operation 9.00 to 5.00.<br />

■ Freehold property/premises.<br />

Combine this exceptional business with a recently renovated 5 bedroom, 3 bath/shower room house set in<br />

grounds approaching c. 3.6 ha (9 acres) that include 3 stables, a ménage and 4 paddocks and the ideal leisure<br />

lifestyle business appears in front of your eyes. Add to this heavenly mix endless local leisure pursuits including<br />

the renowned St Enodoc Golf Club, surfing at Newquay, country sports (including riding with the North Cornwall<br />

Hunt) and fine dining and it is readily apparent that this exceptional leisure lifestyle business is worthy of further<br />

investigation – it certainly beats the grind of City life!<br />

Cascade Springs Water Company & High Furze House are being marketed by <strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong> at a guide<br />

price of £1.75 million.<br />

Contact<br />

Ben Allen BSc(Hons) MRICS, Winchester e: ben.allen@humberts-leisure.com t: +44 (0)1962 835 960<br />

Paul Barnes BSc(Hons) MRICS, London e: paul.barnes@humberts-leisure.com t: +44 (0)20 7629 6700<br />

www.humberts-leisure.com<br />

<strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong> 19

Taxing times<br />

Taxing Times for<br />

Business Owners<br />

Sarah Cardew of Penningtons Solicitors<br />

considers the impact of the withdrawal of<br />

taper relief announced in the Pre Budget<br />

Report and the Chancellor’s introduction of a<br />

new form of capital gains tax retirement relief<br />

Taper relief<br />

To widespread outcry, the Government announced in the Pre-<br />

Budget Report that they intended to withdraw taper relief and<br />

replace it with a new 18% rate of tax, with effect for disposals of<br />

assets on or after 6 April 2008.<br />

Current position<br />

Under the current law, individuals, trustees and personal<br />

representatives are taxed on the gain arising on a disposal of an asset<br />

at the rate of income tax charged on the top slice of their income.<br />

The resulting gain can then be decreased by applying taper relief,<br />

depending on the number of years the asset has been held.<br />

For business assets, Business Asset Taper Relief would be available<br />

so that, after two qualifying years, only 25% of the gain would be<br />

chargeable, typically giving an effective maximum rate of 10%. For<br />

non-business assets, Non-Business Asset Taper Relief would be<br />

available so that, after a ten year qualifying period, only 60% of the<br />

gain would be chargeable, giving an effective maximum rate of 24%.<br />

Changes<br />

For disposals on or after 6 April 2008, or for “held over” gains<br />

coming into charge after 6 April 2008, it is proposed that taper relief<br />

will no longer be available for individuals, trustees and personal<br />

representatives, and a new flat rate of 18% will be applied. Of course,<br />

this means that it will be much simpler to work out how much CGT<br />

will be due because it will not be dependent upon the income tax<br />

bracket of the person who disposes of the asset or how long the asset<br />

has been held.<br />

Practical consequences<br />

Some people will want to accelerate a disposal to ensure the existing<br />

rules apply to a gain e.g. if someone has held their business asset for<br />

longer than two years. Conversely, some people may want to defer a<br />

disposal in order to benefit from the new 18% tax rate because they<br />

would not have qualified for taper relief in the first place. If you are<br />

contemplating a disposal, it would therefore be prudent to undertake<br />

an assessment of your precise position.<br />

The interesting question is whether the change actually has retrospective<br />

effect and as the Government has not yet published any draft legislation,<br />

it is impossible to say with any certainty. However, if someone has<br />

already sold a company (or will pre April 2008) and some element of<br />

the payment is deferred, to be paid after April 2008, that element of the<br />

payment is likely to be subject to the new 18% rate.<br />

A new form of retirement relief<br />

There has been a huge outcry from those adversely affected by the<br />

above changes and in response, the Government has proposed a<br />

new form of CGT retirement relief. It is understood that the first<br />

£100,000 of any chargeable gain on retirement will be exempt from<br />

tax. However, as usual, we do not have any draft legislation and<br />

accordingly, it will be interesting to see what is the Government’s<br />

definition of “retirement”.<br />

Those of us who are not yet ready to retire have not, as yet, been<br />

offered any concessions. It is understood that the Government is<br />

currently consulting on its proposals and it is hoped that there will<br />

be a package of measures to promote investment.<br />

Good news for inheritance tax<br />

There has been much press attention devoted to IHT and the other<br />

headline grabbing PBR announcement was in relation to IHT.<br />

Current position<br />

Under current law, each individual is entitled to an amount known<br />

as the IHT Nil Rate Band (“NRB”), which is chargeable to IHT at<br />

0%. The current NRB is £300,000 but increases each year.<br />

If an estate is left to a surviving spouse or civil partner, the estate is<br />

exempt from IHT anyway and, therefore, the NRB is wasted. The<br />

surviving spouse or civil partner inherits all the assets free of IHT but<br />

their estate is only entitled to a single NRB at the date of their death.<br />

Change<br />

From 9 October 20<strong>07</strong>, any proportion of the NRB unused on the<br />

