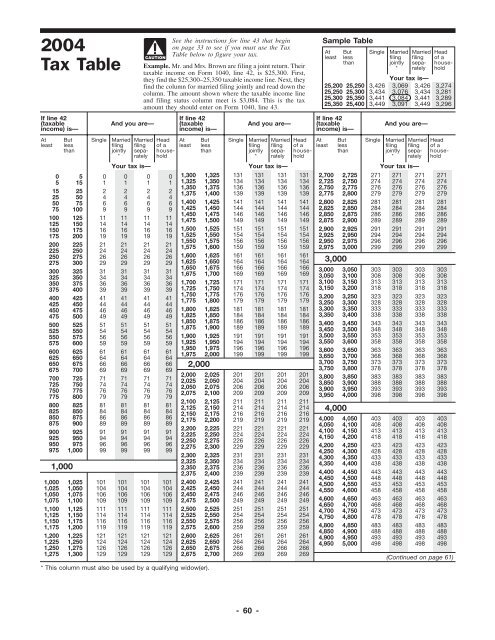

<strong>2004</strong> Tax Table If line 42 (taxable income) is— At least But less than 1,000 Single And you are— Married filing jointly * See the instructions <strong>for</strong> line 43 that begin on page 33 to see if you must use the Tax Table below to figure your tax. Example. Mr. and Mrs. Brown are filing a joint return. Their taxable income on <strong>Form</strong> <strong>1040</strong>, line 42, is $25,300. First, they find the $25,300–25,350 taxable income line. Next, they find the column <strong>for</strong> married filing jointly and read down the column. The amount shown where the taxable income line and filing status column meet is $3,084. This is the tax amount they should enter on <strong>Form</strong> <strong>1040</strong>, line 43. Married filing separately Your tax is— CAUTION Head of a household 0 5 0 0 0 0 5 15 1 1 1 1 15 25 2 2 2 2 25 50 4 4 4 4 50 75 6 6 6 6 75 100 9 9 9 9 100 125 11 11 11 11 125 150 14 14 14 14 150 175 16 16 16 16 175 200 19 19 19 19 200 225 21 21 21 21 225 250 24 24 24 24 250 275 26 26 26 26 275 300 29 29 29 29 300 325 31 31 31 31 325 350 34 34 34 34 350 375 36 36 36 36 375 400 39 39 39 39 400 425 41 41 41 41 425 450 44 44 44 44 450 475 46 46 46 46 475 500 49 49 49 49 500 525 51 51 51 51 525 550 54 54 54 54 550 575 56 56 56 56 575 600 59 59 59 59 600 625 61 61 61 61 625 650 64 64 64 64 650 675 66 66 66 66 675 700 69 69 69 69 700 725 71 71 71 71 725 750 74 74 74 74 750 775 76 76 76 76 775 800 79 79 79 79 800 825 81 81 81 81 825 850 84 84 84 84 850 875 86 86 86 86 875 900 89 89 89 89 900 925 91 91 91 91 925 950 94 94 94 94 950 975 96 96 96 96 975 1,000 99 99 99 99 1,000 1,025 101 101 101 101 1,025 1,050 104 104 104 104 1,050 1,075 106 106 106 106 1,075 1,100 109 109 109 109 1,100 1,125 111 111 111 111 1,125 1,150 114 114 114 114 1,150 1,175 116 116 116 116 1,175 1,200 119 119 119 119 1,200 1,225 121 121 121 121 1,225 1,250 124 124 124 124 1,250 1,275 126 126 126 126 1,275 1,300 129 129 129 129 If line 42 (taxable income) is— At least But less than * This column must also be used by a qualifying widow(er). Single And you are— Married filing jointly * Married filing separately Your tax is— Head of a household 1,300 1,325 131 131 131 131 1,325 1,350 134 134 134 134 1,350 1,375 136 136 136 136 1,375 1,400 139 139 139 139 1,400 1,425 141 141 141 141 1,425 1,450 144 144 144 144 1,450 1,475 146 146 146 146 1,475 1,500 149 149 149 149 1,500 1,525 151 151 151 151 1,525 1,550 154 154 154 154 1,550 1,575 156 156 156 156 1,575 1,600 159 159 159 159 1,600 1,625 161 161 161 161 1,625 1,650 164 164 164 164 1,650 1,675 166 166 166 166 1,675 1,700 169 169 169 169 1,700 1,725 171 171 171 171 1,725 1,750 174 174 174 174 1,750 1,775 176 176 176 176 1,775 1,800 179 179 179 179 1,800 1,825 181 181 181 181 1,825 1,850 184 184 184 184 1,850 1,875 186 186 186 