2004 Instructions for Form 1040 (ALL) - Supreme Law Firm

2004 Instructions for Form 1040 (ALL) - Supreme Law Firm

2004 Instructions for Form 1040 (ALL) - Supreme Law Firm

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

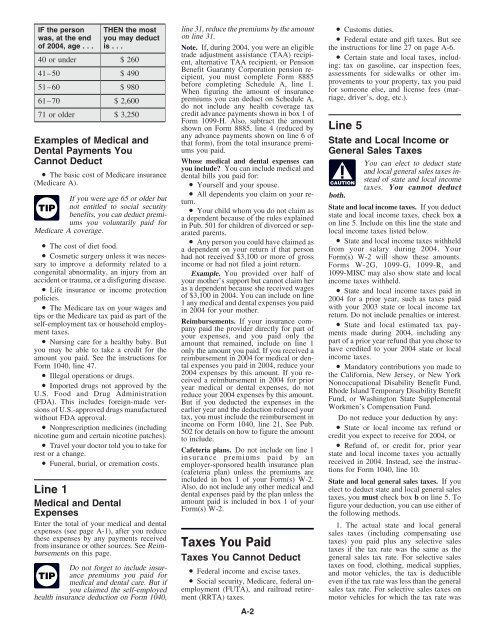

IF the person THEN the most line 31, reduce the premiums by the amount • Customs duties.<br />

was, at the end you may deduct on line 31.<br />

• Federal estate and gift taxes. But see<br />

of <strong>2004</strong>, age . . . is . . . Note. If, during <strong>2004</strong>, you were an eligible the instructions <strong>for</strong> line 27 on page A-6.<br />

trade adjustment assistance (TAA) recipi-<br />

40 or under $ 260 • Certain state and local taxes, includent,<br />

alternative TAA recipient, or Pension<br />

ing: tax on gasoline, car inspection fees,<br />

Benefit Guaranty Corporation pension reassessments<br />

<strong>for</strong> sidewalks or other im-<br />

41–50 $ 490 cipient, you must complete <strong>Form</strong> 8885<br />

be<strong>for</strong>e completing Schedule A, line 1. provements to your property, tax you paid<br />

51–60 $ 980<br />

When figuring the amount of insurance <strong>for</strong> someone else, and license fees (mar-<br />

61–70 $ 2,600<br />

premiums you can deduct on Schedule A, riage, driver’s, dog, etc.).<br />

do not include any health coverage tax<br />

71 or older $ 3,250<br />

credit advance payments shown in box 1 of<br />

<strong>Form</strong> 1099-H. Also, subtract the amount<br />

shown on <strong>Form</strong> 8885, line 4 (reduced by Line 5<br />

any advance payments shown on line 6 of<br />

that <strong>for</strong>m), from the total insurance premiums<br />

you<br />

State and Local Income or<br />

paid.<br />

Examples of Medical and<br />

Dental Payments You<br />

Cannot Deduct<br />

General Sales Taxes<br />

Whose medical and dental expenses can<br />

You can elect to deduct state<br />

you include? You can include medical and<br />

• The basic cost of Medicare insurance<br />

and local general sales taxes indental<br />

bills you paid <strong>for</strong>:<br />

(Medicare A).<br />

stead of state and local income<br />

• Yourself and your spouse. taxes. You cannot deduct<br />

• All dependents you claim on your re-<br />

If you were age 65 or older but<br />

both.<br />

turn.<br />

TIP not entitled to social security<br />

State and local income taxes.<br />

• Your child whom you do not claim as<br />

If you deduct<br />

benefits, you can deduct premia<br />

dependent because of the rules explained state and local income taxes, check box a<br />

ums you voluntarily paid <strong>for</strong> in Pub. 501 <strong>for</strong> children of divorced or sep- on line 5. Include on this line the state and<br />

Medicare A coverage.<br />

arated parents.<br />

local income taxes listed below.<br />

• Any person you could have claimed as • State and local income taxes withheld<br />

• The cost of diet food.<br />

a dependent on your return if that person from your salary during <strong>2004</strong>. Your<br />

• Cosmetic surgery unless it was neces- had not received $3,100 or more of gross <strong>Form</strong>(s) W-2 will show these amounts.<br />

sary to improve a de<strong>for</strong>mity related to a income or had not filed a joint return. <strong>Form</strong>s W-2G, 1099-G, 1099-R, and<br />

congenital abnormality, an injury from an Example. You provided over half of 1099-MISC may also show state and local<br />

accident or trauma, or a disfiguring disease. your mother’s support but cannot claim her income taxes withheld.<br />

• Life insurance or income protection as a dependent because she received wages • State and local income taxes paid in<br />

policies.<br />

of $3,100 in <strong>2004</strong>. You can include on line<br />

<strong>2004</strong> <strong>for</strong> a prior year, such as taxes paid<br />

