Payroll Check Requests Instructions - USC Employee Online Services

Payroll Check Requests Instructions - USC Employee Online Services

Payroll Check Requests Instructions - USC Employee Online Services

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

User’s Guide<br />

Section 600-1<br />

Page 1 of 1<br />

Revised September 2005<br />

<strong>Payroll</strong> <strong>Check</strong> <strong>Requests</strong><br />

Note: On-line hand drawn checks: If your department is on line for hand drawn checks,<br />

please see the procedures you were given at the time of your training. The procedure below<br />

discusses paper <strong>Payroll</strong> <strong>Check</strong> <strong>Requests</strong>.<br />

A <strong>Payroll</strong> <strong>Check</strong> Request or “PCR” is submitted when a hand drawn check needs to be created for late<br />

pay, or for payments (at risk, bonus) which must be run on a hand-drawn check by <strong>Payroll</strong>.<br />

• “Late Pay” means any money which should have been paid to an employee on pay day, but was<br />

not. Included in this definition are overload, over time, etc.<br />

• All monies owed for an individual must be combined onto one paycheck per IRS regulations,<br />

unless the FICA or Disability taxation will be different for each check. For example, if you owe a<br />

student a check for summer (non-enrolled) and for fall (enrolled), the FICA and Disability taxes<br />

are different for the two payments, and so two PCRs would be required. If unsure call <strong>Payroll</strong>.<br />

• A tax modeling (Section 500-14) must accompany all Late Pay PCRs. Do not do a tax modeling<br />

when submitting the following: events; cancelled-check reissue; at risk or bonus earnings; or<br />

employee is not in your home department. Terminations are handled via the Termination Form.<br />

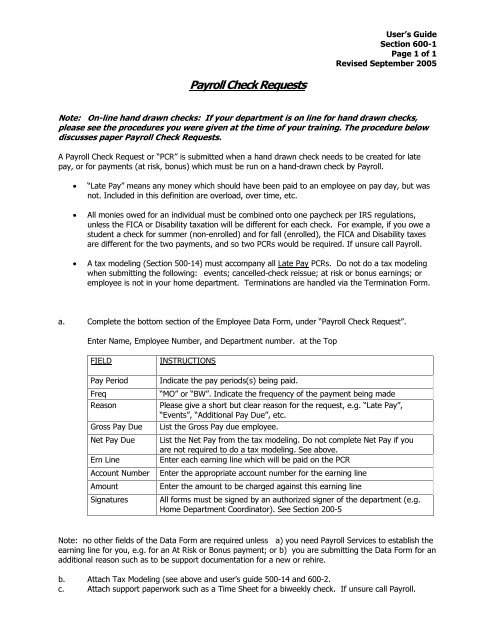

a. Complete the bottom section of the <strong>Employee</strong> Data Form, under “<strong>Payroll</strong> <strong>Check</strong> Request”.<br />

Enter Name, <strong>Employee</strong> Number, and Department number. at the Top<br />

FIELD<br />

Pay Period<br />

Freq<br />

Reason<br />

Gross Pay Due<br />

Net Pay Due<br />

Ern Line<br />

Account Number<br />

Amount<br />

Signatures<br />

INSTRUCTIONS<br />

Indicate the pay periods(s) being paid.<br />

“MO” or “BW”. Indicate the frequency of the payment being made<br />

Please give a short but clear reason for the request, e.g. “Late Pay”,<br />

“Events”, “Additional Pay Due”, etc.<br />

List the Gross Pay due employee.<br />

List the Net Pay from the tax modeling. Do not complete Net Pay if you<br />

are not required to do a tax modeling. See above.<br />

Enter each earning line which will be paid on the PCR<br />

Enter the appropriate account number for the earning line<br />

Enter the amount to be charged against this earning line<br />

All forms must be signed by an authorized signer of the department (e.g.<br />

Home Department Coordinator). See Section 200-5<br />

Note: no other fields of the Data Form are required unless a) you need <strong>Payroll</strong> <strong>Services</strong> to establish the<br />

earning line for you, e.g. for an At Risk or Bonus payment; or b) you are submitting the Data Form for an<br />

additional reason such as to be support documentation for a new or rehire.<br />

b. Attach Tax Modeling (see above and user’s guide 500-14 and 600-2.<br />

c. Attach support paperwork such as a Time Sheet for a biweekly check. If unsure call <strong>Payroll</strong>.

User’s Guide<br />

Section 600-1<br />

Page 2 of 1<br />

Revised September 2005<br />

d. If you are not the “Home Department”, but need to submit a <strong>Payroll</strong> <strong>Check</strong> Request:<br />

i. Work Department completes PCR section of <strong>Employee</strong> Data Form, attaches Time<br />

Report(s) if appropriate, and forwards package to the Home Department. Tax modeling<br />

is NOT required.<br />

ii.<br />

iii.<br />

iv.<br />

Home Department Coordinator:<br />

* reviews the Time Report for adherence to Overtime Requirements<br />

* countersigns PCR or Data Form<br />

*It is not necessary for the Home Department to complete a Tax Modeling.<br />

PCR & Time Report forwarded to <strong>Payroll</strong> <strong>Services</strong> on the Home Department’s campus.<br />

<strong>Payroll</strong> <strong>Services</strong> prints check<br />

NOTE: HAND DRAWN CHECK WILL BE AVAILABLE FOR PICKUP BY THE<br />

HOME DEPARTMENT ONLY.