MOLE VALLEY DISTRICT COUNCIL

MOLE VALLEY DISTRICT COUNCIL

MOLE VALLEY DISTRICT COUNCIL

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

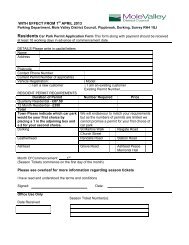

BUILDING ACT 1984, THE BUILDING REGULATIONS 2000<br />

THE BUILDING (LOCAL AUTHORITY CHARGES)<br />

REGULATIONS 1998<br />

GUIDANCE NOTE ON CHARGES<br />

Effective from 1/4/08<br />

1. Before you carry out building work to which the<br />

Building Regulations apply you or your agent must<br />

either deposit Full Plans or a Building Notice together<br />

with the appropriate charge. The charge<br />

payable is dependant upon the type of work carried<br />

out and can be calculated by reference to the<br />

following notes and schedules. Cheques should be<br />

made payable to Mole Valley District Council.<br />

2. CHARGES ARE PAYABLE AS<br />

FOLLOWS<br />

Plan Charge: Should you submit Full Plans<br />

you will generally pay a plan charge at the time of<br />

submission to cover their passing or rejection.<br />

Inspection Charge: With Full Plans submissions,<br />

for most types of work, an inspection<br />

charge covering all necessary site visits will be<br />

payable after we have made our first inspection. If<br />

applicable, you will be sent an invoice for this<br />

charge.<br />

Building Notice Charge: Should you<br />

submit a Building Notice the appropriate building<br />

notice charge is payable at the time of submission<br />

and covers all necessary checks and site visits in<br />

relation to the work described in the notice.<br />

Regularisation Charge: Should you<br />

apply for a regularisation certificate in respect of<br />

unauthorised building work, commenced on or after<br />

11 th November 1985, you will pay a regularisation<br />

charge to cover the cost of assessing your application<br />

and all inspections. The charge is equivalent to<br />

the Building Notice fee plus 20%.<br />

No VAT is payable on a regularisation charge.<br />

3. Schedule 1 - Charges for Small<br />

Domestic Buildings e.g. Certain<br />

new dwelling houses and flats (see<br />

Table 1) Applicable where the total internal floor<br />

area of each dwelling, excluding any garage or carport<br />

does not exceed 300 square metres and the building<br />

has no more than 3 storeys, each basement level<br />

being counted as one storey. In any other case,<br />

schedule 3 applies.<br />

4. Schedule 2 - Charges for Certain<br />

Small Buildings & Domestic Extensions<br />

(see Table 2) Where work<br />

comprises more than one domestic extension the<br />

total internal floor areas of all storeys of all the<br />

extensions shown on the application may be added<br />

together to determine the relevant charge. If the<br />

extension(s) exceeds 60 square metres or 3 storeys<br />

in height then schedule 3 applies.<br />

5. Schedule 3 - Charges for Other<br />

Work (see Table 3) Applicable to all other<br />

building work not covered by Schedules 1 or 2. Total<br />

estimated cost means an acceptable reasonable<br />

estimate that would be charged by a person in business<br />

to carry out the work shown or described in the<br />

application excluding VAT and any professional<br />

charges paid to an Architect, Engineer or Surveyor<br />

etc., and also excluding land acquisition costs.<br />

6. Exemptions/Reductions of<br />

Charges<br />

Where plans have been either approved or rejected<br />

no further charge is payable on resubmission for<br />

substantially the same work.<br />

Certain works to provide access and/or facilities for<br />

disabled people to existing dwellings and buildings to<br />

which the public have access are exempt from<br />

charges. In these regulations disabled person means<br />

a person who is within certain of the descriptions of<br />

persons to whom section 29(1) of the National Assistance<br />

Act 1948 applies.<br />

Where an application or building notice is in respect<br />

of two or more buildings or building work, all of which<br />

is substantially the same as each other, or such<br />

application or building notice have been previously<br />

dealt with by this authority, subject to certain criteria,<br />

a reduction of 25% on the plan charge or on the plan<br />

charge proportion of the building notice charge is<br />

allowable.<br />

7. General: These notes are for guidance only. Full<br />

details may be found in the Councils Building Control<br />

Charges Scheme which is available on request. If<br />

you have any difficulties calculating charges please<br />

contact the Building Control section 01306 879264.<br />

1<br />

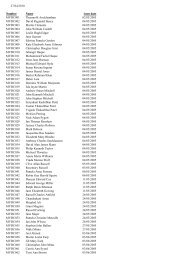

NUMBER<br />

OF<br />

DWELLINGS<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

SCHEDULE 1 - CHARGES FOR SMALL DOMESTIC BUILDINGS<br />

eg. Certain new dwelling houses and flats<br />

FULL PLANS SUBMISSIONS<br />

BUILDING NOTICES<br />

(A) Plan Charge (£) (B) Inspection Charge (£) (C) Building Notice Charge (£)<br />