1 any medical and dental expenses you paid<br />

• The Medicare tax on your wages and in <strong>2004</strong> <strong>for</strong> your mother.<br />

with your 2003 state or local income tax<br />

tips or the Medicare tax paid as part of the<br />

return. Do not include penalties or interest.<br />

self-employment tax or household employ- Reimbursements. If your insurance company<br />

paid the provider directly <strong>for</strong> part of<br />

• State and local estimated tax pay-<br />

ment taxes.<br />

your expenses, and you paid only the<br />

ments made during <strong>2004</strong>, including any<br />

• Nursing care <strong>for</strong> a healthy baby. But amount that remained, include on line 1 part of a prior year refund that you chose to<br />

you may be able to take a credit <strong>for</strong> the only the amount you paid. If you received a have credited to your <strong>2004</strong> state or local<br />

amount you paid. See the instructions <strong>for</strong> reimbursement in <strong>2004</strong> <strong>for</strong> medical or dental<br />

expenses you paid in <strong>2004</strong>, reduce your • Mandatory contributions you made to<br />

income taxes.<br />

<strong>Form</strong> <strong>1040</strong>, line 47.<br />

• Illegal operations or drugs.<br />

<strong>2004</strong> expenses by this amount. If you re- the Cali<strong>for</strong>nia, New Jersey, or New York<br />

ceived a reimbursement in <strong>2004</strong> <strong>for</strong> prior<br />

• Imported drugs not approved by the<br />

Nonoccupational Disability Benefit Fund,<br />

year medical or dental expenses, do not<br />

U.S. Food and Drug Administration<br />

Rhode Island Temporary Disability Benefit<br />

reduce your <strong>2004</strong> expenses by this amount.<br />

(FDA). This includes <strong>for</strong>eign-made ver- But if you deducted the expenses in the<br />

Fund, or Washington State Supplemental<br />

sions of U.S.-approved drugs manufactured earlier year and the deduction reduced your Workmen’s Compensation Fund.<br />

without FDA approval.<br />

tax, you must include the reimbursement in Do not reduce your deduction by any:<br />

• Nonprescription medicines (including<br />

income on <strong>Form</strong> <strong>1040</strong>, line 21. See Pub. • State or local income tax refund or<br />

502 <strong>for</strong> details on how to figure the amount<br />

nicotine gum and certain nicotine patches).<br />

to include.<br />

credit you expect to receive <strong>for</strong> <strong>2004</strong>, or<br />

• Travel your doctor told you to take <strong>for</strong><br />

• Refund of, or credit <strong>for</strong>, prior year<br />

Cafeteria plans.<br />

rest or a change.<br />

Do not include on line 1<br />

insurance premiums paid by an<br />

state and local income taxes you actually<br />

• Funeral, burial, or cremation costs. employer-sponsored health insurance plan<br />

received in <strong>2004</strong>. Instead, see the instruc-<br />

(cafeteria plan) unless the premiums are tions <strong>for</strong> <strong>Form</strong> <strong>1040</strong>, line 10.<br />

included in box 1 of your <strong>Form</strong>(s) W-2. State and local general sales taxes. If you<br />

Also, do not include any other medical and<br />

Line 1<br />

elect to deduct state and local general sales<br />

dental expenses paid by the plan unless the<br />

taxes, you must check box b on line 5. To<br />

Medical and Dental<br />

amount paid is included in box 1 of your<br />

<strong>Form</strong>(s) W-2.<br />

figure your deduction, you can use either of<br />

Expenses<br />

the following methods.<br />

Enter the total of your medical and dental<br />

1. The actual state and local general<br />

expenses (see page A-1), after you reduce<br />

sales taxes (including compensating use<br />

these expenses by any payments received<br />

Taxes You Paid<br />

taxes) you paid plus any selective sales<br />

from insurance or other sources. See Reimtaxes<br />

if the tax rate was the same as the<br />

bursements on this page.<br />

Taxes You Cannot Deduct general sales tax rate. For selective sales<br />

Do not <strong>for</strong>get to include insur- taxes on food, clothing, medical supplies,<br />

• Federal income and excise taxes.<br />

TIP ance premiums you paid <strong>for</strong><br />

and motor vehicles, the tax is deductible<br />

medical and dental care. But if • Social security, Medicare, federal un- even if the tax rate was less than the general<br />

you claimed the self-employed employment (FUTA), and railroad retire- sales tax rate. For selective sales taxes on<br />

health insurance deduction on <strong>Form</strong> <strong>1040</strong>, ment (RRTA) taxes. motor vehicles <strong>for</strong> which the tax rate was<br />

A-2