first death is available automatically on the second death. This rule<br />

applies retrospectively. Therefore, a widow or widower who inherited<br />

all the assets of their spouse some years ago will now be able to pass<br />

assets with a value of up to £600,000 free of tax to their children.<br />

When the second spouse or civil partner dies, a specific claim<br />

needs to be made in order to obtain the benefit of the previously<br />

unused NRB from the estate of the first spouse or civil partner. It is<br />

important to remember that part or all of the NRB may have been<br />

used on the first death if the deceased had made chargeable gifts<br />

during the seven year period prior to their death or if the deceased<br />

was entitled to the income from a trust fund.<br />

This article was drafted on the basis of current tax law,<br />

practice and interpretation thereof as at 20 December 20<strong>07</strong><br />

and is intended for general guidance only. Specific legal and<br />

tax advice should always be sought in relation to the facts of a<br />

particular situation.<br />

Contact<br />

Sarah Cardew, Penningtons Solicitors LLP<br />

e: sarah.cardew@penningtons.co.uk<br />

t: 01256 4<strong>07</strong>170<br />

www.penningtons.co.uk<br />

20 <strong>Winter</strong> 20<strong>07</strong>/Spring 2008

Comment | The Sub-Prime Collapse<br />

Reading runes<br />

The impact of the Sub-Prime Collapse<br />

When it became clear that the serious problems within the US sub-prime mortgage<br />

market had international repercussions some commentators predicted a serious effect on<br />

the property market in the UK. There is no doubt that many lenders are now increasing<br />

their lending rates in the residential and commercial markets. The problems experienced<br />

at Northern Rock are certainly not unique. Many of the leading international investment<br />

banks have seen a vicious effect on their profitability, with the Chief Executives of Merrill<br />

Lynch and Citigroup both being ousted. The UK clearing banks are being forced to inform<br />

the markets of the likely losses they will suffer through the sub-prime crisis. The buy-to-let<br />

mortgage specialist Paragon is facing a very real prospect of collapse unless a rights issue<br />

is successful.<br />

Taken together the problems might be expected to indicate a severe slowing down in the<br />

leisure property market due to the lowering of confidence and tighter bank lending criteria.<br />

Certainly in the late summer it was generally expected that deals over £100m would be<br />

extremely difficult and there would be downward pressure on pricing.<br />

However at the time of writing this article, towards the end of December, there are mixed<br />

messages from the deals with which <strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong> has been involved; some show<br />

little sign of the difficulties which had been predicted. The recent sale of South Lakeland<br />

Parks to White Ocean <strong>Leisure</strong> (reported elsewhere in this bulletin) at a reported price of<br />

£125m shows no indication that prices have deteriorated over the last 6 months. We are<br />

aware that there was substantial competition for the portfolio. Likewise some individual<br />

property sales have been completed at prices which suggest demand has held up well. In<br />

contrast, other deals are under pressure.<br />

There is still an immense amount of capital looking for investment opportunities. It would<br />

appear that this is helping to balance the problems within the market. There is also no doubt<br />

that many investors have become disenchanted with commercial property as an investment<br />

vehicle and are turning their attention to the leisure industry, appreciating that it provides an<br />

interesting mix of asset backing and business upside.<br />

Contact<br />

John Anderson BSc FRICS, Skipton<br />

e: john.anderson@humberts-leisure.com t: +44 (0)1756 799 271<br />

www.humberts-leisure.com<br />

<strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong> 21

Focus | Pubs<br />

The pub and restaurant<br />

market overview<br />

<strong>HLL</strong> <strong>Humberts</strong> <strong>Leisure</strong>’s Peter Constantine reviews the current<br />

conditions in the pub, restaurant and licensed property market<br />

The market continues to evolve with the scarcity of quality freehold properties continuing<br />

to underpin values. The major pub companies with their focused in-house acquisition teams<br />

are effectively purchasing freehouses as soon (or even before) they get to the market. This<br />

acquisition activity is offset by a churn of the lower quality tail of the large pub companies’<br />

estates, which have been acquired by new entrants to the sector such as London Town, AAIM<br />

and Indeed. The prices paid for individual pubs in many cases now equate to yields of circa<br />

