COVER SHEET - 2Go

COVER SHEET - 2Go

COVER SHEET - 2Go

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

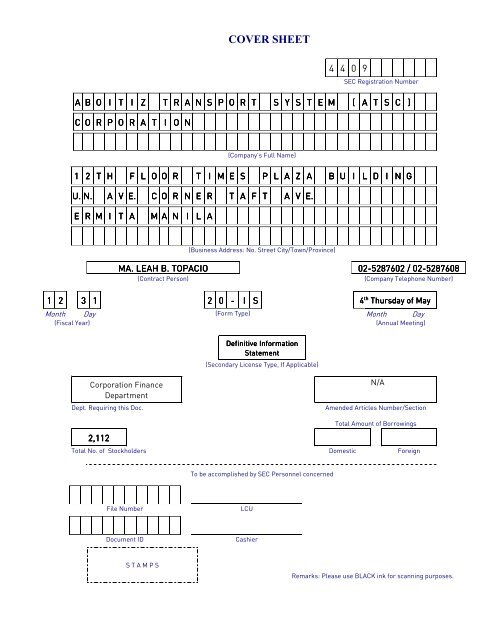

<strong>COVER</strong> <strong>SHEET</strong><br />

4 4 0 9<br />

SEC Registration Number<br />

A B O I T I Z T R A N S P O R T S Y S T E M ( A T S C )<br />

C O R P O R A T I O N<br />

(Company’s Full Name)<br />

1 2 T H F L O O R T I M E S P L A Z A B U I L D I N G<br />

U. N. A V E. C O R N E R T A F T A V E.<br />

E R M I T A<br />

M A N I L A<br />

(Business Address: No. Street City/Town/Province)<br />

MA. LEAH B. TOPACIO 02-5287602 / 02-5287608<br />

(Contract Person)<br />

(Company Telephone Number)<br />

1 2 3 1 2 0 - I S 4 th Thursday of May<br />

Month Day (Form Type) Month Day<br />

(Fiscal Year)<br />

(Annual Meeting)<br />

Definitive<br />

Information<br />

Statement<br />

(Secondary License Type, If Applicable)<br />

Corporation Finance<br />

Department<br />

Dept. Requiring this Doc.<br />

N/A<br />

Amended Articles Number/Section<br />

2,112<br />

Total Amount of Borrowings<br />

Total No. of Stockholders Domestic Foreign<br />

To be accomplished by SEC Personnel concerned<br />

File Number<br />

LCU<br />

Document ID<br />

Cashier<br />

S T A M P S<br />

Remarks: Please use BLACK ink for scanning purposes.

1. Check the appropriate box:<br />

SECURITIES AND EXCHANGE COMMISSION<br />

SEC FORM 20-IS<br />

INFORMATION STATEMENT PURSUANT TO SECTION 20<br />

OF THE SECURITIES REGULATION CODE<br />

[ ] Preliminary Information Statement<br />

[X] Definitive Information Statement<br />

2. ABOITIZ TRANSPORT SYSTEM (ATSC) CORPORATION<br />

Name of the Registrant as specified in its charter<br />

3. PHILIPPINES<br />

Province, country or other jurisdiction of incorporation or organization<br />

4. SEC Identification Number _____4409<br />

4409________<br />

5. BIR Tax Identification Code ___000<br />

000-313<br />

313-401<br />

401___<br />

6. 12 th Floor, Times Plaza Building U.N. Ave. corner Taft Avenue, Ermita, Manila<br />

Address of principal office Postal Code 1000<br />

7. (02) 528-7171 / 528-7516 / 528-7602 and 528-7608<br />

Registrant’s telephone numbers, including area code<br />

8. June 22, 2011 at 3:00 PM, 11 th floor Opal Function Room (Penthouse), Midas Hotel, 2702 Roxas<br />

Boulevard, Pasay City<br />

Date, time and place of the meeting of security holders<br />

9. Approximate date on which the Information Statement is first to be sent or given to security holders<br />

June 01, 2011<br />

10. Securities registered pursuant to Sections 8 and 12 of the Code or Sections 4 and 8 of the RSA<br />

(information on number of shares and amount of debt is applicable only to corporate registrants):<br />