EXC. VAT INC. VAT EXC. VAT INC. VAT<br />

155.75<br />

213.62<br />

280.85<br />

348.94<br />

421.28<br />

493.62<br />

514.89<br />

535.32<br />

556.60<br />

561.70<br />

566.81<br />

571.92<br />

577.02<br />

582.13<br />

587.24<br />

593.19<br />

598.30<br />

603.41<br />

608.51<br />

613.62<br />

183.00<br />

251.00<br />

330.00<br />

410.00<br />

495.00<br />

580.00<br />

605.00<br />

629.00<br />

654.00<br />

660.00<br />

666.00<br />

672.00<br />

678.00<br />

684.00<br />

690.00<br />

697.00<br />

703.00<br />

709.00<br />

715.00<br />

721.00<br />

*<br />

Additional<br />

charge<br />

for each<br />

dwelling<br />

above the<br />

minimum<br />

number in<br />

the band<br />

in<br />

column 1<br />

431.49<br />

598.30<br />

759.15<br />

879.15<br />

972.77<br />

1097.03<br />

1170.22<br />

1362.56<br />

1549.79<br />

1757.45<br />

1919.15<br />

2085.96<br />

2251.92<br />

2381.28<br />

2542.98<br />

2708.94<br />

2870.64<br />

3036.60<br />

3161.71<br />

3322.56<br />

507.00<br />

703.00<br />

892.00<br />

1033.00<br />

1143.00<br />

1289.00<br />

1375.00<br />

1601.00<br />

1821.00<br />

2065.00<br />

2255.00<br />

2451.00<br />

2646.00<br />

2798.00<br />

2988.00<br />

3183.00<br />

3373.00<br />

3568.00<br />

3715.00<br />

3904.00<br />

*<br />

Additional<br />

charge<br />

for each<br />

dwelling<br />

above the<br />

minimum<br />

number in<br />

the band in<br />

column 1<br />

21 - 30 623.83 733.00 12 + VAT 3400.85 3996.00 115 + VAT<br />

31 & over 732.77 861.00 7 + VAT 4440.85 5218.00 85 + VAT<br />

The sum of the relevant Plan<br />

Fee and Inspection Fee<br />

(A) + (B)

2<br />

3<br />

SCHEDULE 2 - CHARGES FOR CERTAIN SMALL BUILDINGS & DOMESTIC EXTENSIONS<br />

TYPE OF WORK<br />

1. Erection or extension of a detached or attached building<br />

which consists solely of a garage or carport or both having<br />

a floor area not exceeding 40 square metres in total and<br />

intended to be used in common with an existing building,<br />

and which is not an exempt building.<br />

2. A garage or carport as in 1. above but having a floor area<br />

exceeding 40 and not exceeding 60 square metres..<br />

FULL PLANS SUBMISSIONS<br />

BUILDING NOTICES<br />

Plan Charge (£) Inspection Charge (£) Building Notice Charge (£)<br />

EXC. VAT INC. VAT E XC.VAT<br />

INC. VAT EXC. VAT INC. VAT<br />

124.26 146.00 - - 124.26 146.00<br />

114.89 135.00 132.77 156.00 247.66 291.00<br />

NB. Where the total or the aggregation of the floor area of one or more extensions referred to in categories 1 & 2 above exceeds 60 square metres the charge should<br />

be calculated from estimated costs under schedule 3.<br />

3. Any extension of a dwelling the total floor area of which does<br />

not exceed 10 square metres including means of access<br />

and work in connection with that extension.<br />

4. An extension as in 3. above but having a floor area<br />

exceeding 10 and not exceeding 40 square metres.<br />

5. An extension as in 3. above but having a floor area<br />

exceeding 40 and not exceeding 60 square metres.<br />

6. The replacement of windows, rooflights or external doors<br />

in an existing dwelling<br />

114.89 135.00 132.77 156.00 247.66 291.00<br />

114.89 135.00 257.03 302.00 371.92 437.00<br />

114.89 135.00 380.43 447.00 495.32 582.00<br />

72.34 85.00 - - 72.34 85.00<br />

NB. Where the total or the aggregation of the floor area of one or more extensions referred to in categories 3, 4 and 5 above exceeds 60 square metres the charge<br />

should be calculated from estimated costs under schedule 3, subject to a minimum charge equivalent to the charge payable under category 5 above.<br />

