Scheme booklet - Barclays Pensions

Scheme booklet - Barclays Pensions

Scheme booklet - Barclays Pensions

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The Pension Investment<br />

Plan (PIP)<br />

get to where you<br />

want to be<br />

Your scheme <strong>booklet</strong><br />

For members of PIP<br />

The <strong>Barclays</strong> Bank UK Retirement Fund (the UKRF)

Inside this <strong>booklet</strong><br />

Terms explained <br />

Overleaf<br />

Welcome to PIP 2<br />

1. Getting started – the essentials: outlining everything you 3<br />

need to know to start saving with PIP including who can<br />

join, how your savings build up and what you need to do<br />

when you join.<br />

2. Additional benefits of PIP: sets out other benefits of PIP, 7<br />

such as the cost-effectiveness of contributions, investment<br />

options and your choices at retirement. It also describes the<br />

benefits available in the event of your death or ill-health.<br />

3. Model your own choices: use the online pension modeller 14<br />

to help you understand your options in PIP. This section<br />

shows how the modeller works. You will also find some case<br />

studies to help you understand your options and how to<br />

review and revise your decisions.<br />

4. Further information: includes information about how to 19<br />

raise concerns, the tax treatment of contributions and how<br />

we use your data.<br />

5. Useful contacts: includes contact details for various external 20<br />

pension bodies, <strong>Barclays</strong> <strong>Pensions</strong> Administration and how to<br />

find an independent financial adviser.<br />

6. Supplement: provides specific information for certain members 21<br />

who joined PIP on 1 April 2010 following <strong>Barclays</strong> <strong>Pensions</strong><br />

Review 2009.

2 PIP – get to where you want to be<br />

Welcome to the Pension<br />

Investment Plan (PIP)<br />

It is never too soon to start saving for your retirement and<br />

by reading this <strong>booklet</strong> you have taken an important step<br />

in your retirement planning. Saving through PIP helps you<br />

build up valuable retirement benefits in a flexible way that<br />

suits you.<br />

PIP gives you…<br />

A valuable benefit<br />

<strong>Barclays</strong> contributes 10% of your monthly Basic Salary to help you save<br />

for retirement.<br />

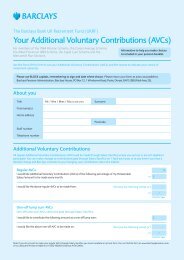

Opportunity to grow<br />

You have the opportunity to grow your retirement benefits further<br />

by making Additional Voluntary Contributions (AVCs).<br />

Flexibility and choice<br />

PIP provides you with the flexibility to save in a way that works for you.<br />

You can choose how much you contribute, how your contributions are<br />

invested and when you retire.<br />

A cost-effective way of saving for retirement<br />

If you make contributions, you will benefit from tax relief and you may<br />

benefit from savings in National Insurance too. Making AVCs to PIP may<br />

cost less than you think.<br />

Protection<br />

PIP provides benefits in the event of your death or if you become<br />

too ill to work.<br />

To find out more<br />

This <strong>booklet</strong> describes the<br />

standard provisions of PIP. If<br />

you were a member of another<br />

section(s) of The <strong>Barclays</strong><br />

Bank UK Retirement Fund (the<br />

UKRF) as at 31 March 2010,<br />

please ensure you refer to any<br />

additional information you were<br />

provided at the time of transfer<br />

and the Supplement on page 21.<br />

Where defined terms are used<br />

in this <strong>booklet</strong> you should refer<br />

to Terms explained on the<br />

inside front cover.<br />

If you need this <strong>booklet</strong><br />

in a different format<br />

You can obtain this <strong>booklet</strong><br />

in large print, Braille or audio<br />

format. Please contact <strong>Barclays</strong><br />

<strong>Pensions</strong> Administration. Details<br />

are on page 20.<br />

This <strong>booklet</strong> is a summary of<br />

the benefits payable from PIP.<br />

Nothing in this <strong>booklet</strong> confers<br />

any entitlement to benefits<br />

in excess of those provided<br />

under the Rules of the UKRF.<br />

The Rules, and applicable law,<br />

override this <strong>booklet</strong> in the<br />

event of any discrepancies<br />

between them.<br />

All references to tax are based<br />

on the Trustee’s understanding<br />

at the date of this <strong>booklet</strong>.<br />

Benefits and contributions<br />

are taxed at the rate and in the<br />

manner actually in force at<br />

the relevant time.<br />

Visit www.barclayspensions.co.uk or contact <strong>Barclays</strong> <strong>Pensions</strong><br />

Administration (see page 20).

PIP – get to where you want to be 3<br />

1. Getting started – the essentials<br />

This section confirms who<br />

can join PIP and provides<br />

a summary of how your<br />

retirement savings will<br />

build up. This section also<br />

provides information<br />

about what you need<br />

to do when you join.<br />

Read the rest of this <strong>booklet</strong><br />

to understand the full range<br />

of benefits available to you.<br />

Who can join?<br />

<strong>Barclays</strong> decides who may join PIP and notifies prospective members of their<br />

eligibility. All permanent employees of <strong>Barclays</strong> Capital who are aged between 18<br />

and 60 years, or who are outside of this age range but are entitled to join under<br />

their contract of employment, are eligible to join (subject to exclusions for certain<br />

overseas employment).<br />

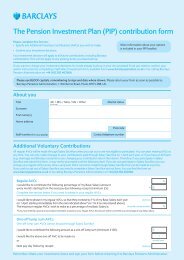

How do I join?<br />

We believe that saving for your retirement is so important that, if eligible, you will<br />

automatically become a member of PIP when you join <strong>Barclays</strong>. This means you<br />

will benefit straight away from <strong>Barclays</strong> contributions. You can choose how these<br />

contributions are invested and whether to make Additional Voluntary Contributions<br />

(AVCs). Complete a contribution form to confirm your choices. Make sure that you<br />

read this <strong>booklet</strong> carefully to understand the options available to you.<br />

You can also opt out of PIP but should consider this carefully before doing so<br />

(see page 6 for further details).

4 PIP – get to where you want to be<br />

PIP – get to where you want to be 5<br />

How it works<br />

<strong>Barclays</strong> contributions and, any contributions you make, form your Accumulated Fund. You can<br />

choose how your Accumulated Fund is invested. When you reach retirement, your Accumulated<br />

Fund is used to provide your retirement benefits.<br />

<strong>Barclays</strong> helps you save<br />

<strong>Barclays</strong> contributes 10% of your monthly Basic Salary into your Accumulated Fund.<br />

<strong>Barclays</strong><br />

contributes<br />

10% of your<br />

Basic Salary<br />

Accumulated Fund<br />

(used to buy benefits when you retire)<br />

More information<br />

on the cost-effectiveness<br />

of AVCs and your investment<br />

options can be found on<br />

pages 7 to 9.<br />

You can grow your retirement savings with<br />

Additional Voluntary Contributions (AVCs)<br />

You do not have to make any contributions to PIP but you can grow your Accumulated<br />

Fund further by making AVCs.<br />

There are two types of AVCs:<br />

• Regular AVCs. You can choose how much to contribute on a monthly basis,<br />

subject to a minimum contribution of £5 a month.<br />

• Lump-sum AVCs. You may not always be in a position to make regular AVCs,<br />

which is why you can also make lump-sum AVCs at any time, subject to<br />

a minimum of £100.<br />

Phasing your regular AVCs<br />

You also have the option to phase in your regular AVCs if you cannot commit to the<br />

level you want to make straight away. Phasing allows you to increase your regular<br />