Title of Each Class<br />

Number of Shares of Common Stock<br />

Outstanding or Amount of Debt Outstanding<br />

Common Stock 2,446,136,400<br />

Redeemable Preferred Stock 4,560,417<br />

417<br />

11. Are any or all of registrant's securities listed in a Stock Exchange?<br />

YES [X] NO [ ]<br />

If yes, disclose the name of such Stock Exchange and the class of securities therein:<br />

Philippine Stock Exchange - Common Stock and Redeemable PreferredStock<br />

2

Dear Stockholder:<br />

ABOITIZ TRANSPORT SYSTEM (ATSC) CORPORATION<br />

NOTICE OF REGULAR ANNUAL MEETING OF STOCKHOLDERS<br />

PLACE:<br />

11 th Floor Opal Function Room (Penthouse), Midas Hotel<br />

2702 Roxas Boulevard, Pasay City<br />

DATE: June 22, 2011<br />

TIME: 3:00 P.M.<br />

You are cordially invited to attend the Regular Annual Meeting of Stockholders of Aboitiz Transport System<br />

(ATSC) Corporation (the "Company" or “ATS”), which will be held on June 22, 2011 at the 11 th Floor Opal<br />

Function Room (Penthouse), Midas Hotel, 2702 Roxas Boulevard, Pasay City at 3:00 PM. The agenda for the<br />

meeting is as follows:<br />

1. Call to Order<br />

2. Certification of Notice<br />

3. Determination and Declaration of Quorum<br />

4. Approval of Minutes of the Special Stockholders’ Meeting held on July 15, 2010<br />

5. Annual Report for the year ended December 31, 2010<br />

6. Election of the Members of the Board of Directors<br />

7. Amendments to the First, Second and Sixth Articles of the Company’s Articles of<br />

Incorporation, changing the Company’s corporate name, business purpose, and increase<br />

in the number of directors. [Please refer to Annex “A” for the summary of amendments<br />

proposed]<br />

8. Amendment of Section 2, Article III of the Company’s By-Laws, to increase the number of<br />

directors. [Please refer to Annex “A” for the summary of amendments proposed]<br />

9. Approval and Ratification of all Acts and Resolutions of the Board of Directors and<br />

Management for the period covering May 28, 2010 to April 28, 2011<br />

10. Other Matters<br />

11. Adjournment<br />

Only stockholders of record in the books of the Company at the close of business on May 20, 2011 will be<br />

entitled to vote at said stockholders’ meeting.<br />

Manila, Philippines, May 06, 2011.<br />

========================<br />

We are not soliciting your proxy. However, if you would be unable to attend the meeting but would like to be represented<br />

thereat, you may accomplish the enclosed proxy form and submit the same on or before June 15, 2011 to the Office of the<br />

Corporate Secretary at the G/F Ortigas Bldg., Ortigas Avenue, Pasig City 1605. Validation of proxies shall be held on June<br />

17, 2011 at 9:00 a.m. at the Office of the Corporate Secretary. Thank you.<br />

3

Annex “A”<br />

Summary of Proposed Amendments to ATS’<br />

Articles of Incorporation and By-Laws<br />

A. Amendment of the Company’s Articles of Incorporation, specifically the following articles:<br />

1. First Article: To change the corporate name “Aboitiz Transport System (ATSC)<br />

Corporation” to “ATS Consolidated (ATSC), Inc.”<br />

2. Second Article: To include the following purposes:<br />

(a) To conduct the business of rendering technical services requirement to<br />

customers nationwide for refrigerated marine container vans and related<br />

equipments or accessories including but not limited to repair and maintenance,<br />

equipment rental and leasing, technical consultancy and training, selling of<br />

spare parts, components and accessories, service contracting and to act as<br />

service agent on behalf of the various domestic and foreign container<br />

manufacturer with services but not limited to performing warranty and nonwarranty<br />

repair services, selling of service parts, components and accessories,<br />

and consultancy services; and<br />

(b) To conduct and transact any and all lawful business, and to do or cause to be<br />

done any one or more of the acts and things herein set forth as its purposes,<br />

within or without the Philippines, and in any and all foreign countries, and to do<br />

everything necessary, desirable or incidental to the accomplishment of the<br />

purposes or the exercise of any one of more of the powers herein enumerated, or<br />

which shall at any time appear conducive to or expedient for the protection or<br />

benefit of this corporation.<br />

Sixth Article: To increase the number of directors from nine (9) to thirteen (13).<br />

