MOLE VALLEY DISTRICT COUNCIL

MOLE VALLEY DISTRICT COUNCIL

MOLE VALLEY DISTRICT COUNCIL

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2<br />

3<br />

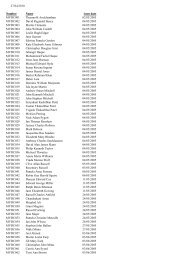

SCHEDULE 2 - CHARGES FOR CERTAIN SMALL BUILDINGS & DOMESTIC EXTENSIONS<br />

TYPE OF WORK<br />

1. Erection or extension of a detached or attached building<br />

which consists solely of a garage or carport or both having<br />

a floor area not exceeding 40 square metres in total and<br />

intended to be used in common with an existing building,<br />

and which is not an exempt building.<br />

2. A garage or carport as in 1. above but having a floor area<br />

exceeding 40 and not exceeding 60 square metres..<br />

FULL PLANS SUBMISSIONS<br />

BUILDING NOTICES<br />

Plan Charge (£) Inspection Charge (£) Building Notice Charge (£)<br />

EXC. VAT INC. VAT E XC.VAT<br />

INC. VAT EXC. VAT INC. VAT<br />

124.26 146.00 - - 124.26 146.00<br />

114.89 135.00 132.77 156.00 247.66 291.00<br />

NB. Where the total or the aggregation of the floor area of one or more extensions referred to in categories 1 & 2 above exceeds 60 square metres the charge should<br />

be calculated from estimated costs under schedule 3.<br />

3. Any extension of a dwelling the total floor area of which does<br />

not exceed 10 square metres including means of access<br />

and work in connection with that extension.<br />

4. An extension as in 3. above but having a floor area<br />

exceeding 10 and not exceeding 40 square metres.<br />

5. An extension as in 3. above but having a floor area<br />

exceeding 40 and not exceeding 60 square metres.<br />

6. The replacement of windows, rooflights or external doors<br />

in an existing dwelling<br />

114.89 135.00 132.77 156.00 247.66 291.00<br />

114.89 135.00 257.03 302.00 371.92 437.00<br />

114.89 135.00 380.43 447.00 495.32 582.00<br />

72.34 85.00 - - 72.34 85.00<br />

NB. Where the total or the aggregation of the floor area of one or more extensions referred to in categories 3, 4 and 5 above exceeds 60 square metres the charge<br />

should be calculated from estimated costs under schedule 3, subject to a minimum charge equivalent to the charge payable under category 5 above.<br />

7. Any extension or alteration of a dwelling consisting of the<br />

provision of one or more rooms in roof space, including<br />

means of access.<br />

To be calculated from estimated costs under Schedule 3, subject to a minimum charge equivalent<br />

to the charge payable under category 4 above.<br />

SCHEDULE 3 - CHARGES FOR OTHER WORK (NOT COVERED BY SCHEDULES 1 OR 2)<br />

TOTAL ESTIMATED<br />

COST OF WORK (£)<br />

FULL PLANS SUBMISSIONS<br />

BUILDING NOTICES<br />

Plan Charge (£) Inspection Charge (£) Building Notice Charge (£)<br />

EXC. VAT INC. VAT EXC. VAT INC. VAT EXC. VAT INC. VAT<br />

0 - 2,000<br />

2,001 - 5,000<br />

100.00<br />

165.00<br />

117.50<br />

193.88<br />

- - 100.00<br />

165.00<br />

117.50<br />

193.88<br />

5,001 - 6,000<br />

6,001 -7,000<br />

7,001 - 8,000<br />

8,001 - 9,000<br />

9,001 -10,000<br />

10,001 -11,000<br />

11,001 -12,000<br />

12,001 -13,000<br />

13,001 -14,000<br />

14,001 -15,000<br />

15,001 -16,000<br />

16,001 -17,000<br />

17,001 -18,000<br />

18,001 -19,000<br />

19,001 -20,000<br />

43.50<br />

45.75<br />

48.00<br />

50.25<br />

52.50<br />

54.75<br />

57.00<br />

59.25<br />

61.50<br />

63.75<br />

66.00<br />

68.25<br />

70.50<br />

72.75<br />

75.00<br />

51.11<br />

53.76<br />

56.40<br />

59.04<br />

61.69<br />

64.33<br />

66.97<br />

69.62<br />

72.26<br />

74.91<br />

77.55<br />

80.19<br />

82.84<br />

85.48<br />

88.12<br />

20,001 -100,000 To 75.00 excl. VAT add 2.00 excl. VAT<br />

for each 1,000 (or part thereof) over<br />

20,000 up to 100,000 then ADD VAT<br />

100,001 - 1m To 235.00 excl. VAT add 0.87 excl. VAT<br />

for each 1,000 (or part thereof) over<br />

100,000 up to 1m then ADD VAT<br />

Over 1m- 10m<br />

Over 10m<br />

To 1022.50 excl. VAT add 0.70 excl. VAT<br />

for each 1,000 (or part thereof) over 1m<br />

up to 10m then ADD VAT<br />

To 7,210.00 excl. VAT add 0.50 excl.<br />

VAT for each 1,000 (or part thereof) over<br />

10m then ADD VAT<br />

130.50<br />

137.25<br />

144.00<br />

150.75<br />

157.50<br />

164.25<br />

171.00<br />

177.75<br />

184.50<br />

191.25<br />

198.00<br />

204.75<br />

211.50<br />

218.25<br />

225.00<br />

153.34<br />

161.27<br />

169.20<br />

177.13<br />

185.06<br />

192.99<br />

200.93<br />

208.86<br />

216.79<br />

224.72<br />

232.65<br />

240.58<br />

248.51<br />

256.44<br />

264.38<br />

To 225.00 excl. VAT add 6.00 excl. VAT<br />

for each 1,000 (or part thereof) over<br />

20,000 up to 100,000 then ADD VAT<br />

To 705.00 excl. VAT add 2.63 excl. VAT<br />

for each 1,000 (or part thereof) over<br />

100,000 up to 1m then ADD VAT<br />

To 3067.50 excl. VAT add 2.05 excl.<br />

VAT for each 1,000 (or part thereof) over<br />

1m up to 10m then ADD VAT<br />

To 21,630.00 excl. VAT add 1.50 excl.<br />

VAT for each 1,000 (or part thereof) over<br />

10m then ADD VAT<br />

174.00<br />

183.00<br />

192.00<br />

201.00<br />

210.00<br />

219.00<br />

228.00<br />

237.00<br />

246.00<br />

255.00<br />

264.00<br />

273.00<br />

282.00<br />

291.00<br />

300.00<br />

204.45<br />

215.03<br />

225.60<br />

236.17<br />

246.75<br />

257.32<br />

267.90<br />

278.48<br />

289.05<br />

299.63<br />

310.20<br />

320.77<br />

331.35<br />

341.93<br />

352.50<br />

To 300.00 excl. VAT add 8.00 excl. VAT<br />

for each 1,000 (or part thereof) over<br />

20,000 up to 100,000 then ADD VAT<br />

To 940.00 excl. VAT add 3.50 excl. VAT<br />

for each 1,000 (or part thereof) over<br />

100,000 up to 1m then ADD VAT<br />

To 4090.00 excl. VAT add 2.75 excl. VAT<br />

for each 1,000 (or part thereof) over 1m up<br />

to 10m then ADD VAT<br />

To 28,840.00 excl. VAT add 2.00 excl.<br />

VAT for each 1,000 (or part thereof) over<br />

10m then ADD VAT