2004 Instructions for Form 1040 (ALL) - Supreme Law Firm

2004 Instructions for Form 1040 (ALL) - Supreme Law Firm

2004 Instructions for Form 1040 (ALL) - Supreme Law Firm

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

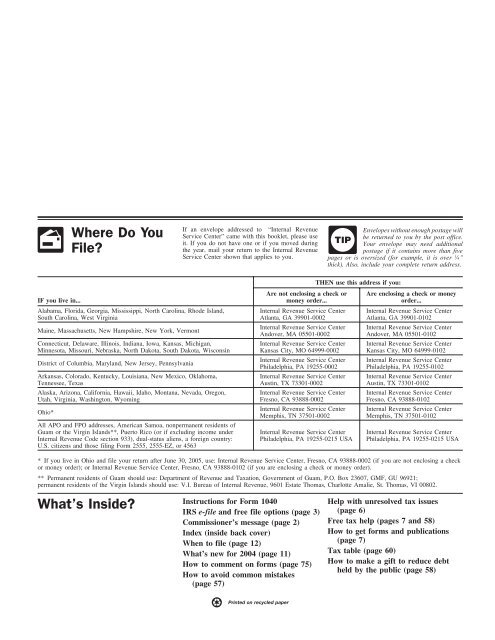

Where Do You<br />

File?<br />

If an envelope addressed to “Internal Revenue<br />

Service Center” came with this booklet, please use<br />

it. If you do not have one or if you moved during<br />

the year, mail your return to the Internal Revenue<br />

Service Center shown that applies to you.<br />

Envelopes without enough postage will<br />

be returned to you by the post office.<br />

TIP<br />

Your envelope may need additional<br />

postage if it contains more than five<br />

pages or is oversized (<strong>for</strong> example, it is over 1 ⁄4"<br />

thick). Also, include your complete return address.<br />

IF you live in...<br />

Alabama, Florida, Georgia, Mississippi, North Carolina, Rhode Island,<br />

South Carolina, West Virginia<br />

Maine, Massachusetts, New Hampshire, New York, Vermont<br />

Connecticut, Delaware, Illinois, Indiana, Iowa, Kansas, Michigan,<br />

Minnesota, Missouri, Nebraska, North Dakota, South Dakota, Wisconsin<br />

District of Columbia, Maryland, New Jersey, Pennsylvania<br />

Arkansas, Colorado, Kentucky, Louisiana, New Mexico, Oklahoma,<br />

Tennessee, Texas<br />

Alaska, Arizona, Cali<strong>for</strong>nia, Hawaii, Idaho, Montana, Nevada, Oregon,<br />

Utah, Virginia, Washington, Wyoming<br />

Ohio*<br />

All APO and FPO addresses, American Samoa, nonpermanent residents of<br />

Guam or the Virgin Islands**, Puerto Rico (or if excluding income under<br />

Internal Revenue Code section 933), dual-status aliens, a <strong>for</strong>eign country:<br />

U.S. citizens and those filing <strong>Form</strong> 2555, 2555-EZ, or 4563<br />

Are not enclosing a check or<br />

money order...<br />

Internal Revenue Service Center<br />

Atlanta, GA 39901-0002<br />

Internal Revenue Service Center<br />

Andover, MA 05501-0002<br />

Internal Revenue Service Center<br />

Kansas City, MO 64999-0002<br />

Internal Revenue Service Center<br />

Philadelphia, PA 19255-0002<br />

Internal Revenue Service Center<br />

Austin, TX 73301-0002<br />

Internal Revenue Service Center<br />

Fresno, CA 93888-0002<br />

Internal Revenue Service Center<br />

Memphis, TN 37501-0002<br />

Internal Revenue Service Center<br />

Philadelphia, PA 19255-0215 USA<br />

THEN use this address if you:<br />

Are enclosing a check or money<br />

order...<br />

Internal Revenue Service Center<br />

Atlanta, GA 39901-0102<br />

Internal Revenue Service Center<br />

Andover, MA 05501-0102<br />

Internal Revenue Service Center<br />

Kansas City, MO 64999-0102<br />

Internal Revenue Service Center<br />

Philadelphia, PA 19255-0102<br />

Internal Revenue Service Center<br />

Austin, TX 73301-0102<br />

Internal Revenue Service Center<br />

Fresno, CA 93888-0102<br />

Internal Revenue Service Center<br />

Memphis, TN 37501-0102<br />

Internal Revenue Service Center<br />

Philadelphia, PA 19255-0215 USA<br />

* If you live in Ohio and file your return after June 30, 2005, use: Internal Revenue Service Center, Fresno, CA 93888-0002 (if you are not enclosing a check<br />

or money order); or Internal Revenue Service Center, Fresno, CA 93888-0102 (if you are enclosing a check or money order).<br />

** Permanent residents of Guam should use: Department of Revenue and Taxation, Government of Guam, P.O. Box 23607, GMF, GU 96921;<br />

permanent residents of the Virgin Islands should use: V.I. Bureau of Internal Revenue, 9601 Estate Thomas, Charlotte Amalie, St. Thomas, VI 00802.<br />

What’s Inside?<br />

<strong>Instructions</strong> <strong>for</strong> <strong>Form</strong> <strong>1040</strong><br />

IRS e-file and free file options (page 3)<br />

Commissioner’s message (page 2)<br />

Index (inside back cover)<br />

When to file (page 12)<br />

What’s new <strong>for</strong> <strong>2004</strong> (page 11)<br />

How to comment on <strong>for</strong>ms (page 75)<br />

How to avoid common mistakes<br />

(page 57)<br />

Help with unresolved tax issues<br />

(page 6)<br />

Free tax help (pages 7 and 58)<br />

How to get <strong>for</strong>ms and publications<br />

(page 7)<br />

Tax table (page 60)<br />

How to make a gift to reduce debt<br />

held by the public (page 58)<br />

Printed on recycled paper