AVCs by 1% of your Basic Salary each April until you reach your pre-specified target<br />

contribution level.<br />

Investment returns<br />

You can choose how contributions from <strong>Barclays</strong>, and any AVCs you make, are invested<br />

from a range of funds made available by the Trustee. Details of the investment funds<br />

available are included on page 9. The value of your Accumulated Fund depends on how<br />

much has been paid into it and the investment returns it receives. Over time the value of<br />

your Accumulated Fund may go up or down depending on your choice of investments.<br />

You can choose<br />

to make<br />

Additional<br />

Voluntary<br />

Contributions<br />

(AVCs)<br />

Investment<br />

performance<br />

<strong>Barclays</strong> contributions<br />

AVCs<br />

Benefits already built up<br />

Your Accumulated Fund<br />

may go up and down<br />

in value in line with<br />

investment performance.<br />

£<br />

Option to take<br />

tax-free cash<br />

You can take up to 25% of your<br />

Accumulated Fund as a cash<br />

lump-sum when you retire<br />

(subject to any additional limits<br />

imposed by HMRC from time<br />

to time). Under current HMRC<br />

rules this lump-sum can be<br />

paid tax free.<br />

30 15 0<br />

Years to retirement<br />

When you retire, your Accumulated Fund is used to provide retirement<br />

benefits. There are two main types of retirement benefit you can receive:<br />

Buy retirement<br />

income<br />

After taking any tax-free<br />

cash, the remainder of your<br />

Accumulated Fund is used<br />

to buy an annuity. An annuity<br />

provides you with a regular<br />

income in retirement.<br />

You can also choose to<br />

provide benefits for your<br />

dependants after your death.<br />

Protection for you and<br />

your dependants<br />

In addition to building up<br />

benefits for your retirement,<br />

PIP also provides benefits in<br />

the event of your death while<br />

you are in <strong>Barclays</strong> service<br />

and ill-health benefits if<br />

you become too ill to work.<br />

More information is provided<br />

about these benefits on<br />

page 12.<br />

Changing your<br />

regular AVCs<br />

Regular AVCs are<br />

normally made through<br />

Salary Sacrifice unless<br />

you opt out or are not<br />

eligible. See page 8 for<br />

more information about<br />

Salary Sacrifice. You will<br />

be able to change<br />

your Salary Sacrifice<br />

contributions on 1 April<br />

each year. However, you<br />

can change your level<br />

of regular AVCs if you<br />

have a Life Event, such<br />

as marriage. See Terms<br />

explained for more<br />

details about Life Events.<br />

If you do not participate<br />

in Salary Sacrifice you<br />

can change your regular<br />

AVCs at any time.

6 PIP – get to where you want to be<br />

What do I need to do when I join?<br />

When you join PIP you need to consider how you<br />

would like your contributions to be invested and<br />

whether to make AVCs in addition to the 10%<br />

contribution made by <strong>Barclays</strong>.<br />

You need to:<br />

• Consider your investment options and decide how you would like your <strong>Barclays</strong><br />

contributions to be invested. You can choose from Lifestyle, Anchor or Self<br />

Select Investments. If you do not make a selection and complete a contribution<br />

form indicating otherwise, these contributions will be invested in a Lifestyle fund<br />

targeting retirement in the year of your 60th birthday.<br />

• Decide if you want to make regular or lump-sum AVCs:<br />

• Consider phasing in your regular AVCs over a number of years if you<br />

would like to make regular AVCs but are concerned about the cost;<br />

• Decide how to invest your AVCs (see above).<br />

• Complete and return a contribution form to confirm your investment<br />

decision for future <strong>Barclays</strong> contributions and any AVCs you wish to make.<br />

Copies of the contribution form can be found online at<br />

www.barclayspensions.co.uk or by contacting <strong>Barclays</strong> <strong>Pensions</strong><br />

Administration (see page 20).<br />

Model your own choices<br />

Use the pension modeller at www.barclayspensions.co.uk. You can<br />

find out how the modeller works on page 14. We have also included<br />

some case studies to help you make your choices.<br />

Information to consider<br />

before opting out of PIP<br />

If you do not want to be a member<br />

of PIP, you can opt out at any time<br />

by giving at least one month’s notice<br />

in writing to <strong>Barclays</strong> <strong>Pensions</strong><br />

Administration. Here are some of the<br />

things you should think about before<br />

doing so:<br />

• If you opt out, you will continue<br />

to be covered for life assurance<br />

of four times your Basic Salary<br />

but will not be eligible for the<br />

additional PIP dependants’<br />

death-in-service benefit or<br />

ill-health benefits (see page<br />

12 for more information). You<br />

will also not receive <strong>Barclays</strong><br />

contributions of 10% of your<br />

Basic Salary.<br />

• You can apply to rejoin PIP by<br />

writing to <strong>Barclays</strong> <strong>Pensions</strong><br />

Administration, giving one<br />

month’s notice. Your application<br />

will be considered at the discretion<br />

of <strong>Barclays</strong> which may set specific<br />

terms on your rejoining.

PIP – get to where you want to be 7<br />

2. Additional benefits of PIP<br />

This section sets out some<br />

additional benefits of PIP.<br />

It includes details of<br />

the cost-effectiveness<br />

of contributions and<br />

options for investing your<br />

Accumulated Fund. It gives<br />

a summary of your choices<br />

at retirement and outlines<br />

the benefits available from<br />

PIP if you die or are too ill to<br />

work. It also describes what<br />

happens if you leave PIP.<br />

You may be able<br />

to transfer in<br />

previous benefits<br />

You may have the option to<br />

transfer in benefits from previous<br />

registered pension arrangements<br />

that you have been a member of.<br />

Your contributions to PIP are cost effective<br />

If you decide to make regular or lump-sum AVCs, you will receive tax relief.<br />

If you make your regular AVCs through Salary Sacrifice you could also save on<br />

National Insurance. This makes paying AVCs into PIP a cost-effective way to<br />

save for your retirement.<br />

Tax relief<br />

Your AVCs are deducted from your gross salary before any calculation or<br />

deduction for income tax, so you receive full tax relief on the amount you<br />

contribute to PIP (subject to certain limits, which are detailed on page 19).<br />

This means that contributing to PIP may cost less than you think.<br />

Example: Basic rate tax payer<br />

Based on a Basic salary of £30,000, 5% AVCs (ie. £125 a month) to your<br />

Accumulated Fund will cost £100 a month of your take home salary.<br />

Example: Higher rate tax payer<br />

Based on a basic salary of £60,000, 5% AVCs (ie. £250 a month) to your<br />

Accumulated Fund will cost £150 a month of your take home salary.<br />

If you are eligible and participate in Salary Sacrifice, you can also save on National<br />

Insurance on any regular AVCs you decide to make (see page 8).<br />

If you have been a member of<br />

PIP for more than two years,<br />

transfers in are accepted at the<br />

Trustee’s discretion. The Trustee<br />

decides the terms on which a<br />

transfer is accepted, with the<br />

advice of the UKRF’s actuary and<br />

with the consent of <strong>Barclays</strong>.<br />

Transfers in to PIP are credited<br />

to your Accumulated Fund.

