2004 Instructions for Form 1040 (ALL) - Supreme Law Firm

2004 Instructions for Form 1040 (ALL) - Supreme Law Firm

2004 Instructions for Form 1040 (ALL) - Supreme Law Firm

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

line 36. The amount you can deduct <strong>for</strong><br />

$50,000. You can elect to amortize any remaining<br />

business start-up costs over 15<br />

<strong>2004</strong> is figured on line 42. Part V. Other<br />

years. For details, see Pub. 535. For amorti-<br />

Additional in<strong>for</strong>mation. For additional Expenses zation that begins in <strong>2004</strong>, you must comguidance<br />

on this method of accounting <strong>for</strong><br />

plete and attach <strong>Form</strong> 4562.<br />

inventoriable items, see Rev. Proc. 2001-10<br />

Include all ordinary and necessary business<br />

expenses not deducted elsewhere on Capital construction fund. Do not claim<br />

if you are a qualifying taxpayer or Rev.<br />

Schedule C. List the type and amount of on Schedule C or C-EZ the deduction <strong>for</strong><br />

Proc. 2002-28 if you are a qualifying small<br />

each expense separately in the space probusiness<br />

taxpayer. You can find Rev. Proc.<br />

amounts contributed to a capital construc-<br />

vided. Enter the total on lines 48 and 27. Do tion fund set up under the Merchant Marine<br />

2001-10 on page 272 of Internal Revenue<br />

not include the cost of business equipment Act of 1936. Instead, reduce the amount<br />

Bulletin 2001-2 at www.irs.gov/pub/<br />

or furniture, replacements or permanent you would otherwise enter on <strong>Form</strong> <strong>1040</strong>,<br />

irs-irbs/irb01-02.pdf, and Rev. Proc.<br />

improvements to property, or personal, liv- line 42, by the amount of the deduction.<br />

2002-28 on page 815 of Internal Revenue<br />

ing, and family expenses. Do not include Next to line 42, enter “CCF” and the<br />

Bulletin 2002-18 at www.irs.gov/pub/<br />

charitable contributions. Also, you cannot amount of the deduction. For details, see<br />

irs-irbs/irb02-18.pdf.<br />

deduct fines or penalties paid to a government<br />

<strong>for</strong> violating any law. For details on Clean-fuel vehicles and clean-fuel vehicle<br />

Pub. 595.<br />

Certain direct and indirect ex- business expenses, see Pub. 535. refueling property. You may be able to depenses<br />

may have to be capital-<br />

duct part of the cost of qualified clean-fuel<br />

ized or included in inventory. Amortization. Include amortization in this<br />

vehicle property used in your business and<br />

See the instructions <strong>for</strong> Part II part. For amortization that begins in <strong>2004</strong>,<br />

qualified clean-fuel vehicle refueling propyou<br />

must complete and attach <strong>Form</strong> 4562.<br />

beginning on page C-3.<br />

erty. See Pub. 535 <strong>for</strong> details.<br />

You can amortize:<br />

Disabled access credit and the deduction<br />

• The cost of pollution-control facilidisabilities<br />

and the elderly. You may be<br />

<strong>for</strong> removing barriers to individuals with<br />

Line 33<br />

ties.<br />

Your inventories can be valued at cost; cost • Amounts paid <strong>for</strong> research and experi- able to claim a tax credit of up to $5,000 <strong>for</strong><br />

or market value, whichever is lower; or any mentation.<br />

eligible expenditures paid or incurred in<br />

other method approved by the IRS. How- • Qualified revitalization expenditures.<br />

<strong>2004</strong> to provide access to your business <strong>for</strong><br />

ever, you are required to use cost if you are<br />

individuals with disabilities. See <strong>Form</strong><br />

• Amounts paid to acquire, protect, exusing<br />

the cash method of accounting.<br />

8826 <strong>for</strong> details. You can also deduct up to<br />

pand, register, or defend trademarks or $15,000 of costs paid or incurred in <strong>2004</strong> to<br />

trade names.<br />

remove architectural or transportation bar-<br />

• Goodwill and certain other in- riers to individuals with disabilities and the<br />

Line 35<br />

tangibles.<br />

elderly. However, you cannot take both the<br />

credit and the deduction on the same ex-<br />

If you are changing your method of ac- In general, you cannot amortize real<br />

penditures.<br />

counting beginning with <strong>2004</strong>, refigure last property construction period interest and<br />

year’s closing inventory using your new taxes. Special rules apply <strong>for</strong> allocating in-<br />