B. Amendment of the Company’s By-Laws, specifically Section 2, Article III, to increase the<br />

number of directors from nine (9) to thirteen (13).<br />

4

INFORMATION STATEMENT<br />

(SEC FORM 20-IS)<br />

A. GENERAL INFORMATION<br />

WE ARE NOT ASKING YOU FOR A PROXY<br />

AND YOU ARE REQUESTED NOT TO SEND US A PROXY<br />

Item 1.<br />

DATE, TIME AND PLACE OF MEETING OF SECURITY HOLDERS<br />

Date of meeting : June 22, 2011<br />

Time of meeting : 3:00 P.M.<br />

Place of meeting : 11 th Floor Opal Function Room<br />

(Penthouse), Midas Hotel, 2702 Roxas<br />

Boulevard, Pasay City<br />

Approximate date of mailing of this<br />

Statement : May 31, 2011<br />

Registrant’s Mailing Address : 12 th Floor, Times Plaza Bldg. UN Ave.<br />

corner Taft Ave. Ermita, Manila<br />

Item 2.<br />

DISSENTERS’ RIGHT OF APPRAISAL<br />

Under the Corporation Code, a dissenting stockholder shall have the right of appraisal or the right to<br />

demand payment of the fair value of his shares in the following instances:<br />

a. any amendment to the articles of incorporation which has the effect of changing or<br />

restricting the rights of any stockholder or class of shares, or of authorizing preferences in<br />

any respect superior to those of outstanding shares of any class, or of extending or<br />

shortening the term of corporate existence;<br />

b. sale, lease, exchange, transfer, mortgage, pledge or other disposition of all or substantially<br />

all of the corporate property and assets;<br />

c. merger or consolidation.<br />

In the foregoing cases, any stockholder who wishes to exercise his appraisal right must have voted<br />

against the proposed corporate action, made a written demand on the corporation within thirty (30) days<br />

after the date on which the vote was taken for payment of the fair value of his shares as well as<br />

complied with all other requirements provided under Title X of the Corporation Code. Failure to make<br />

the demand within such period or comply with the requirements provided under Title X of the<br />

Corporation Code shall be deemed a waiver of the appraisal right. If the proposed corporate action is<br />

implemented or effected, the corporation shall pay to such stockholder, upon surrender of the<br />

certificate or certificates of stock representing his shares, the fair value thereof as of the day prior to<br />

the date on which the vote was taken, excluding any appreciation or depreciation in anticipation of such<br />

corporate action.<br />

If within a period of sixty (60) days from the date the corporate action was approved by the stockholders,<br />

the withdrawing stockholder and the corporation cannot agree on the fair value of the shares, it shall be<br />

determined and appraised by three (3) disinterested persons, one of whom shall be named by the<br />

stockholder, another by the corporation, and the third by the two thus chosen. The findings of the<br />

majority of the appraisers shall be final, and their award shall be paid by the corporation within thirty<br />

(30) days after such award is made. No payment shall be made to any dissenting stockholder unless<br />

the corporation has unrestricted retained earnings in its books to cover such payment. Upon payment<br />

by the corporation of the agreed or awarded price, the stockholder shall forthwith transfer his shares to<br />

the corporation.