8 PIP – get to where you want to be<br />

Salary Sacrifice<br />

If you pay UK National Insurance, all regular AVCs are made to PIP through Salary<br />

Sacrifice. You will automatically make regular AVCs in this way, unless you are not<br />

eligible or you decide to opt out of Salary Sacrifice. Salary Sacrifice takes advantage<br />

of the National Insurance savings that can be made if <strong>Barclays</strong> pays your regular<br />

AVCs on your behalf.<br />

Example: Basic rate tax payer<br />

Based on a Basic salary of £30,000, 5% AVCs (ie. £125 a month) to your<br />

Accumulated Fund could only cost you £87 a month after tax and National Insurance<br />

savings, compared to £100 if not paid through salary sacrifice.<br />

Example: Higher rate taxpayer<br />

Based on a Basic salary of £60,000, 5% AVCs (ie. £250 a month) to your<br />

Accumulated Fund could only cost you £145 a month after tax and National<br />

Insurance savings, compared to £150 if not paid through salary sacrifice.<br />

Through Salary Sacrifice:<br />

1. You do not make regular pension contributions.<br />

2. Instead, <strong>Barclays</strong> reduces your salary by the value of the regular AVCs<br />

you would otherwise have made.<br />

To find out more<br />

Visit www.barclayspensions.co.uk<br />

or contact <strong>Barclays</strong> <strong>Pensions</strong><br />

Administration (see page 20).<br />

Changing your<br />

regular AVCs<br />

You can only make changes to the<br />

amount of regular AVCs you pay<br />

through Salary Sacrifice, with effect<br />

from 1 April every year. You may also<br />

be able to make changes during the<br />

year if you experience a Life Event,<br />

which includes marriage, birth or<br />

adoption and changes in working hours.<br />

3. <strong>Barclays</strong> then pays an amount directly into PIP equal to the regular<br />

AVCs you would otherwise have made (<strong>Barclays</strong> will also continue to<br />

make contributions of 10% of your Basic Salary).<br />

4. This means that both you and <strong>Barclays</strong> pay less National Insurance,<br />

and your take-home pay is higher than it would be had you paid regular<br />

AVCs directly.<br />

Salary Sacrifice is a change to your terms and conditions of employment. It will not<br />

affect your income tax position compared to making regular AVCs normally, or your<br />

pay reviews or bonuses. Your other salary-related benefits such as life assurance and<br />

contractual maternity pay will be based on your Pre-Sacrifice Salary.<br />

Nearly all members will benefit by participating in Salary Sacrifice. However, there<br />

may be some members who may not benefit, including those who are receiving<br />

State benefits (eg. Statutory Sick Pay), or some who are members of more than one<br />

Salary Sacrifice arrangement. For this reason, if you earn less than the Lower Salary<br />

Sacrifice Limit you will not be eligible to participate in Salary Sacrifice. You will still<br />

be able to make regular AVCs but these will not be made through Salary Sacrifice<br />

(see Terms explained on the inside front cover).<br />

If you decide you do not want to participate in Salary Sacrifice you will need to let<br />

us know by filling in a Salary Sacrifice opt-out form. This is available online at<br />

www.barclayspensions.co.uk or from <strong>Barclays</strong> <strong>Pensions</strong> Administration<br />

(see page 20 for details).<br />

Where a refund of your regular AVCs would have been due under the Rules of PIP<br />

on leaving service, but your AVCs were made through Salary Sacrifice, <strong>Barclays</strong><br />

will make an ex-gratia payment equal to the refund that would have been payable<br />

had you not participated in Salary Sacrifice. For the purpose of this <strong>booklet</strong><br />

references to ‘your regular AVCs’ also include regular AVCs made on your behalf<br />

through Salary Sacrifice.

PIP – get to where you want to be 9<br />

PIP gives you access to a wide range<br />

of investment options<br />

You decide how your Accumulated Fund is invested from a range of options<br />

made available by the Trustee. If you do not make AVCs, or have not submitted<br />

a contribution form confirming your investment choice, your <strong>Barclays</strong> contributions<br />

will be invested in a Lifestyle fund which targets retirement in the year of your 60th<br />

birthday. You have three investment options to choose from: Lifestyle, Anchor and<br />

Self Select Investments.<br />

Lifestyle<br />

The investments in Lifestyle follow a pre-set investment strategy which depends<br />

upon the amount of time until your target retirement year.<br />

Whilst you are more than 10 years from your target retirement year, Lifestyle follows<br />

a higher-risk investment strategy, designed to grow the retirement benefits your<br />

Accumulated Fund can provide. Then, over the last 10 years before your retirement,<br />

Lifestyle increasingly switches into investments which are expected to protect the<br />

value of your retirement benefits, reducing the amount of risk it takes.<br />

Factsheets<br />

Factsheets for Lifestyle, Anchor and<br />

all the funds available through<br />

Self Select Investments as well as<br />

the Self Select Investment Guide are<br />

available at www.barclayspensions.co.uk<br />

or from <strong>Barclays</strong> <strong>Pensions</strong><br />

Administration (see page 20).<br />

The Trustee and <strong>Barclays</strong> have provided<br />

this information as general guidance<br />

to support you in making your pension<br />

decisions. You should make sure<br />

that you read the fund factsheets<br />

and consider getting independent<br />

financial advice before making any<br />

investment decisions.<br />

You should consider your own preferences and the level of risk you are comfortable<br />

with, when deciding if Lifestyle is right for you.<br />

Lifestyle aims to ensure that, while you remain comfortable with its<br />

investment approach, you will only need to make an investment decision<br />

if your expected retirement date changes. If it does, you should consider<br />

changing to the Lifestyle fund which matures in the year of your new<br />

expected retirement date.<br />

Anchor<br />

The aim of the Anchor fund is to ensure that its value broadly keeps pace with<br />

the cost of buying a retirement income over the long term. It cannot offer any<br />

guarantees, but provides members with some certainty around the amount<br />

of retirement benefits their Accumulated Fund will secure when they retire.<br />

Unlike Lifestyle, it does not change its investment strategy over time by targeting<br />

a particular retirement age. Anchor is a lower-risk investment strategy so is less<br />

likely to fluctuate in value than the Lifestyle fund.<br />

Anchor is not expected to grow your retirement savings in the longer term. If you<br />

invest only in Anchor until you retire, you would expect to have to contribute more<br />

to get the same PIP benefits as if you had invested only in Lifestyle. However, you<br />

are less likely to need to change your level of contributions to respond to fluctuations<br />

in the value of your savings over time. Even though this is a lower-risk option, your<br />

expected benefits may still go up or down over time.<br />

Self Select Investments<br />

If you want to build an investment strategy which is more closely aligned to your<br />

goals and views on investing, PIP also offers a range of funds called Self Select<br />

Investments, which includes the Lifestyle and Anchor funds. You can select<br />

these funds in any combination you choose. This option requires a higher level of<br />

involvement from you than the Lifestyle or Anchor funds, and is more likely to be<br />

suited to you if you are a confident and experienced investor who can commit the<br />

time to managing your investments yourself.<br />

You should review your<br />

investment decisions from<br />

time to time. If you would like<br />

to change how <strong>Barclays</strong><br />

contributions, or your AVCs,<br />

are invested, or switch the<br />

money already invested to<br />

different funds, you can do so<br />

at any time by completing a<br />

Self Select Investment form.<br />

For more information see the<br />

Self Select Investment Guide<br />

at www.barclayspensions.co.uk<br />

or request a copy from <strong>Barclays</strong><br />

<strong>Pensions</strong> Administration.<br />

Lifestyle works<br />

with Anchor<br />

You can also choose to combine<br />

the Lifestyle and Anchor funds to<br />

get the balance between growth<br />

and protection that is right for<br />

you.

