Plaintiffs' Memorandum of Law in Opposition to Motions to Dismiss ...

Plaintiffs' Memorandum of Law in Opposition to Motions to Dismiss ...

Plaintiffs' Memorandum of Law in Opposition to Motions to Dismiss ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

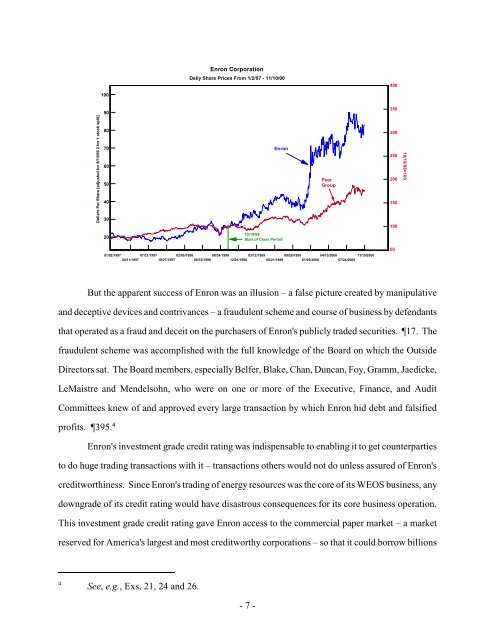

Enron Corporation<br />

Daily Share Prices From 1/2/97 - 11/10/00<br />

400<br />

100<br />

90<br />

350<br />

Dollars Per Share [adjusted for 8/13/99 2 for 1 s<strong>to</strong>ck split]<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

Enron<br />

Peer<br />

Group<br />

300<br />

250<br />

200<br />

150<br />

100<br />

10/19/98=100<br />

20<br />

10/19/98<br />

Start <strong>of</strong> Class Period<br />

01/02/1997<br />

07/21/1997<br />

02/05/1998<br />

08/24/1998<br />

03/12/1999<br />

09/28/1999<br />

04/13/2000<br />

11/10/2000<br />

04/11/1997<br />

10/27/1997<br />

05/15/1998<br />

12/01/1998<br />

06/21/1999<br />

01/05/2000<br />

07/24/2000<br />

50<br />

But the apparent success <strong>of</strong> Enron was an illusion – a false picture created by manipulative<br />

and deceptive devices and contrivances – a fraudulent scheme and course <strong>of</strong> bus<strong>in</strong>ess by defendants<br />

that operated as a fraud and deceit on the purchasers <strong>of</strong> Enron's publicly traded securities. 17. The<br />

fraudulent scheme was accomplished with the full knowledge <strong>of</strong> the Board on which the Outside<br />

Direc<strong>to</strong>rs sat. The Board members, especially Belfer, Blake, Chan, Duncan, Foy, Gramm, Jaedicke,<br />

LeMaistre and Mendelsohn, who were on one or more <strong>of</strong> the Executive, F<strong>in</strong>ance, and Audit<br />

Committees knew <strong>of</strong> and approved every large transaction by which Enron hid debt and falsified<br />

pr<strong>of</strong>its. 395. 4<br />

Enron's <strong>in</strong>vestment grade credit rat<strong>in</strong>g was <strong>in</strong>dispensable <strong>to</strong> enabl<strong>in</strong>g it <strong>to</strong> get counterparties<br />

<strong>to</strong> do huge trad<strong>in</strong>g transactions with it – transactions others would not do unless assured <strong>of</strong> Enron's<br />

creditworth<strong>in</strong>ess. S<strong>in</strong>ce Enron's trad<strong>in</strong>g <strong>of</strong> energy resources was the core <strong>of</strong> its WEOS bus<strong>in</strong>ess, any<br />

downgrade <strong>of</strong> its credit rat<strong>in</strong>g would have disastrous consequences for its core bus<strong>in</strong>ess operation.<br />

This <strong>in</strong>vestment grade credit rat<strong>in</strong>g gave Enron access <strong>to</strong> the commercial paper market – a market<br />

reserved for America's largest and most creditworthy corporations – so that it could borrow billions<br />

4<br />

See, e.g., Exs. 21, 24 and 26.<br />

- 7 -