The following agenda for the stockholders’ meeting to be held on June 22, 2011 call for the approval by<br />

stockholders representing at least two-thirds (2/3) of the Aboitiz Transport System (ATSC)<br />

Corporation’s (the “Registrant”, the “Company”, or “ATS”) outstanding capital stock:<br />

1. Approval of the amendment to the First Article of the Articles of Incorporation of ATS, to change<br />

the corporate name “Aboitiz Transport System (ATSC) Corporation” to “ATS Consolidated<br />

(ATSC), Inc.”<br />

2. Approval of the amendment to the Second Article of the Articles of Incorporation of ATS, to<br />

include the following purpose:<br />

a. To conduct the business of rendering technical services requirement to customers<br />

nationwide for refrigerated marine container vans and related equipments or<br />

accessories including but not limited to repair and maintenance, equipment rental and<br />

leasing, technical consultancy and training, selling of spare parts, components and<br />

accessories, service contracting and to act as service agent on behalf of the various<br />

domestic and foreign container manufacturer with services but not limited to<br />

performing warranty and non-warranty repair services, selling of service parts,<br />

components and accessories, and consultancy services; and<br />

b. To conduct and transact any and all lawful business, and to do or cause to be done any<br />

one or more of the acts and things herein set forth as its purposes, within or without<br />

the Philippines, and in any and all foreign countries, and to do everything necessary,<br />

desirable or incidental to the accomplishment of the purposes or the exercise of any<br />

one of more of the powers herein enumerated, or which shall at any time appear<br />

conducive to or expedient for the protection or benefit of this corporation.<br />

3. Approval of the amendment to the Sixth Article of the Articles of Incorporation of ATS, to<br />

increase the number of directors from nine (9) to thirteen (13).<br />

4. Approval of the amendment of Section 2, Article III of the Company’s By-Laws, to increase the<br />

number of directors from nine (9) to thirteen (13).<br />

These proposed corporate actions may give rise to a possible exercise by stockholders of their<br />

appraisal right.<br />

Item 3.<br />

INTEREST OF CERTAIN PERSONS IN OR OPPOSITION TO MATTERS TO BE ACTED UPON<br />

No director or officer of the Company at any time since the beginning of the last fiscal year or any<br />

nominee for election as a director of the Company or any associate of any of the foregoing persons has<br />

any substantial interest, direct or indirect, by security holdings or otherwise, in any matter to be acted<br />

upon in the stockholders’ meeting other than their re-election to their respective positions.<br />

No director has informed the Company in writing that he intends to oppose any action to be taken by<br />

the Company at the meeting.<br />

B. CONTROL & COMPENSATION INFORMATION<br />

Item 4. VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF<br />

(1) The Registrant has 2,446,136,400 outstanding common shares and 4,560,417 outstanding<br />

redeemable preferred shares as of May 17, 2011. Each common share shall be entitled to one<br />

vote with respect to all matters to be taken up during the annual stockholders’ meeting. Holders<br />

of redeemable preferred shares do not have the right to vote, except on matters specified in<br />

2

Section 6 of the Corporation Code with respect to which holders of non-voting shares shall<br />

nevertheless be entitled to vote, i.e.:<br />

(1) Amendment of the articles of incorporation;<br />

(2) Adoption and amendment of by-laws;<br />

(3) Sale, lease, exchange, mortgage, pledge or other disposition of all or substantially<br />

all of the corporate property;<br />

(4) Incurring, creating or increasing bonded indebtedness;<br />

(5) Increase or decrease of capital stock;<br />

(6) Merger or consolidation of the corporation with another corporation or other<br />

corporations;<br />

(7) Investment of corporate funds in another corporation or business in accordance<br />

with this Code; and<br />

(8) Dissolution of the corporation.<br />

Accordingly, during the annual stockholders’ meeting, holders of both common and redeemable<br />

preferred shares shall each be entitled to vote with respect to the following:<br />

a) Approval of the amendment to the First Article of the Articles of Incorporation of ATS,<br />

to change the corporate name “Aboitiz Transport System (ATSC) Corporation” to<br />

“ATS Consolidated (ATSC), Inc.”;<br />

b) Approval of the amendment to the Second Article of the Articles of Incorporation of<br />