186 1,875 1,900 189 189 189 189 1,900 1,925 191 191 191 191 1,925 1,950 194 194 194 194 1,950 1,975 196 196 196 196 1,975 2,000 199 199 199 199 2,000 2,000 2,025 201 201 201 201 2,025 2,050 204 204 204 204 2,050 2,075 206 206 206 206 2,075 2,100 209 209 209 209 2,100 2,125 211 211 211 211 2,125 2,150 214 214 214 214 2,150 2,175 216 216 216 216 2,175 2,200 219 219 219 219 2,200 2,225 221 221 221 221 2,225 2,250 224 224 224 224 2,250 2,275 226 226 226 226 2,275 2,300 229 229 229 229 2,300 2,325 231 231 231 231 2,325 2,350 234 234 234 234 2,350 2,375 236 236 236 236 2,375 2,400 239 239 239 239 2,400 2,425 241 241 241 241 2,425 2,450 244 244 244 244 2,450 2,475 246 246 246 246 2,475 2,500 249 249 249 249 2,500 2,525 251 251 251 251 2,525 2,550 254 254 254 254 2,550 2,575 256 256 256 256 2,575 2,600 259 259 259 259 2,600 2,625 261 261 261 261 2,625 2,650 264 264 264 264 2,650 2,675 266 266 266 266 2,675 2,700 269 269 269 269 If line 42 (taxable income) is— At least Sample Table At least 25,200 25,250 25,300 25,350 But less than But less than 3,000 4,000 25,250 25,300 25,350 25,400 Single 3,426 3,434 3,441 3,449 Single Married filing jointly * And you are— Married filing jointly * Married filing separately Your tax is— Married filing separately Your tax is— 3,069 3,426 3,076 3,434 3,084 3,441 3,091 3,449 3,274 3,281 3,289 3,296 Head of a household 2,700 2,725 271 271 271 271 2,725 2,750 274 274 274 274 2,750 2,775 276 276 276 276 2,775 2,800 279 279 279 279 2,800 2,825 281 281 281 281 2,825 2,850 284 284 284 284 2,850 2,875 286 286 286 286 2,875 2,900 289 289 289 289 2,900 2,925 291 291 291 291 2,925 2,950 294 294 294 294 2,950 2,975 296 296 296 296 2,975 3,000 299 299 299 299 3,000 3,050 303 303 303 303 3,050 3,100 308 308 308 308 3,100 3,150 313 313 313 313 3,150 3,200 318 318 318 318 3,200 3,250 323 323 323 323 3,250 3,300 328 328 328 328 3,300 3,350 333 333 333 333 3,350 3,400 338 338 338 338 3,400 3,450 343 343 343 343 3,450 3,500 348 348 348 348 3,500 3,550 353 353 353 353 3,550 3,600 358 358 358 358 3,600 3,650 363 363 363 363 3,650 3,700 368 368 368 368 3,700 3,750 373 373 373 373 3,750 3,800 378 378 378 378 3,800 3,850 383 383 383 383 3,850 3,900 388 388 388 388 3,900 3,950 393 393 393 393 3,950 4,000 398 398 398 398 4,000 4,050 403 403 403 403 4,050 4,100 408 408 408 408 4,100 4,150 413 413 413 413 4,150 4,200 418 418 418 418 4,200 4,250 423 423 423 423 4,250 4,300 428 428 428 428 4,300 4,350 433 433 433 433 4,350 4,400 438 438 438 438 4,400 4,450 443 443 443 443 4,450 4,500 448 448 448 448 4,500 4,550 453 453 453 453 4,550 4,600 458 458 458 458 4,600 4,650 463 463 463 463 4,650 4,700 468 468 468 468 4,700 4,750 473 473 473 473 4,750 4,800 478 478 478 478 4,800 4,850 483 483 483 483 4,850 4,900 488 488 488 488 4,900 4,950 493 493 493 493 4,950 5,000 498 498 498 498 (Continued on page 61) Head of a household -60-