10 PIP – get to where you want to be<br />

PIP gives you flexibility<br />

at retirement<br />

As a member of PIP you can choose<br />

the age at which you retire, the type<br />

of pension you buy, and the amount<br />

of tax-free cash that you take.<br />

Your age at retirement<br />

Your Normal Retirement Age in PIP<br />

is your 60th birthday.<br />

You can take your pension benefits at<br />

any time from your Minimum Pension<br />

Age (normally 55), up to age 75.<br />

• Early retirement: You can retire on<br />

or after your Minimum Pension Age<br />

but before your Normal Retirement<br />

Age. If you want to retire early,<br />

you will have less time to build up<br />

benefits and earn investment returns<br />

in your Accumulated Fund. As your<br />

pension will be paid for longer, the<br />

pension you will be able to buy<br />

will normally cost more, possibly<br />

resulting in a smaller pension.<br />

• Late retirement: You may be able to<br />

retire after your Normal Retirement<br />

Age, but not later than the date you<br />

leave all employment or 75, if earlier.<br />

In this case, you will have more<br />

time to build up benefits and<br />

earn investment returns in your<br />

Accumulated Fund. As your pension<br />

will be paid for a shorter period,<br />

the pension you will be able to<br />

buy may be bigger.<br />

• Flexible retirement: You can take<br />

your pension while still working<br />

for <strong>Barclays</strong> after reaching your<br />

minimum pension age. You will<br />

need <strong>Barclays</strong> consent and will stop<br />

building up any further benefits in<br />

PIP. Your death-in-service lumpsum<br />

will be reduced to one times<br />

your Basic Salary, and no additional<br />

dependants’ lump-sum will be<br />

payable if you die in service. You will<br />

also no longer be eligible for ill-health<br />

retirement benefits.<br />

The age you choose to retire affects how much time<br />

you have to save as well as the value of your PIP benefits. It<br />

could have a significant impact on your retirement benefits.<br />

State pensions<br />

The State currently provides two types of pension: the Basic State Pension and the<br />

State Second Pension (S2P). Before 6 April 2012 PIP was Contracted Out of the S2P<br />

and you did not build up benefits in the S2P. PIP does not affect your entitlement to<br />

the Basic State Pension.<br />

You can find out more about State benefits, including how to get a forecast of your<br />

personal entitlement, by visiting www.direct.gov.uk/pensions<br />

You can also visit www.barclayspensions.co.uk for more information specific to PIP.

PIP – get to where you want to be 11<br />

Buying an annuity<br />

As you approach retirement, you will need to decide how you want to use your<br />

Accumulated Fund.<br />

Most people secure their income in retirement by purchasing an annuity (or pension)<br />

from an insurance company, although you do have some other options (see opposite).<br />

You can use all of your Accumulated Fund to buy an annuity or you can take up to<br />

25% as a cash lump-sum and then use the remainder of your Accumulated Fund to<br />

buy an annuity. Your pension income will be subject to income tax when it is paid. For<br />

most members there will be no other tax liability in respect of their Accumulated Fund,<br />

subject to it not exceeding the Lifetime Allowance (see page 19 for details).<br />

Annuities are policies sold by insurance companies which usually guarantee to<br />

provide you with a certain level of income for the rest of your life and, if you choose,<br />

benefits for your dependants after your death. Until 31 March 2013 you may also<br />

have the option of purchasing your pension from the UKRF.<br />

Other types of pension<br />

Apart from buying an annuity, there<br />

are a number of other ways to take an<br />

income from your Accumulated Fund<br />

by transferring your benefits to another<br />

pension arrangement. These include<br />

income drawdown, unsecured pensions<br />

and alternatively secured pensions.<br />

Generally, these products have higher<br />

charges and involve taking some risk<br />

as to the level of pension they provide<br />

and are therefore not appropriate for<br />

everyone. For more information on these<br />

benefits or to find out if they might be<br />

right for you, you should contact an<br />

independent financial adviser.<br />

When choosing an annuity, you have a number of options to consider:<br />

• Pension increases. You can buy an annuity that increases your pension over<br />

time so your spending power keeps pace with inflation. You can also choose an<br />

annuity that increases at a fixed rate, for example at 3% a year, or one that does<br />

not increase at all. Choosing an annuity that does not increase is likely to give<br />

you a higher pension at first, but means your spending power will reduce as the<br />

cost of living increases in the future.<br />

• Protection for your dependants if you die. You can choose an annuity which<br />

pays a proportion of your pension to your dependants if you die before them,<br />

for example 50%. Or you can decide on an annuity which will pay a cash<br />

lump-sum if you die within a certain time after you retire, a guarantee period, for<br />

example five years. When you retire, you will need to tell the insurance company,<br />

who provides your annuity, to whom you would like them to pay any benefits if<br />

you die.<br />

Your retirement<br />

benefit is a major<br />

purchase and one<br />

that you can only<br />

make once.<br />

It pays to shop around and you<br />

may want to consider getting<br />

independent financial advice<br />

before you make your decision.<br />

The cost of an annuity when you retire is affected by the options you choose,<br />

expected future interest rates and inflation, your life expectancy at the time you buy<br />

your pension, your age and the age of your dependants (if you choose to provide<br />

them with a pension after your death).<br />

Taking tax-free cash<br />

The Rules of the UKRF allow you to take up to 25% of your Accumulated Fund<br />

as a cash lump-sum when you retire (subject to any additional limits imposed<br />

by HMRC from time to time). Under current HMRC rules this lump-sum can be<br />

paid tax free.<br />

Use the pension modeller<br />

Visit www.barclayspensions.co.uk to see how your retirement benefit<br />

choices may impact the pension you will receive when you retire.

12 PIP – get to where you want to be<br />

PIP provides protection in the event of your death<br />

If you die as an employee<br />

of <strong>Barclays</strong> and an active<br />

PIP member<br />

The following may be payable:<br />

• A lump-sum of four times<br />

your annual Basic Salary<br />

(subject to a maximum<br />

lump-sum of the Lifetime<br />

Allowance at the date of<br />

your death);<br />

• A refund of the value of your<br />

AVCs, adjusted to reflect<br />

investment performance<br />

(which also counts towards,<br />

the Lifetime Allowance limit<br />

described above);<br />

• If you have eligible dependants,<br />

an additional lump-sum of<br />

eight times your Pensionable<br />

Salary (subject to the Internal<br />

Earnings Cap if applicable).<br />

If you leave <strong>Barclays</strong> service and<br />

die before taking your PIP benefits<br />

Your Accumulated Fund will be used<br />

to provide such cash lump-sums<br />

and/or pensions for your Partner,<br />

children and/or other dependants<br />

at the Trustee’s discretion.<br />

If you die after taking your<br />

retirement benefits from PIP<br />

The benefits payable when you die<br />

after retiring from PIP will depend<br />

on the type of pension you decided<br />

to buy at retirement.<br />

If you have chosen to take flexible<br />

retirement and die in <strong>Barclays</strong><br />

service before age 75, a lump-sum<br />

of one times your annual Basic<br />

Salary will be payable (subject to<br />

the Lifetime Allowance at the date<br />

of your death).<br />

You may be able to take<br />

your benefits early if you<br />

are too ill to work<br />

If you are too ill to continue working<br />

for <strong>Barclays</strong>, you can be considered<br />

by <strong>Barclays</strong> for immediate retirement,<br />

regardless of your age. You will be<br />

considered for this benefit if you are<br />

medically incapable of continuing<br />

your current occupation and meet the<br />

criteria set out by HMRC from time to<br />

time. If you qualify, your Accumulated<br />

Fund will be used to provide pension<br />

benefits, including the option to take<br />

a cash lump-sum (see page 11).<br />

The Trustee has the discretion to decide who receives benefits in the event<br />

of your death. Paying benefits in this way means that they do not form part<br />

of your estate and are not subject to Inheritance Tax. That is why you should<br />

let the Trustee know who you would like them to consider, by completing<br />

and returning an Expression of Wish form and keeping it up to date if your<br />

circumstances change (eg. due to a change in marital status or the birth<br />

or adoption of a child).<br />

Lump-sums on death are usually payable tax free, but may be subject<br />

to limits as determined from time to time.<br />

To find out more<br />

You can find out more and download<br />

a new Expression of Wish form by<br />

visiting www.barclayspensions.co.uk<br />

or by contacting <strong>Barclays</strong> <strong>Pensions</strong><br />

Administration (see page 20).