ATS, to include the following purpose:<br />

(i) To conduct the business of rendering technical services requirement to<br />

customers nationwide for refrigerated marine container vans and related<br />

equipments or accessories including but not limited to repair and<br />

maintenance, equipment rental and leasing, technical consultancy and<br />

training, selling of spare parts, components and accessories, service<br />

contracting and to act as service agent on behalf of the various domestic and<br />

foreign container manufacturer with services but not limited to performing<br />

warranty and non-warranty repair services, selling of service parts,<br />

components and accessories, and consultancy services; and<br />

(ii) To conduct and transact any and all lawful business, and to do or cause to be<br />

done any one or more of the acts and things herein set forth as its purposes,<br />

within or without the Philippines, and in any and all foreign countries, and to do<br />

everything necessary, desirable or incidental to the accomplishment of the<br />

purposes or the exercise of any one of more of the powers herein enumerated,<br />

or which shall at any time appear conducive to or expedient for the protection<br />

or benefit of this corporation<br />

c) Approval of the amendment to the Sixth Article of the Articles of Incorporation of ATS,<br />

to increase the number of directors from nine (9) to thirteen (13);<br />

d) Approval of the amendment of Section 2, Article III of the Company’s By-Laws, to<br />

increase the number of directors from nine (9) to thirteen (13);<br />

(2) The record date for determining stockholders entitled to notice and to vote during the annual<br />

stockholders meeting and also to this information statement is May 20, 2011.<br />

(3) At each election for directors, every common stockholder shall have the right to vote, in person or<br />

by proxy, the number of shares owned by him for as many persons as there are directors to be<br />

elected, or to cumulate his vote by giving one candidate as many votes as the number of such<br />

directors multiplied by the number of shares shall equal, or by distributing such votes on the same<br />

principle among any number of candidates.<br />

3

(4) Security ownership of certain record and beneficial owners and management.<br />

Security ownership of certain record and beneficial owners of five per centum (5%) or more of the<br />

outstanding capital stock of the Registrant as of April 30, 2011:<br />

Title of<br />

Class<br />

Name and Address of Record<br />

Owner and Relationship with<br />

ATS<br />

Name of Beneficial Owner<br />

and Relationship with<br />

Record Owner<br />

Citizenship<br />

No. of Shares<br />

Held<br />

Percent<br />

of Class<br />

Common<br />

1. Negros Navigation Co., Inc.<br />

Pier 2, North Harbor, Manila<br />

(PARENT COMPANY)<br />

Negros Navigation Co., Inc.<br />

Authorized Representative:<br />

Mr. Sulficio O. Tagud Jr.<br />

President<br />

Filipino 2,400,141,995 98.12%<br />

Preferred 2. PCD Nominee Corporation<br />

(Filipino)<br />

37/F Enterprise Building<br />

Ayala Avenue, Makati City<br />

(STOCKHOLDER)<br />

Various Clients Filipino 2,962,151 64.95%<br />

Negros Navigation Co., Inc. (“NENACO”) is one of the oldest domestic shipping companies in the<br />

Philippines. It was organized and registered with the Securities and Exchange Commission (SEC) on 26<br />

July 1932 for the purpose of transporting passengers and cargoes at various ports of call in the<br />

Philippines. NENACO is 99.03% owned by KGLI-NM Holdings, Inc.<br />

Security Ownership of Management – Record and Beneficial Owners as of April 30, 2011:<br />