<strong>2004</strong> Tax Table—Continued If line 42 (taxable income) is— And you are— If line 42 (taxable income) is— And you are— If line 42 (taxable income) is— And you are— At least 5,000 6,000 7,000 But less than Single Married filing jointly * Your tax is— Head of a household 5,000 5,050 503 503 503 503 5,050 5,100 508 508 508 508 5,100 5,150 513 513 513 513 5,150 5,200 518 518 518 518 5,200 5,250 523 523 523 523 5,250 5,300 528 528 528 528 5,300 5,350 533 533 533 533 5,350 5,400 538 538 538 538 5,400 5,450 543 543 543 543 5,450 5,500 548 548 548 548 5,500 5,550 553 553 553 553 5,550 5,600 558 558 558 558 5,600 5,650 563 563 563 563 5,650 5,700 568 568 568 568 5,700 5,750 573 573 573 573 5,750 5,800 578 578 578 578 5,800 5,850 583 583 583 583 5,850 5,900 588 588 588 588 5,900 5,950 593 593 593 593 5,950 6,000 598 598 598 598 6,000 6,050 603 603 603 603 6,050 6,100 608 608 608 608 6,100 6,150 613 613 613 613 6,150 6,200 618 618 618 618 6,200 6,250 623 623 623 623 6,250 6,300 628 628 628 628 6,300 6,350 633 633 633 633 6,350 6,400 638 638 638 638 6,400 6,450 643 643 643 643 6,450 6,500 648 648 648 648 6,500 6,550 653 653 653 653 6,550 6,600 658 658 658 658 6,600 6,650 663 663 663 663 6,650 6,700 668 668 668 668 6,700 6,750 673 673 673 673 6,750 6,800 678 678 678 678 6,800 6,850 683 683 683 683 6,850 6,900 688 688 688 688 6,900 6,950 693 693 693 693 6,950 7,000 698 698 698 698 7,000 7,050 703 703 703 703 7,050 7,100 708 708 708 708 7,100 7,150 713 713 713 713 7,150 7,200 719 718 719 718 7,200 7,250 726 723 726 723 7,250 7,300 734 728 734 728 7,300 7,350 741 733 741 733 7,350 7,400 749 738 749 738 7,400 7,450 756 743 756 743 7,450 7,500 764 748 764 748 7,500 7,550 771 753 771 753 7,550 7,600 779 758 779 758 7,600 7,650 786 763 786 763 7,650 7,700 794 768 794 768 7,700 7,750 801 773 801 773 7,750 7,800 809 778 809 778 7,800 7,850 816 783 816 783 7,850 7,900 824 788 824 788 7,900 7,950 831 793 831 793 7,950 8,000 839 798 839 798 At least 8,000 9,000 * This column must also be used by a qualifying widow(er). But less than 10,000 Single Married filing jointly * Married filing separately Your tax is— Head of a household 8,000 8,050 846 803 846 803 8,050 8,100 854 808 854 808 8,100 8,150 861 813 861 813 8,150 8,200 869 818 869 818 8,200 8,250 876 823 876 823 8,250 8,300 884 828 884 828 8,300 8,350 891 833 891 833 8,350 8,400 899 838 899 838 8,400 8,450 906 843 906 843 8,450 8,500 914 848 914 848 8,500 8,550 921 853 921 853 8,550 8,600 929 858 929 858 8,600 8,650 936 863 936 863 8,650 8,700 944 868 944 868 8,700 8,750 951 873 951 873 8,750 8,800 959 878 959 878 8,800 8,850 966 883 966 883 8,850 8,900 974 888 974 888 8,900 8,950 981 893 981 893 8,950 9,000 989 898 989 898 9,000 9,050 996 903 996 903 9,050 9,100 1,004 908 1,004 908 9,100 9,150 1,011 913 1,011 913 9,150 9,200 1,019 918 1,019 918 9,200 9,250 1,026 923 1,026 923 9,250 9,300 1,034 928 1,034 928 9,300 9,350 1,041 933 1,041 933 9,350 9,400 1,049 938 1,049 938 9,400 9,450 1,056 943 1,056 943 9,450 9,500 1,064 948 1,064 948 9,500 9,550 1,071 953 1,071 953 9,550 9,600 1,079 958 1,079 958 9,600 9,650 1,086 963 1,086 963 9,650 9,700 1,094 968 1,094 968 9,700 9,750 1,101 973 1,101 973 9,750 9,800 1,109 978 1,109 978 9,800 9,850 1,116 983 1,116 983 9,850 9,900 1,124 988 1,124 988 9,900 