PIP – get to where you want to be 13<br />

You still benefit from PIP even if you leave<br />

<strong>Barclays</strong> or opt out<br />

If you decide to leave <strong>Barclays</strong> or opt out of PIP your options will depend<br />

on how long you have been a member of PIP:<br />

Less than three months: You will not receive the benefit from any of <strong>Barclays</strong><br />

contributions. You will receive a refund of the part of your Accumulated Fund<br />

built up by your AVCs. You will be liable to pay tax on any investment growth<br />

you have received and should do this through your annual return if applicable.<br />

If you made regular AVCs through Salary Sacrifice, instead of a refund from the<br />

UKRF, these will be paid to you as an ex-gratia payment by <strong>Barclays</strong> and will be<br />

subject to tax and National Insurance.<br />

Between three months and two years: You can transfer the full value of your<br />

Accumulated Fund, including the value derived from <strong>Barclays</strong> contributions,<br />

to another registered pension arrangement. If you do not transfer your benefits,<br />

and you joined PIP after 7 August 2009, any AVCs you have paid will be<br />

refunded to you in the same way as if you left with less than three months’<br />

membership. You will not receive the benefit from <strong>Barclays</strong> contributions.<br />

Two years or more: You can leave your benefits in PIP. The value of your<br />

Accumulated Fund will move in line with the investment performance of<br />

the funds in which it is invested. You will continue to be able to choose<br />

funds from those made available. You cannot make any further contributions<br />

to PIP and will not receive any further contributions from <strong>Barclays</strong>. You<br />

will not be able to request a refund, or an ex-gratia payment, in respect<br />

of your AVCs either, but can transfer your benefits to another registered<br />

pension arrangement.<br />

Transferring your benefit to another registered pension arrangement<br />

If you wish to transfer your PIP benefits, you should contact <strong>Barclays</strong> <strong>Pensions</strong><br />

Administration for a statement of your transfer value. Charges or market value<br />

reductions may be applied to your Accumulated Fund, depending on the<br />

funds you are invested in.<br />

Your transfer value will not be guaranteed and will depend on the value<br />

of your funds at the time they are sold.<br />

To find out more<br />

Visit www.barclayspensions.co.uk<br />

or contact <strong>Barclays</strong> <strong>Pensions</strong><br />

Administration (see page 20).<br />

PIP provides some benefits<br />

if you are temporarily<br />

absent from work<br />

If you take ordinary maternity, paternity,<br />

parental or adoption leave, your PIP<br />

AVCs can continue, based on the salary<br />

you actually receive. However, you may<br />

have to opt out of Salary Sacrifice to<br />

continue making AVCs. Contributions<br />

from <strong>Barclays</strong> to your Accumulated<br />

Fund will continue as though you were<br />

still working for <strong>Barclays</strong> during any<br />

period of paid leave.<br />

If you take any other form of career<br />

break, both <strong>Barclays</strong> contributions and<br />

any AVCs you pay, will stop until you<br />

return to work. However, you will still<br />

be covered for death-in-service benefits<br />

during your break.<br />

If you are absent from work due to<br />

illness, <strong>Barclays</strong> contributions and AVCs<br />

to your Accumulated Fund will usually<br />

continue as though you were still<br />

working for <strong>Barclays</strong>.<br />

For further information go to the HR<br />

section of your intranet.

14 PIP – get to where you want to be<br />

3. Model your own choices<br />

Whether you are about to join or are already a member of PIP, it is useful to<br />

understand your expected benefits from PIP. You can use the online pension modeller<br />

at www.barclayspensions.co.uk to help you set your PIP goals and understand the<br />

impact of the choices you make today.<br />

How to use the modeller<br />

Visit www.barclayspensions.co.uk and log in.<br />

You can access the modeller by following the link from the<br />

home page or by clicking on the ‘Planning ahead’ tab.<br />

Once you have launched the modeller, you will need to enter<br />

a few basic personal details and make some contribution<br />

choices, then click ‘Continue’. You may find it useful to have<br />

your latest Pension Statement to hand to enter a value for<br />

your Accumulated Fund into the modeller.<br />

The next page on the modeller shows you an estimate of the<br />

benefits you could expect to buy, in today’s money terms.<br />

On this page you can see how your expected benefits are<br />

affected by changing options such as your AVCs, retirement<br />

age, retirement options and investment returns.<br />

The modeller can be used at any time whether it is to help<br />

you make your choices on joining or to help you review and<br />

revise your benefits. It will also show you the actual cost<br />

of your AVCs, after taking account of any tax and National<br />

Insurance savings.<br />

Please note: The pension figures given in the examples on<br />

pages 15 to 18 have been rounded and are in today’s money<br />

terms. This gives you an estimate of the spending power of<br />

the pension which can be compared with the cost of living<br />

today. They assume that the maximum tax-free cash<br />

lump-sum of 25% has been taken at retirement and the<br />

annuity purchased includes a five-year guarantee period,<br />

a 50% spouse’s pension and receives inflationary<br />

pension increases.<br />

All figures have been calculated based on the following<br />

financial assumptions:<br />

• Inflation of 2.5% a year;<br />

• Future salary growth of 2.5% a year;<br />

• Investment returns of 7% a year up to 10 years before<br />

retirement, reducing to 3.5% in the year before retirement;<br />

and<br />

• Annuity purchase costs of 4%.<br />

They have been provided for illustration purposes only<br />

and you should use the modeller to explore your own<br />

circumstances. Figures were correct as at March 2012.

PIP – get to where you want to be 15<br />

Joining<br />

The following examples show how two members use the modeller to help them make<br />

their choices on joining PIP.<br />

The benefits of paying AVCs –<br />

Meet Anna<br />

Anna would like to enhance the income that PIP will<br />

provide her in retirement and wants to understand<br />

the impact of paying regular AVCs on her PIP benefits.<br />

She is age 30 and has a salary of £25,000 a year.<br />

Using the modeller, she sees that:<br />

• Based on <strong>Barclays</strong> contributions of 10% of her Basic<br />

Salary, she may expect to receive a pension of around<br />

£2,200 a year from PIP at age 60 if she takes the<br />

maximum amount of tax-free cash;<br />

• If she pays 5% of her Basic Salary in regular AVCs,<br />

which will cost £72.29 a month (after basic rate tax and<br />

National Insurance savings), she is expected to receive<br />

a pension of around £3,300 a year at age 60; and<br />

• If she phases in her regular AVCs to 5% over five<br />

years, her expected pension will be £3,100 a year,<br />

with an initial cost of £14.45 a month.<br />

See page 4 to find out how<br />

phasing works.<br />

Pension £/year<br />

6,000<br />

5,000<br />

4,000<br />

3,000<br />

2,000<br />

1,000<br />

55 60 65 70 75<br />

Retirement age<br />

<strong>Barclays</strong> contributions<br />

5% AVCs phased in<br />

5% Regular AVCs<br />

Anna decides to pay regular AVCs to build a<br />

greater level of potential benefits. To minimise<br />

the immediate impact on her take-home pay,<br />

she decides to phase in her regular AVCs over<br />

five years.

16 PIP – get to where you want to be<br />

Maximising savings to retire early –<br />

Meet James<br />

James wants to use PIP to build on his existing<br />

retirement savings and retire earlier than age 60.<br />

James is age 45 with a salary of £50,000 a year and has<br />

just joined PIP. He has built up benefits from a previous<br />

pension arrangement which provides him with a level<br />

of financial security. He thinks he will need PIP to provide<br />

him with an additional income of £2,500 a year.<br />

Using the modeller James sees that:<br />

• Based on <strong>Barclays</strong> contributions of 10% of his Basic<br />

Salary, he can expect to receive a pension of around<br />

£1,600 a year at age 60, if he takes the maximum<br />

amount of tax-free cash;<br />

• If he makes regular AVCs of 10% of his Basic Salary,<br />

he is expected to receive a pension of £3,200 a year<br />

at age 60 or £2,500 at age 58, after taking the<br />

maximum amount of tax-free cash; and<br />

• His 10% AVC will cost him £241.66 a month after tax<br />

and National Insurance savings.<br />

Pension £/year<br />

6,000<br />

5,000<br />

4,000<br />

3,000<br />

2,000<br />

1,000<br />

Target<br />

55 60 65 70 75<br />

Retirement age<br />

<strong>Barclays</strong> contributions<br />

10% Regular AVCs<br />

James decides to make regular AVCs<br />

of 10% of his Basic Salary with the aim<br />

of retiring earlier. He decides to review<br />

his progress towards his target and make<br />

changes to his choices if required to make<br />

sure he remains on track to retire earlier.

