Chicago Park Disrict Human Resources Policy and Procedures ...

Chicago Park Disrict Human Resources Policy and Procedures ...

Chicago Park Disrict Human Resources Policy and Procedures ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Short-Term Disability<br />

Employees off work for eight (8) consecutive days due to a non-work related illness or injury, may be<br />

eligible to receive 45% of their gross salary (at the time of disability) from the pension fund if they are in an<br />

unpaid status with the <strong>Chicago</strong> <strong>Park</strong> District. Employees may apply for disability benefits through the<br />

pension fund office only after they have exhausted any accumulated sick pay. The maximum length of<br />

benefits available is 1 /4 of the employee's credited service, or five years, whichever is less. The telephone<br />

number for the Pension Fund is 312.553.9265.<br />

When a disability is the result of a bona-fide injury on duty, an employee is eligible for 75% of their<br />

salary (reduced by workers' compensation payments) from the first day of injury. An employee will<br />

continue to receive Short-Term Disability.<br />

You will receive full pension service credit during the period you are collecting disability through the<br />

pension plan.<br />

Contact the pension fund office at 312.553.9265 to request Short-Term Disability benefits. They will send<br />

you the appropriate paperwork.<br />

Long-Term Disability<br />

Monthly employees are eligible to enroll for optional Long-Term Disability benefits, the first day of the<br />

month following full-time employment, provided they pay the required monthly premium. There is a thirty<br />

(30) day grace period for the initial enrollment. The premium is deducted the first pay period of each month<br />

<strong>and</strong> is based on your age <strong>and</strong> annual salary.<br />

In order to calculate your monthly premium, divide your monthly earnings by 100 then multiply by the rate<br />

listed below for your age group.<br />

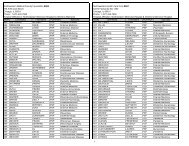

Age Rate<br />

0-29 .25<br />

30-34 .34<br />

35-39 .54<br />

40-44 .80<br />

45-49 1.19<br />

50-54 1.66<br />

55-59 2.28<br />

60-64 2.08<br />

65-69 1.28<br />

70-74 1.05<br />

75-80 1.05<br />

The policy provides you with 60% of your salary (after taxes), when<br />

you have been continuously disabled for 180 days (six months), up to<br />

age 65. The minimum monthly benefit is $100 <strong>and</strong> the maximum is<br />

$10,000. Premium payments are waived while you are collecting<br />

Long-Term Disability benefits. Benefits are reduced by<br />

social security, Workers' Compensation <strong>and</strong> pension disability<br />

payments.<br />

Benefits are not payable for a pre-existing condition — a<br />

sickness or injury for which you received treatment during the 12<br />

months prior to the effective date.<br />

If you do not enroll for coverage when first eligible, you will<br />

need to complete a health questionnaire to be submitted to the carrier for approval. There is no<br />

open enrollment period for Long-Term Disability coverage.<br />

83