9,950 1,131 993 1,131 993 9,950 10,000 1,139 998 1,139 998 10,000 10,050 1,146 1,003 1,146 1,003 10,050 10,100 1,154 1,008 1,154 1,008 10,100 10,150 1,161 1,013 1,161 1,013 10,150 10,200 1,169 1,018 1,169 1,018 10,200 10,250 1,176 1,023 1,176 1,024 10,250 10,300 1,184 1,028 1,184 1,031 10,300 10,350 1,191 1,033 1,191 1,039 10,350 10,400 1,199 1,038 1,199 1,046 10,400 10,450 1,206 1,043 1,206 1,054 10,450 10,500 1,214 1,048 1,214 1,061 10,500 10,550 1,221 1,053 1,221 1,069 10,550 10,600 1,229 1,058 1,229 1,076 10,600 10,650 1,236 1,063 1,236 1,084 10,650 10,700 1,244 1,068 1,244 1,091 10,700 10,750 1,251 1,073 1,251 1,099 10,750 10,800 1,259 1,078 1,259 1,106 10,800 10,850 1,266 1,083 1,266 1,114 10,850 10,900 1,274 1,088 1,274 1,121 10,900 10,950 1,281 1,093 1,281 1,129 10,950 11,000 1,289 1,098 1,289 1,136 At least But less than 11,000 12,000 13,000 Single Married filing jointly * Married filing separately Your tax is— Head of a household 11,000 11,050 1,296 1,103 1,296 1,144 11,050 11,100 1,304 1,108 1,304 1,151 11,100 11,150 1,311 1,113 1,311 1,159 11,150 11,200 1,319 1,118 1,319 1,166 11,200 11,250 1,326 1,123 1,326 1,174 11,250 11,300 1,334 1,128 1,334 1,181 11,300 11,350 1,341 1,133 1,341 1,189 11,350 11,400 1,349 1,138 1,349 1,196 11,400 11,450 1,356 1,143 1,356 1,204 11,450 11,500 1,364 1,148 1,364 1,211 11,500 11,550 1,371 1,153 1,371 1,219 11,550 11,600 1,379 1,158 1,379 1,226 11,600 11,650 1,386 1,163 1,386 1,234 11,650 11,700 1,394 1,168 1,394 1,241 11,700 11,750 1,401 1,173 1,401 1,249 11,750 11,800 1,409 1,178 1,409 1,256 11,800 11,850 1,416 1,183 1,416 1,264 11,850 11,900 1,424 1,188 1,424 1,271 11,900 11,950 1,431 1,193 1,431 1,279 11,950 12,000 1,439 1,198 1,439 1,286 12,000 12,050 1,446 1,203 1,446 1,294 12,050 12,100 1,454 1,208 1,454 1,301 12,100 12,150 1,461 1,213 1,461 1,309 12,150 12,200 1,469 1,218 1,469 1,316 12,200 12,250 1,476 1,223 1,476 1,324 12,250 12,300 1,484 1,228 1,484 1,331 12,300 12,350 1,491 1,233 1,491 1,339 12,350 12,400 1,499 1,238 1,499 1,346 12,400 12,450 1,506 1,243 1,506 1,354 12,450 12,500 1,514 1,248 1,514 1,361 12,500 12,550 1,521 1,253 1,521 1,369 12,550 12,600 1,529 1,258 1,529 1,376 12,600 12,650 1,536 1,263 1,536 1,384 12,650 12,700 1,544 1,268 1,544 1,391 12,700 12,750 1,551 1,273 1,551 1,399 12,750 12,800 1,559 1,278 1,559 1,406 12,800 12,850 1,566 1,283 1,566 1,414 12,850 12,900 1,574 1,288 1,574 1,421 12,900 12,950 1,581 1,293 1,581 1,429 12,950 13,000 1,589 1,298 1,589 1,436 13,000 13,050 1,596 1,303 1,596 1,444 13,050 13,100 1,604 1,308 1,604 1,451 13,100 13,150 1,611 1,313 1,611 1,459 13,150 13,200 1,619 1,318 1,619 1,466 13,200 13,250 1,626 1,323 1,626 1,474 13,250 13,300 1,634 1,328 1,634 1,481 13,300 13,350 1,641 1,333 1,641 1,489 13,350 13,400 1,649 1,338 1,649 1,496 13,400 13,450 1,656 1,343 1,656 1,504 13,450 13,500 1,664 1,348 1,664 1,511 13,500 13,550 1,671 1,353 1,671 1,519 13,550 13,600 1,679 1,358 1,679 1,526 13,600 13,650 1,686 1,363 1,686 1,534 13,650 13,700 1,694 1,368 1,694 1,541 13,700 13,750 1,701 1,373 1,701 1,549 13,750 13,800 1,709 1,378 1,709 1,556 13,800 13,850 1,716 1,383 1,716 1,564 13,850 13,900 1,724 1,388 1,724 1,571 13,900 13,950 1,731 1,393 1,731 1,579 13,950 14,000 1,739 1,398 1,739 1,586 (Continued on page 62) Married filing separately -61-