7% for good quality outlets with a well balanced and sustainable business which could be<br />

converted to a tied lease model.<br />

Another feature of the current market is the sale of many of the lower quality pubs for<br />

alternative use. We have acted on numerous occasions for vendors who wish to take a licensed<br />

unit out of the market whilst achieving a sale price in excess of the existing use value by<br />

selling the property for commercial or residential use. An example of this is the Greyhound<br />

at Tunbridge Wells where we acted for Punch Taverns and sold the property with planning<br />

permission for residential development.<br />

We anticipate further consolidation within the sector with low quality pubs being packaged in<br />

order to improve the quality of the larger pub companies’ estates. Multiples of 9, 10 and 11<br />

on EBITDA have been achieved and the basic supply/demand inbalance should ensure that<br />

values are maintained.<br />

The latest deal within the sector is the acquisition by Greene King of the New Century Inns<br />

estate of 49 pubs for £32.6 million, which equates to a headline multiple on EBITDA<br />

of 10.8.<br />

It will be interesting to assess the impact of the smoking ban following a full winter’s trading<br />

period. In our experience to date good operators who have invested in outdoor facilities<br />

will be best placed to protect their existing trade. There should also be an opportunity for<br />

pubs with good facilities including restaurants to be able to improve their catering trade by<br />

attracting families and non smokers to a smoke free environment.<br />

In the restaurant sector activity has also<br />

been frenetic with corporate deals such as<br />

the sale of Loch Fyne to Greene King for a<br />

reported £68 million for a leasehold estate<br />

of 36 restaurants. This deal demonstrates<br />

the high level of interest in the casual dining<br />

market with recent deals including Laurels<br />

acquisition of La Tasca and Ultimate<br />

<strong>Leisure</strong>’s purchase of Bel and the Dragon.<br />

We anticipate more deals in this sector as<br />

pub companies look to acquire operating<br />

formats that could be rolled out within their<br />

large property portfolios and provide them<br />

with a platform for the growth of food sales.<br />

We think it is safe to assume<br />

that the next 12 months<br />

within the sector will be a<br />

challenging time for operators<br />

with continued high levels of<br />

activity on the disposal and<br />

acquisition fronts.<br />

Contact<br />

Peter Constantine BSc(Hons) FRICS, Chepstow<br />

e: peter.constantine@humberts-leisure.com<br />

t: +44 (0)1291 627 813<br />

22 <strong>Winter</strong> 20<strong>07</strong>/Spring 2008

Focus | Pubs<br />

Brains gets brave with<br />

pub development<br />

When SA Brain & Co Ltd bought an old Whitbread site it was determined to fill a gap in the upper<br />

end of the casual dining market. Grape & Olive is the result.<br />

The site was initially acquired by Wales’ leading brewer and pub operator as a defensive move. Philip<br />

Lay, Retail Director at Brains explains, “We have half a dozen pubs in the area, all trading reasonably<br />

well. A rival operator could have bought the pub and taken trade off any or all of them.<br />

“The challenge for us was to come up with a concept that could win new trade without having an<br />

impact on our other businesses in the area.”<br />

So Brains got brave and moved away from the classic pub development, settling instead on a stylish<br />

brasserie style operation.<br />

The bright, contemporary design, with a varied mix of seating areas, is designed for everything<br />

from a meal for two to after-work groups and extended families enjoying Sunday brunch.<br />

As the name implies, food is as integral to the mix as drinks and Brains wanted to create a menu<br />

very different to anything else in the estate. The mediterranean inspired menu is based on fresh,<br />

authentic ingredients and includes antipasto, fresh pastas and stone-baked pizzas.<br />

A glass panel allows customers to observe their food being prepared and adds a sense of theatre to<br />

the occasion. The kitchen has been fitted out with brand-new equipment, including a pizza oven.<br />

The drinks portfolio itself was carefully chosen and varied from the standard Brains list. Only<br />

premium brand of ales and lagers are on sale as well as a range of classic cocktails.<br />

The Grape and Olive has a large function area and an upmarket outdoor terrace. And uniquely<br />

there is also a marketing suite, with two-way mirrors and the chance to run focus groups for<br />

product launches and similar research.<br />

“There isn’t anything else like this in Wales,” says Lay proudly.<br />

<strong>Humberts</strong> <strong>Leisure</strong> advised SA Brain & Co. on this acquisition.<br />

Contact<br />

Peter Constantine BSc(Hons) FRICS, Chepstow e: peter.constantine@humberts-leisure.com t: +44 (0)1291 627 813<br />

Bernard Wilkinson BA(Hons) MRICS, London e: bernard.wilkinson@humberts-leisure.com t: +44 (0)20 7629 6700<br />