7. Any extension or alteration of a dwelling consisting of the<br />

provision of one or more rooms in roof space, including<br />

means of access.<br />

To be calculated from estimated costs under Schedule 3, subject to a minimum charge equivalent<br />

to the charge payable under category 4 above.<br />

SCHEDULE 3 - CHARGES FOR OTHER WORK (NOT COVERED BY SCHEDULES 1 OR 2)<br />

TOTAL ESTIMATED<br />

COST OF WORK (£)<br />

FULL PLANS SUBMISSIONS<br />

BUILDING NOTICES<br />

Plan Charge (£) Inspection Charge (£) Building Notice Charge (£)<br />

EXC. VAT INC. VAT EXC. VAT INC. VAT EXC. VAT INC. VAT<br />

0 - 2,000<br />

2,001 - 5,000<br />

100.00<br />

165.00<br />

117.50<br />

193.88<br />

- - 100.00<br />

165.00<br />

117.50<br />

193.88<br />

5,001 - 6,000<br />

6,001 -7,000<br />

7,001 - 8,000<br />

8,001 - 9,000<br />

9,001 -10,000<br />

10,001 -11,000<br />

11,001 -12,000<br />

12,001 -13,000<br />

13,001 -14,000<br />

14,001 -15,000<br />

15,001 -16,000<br />

16,001 -17,000<br />

17,001 -18,000<br />

18,001 -19,000<br />

19,001 -20,000<br />

43.50<br />

45.75<br />

48.00<br />

50.25<br />

52.50<br />

54.75<br />

57.00<br />

59.25<br />

61.50<br />

63.75<br />

66.00<br />

68.25<br />

70.50<br />

72.75<br />

75.00<br />

51.11<br />

53.76<br />

56.40<br />

59.04<br />

61.69<br />

64.33<br />

66.97<br />

69.62<br />

72.26<br />

74.91<br />

77.55<br />

80.19<br />

82.84<br />

85.48<br />

88.12<br />

20,001 -100,000 To 75.00 excl. VAT add 2.00 excl. VAT<br />

for each 1,000 (or part thereof) over<br />

20,000 up to 100,000 then ADD VAT<br />

100,001 - 1m To 235.00 excl. VAT add 0.87 excl. VAT<br />

for each 1,000 (or part thereof) over<br />

100,000 up to 1m then ADD VAT<br />

Over 1m- 10m<br />

Over 10m<br />

To 1022.50 excl. VAT add 0.70 excl. VAT<br />

for each 1,000 (or part thereof) over 1m<br />

up to 10m then ADD VAT<br />

To 7,210.00 excl. VAT add 0.50 excl.<br />

VAT for each 1,000 (or part thereof) over<br />

10m then ADD VAT<br />

130.50<br />

137.25<br />

144.00<br />

150.75<br />

157.50<br />

164.25<br />

171.00<br />

177.75<br />

184.50<br />

191.25<br />

198.00<br />

204.75<br />

211.50<br />

218.25<br />

225.00<br />

153.34<br />

161.27<br />

169.20<br />

177.13<br />

185.06<br />

192.99<br />

200.93<br />

208.86<br />

216.79<br />

224.72<br />

232.65<br />

240.58<br />

248.51<br />

256.44<br />

264.38<br />

To 225.00 excl. VAT add 6.00 excl. VAT<br />

for each 1,000 (or part thereof) over<br />

20,000 up to 100,000 then ADD VAT<br />

To 705.00 excl. VAT add 2.63 excl. VAT<br />

for each 1,000 (or part thereof) over<br />

100,000 up to 1m then ADD VAT<br />

To 3067.50 excl. VAT add 2.05 excl.<br />

VAT for each 1,000 (or part thereof) over<br />

1m up to 10m then ADD VAT<br />

To 21,630.00 excl. VAT add 1.50 excl.<br />

VAT for each 1,000 (or part thereof) over<br />

10m then ADD VAT<br />

174.00<br />

183.00<br />

192.00<br />

201.00<br />

210.00<br />

219.00<br />

228.00<br />

237.00<br />

246.00<br />

255.00<br />

264.00<br />

273.00<br />

282.00<br />

291.00<br />

300.00<br />

204.45<br />

215.03<br />

225.60<br />

236.17<br />

246.75<br />

257.32<br />

267.90<br />

278.48<br />

289.05<br />

299.63<br />

310.20<br />

320.77<br />

331.35<br />

341.93<br />

352.50<br />

To 300.00 excl. VAT add 8.00 excl. VAT<br />

for each 1,000 (or part thereof) over<br />

20,000 up to 100,000 then ADD VAT<br />

To 940.00 excl. VAT add 3.50 excl. VAT<br />

for each 1,000 (or part thereof) over<br />

100,000 up to 1m then ADD VAT<br />

To 4090.00 excl. VAT add 2.75 excl. VAT<br />

for each 1,000 (or part thereof) over 1m up<br />

to 10m then ADD VAT<br />

To 28,840.00 excl. VAT add 2.00 excl.<br />

VAT for each 1,000 (or part thereof) over<br />

10m then ADD VAT