Plaintiffs' Memorandum of Law in Opposition to Motions to Dismiss ...

Plaintiffs' Memorandum of Law in Opposition to Motions to Dismiss ...

Plaintiffs' Memorandum of Law in Opposition to Motions to Dismiss ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

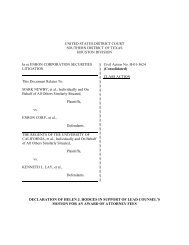

S<strong>to</strong>ck<br />

Price<br />

$100<br />

$80<br />

RED FLAGS KNOWN TO ENRON'S BOARD<br />

1 - Audit Committee <strong>to</strong>ld Enron account<strong>in</strong>g practices "push limits"<br />

2 - Board approves Fas<strong>to</strong>w's Code <strong>of</strong> Conduct waiver for LJM1<br />

3 - Whitew<strong>in</strong>g moved <strong>of</strong>f-balance sheet with $1.5 billion<br />

4 - Board approves second Fas<strong>to</strong>w waiver for LJM2<br />

5 - LJM2 update: "Q41999: 8 days/6 deals/$125 million";<br />

$2 billion <strong>in</strong> funds flow <strong>to</strong> Enron; Board approves Rap<strong>to</strong>r I<br />

6 - Executive Committee approves Rap<strong>to</strong>r II<br />

7 - "Project Summer" <strong>to</strong> sell $6 billion <strong>in</strong> assets fails;<br />

Board approves Rap<strong>to</strong>r III/IV<br />

8 - Board approves third Fas<strong>to</strong>w waiver for LJM3; Board <strong>to</strong>ld $27<br />

billion <strong>in</strong> assets <strong>of</strong>f-balance sheet<br />

9 - Board <strong>to</strong>ld <strong>to</strong>tal revenues jump from $40 billion <strong>in</strong> 1999 <strong>to</strong> $100<br />

billion <strong>in</strong> 2000; Audit and F<strong>in</strong>ance Committees review LJM<br />

procedures and FY2000 transactions<br />

5<br />

10 - Fortune article questions Enron's earn<strong>in</strong>gs and account<strong>in</strong>g<br />

11 - Board <strong>to</strong>ld 64% <strong>of</strong> <strong>in</strong>ternational asset portfolio "Troubled" or "Not<br />

Perform<strong>in</strong>g"; 45 million Enron shares at risk <strong>in</strong> Rap<strong>to</strong>rs and<br />

Whitew <strong>in</strong>g<br />

12 - Board <strong>to</strong>ld <strong>of</strong> $2.3 billion deficit <strong>in</strong> market value <strong>of</strong> Enron's<br />

<strong>in</strong>ternational assets<br />

13 - Fas<strong>to</strong>w sells <strong>in</strong>terest <strong>in</strong> LJM <strong>to</strong> Kopper<br />

14 - Skill<strong>in</strong>g resigns; F<strong>in</strong>ance Committee <strong>to</strong>ld <strong>of</strong> $6.6 billion <strong>in</strong> prepays<br />

and FAS 125 transactions<br />

15 - Lay defends use <strong>of</strong> SPEs <strong>in</strong> onl<strong>in</strong>e session with employees<br />

16 - F<strong>in</strong>ance Committee <strong>to</strong>ld <strong>of</strong> $800 million earn<strong>in</strong>gs write-down from<br />

Rap<strong>to</strong>rs; Audit Committee <strong>to</strong>ld <strong>of</strong> closed <strong>in</strong>vestigation <strong>in</strong><strong>to</strong> the<br />

Watk<strong>in</strong>s letter<br />

7<br />

8<br />

9<br />

$60<br />

6<br />

10 11<br />

12<br />

$40<br />

1<br />

2 3 4<br />

13<br />

14<br />

15<br />

$20<br />

16<br />

0<br />

Jan-99<br />

Mar-99<br />

May-99<br />

Jul-99<br />

Sep-99<br />

Nov-99<br />

Jan-00<br />

Source: U.S. Senate Permanent Subcommittee on Investigations, May 2002<br />

Mar-00<br />

May-00<br />

Jul-00<br />

Sep-00<br />

Nov-00<br />

Jan-01<br />

Mar-01<br />

May-01<br />

Jul-01<br />

Sep-01<br />

Nov-01<br />

II.<br />

Statement <strong>of</strong> Facts<br />

The alleged fraudulent scheme and course <strong>of</strong> bus<strong>in</strong>ess <strong>in</strong>volv<strong>in</strong>g Enron f<strong>in</strong>ds its orig<strong>in</strong>s <strong>in</strong><br />

mid-97 when Enron suffered huge losses on British natural gas and MTBE transactions which called<br />

<strong>in</strong><strong>to</strong> question its trad<strong>in</strong>g and f<strong>in</strong>ancial risk management statistics. Analysts downgraded Enron's<br />

s<strong>to</strong>ck and lowered their forecasts <strong>of</strong> Enron's future earn<strong>in</strong>gs growth. Enron's s<strong>to</strong>ck lost one-third <strong>of</strong><br />

its value and Enron's executives' performance-based bonuses were slashed. Enron was determ<strong>in</strong>ed<br />

<strong>to</strong> halt its s<strong>to</strong>ck's decl<strong>in</strong>e and push it back <strong>to</strong> higher levels. Enron knew this could only be<br />

accomplished by report<strong>in</strong>g stronger-than-expected f<strong>in</strong>ancial results, thus enabl<strong>in</strong>g it <strong>to</strong> credibly<br />

forecast stronger future earn<strong>in</strong>gs growth. Unfortunately, Enron's actual bus<strong>in</strong>ess operations were not<br />

capable <strong>of</strong> generat<strong>in</strong>g such results. 8.<br />

A. Year-End 97 Crisis<br />

To make matters worse, <strong>in</strong> late 12/97, Enron learned that an entity it had established with an<br />

outside <strong>in</strong>ves<strong>to</strong>r, Jo<strong>in</strong>t Energy Development Incorporated ("JEDI") – and had done transactions with<br />

- 3 -