Film and television production expenses.<br />

method of accounting and enter the result terest to real or personal property produced You can elect to deduct costs of certain<br />

on line 35. If there is a difference between in your trade or business.<br />

qualified film and television productions<br />

last year’s closing inventory and the<br />

that begin after October 22, <strong>2004</strong>. For de-<br />

refigured amount, attach an explanation<br />

At-risk loss deduction. Any loss from this tails, see Pub. 535.<br />

and take it into account when figuring your<br />

activity that was not allowed as a deduction<br />

last year because of the at-risk rules is Forestation and re<strong>for</strong>estation costs. You<br />

section 481(a) adjustment. See the example<br />

treated as a deduction allocable to this acon<br />

page C-2 <strong>for</strong> details.<br />

can elect to amortize certain <strong>for</strong>estation and<br />

tivity in <strong>2004</strong>.<br />

re<strong>for</strong>estation costs over 84 months. You<br />

can also elect to expense up to $10,000<br />

Business start-up costs. You can elect to ($5,000 if married filing separately) of ceramortize<br />

certain business start-up costs tain <strong>for</strong>estation and re<strong>for</strong>estation costs paid<br />

Line 41<br />

paid or incurred be<strong>for</strong>e October 23, <strong>2004</strong>, or incurred after October 22, <strong>2004</strong>, <strong>for</strong> each<br />

If you account <strong>for</strong> inventoriable items in over 60 months or more, beginning with the qualified timber property. The amortization<br />

the same manner as materials and supplies month your business began. For certain election does not apply to trusts and the<br />

that are not incidental, enter on line 41 the business start-up costs paid or incurred afand<br />

trusts. For details, see Pub. 535. For<br />

expense election does not apply to estates<br />

portion of your raw materials and merchan- ter October 22, <strong>2004</strong>, you can elect to deamortization<br />

that begins in <strong>2004</strong>, you must<br />

dise purchased <strong>for</strong> resale that are included duct up to $5,000 <strong>for</strong> the year your business<br />

on line 40 and were not sold during the began. This limit is reduced by the amount complete and attach <strong>Form</strong> 4562.<br />

year.<br />

by which your start-up costs exceed<br />

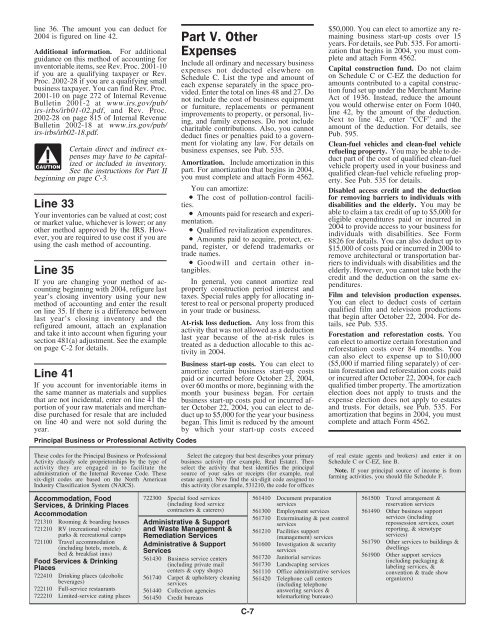

Principal Business or Professional Activity Codes<br />

These codes <strong>for</strong> the Principal Business or Professional Select the category that best describes your primary of real estate agents and brokers) and enter it on<br />

Activity classify sole proprietorships by the type of business activity (<strong>for</strong> example, Real Estate). Then Schedule C or C-EZ, line B.<br />

activity they are engaged in to facilitate the select the activity that best identifies the principal<br />

administration of the Internal Revenue Code. These source of your sales or receipts (<strong>for</strong> example, real<br />

six-digit codes are based on the North American estate agent). Now find the six-digit code assigned to<br />

Note. If your principal source of income is from<br />

farming activities, you should file Schedule F.<br />

Industry Classification System (NAICS).<br />

this activity (<strong>for</strong> example, 531210, the code <strong>for</strong> offices<br />

Accommodation, Food<br />

722300 Special food services 561410 Document preparation 561500 Travel arrangement &<br />

Services, & Drinking Places<br />

(including food service services reservation services<br />

contractors & caterers) 561300 Employment services 561490 Other business support<br />

Accommodation<br />

561710 Exterminating & pest control<br />

services (including<br />

721310 Rooming & boarding houses Administrative & Support services<br />

repossession services, court<br />

721210 RV (recreational vehicle) and Waste Management & 561210 Facilities support<br />

reporting, & stenotype<br />

parks & recreational camps Remediation Services (management) services<br />

services)<br />

721100 Travel accommodation Administrative & Support 561600 Investigation & security<br />

561790 Other services to buildings &<br />

(including hotels, motels, &<br />

services<br />

dwellings<br />

bed & breakfast inns)<br />

Services<br />

561720 Janitorial services<br />

561900 Other support services<br />

Food Services & Drinking<br />

561430 Business service centers (including packaging &<br />

(including private mail 561730 Landscaping services<br />

Places labeling services, &<br />

centers & copy shops) 561110 Office administrative services convention & trade show<br />

722410 Drinking places (alcoholic 561740 Carpet & upholstery cleaning 561420 Telephone call centers<br />

organizers)<br />

beverages) services (including telephone<br />

722110 Full-service restaurants 561440 Collection agencies<br />

answering services &<br />

722210 Limited-service eating places 561450 Credit bureaus<br />

telemarketing bureaus)<br />

C-7