PIP – get to where you want to be 17<br />

Review and revise<br />

Once you have joined PIP, you need to review your<br />

expected PIP benefits regularly. You should revise your<br />

choices if you are not on track to meet your retirement<br />

goals, or if your goals change.<br />

A good time to do this may be when you receive your annual Pension Statement,<br />

which shows your expected PIP benefits at retirement based on the choices you<br />

have made to date. Alternatively, you could do this when you receive a salary<br />

increase or bonus. The case study in this section will help you understand how<br />

you can review and revise your choices.<br />

Review<br />

You need to review your<br />

progress towards your<br />

retirement goals regularly.<br />

When you review your choices and the<br />

benefits you are forecast to receive,<br />

you should consider the following:<br />

• Have your personal circumstances<br />

changed? For example, have you<br />

cleared your student debt, married<br />

or moved house?<br />

• Do you have a better idea of when<br />

you are likely to retire and how much<br />

income you might need?<br />

• Can you afford to contribute more<br />

to PIP now?<br />

Revise<br />

You can influence your<br />

expected PIP benefits<br />

in three ways.<br />

You can change:<br />

• How much you put in. The more you<br />

contribute, the more you are likely<br />

to have when you retire;<br />

• When you plan to retire.<br />

Changing your expected retirement<br />

age changes how much time you<br />

have to save; and<br />

• How you invest.<br />

Remember<br />

You may have other sources<br />

of retirement income including:<br />

• A State Pension (your State<br />

Second Pension will be<br />

reduced for any period<br />

for which you were<br />

Contracted Out);<br />

• Pension savings from other<br />

<strong>Barclays</strong> schemes or sections<br />

of the UKRF;<br />

• Pension savings from other<br />

providers or employers;<br />

• <strong>Barclays</strong> financial investments,<br />

such as Share Options; and<br />

• Other financial investments,<br />

such as ISAs or property.<br />

Make sure you consider these<br />

other sources of income when<br />

choosing your PIP retirement<br />

options (see page 11 for<br />

more details).<br />

As you get closer to retiring, you are<br />

likely to want more certainty and<br />

understanding about the retirement<br />

benefits you will be able to buy.<br />

However, you should not wait until<br />

you are just about to retire to review<br />

your goals or revise your choices.<br />

The sooner you<br />

identify and act<br />

on any changes you need<br />

to make, the greater the<br />

impact they could have<br />

on your PIP benefits.

18 PIP – get to where you want to be<br />

Pension £/year<br />

6,000<br />

5,000<br />

4,000<br />

3,000<br />

2,000<br />

1,000<br />

<strong>Barclays</strong> contributions<br />

Lump-sum AVC<br />

2% Regular AVCs + lump sum AVC<br />

55 60 65 70 75<br />

Retirement age<br />

Working longer and making extra<br />

contributions – Meet George<br />

George wants PIP to provide him with higher retirement<br />

benefits than he is currently on track to receive. He is<br />

thinking about making AVCs to help him achieve this.<br />

George is age 34 with a salary of £30,000 a year. He joined<br />

PIP when he was 30 and has not made any regular or lumpsum<br />

AVCs into PIP. His latest Pension Statement shows that<br />

he is currently on track to receive a pension of about £2,500<br />

a year. He does not have a definite target for the pension<br />

he will need from PIP yet, but he does not think that the<br />

estimate of £2,500 will be enough. Using the modeller,<br />

George sees that he can increase his expected benefits<br />

from PIP by:<br />

• Starting to make regular or lump-sum AVCs; or<br />

• Increasing his planned retirement age.<br />

George would like to pay AVCs but cannot commit to<br />

regular AVCs. If he makes a lump-sum AVC of £2,000<br />

it will only cost him £1,600 from his take-home pay,<br />

after tax savings. Using the modeller he sees that:<br />

• If he pays this lump-sum AVC now he could increase<br />

his expected pension to £2,600 a year, after taking<br />

the maximum amount of tax-free cash;<br />

• If he starts making regular AVCs of 2% of his Basic<br />

Salary a month, in addition to the lump-sum AVC,<br />

he could increase his expected pension to £3,000.<br />

This will only cost him £34.70 a month; and<br />

• The later he retires the greater the impact these AVCs<br />

will have on his pension benefits from PIP.<br />

George decides to make a lump-sum AVC of £2,000<br />

now. He decides to review his progress yearly and<br />

start making regular AVCs when he is able to do<br />

so. He recognises that if he sets a specific target<br />

income for retirement in the future, he could also<br />

consider working longer to achieve it.

