2004 Instructions for Form 1040 (ALL) - Supreme Law Firm

2004 Instructions for Form 1040 (ALL) - Supreme Law Firm

2004 Instructions for Form 1040 (ALL) - Supreme Law Firm

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Form</strong> <strong>1040</strong>—Lines 30 Through 34b<br />

be used to figure the deduction. For exam-<br />

• You are using amounts paid <strong>for</strong> quali-<br />

Line 30 ple, if you were eligible to participate in a fied long-term care insurance to figure the<br />

subsidized health plan maintained by your<br />

One-Half of spouse’s employer from September 30<br />

Self-Employment Tax<br />

through December 31, you cannot use<br />

amounts paid <strong>for</strong> health insurance coverage<br />

<strong>for</strong> September through December to figure<br />

your deduction.<br />

For more details, see Pub. 535.<br />

deduction.<br />

If you were self-employed and owe Line 32<br />

self-employment tax, fill in Schedule SE to<br />

figure the amount of your deduction.<br />

Line 31<br />

Note. If, during <strong>2004</strong>, you were an eligible<br />

trade adjustment assistance (TAA) recipient,<br />

alternative TAA recipient, or Pension<br />

Benefit Guaranty Corporation pension re-<br />

Self-Employed Health 517.<br />

Insurance Deduction cipient, you must complete <strong>Form</strong> 8885<br />

Self-Employed SEP, SIMPLE,<br />

and Qualified Plans<br />

If you were self-employed or a partner, you<br />

may be able to take this deduction. See<br />

Pub. 560 or, if you were a minister, Pub.<br />

You may be able to deduct the amount you be<strong>for</strong>e completing the worksheet below.<br />

paid <strong>for</strong> health insurance <strong>for</strong> yourself, your When figuring the amount to enter on line 1<br />

of the worksheet below, do not include any Line 33<br />

spouse, and your dependents if any of the<br />

following apply.<br />

health coverage tax credit advance pay-<br />

Penalty on Early Withdrawal<br />

ments shown in <strong>Form</strong> 1099-H, box 1. Also,<br />

• You were self-employed and had a net<br />

subtract the amount shown on <strong>Form</strong> 8885, of Savings<br />

profit <strong>for</strong> the year.<br />

line 4, (reduced by any advance payments The <strong>Form</strong> 1099-INT or <strong>Form</strong> 1099-OID<br />

• You used one of the optional methods shown on line 6 of that <strong>for</strong>m) from the total you received will show the amount of any<br />

to figure your net earnings from self-em- insurance premiums you paid. penalty you were charged.<br />

ployment on Schedule SE.<br />

• You received wages in <strong>2004</strong> from an<br />

If you qualify to take the deduction, use<br />

S corporation in which you were a the worksheet below to figure the amount<br />

Lines 34a and 34b<br />

If you made payments to or <strong>for</strong> your spouse<br />

or <strong>for</strong>mer spouse under a divorce or separa-<br />

tion instrument, you may be able to take<br />

this deduction. Use TeleTax topic 452 (see<br />

page 8) or see Pub. 504.<br />

more-than-2% shareholder. Health insurance<br />

benefits paid <strong>for</strong> you may be shown in<br />

<strong>Form</strong> W-2, box 14.<br />

The insurance plan must be established<br />

under your business. But if you were also<br />

eligible to participate in any subsidized<br />

health plan maintained by your or your<br />

spouse’s employer <strong>for</strong> any month or part of<br />

a month in <strong>2004</strong>, amounts paid <strong>for</strong> health<br />

insurance coverage <strong>for</strong> that month cannot<br />

you can deduct.<br />

Exception. Use Pub. 535 instead of the<br />

worksheet below to find out how to figure<br />

your deduction if any of the following apply.<br />

• You had more than one source of in-<br />

come subject to self-employment tax.<br />

• You file <strong>Form</strong> 2555 or 2555-EZ.<br />

Alimony Paid<br />

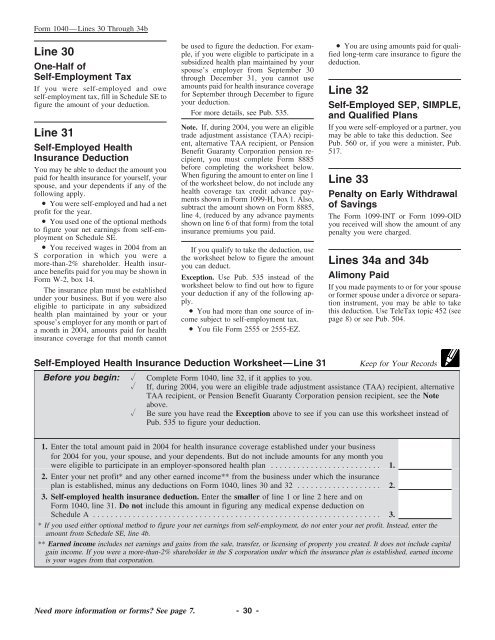

Self-Employed Health Insurance Deduction Worksheet—Line 31 Keep <strong>for</strong> Your Records<br />

Be<strong>for</strong>e you begin: Complete <strong>Form</strong> <strong>1040</strong>, line 32, if it applies to you.<br />

If, during <strong>2004</strong>, you were an eligible trade adjustment assistance (TAA) recipient, alternative<br />

TAA recipient, or Pension Benefit Guaranty Corporation pension recipient, see the Note<br />

above.<br />

Be sure you have read the Exception above to see if you can use this worksheet instead of<br />

Pub. 535 to figure your deduction.<br />

1. Enter the total amount paid in <strong>2004</strong> <strong>for</strong> health insurance coverage established under your business<br />

<strong>for</strong> <strong>2004</strong> <strong>for</strong> you, your spouse, and your dependents. But do not include amounts <strong>for</strong> any month you<br />

were eligible to participate in an employer-sponsored health plan ......................... 1.<br />

2. Enter your net profit* and any other earned income** from the business under which the insurance<br />

plan is established, minus any deductions on <strong>Form</strong> <strong>1040</strong>, lines 30 and 32 ................... 2.<br />

3. Self-employed health insurance deduction. Enter the smaller of line 1 or line 2 here and on<br />

<strong>Form</strong> <strong>1040</strong>, line 31. Do not include this amount in figuring any medical expense deduction on<br />

Schedule A ................................................................. 3.<br />

* If you used either optional method to figure your net earnings from self-employment, do not enter your net profit. Instead, enter the<br />

amount from Schedule SE, line 4b.<br />

** Earned income includes net earnings and gains from the sale, transfer, or licensing of property you created. It does not include capital<br />

gain income. If you were a more-than-2% shareholder in the S corporation under which the insurance plan is established, earned income<br />

is your wages from that corporation.<br />

Need more in<strong>for</strong>mation or <strong>for</strong>ms? See page 7. -30-