Title of<br />

Class<br />

Common<br />

Common<br />

Common<br />

Common<br />

Common<br />

Common<br />

Common<br />

Common<br />

Common<br />

Name of Beneficial Owner and<br />

Position<br />

Jon Ramon M. Aboitiz<br />

Chairman of the Board<br />

Sulfico O. Tagud, Jr.<br />

President and CEO<br />

Jeremias E. Cruzabra<br />

Director<br />

Mark E. Williams<br />

Director<br />

Michelle Lu<br />

Director<br />

Enrique M. Aboitiz, Jr.<br />

Director<br />

Bob D. Gothong<br />

Director<br />

Amb. Raul C. Rabe<br />

Independent Director<br />

Francis Chua<br />

Independent Director<br />

TOTAL<br />

Citizenship<br />

Amount and nature of ownership<br />

(Indicate record and/or beneficial)<br />

Filipino 10 – “direct”<br />

126,460 – “indirect”<br />

Record Owner: Lekeitio & Company. Inc.<br />

Filipino 1,000 – “indirect”<br />

Record Owner: PCD Nominee Corporation<br />

(Filipino)<br />

Filipino 1,000 – “indirect”<br />

Record Owner: PCD Nominee Corporation<br />

(Filipino)<br />

American 1,000 – “indirect”<br />

Record Owner: PCD Nominee Corporation<br />

(Non-Filipino)<br />

Chinese 1,000 – “indirect”<br />

Record Owner: PCD Nominee Corporation<br />

(Non-Filipino)<br />

Filipino 10 – “indirect”<br />

Record Owner: PCD Nominee Corporation<br />

Filipino 148 – “direct”<br />

Filipino 1,000 – “indirect”<br />

Record Owner: PCD Nominee Corporation<br />

(Filipino)<br />

Filipino 10 ,000– “direct”<br />

10,158”directt”;<br />

131,470“indirect”b”<br />

Percent<br />

of Class<br />

0.01%<br />

0.00%<br />

0.00%<br />

0.00%<br />

0.00%<br />

0.00%<br />

0.00%<br />

0.00%<br />

0.00%<br />

Security Ownership of the Directors and Officers in the Registrant as a Group: Common is 141,628<br />

shares.<br />

4

Voting trust holders of 5% or More<br />

No person holds more than five per centum (5%) of a class under a voting trust agreement or similar<br />

arrangement.<br />

Changes in Control<br />

In December 28, 2010, NENACO purchased the shareholdings of Aboitiz Equity Ventures, Inc. (AEV) in<br />

ATS comprising 1,889,489,607 common shares at a purchase price of approximately PhP3.55 billion<br />

and the shareholdings of Aboitiz & Company, Inc. (ACO) in ATS comprising 390,322,384 common<br />

shares at a purchase price of approximately PhP734 million.<br />

In February 2011, as a result of the mandatory Tender Offer, NENACO purchased an additional<br />

120,330,004 common shares in ATS. NENACO now owns 2,400,141,995 common shares of ATS,<br />

equivalent to 98.12%<br />

Item 5. DIRECTORS AND A<br />

EXECUTIVE OFFICERS<br />

Board of Directors, Including Independent Directors and Executive Officers<br />

The names, ages, citizenship, position and offices held or will hold, and brief description of business<br />

experience during the past 5 years (except those years stated otherwise) and other directorships held<br />

in reporting companies, including name of each company, of all directors and executive officers are as<br />

follows:<br />

Mr. Jon Ramon M. Aboitiz, 62 years old, Filipino, has served as Chairman of the Board since 2002 and a<br />

Director since 1996. His other positions include Chairman of the Board of Directors of Aboitiz Equity<br />

Ventures, Inc., Aboitiz and Company. Inc., and Aboitiz Jebsen Bulk Transport Corporation, and Vice<br />

Chairman of the Board of Directors of Union Bank of the Philippines and Aboitiz Power Corporation;<br />

President of Aboitiz Foundation, Inc. and Trustee and Vice President of the Ramon Aboitiz Foundation,<br />

Inc. He graduated with a degree in Commerce major in Management from the University of Santa<br />

Clara, California, U.S.A.<br />

Mr. Sulficio O. Tagud, Jr., 60 years old, Filipino, has served as President, Chief Executive Officer, and<br />

Director of ATS since December 2010. He has also served as the Chairman and President of KGLI-NM<br />

Holdings, Inc. since July 2008; Chairman and Chief Executive Officer of NENACO since August 2004;<br />

and President of One Urban Resource and Property Management Company since September 2003. He<br />

graduated Class Valedictorian with a Bachelor of Science degree in Business Administration, major in<br />

Economics (Magna Cum Laude) at Xavier University, Cagayan De Oro City. He also completed his<br />

Masters in Industrial Economics at the Center for Research and Communication in Manila, and<br />

Masters in Business Administration at the Ateneo de Manila University. He also completed Real Estate<br />

Development Program at the Urban Land Institute at Washington, D.C., U.S.A.<br />

Mr. Jeremias E. Cruzabra, 44 years old, Filipino, has served as Director of ATS since December 2010.<br />

He has also served as the Chief Finance Officer of NENACO since April 2004; Chief Finance Officer and<br />

Board Director of KGLI-NM Holdings, Inc. since July 2008; Court-Appointed Receiver of Selegna<br />

Holdings Corporation since November 2006; Chief Finance Officer (and later Trustee) of Sapphire<br />