PIP – get to where you want to be 19<br />

4. Further information<br />

Tax treatment of PIP contributions<br />

and benefits<br />

The UKRF is a UK pension scheme<br />

registered with HMRC under the Finance<br />

Act 2004. As a result, there are certain<br />

limits on the contributions and<br />

benefits payable:<br />

• The Annual Allowance. Each year,<br />

your ‘pension input’ for the tax year<br />

is compared to the Annual<br />

Allowance. For PIP, your pension<br />

input is the total amount contributed<br />

to PIP by both you and <strong>Barclays</strong>, and<br />

is measured over a Pension Input<br />

Period. For PIP, this period is 6 April<br />

to the following 5 April each year.<br />

The Annual Allowance is £50,000 for<br />

the 2012/2013 tax year. Any excess<br />

over the Annual Allowance is taxed<br />

through your self-assessment tax<br />

return. You can carry forward any<br />

unused annual allowance from any<br />

of the previous three years. The<br />

maximum amount you can carry<br />

forward each year is the difference<br />

between £50,000 and your Pension<br />

Input for that year.<br />

• The Lifetime Allowance. If your total<br />

pension benefits from all of your<br />

pension arrangements are greater<br />

than the Lifetime Allowance in force<br />

when you come to retire, the benefits<br />

you take in excess of this limit will be<br />

taxed. The Lifetime Allowance for the<br />

2012/2013 tax year has been reduced<br />

to £1.5 million. If you have benefits<br />

over this limit, you can either take<br />

them as a lump-sum which is taxed at<br />

55%, or as income which is taxed at<br />

25% when converted, and then again<br />

at your marginal rate of income tax.<br />

Where pension benefits paid in the<br />

event of your death from all sources<br />

exceed the Lifetime Allowance, a<br />

tax charge may be applied to the<br />

lump-sum payable from PIP. If your<br />

dependants provide proof of this, the<br />

Trustee, with <strong>Barclays</strong> consent, may<br />

agree to pay this benefit as pensions<br />

to minimise the amount of tax paid.<br />

These limits are set annually and<br />

the current limits can be found at<br />

www.barclayspensions.co.uk<br />

Data protection – how your information<br />

will be used<br />

The Trustee will use the information<br />

you give to administer and calculate<br />

your pension and pay your benefits.<br />

This could include information about<br />

your health or family circumstances.<br />

We may share your information with<br />

<strong>Barclays</strong> Bank PLC and its affiliates,<br />

for employment administration, payroll,<br />

and performance and management<br />

purposes. We may also share your<br />

information with third parties such<br />

as actuaries, auditors, legal advisers,<br />

consultants and administrators<br />

for the purposes of administering and<br />

calculating your pension and paying<br />

your benefits. We will not share your<br />

information for any other reason except<br />

to help prevent fraud, or if required to<br />

do so by law.<br />

We may need to transfer your information<br />

to other countries. If we do, we will take<br />

steps to ensure that your information<br />

is protected.<br />

You have the right to check the<br />

information we hold about you and to<br />

correct any inaccuracies. You can do<br />

this by contacting <strong>Barclays</strong> <strong>Pensions</strong><br />

Administration (see page 20).<br />

For more information about how<br />

your information is used, please visit<br />

www.barclayspensions.co.uk or write<br />

to the <strong>Pensions</strong> Data Privacy Manager<br />

at <strong>Barclays</strong> <strong>Pensions</strong> Administration<br />

(see page 20 for details).<br />

The Trustee and <strong>Barclays</strong> have<br />

provided this information as general<br />

guidance to support you in making<br />

your pension decisions. You should<br />

consider seeking independent<br />

financial advice, when making<br />

pension decisions.<br />

Trust Status<br />

PIP is a section of the UKRF which<br />

provides members’ benefits in accordance<br />

with the Rules. The UKRF is a trust,<br />

which is administered by a trustee<br />

company: <strong>Barclays</strong> Pension Funds<br />

Trustees Limited (the Trustee).<br />

The Trustee has a duty to ensure that<br />

PIP is managed according to the Rules.<br />

The Rules give <strong>Barclays</strong> the right to<br />

amend or terminate PIP (without<br />

replacing it) at any time. Some<br />

amendments would require the<br />

Trustee’s agreement.<br />

The UKRF’s annual report is published<br />

each year and copies are available<br />

from <strong>Barclays</strong> <strong>Pensions</strong> Administration<br />

or www.barclayspensions.co.uk.<br />

The assets of the trust are managed<br />

entirely separately from those of<br />

<strong>Barclays</strong> and may only be used to pay<br />

members’ benefits and the expenses<br />

of running the UKRF.<br />

If you have a dispute<br />

You are encouraged to raise any<br />

concerns as soon as possible so that<br />

they can be resolved quickly and fairly.<br />

In accordance with legislation, the UKRF<br />

has established an Internal Dispute<br />

Resolution Procedure (IDRP) to consider<br />

formally any complaint from a member<br />

(including those received from any<br />

dependants or other beneficiaries, or<br />

anyone claiming to be such a person).<br />

If you have a problem that <strong>Barclays</strong><br />

<strong>Pensions</strong> Administration cannot<br />

resolve, or you are unhappy with the<br />

decision reached, the IDRP will be used<br />

to resolve any dispute. You will need to<br />

tell <strong>Barclays</strong> <strong>Pensions</strong> Administration<br />

if you wish to invoke the IDRP and you<br />

can find a copy of the procedure at<br />

www.barclayspensions.co.uk or by<br />

phoning <strong>Barclays</strong> <strong>Pensions</strong> Administration.<br />

They will give you full details of the IDRP<br />

and ask you to put your complaint in<br />

writing to the Technical Manager at<br />

<strong>Barclays</strong> <strong>Pensions</strong> Administration<br />

(see page 20 for details).<br />

Use the pension modeller<br />

Visit www.barclayspensions.co.uk to help<br />

you review your own PIP pension benefits.

