COVER SHEET - 2Go

COVER SHEET - 2Go

COVER SHEET - 2Go

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

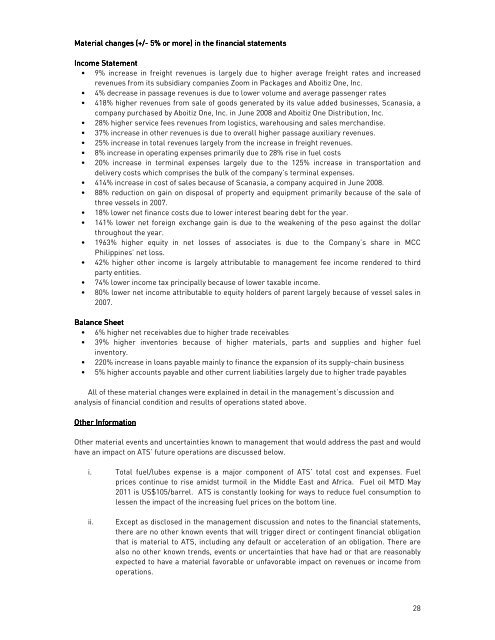

Material changes (+/- 5% or more) in the financial statements<br />

Income Statement<br />

• 9% increase in freight revenues is largely due to higher average freight rates and increased<br />

revenues from its subsidiary companies Zoom in Packages and Aboitiz One, Inc.<br />

• 4% decrease in passage revenues is due to lower volume and average passenger rates<br />

• 418% higher revenues from sale of goods generated by its value added businesses, Scanasia, a<br />

company purchased by Aboitiz One, Inc. in June 2008 and Aboitiz One Distribution, Inc.<br />

• 28% higher service fees revenues from logistics, warehousing and sales merchandise.<br />

• 37% increase in other revenues is due to overall higher passage auxiliary revenues.<br />

• 25% increase in total revenues largely from the increase in freight revenues.<br />

• 8% increase in operating expenses primarily due to 28% rise in fuel costs<br />

• 20% increase in terminal expenses largely due to the 125% increase in transportation and<br />

delivery costs which comprises the bulk of the company’s terminal expenses.<br />

• 414% increase in cost of sales because of Scanasia, a company acquired in June 2008.<br />

• 88% reduction on gain on disposal of property and equipment primarily because of the sale of<br />

three vessels in 2007.<br />

• 18% lower net finance costs due to lower interest bearing debt for the year.<br />

• 141% lower net foreign exchange gain is due to the weakening of the peso against the dollar<br />

throughout the year.<br />

• 1963% higher equity in net losses of associates is due to the Company’s share in MCC<br />

Philippines’ net loss.<br />

• 42% higher other income is largely attributable to management fee income rendered to third<br />

party entities.<br />

• 74% lower income tax principally because of lower taxable income.<br />

• 80% lower net income attributable to equity holders of parent largely because of vessel sales in<br />

2007.<br />

Balance Sheet<br />

• 6% higher net receivables due to higher trade receivables<br />

• 39% higher inventories because of higher materials, parts and supplies and higher fuel<br />

inventory.<br />

• 220% increase in loans payable mainly to finance the expansion of its supply-chain business<br />

• 5% higher accounts payable and other current liabilities largely due to higher trade payables<br />

All of these material changes were explained in detail in the management’s discussion and<br />

analysis of financial condition and results of operations stated above.<br />

Other Information<br />

Other material events and uncertainties known to management that would address the past and would<br />

have an impact on ATS’ future operations are discussed below.<br />

i. Total fuel/lubes expense is a major component of ATS’ total cost and expenses. Fuel<br />

prices continue to rise amidst turmoil in the Middle East and Africa. Fuel oil MTD May<br />

2011 is US$105/barrel. ATS is constantly looking for ways to reduce fuel consumption to<br />

lessen the impact of the increasing fuel prices on the bottom line.<br />

ii.<br />

Except as disclosed in the management discussion and notes to the financial statements,<br />

there are no other known events that will trigger direct or contingent financial obligation<br />

that is material to ATS, including any default or acceleration of an obligation. There are<br />

also no other known trends, events or uncertainties that have had or that are reasonably<br />

expected to have a material favorable or unfavorable impact on revenues or income from<br />

operations.<br />

28