- Page 1 and 2:

Note. This booklet does not contain

- Page 3 and 4:

What is IRS e-file? It’s the fast

- Page 5 and 6:

Tax Return Page Reference Questions

- Page 7 and 8:

Quick and Easy Access to Tax Help a

- Page 9 and 10: Topic TeleTax Topics No. Subject No

- Page 11 and 12: Before You Fill In Form 1040 See Ho

- Page 13 and 14: Chart B—For Children and Other De

- Page 15 and 16: Form Item and Box in Which it Shoul

- Page 17 and 18: Line 2 December 31, 2004, you were

- Page 19 and 20: Form 1040—Lines 7 and 8a less tha

- Page 21 and 22: gross income was over $139,500 ($69

- Page 23 and 24: Form 1040—Lines 16a and 16b Age (

- Page 25 and 26: Form 1040—Lines 20a and 20b Socia

- Page 27 and 28: Form 1040—Line 25 IRA Deduction W

- Page 29 and 30: Form 1040—Lines 27 Through 29 for

- Page 31 and 32: Line 35 Include in the total on lin

- Page 33 and 34: Form 1040—Lines 41 and 43 Tax Tab

- Page 35 and 36: Line 44 • Tax-exempt interest fro

- Page 37 and 38: Line 51—Child Tax Credit What Is

- Page 39 and 40: ured the credit. Check box c and en

- Page 41 and 42: Lines 65a and 65b— Earned Income

- Page 43 and 44: Form 1040—Lines 65a and 65b Conti

- Page 45 and 46: Worksheet A—Earned Income Credit

- Page 47 and 48: Form 1040—Lines 65a and 65b Works

- Page 49 and 50: 2004 Earned Income Credit (EIC) Tab

- Page 51 and 52: 2004 Earned Income Credit (EIC) Tab

- Page 53 and 54: 2004 Earned Income Credit (EIC) Tab

- Page 55 and 56: number is 20202086. Do not include

- Page 57 and 58: You cannot sign your return are not

- Page 59: site at www.aarp.org/taxaide or cal

- Page 63 and 64: 2004 Tax Table—Continued If line

- Page 65 and 66: 2004 Tax Table—Continued If line

- Page 67 and 68: 2004 Tax Table—Continued If line

- Page 69 and 70: 2004 Tax Table—Continued If line

- Page 71 and 72: If line 42 (taxable income) is— A

- Page 73 and 74: Order Blank for Forms and Publicati

- Page 75 and 76: Disclosure, Privacy Act, and Paperw

- Page 77 and 78: Department of the Treasury Internal

- Page 79 and 80: more than the general sales tax rat

- Page 81 and 82: • You gave gifts of property that

- Page 83 and 84: Instructions for Schedule B, after

- Page 85 and 86: Department of the Treasury Internal

- Page 87 and 88: ing the tax year, and you did not m

- Page 89 and 90: also include the amount collected i

- Page 91 and 92: line 36. The amount you can deduct

- Page 93 and 94: Principal Business or Professional

- Page 95 and 96: Partnership Interests vestment. Thi

- Page 97 and 98: If there is an amount in box 1c, se

- Page 99 and 100: sale of your main home if you are n

- Page 101 and 102: follow the applicable instructions

- Page 103 and 104: Department of the Treasury Internal

- Page 105 and 106: which you entered the combined tota

- Page 107 and 108: If your rental real estate loss is

- Page 109 and 110: Department of the Treasury Internal

- Page 111 and 112:

gain results from redemption of the

- Page 113 and 114:

• Deducting the prepayment will n

- Page 115 and 116:

Department of the Treasury Internal

- Page 117 and 118:

2001 Capital Gain Tax Worksheet—L

- Page 119 and 120:

2002 Tax Rate Schedules—Line 12 S

- Page 121 and 122:

2003 Tax Rate Schedules—Line 16 S

- Page 123 and 124:

Department of the Treasury Internal

- Page 125 and 126:

homes, parking lots, warehouses, an

- Page 127 and 128:

Index to Instructions A Foreign Tax