20 PIP – get to where you want to be<br />

5. Useful contacts<br />

<strong>Barclays</strong> <strong>Pensions</strong> Administration<br />

You should contact <strong>Barclays</strong> <strong>Pensions</strong><br />

Administration for any further<br />

information about your PIP benefits.<br />

Post:<br />

<strong>Barclays</strong> <strong>Pensions</strong> Administration<br />

<strong>Barclays</strong> House, PO Box 12<br />

1 Wimborne Road, Poole<br />

Dorset BH15 2BB, UK<br />

Telephone:<br />

+44 (0)1202 402060<br />

Email:<br />

HRSS.pensions@barclays.com<br />

Website:<br />

www.barclayspensions.co.uk<br />

The <strong>Pensions</strong> Advisory Service (TPAS)<br />

TPAS is an independent organisation<br />

giving free help and advice to members<br />

and beneficiaries of pension schemes,<br />

who are unable to resolve a dispute<br />

with the scheme administrators or<br />

trustees. TPAS can be contacted at:<br />

Post:<br />

The <strong>Pensions</strong> Advisory Service (TPAS)<br />

11 Belgrave Road<br />

London SW1V 1RB, UK<br />

Telephone:<br />

+44 (0)845 601 2923<br />

Website:<br />

www.pensionsadvisoryservice.org.uk<br />

The role of the <strong>Pensions</strong> Ombudsman<br />

The <strong>Pensions</strong> Ombudsman is able to<br />

investigate or determine complaints<br />

or disputes of fact or law in relation to<br />

occupational pension schemes. If you<br />

have a dispute, you must first follow<br />

the UKRF’s Internal Dispute Resolution<br />

Procedure. If, with the assistance of<br />

TPAS, you are still unable to resolve the<br />

dispute, you may contact the <strong>Pensions</strong><br />

Ombudsman. The Ombudsman’s<br />

address is:<br />

Post:<br />

The <strong>Pensions</strong> Ombudsman<br />

11 Belgrave Road<br />

London SW1V 1RB, UK<br />

Telephone:<br />

+44 (0)20 7630 2200<br />

Website:<br />

www.pensions-ombudsman.org.uk<br />

The <strong>Pensions</strong> Regulator<br />

The <strong>Pensions</strong> Regulator was created<br />

under the <strong>Pensions</strong> Act 2004 and<br />

regulates work-based pension schemes<br />

in the UK. Among other powers, it is<br />

able to intervene in the running of<br />

schemes where trustees, employers or<br />

professional advisers have failed in their<br />

duties. The <strong>Pensions</strong> Regulator can be<br />

contacted at the following address:<br />

Post:<br />

The <strong>Pensions</strong> Regulator<br />

Napier House<br />

Trafalgar Place<br />

Trafalgar Street<br />

Brighton<br />

East Sussex BN1 4DW, UK<br />

Telephone:<br />

+44 (0) 0845 600 0707<br />

Website:<br />

www.thepensionsregulator.gov.uk<br />

The Pension Tracing Service<br />

If you had a pension in a previous job<br />

but you no longer have the details, the<br />

tracing service of the Department for<br />

Work and <strong>Pensions</strong> (DWP) may be able<br />

to help you. The DWP’s Pension Tracing<br />

Service can be contacted as follows:<br />

Post:<br />

The Pension Tracing Service<br />

The Pension Service<br />

Tyneview Park<br />

Whitley Road<br />

Newcastle upon Tyne NE98 1BA, UK<br />

Telephone:<br />

+44 (0)845 600 2537<br />

Website:<br />

www.direct.gov.uk/pensions<br />

Independent financial advice<br />

It is important that you plan for your<br />

retirement early. The right advice is<br />

crucial to making these decisions.<br />

If you wish to get advice and do not<br />

already use a financial adviser, you<br />

can contact IFA Promotion Ltd, who<br />

will give you details of an independent<br />

financial adviser in your area. You can<br />

contact IFA Promotion Ltd at<br />

www.unbiased.co.uk

PIP – get to where you want to be 21<br />

6. Supplement<br />

For members who joined<br />

PIP on 1 April 2010<br />

following <strong>Barclays</strong> <strong>Pensions</strong><br />

Review 2009<br />

(and were employed by <strong>Barclays</strong><br />

Capital on 31 March 2010)<br />

If you were a member of a <strong>Barclays</strong><br />

scheme which closed on 31 March 2010,<br />

you would have automatically become<br />

a member of PIP with effect from<br />

1 April 2010.<br />

This Supplement is a summary of<br />

the additional features, which apply<br />

specifically to your membership.<br />

You should also refer to the brochure,<br />

‘Your future pension benefits’, which<br />

details the outcome of the consultation<br />

for further information on these<br />

additional features. Copies of this<br />

brochure are available on<br />

www.barclayspensions.co.uk or from<br />

<strong>Barclays</strong> <strong>Pensions</strong> Administration.<br />

• You will be able to take more of your<br />

PIP benefits as a tax-free cash lumpsum<br />

if you retire on or before<br />

31 March 2013. You will be able to<br />

use up to 100% of your PIP benefits<br />

to provide a tax-free cash lumpsum<br />

(subject to current HMRC<br />

limits). This means that you may<br />

receive more of the benefits from<br />

your closing scheme as pension. If<br />

you retire after 31 March 2013, the<br />

usual PIP tax-free cash lump-sum<br />

conditions will apply.<br />

• If you die as a member of PIP while<br />

employed by <strong>Barclays</strong> and leave<br />

eligible dependants, your deferred<br />

death-in-service benefits from your<br />

closing scheme will be offset against<br />

the dependants’ lump-sum of eight<br />

times your Pensionable Salary.<br />

For the purposes of calculating<br />

the offset, the Trustee will multiply<br />

any spouse’s or dependants’<br />

pensions payable from your closing<br />

scheme by a factor agreed between<br />

<strong>Barclays</strong> and the Trustee from time<br />

to time. This means that the spouse’s<br />

or dependants’ pensions will be paid<br />

from your closing scheme and the<br />

additional death-in-service benefits<br />

payable from PIP will be reduced.<br />

If you transferred your benefits from<br />

the 1964 section or your benefits<br />

have been reduced due to a pension<br />

debit, this will be taken into account<br />

in the calculation of the offset.<br />

• If you are too ill to work you may<br />

apply for an ill-health pension in<br />

respect of any benefits you built<br />

up on or before 31 March 2010.<br />

If <strong>Barclays</strong> agrees you may be<br />

entitled to a pension from any<br />

benefits you built up on or before<br />

31 March 2010, which will be<br />

reduced because it is being paid<br />

earlier, plus any income purchased<br />

with your Accumulated Fund<br />

from PIP.<br />

• The availability of <strong>Barclays</strong> Capital<br />

reduction factors is conditional<br />

on becoming a member of PIP<br />

on 1 April 2010.

Terms explained<br />

Annual Allowance<br />

The limit of how much tax-free<br />

pension savings a member can<br />

make in one year (see page 19).<br />

Basic Salary<br />

Your salary before any reduction<br />

under the Salary Sacrifice<br />

arrangement.<br />

Basic State Pension<br />

The pension available from State<br />

Pension Age to everyone who has<br />

made sufficient National Insurance<br />

contributions during their working life.<br />

Contracted Out<br />

PIP was a Contracted Out scheme<br />

until the Government ended<br />

Contracting Out from 6 April 2012.<br />

Members of a Contracted Out<br />

pension scheme paid reduced<br />

National Insurance contributions<br />

and did not participate in the State<br />

Second Pension (S2P).<br />

Internal Earnings Cap<br />

The maximum earnings which may<br />

be used in calculating your benefits<br />

if you joined the UKRF on or after<br />

1 June 1989. This is set each year<br />

and is £125,000 in 2012/2013. The<br />

current limit can be found at<br />

www.barclayspensions.co.uk.k.<br />

Lifetime Allowance<br />

The maximum value of pension<br />

benefits from all sources (excluding<br />

State pension) that a member can<br />

build up without incurring a tax<br />

charge (see page 19).<br />

Life Event<br />

A lifestyle change that occurs<br />

during the course of the year where<br />

<strong>Barclays</strong> consents to you changing<br />

your Salary Sacrifice options on a<br />

date other than 1 April. A Life Event<br />

includes marriage; birth/adoption of<br />

a child/children; separation/divorce<br />

or changes in working hours (for<br />

example, full time to part time).<br />

Lower Salary Sacrifice Limit<br />

The limit set by <strong>Barclays</strong>, to be<br />

reviewed from time to time.<br />

You must earn above this limit in a<br />

year to participate in Salary Sacrifice<br />

(£7,800 from 1 April 2011).<br />

Normal Retirement Age<br />

Is your 60th birthday.<br />

Partner<br />

Your spouse, civil partner<br />

(as defined by the Civil Partnership<br />

Act) or an adult of either sex<br />

with whom you were having an<br />

established relationship akin to<br />

marriage at your death, provided<br />

that, in the opinion of the<br />

Trustee, your Partner is financially<br />

dependent on you or has financial<br />

interdependence with you.<br />

Pensionable Salary<br />

Your Basic Salary up to a maximum<br />

of the Internal Earnings Cap which<br />

is used to calculate the additional<br />

dependants’ lump sum payable on<br />

your death as an active member<br />

of PIP (see page 12).<br />

Pre-Sacrifice Salary<br />

The salary you would have received<br />

if you had not been participating<br />

in Salary Sacrifice.<br />

State Second Pension (S2P)<br />

The S2P provides an additional<br />

pension from State Pension Age<br />

based on eligible individuals’<br />

earnings.<br />

Rules<br />

The Trust Deed and Rules<br />

governing the UKRF, as amended<br />

from time<br />

to time.<br />

Trustee<br />

The Trustee of The <strong>Barclays</strong> Bank<br />

UK Retirement Fund (the UKRF).<br />

This is a trustee company –<br />

<strong>Barclays</strong> Pension Funds Trustees<br />

Limited. Its board is made up of<br />

<strong>Barclays</strong>-appointed, independent<br />

and member-nominated directors<br />

who are responsible for managing<br />

the UKRF.<br />

UKRF<br />

The <strong>Barclays</strong> Bank UK Retirement<br />

Fund. PIP is one of a number of<br />

sections that make up the UKRF.

Further information including details of your benefits can be obtained from:<br />

<strong>Barclays</strong> <strong>Pensions</strong> Administration<br />

Telephone: +44 (0)1202 402060<br />

Email: HRSS.pensions@barclays.com<br />

Website: www.barclayspensions.co.uk<br />

In writing:<br />

<strong>Barclays</strong> <strong>Pensions</strong> Administration<br />

<strong>Barclays</strong> House<br />

PO Box 12, 1 Wimborne Road, Poole<br />

Dorset BH15 2BB, UK<br />

Issued by <strong>Barclays</strong> Pension Funds Trustees Limited<br />

Registered in England<br />

Registered No. 02569835<br />

1 Churchill Place<br />

London E14 5HP, UK<br />

This <strong>booklet</strong> is intended to provide an introduction to the benefits available from the PIP section of The <strong>Barclays</strong> Bank UK Retirement Fund (the UKRF).<br />

However, there are different categories of members within PIP who may have different rights to those set out within this <strong>booklet</strong>. Those members should refer to the<br />

information that they were provided at the time they joined PIP in order to see how the provisions of PIP differ for them.<br />

The UKRF’s Trust Deed and Rules, as amended from time to time (the Rules), govern the pension benefits that will be payable to you. As a result, where there is a<br />

discrepancy between this <strong>booklet</strong> and the Rules, the Rules will prevail. The UKRF’s Trust Deed and Rules can, in certain circumstances, change. Likewise, the law that<br />

governs pension schemes can also change and, in turn, alter the benefits payable from the UKRF. The contents of this <strong>booklet</strong> are subject to those changes.<br />

You should also note that neither the Trustee nor <strong>Barclays</strong> are able to provide financial advice in relation to the UKRF or any of the investment options available within<br />

the UKRF. Nothing in this <strong>booklet</strong> is intended to amount to financial advice or promotion of any financial product. You may wish to seek your own independent financial<br />

advice before making decisions regarding your benefits.<br />

Issued April 2012