Securities, Inc. (owned by the Brunei Investment Agency) from 1997 to 1999. He started his career with<br />

SGV & Co. (a member company of Ernst & Young) from 1988 to 1992. Mr. Cruzabra, who is a Certified<br />

Public Accountant (CPA), graduated with a Bachelor of Science degree in Commerce, major in<br />

Accounting (Magna Cum Laude) from the University of Luzon, and has completed his Masters in<br />

Business Administration at Murdoch University in Perth, Western Australia.<br />

Amb. Raul Ch. Rabe, 70 years old, Filipino, has been an Independent Director of ATS since December<br />

2010. He has also served as a member of the Board of Directors of KGLI-NM Holdings, Inc. since July<br />

2008; Bancommerce Investment Corporation since 2007; PET Plans, Inc. since 2007; Vivant<br />

5

Corporation since 2002; Bank of Commerce since 2001; Corporate Secretary of Manila Economic and<br />

Cultural Office since 2001, and of Counsel for Rodrigo, Berenguer and Guno since 1999. He graduated<br />

with a Bachelor of Arts degree at the University of Santo Tomas, and Bachelor of Laws degree from<br />

the Ateneo de Manila Law School. He also completed the Colombo Plan Scholarship on Diplomacy at<br />

the Australian Institute of Foreign Service in Canberra, Australia.<br />

Mr. Mark E. Williams, 37 years old, American, has served as Director of ATS since December 2010. He<br />

has also served as Investment Director of KGLI-KSCC since 2008. He obtained his Bachelor of Science<br />

degrees in Accounting, Business Administration, and Finance at the University of Akron in Akron, Ohio,<br />

U.S.A. He completed his Juris Doctorate degree at Case Western Reserve University, Cleveland, Ohio,<br />

U.S.A., and also obtained a Masters degree in Business Administration, concentration in Finance, from<br />

Weatherhead School of Management of the same university.<br />

Ms. Michelle Lu, 50 years old, Chinese, has served as Director of ATS since December 2010. She is the<br />

Managing Director of the China-ASEAN Capital Advisory Company and advisor to the China-ASEAN<br />

Investment Cooperation Fund. Prior to this role, Ms. Lu was Managing Director and Head of<br />

Infrastructure China at Standard Chartered Bank, with responsibility for managing the Standard<br />

Chartered IL & FS Asia Infrastructure Growth Fund. She has also held senior management roles at<br />

Macquarie Bank, Temasek Holdings and Hutchison Port Holdings. Her extensive experience in private<br />

equity investment includes shipping, ports, airports, toll roads, wastewater treatment, renewable<br />

energy, metal and mining, and telecom. She graduated with a Bachelor of Science in Physics at the<br />

Beijing Normal University in China, and obtained a Masters Degree in Business Administration from<br />

San Jose State University, California, U.S.A.<br />

Mr. Enrique M. Aboitiz, Jr., 56 years old, Filipino, has served as President and Chief Executive Officer<br />

of ATS from May 1999 upto December 2010 and a Director since 1997. He is a member of the Risk<br />

Management Committee. He is also the Director and Senior Vice President of Aboitiz and Company,<br />

Inc; Director and President of Aboitiz Jebsen Bulk Transport Corporation; Director and Chairman of<br />

the Board of Aboitiz Power Corporation (AP); Director of Aboitiz Equity Ventures, Inc. (AEV), Amanpulo<br />

Resorts, MacroAsia Corporation, E-Media Foundation, Pilmico Foods Corporation and Aboitizland, Inc.<br />

He also sits as the Chairman of AEV Board’s Risk Management Committee, Chairman of AP Board’s<br />

Strategy Committee, and Member of AP Board’s Corporate Governance Committee. He graduated<br />

with a degree of Bachelor of Science in Business Administration (Major in Economics) from Gonzaga<br />

University, Spokane, Washington U.S.A.<br />

Mr. Bob D. Gothong, 55 years old, Filipino, has served as Vice Chairman of the Board of ATS since<br />

September 2002 upto December 2010 and a Director of ATS since 1997. Mr. Gothong was also a<br />

Chairman of the Risk Management Committee and a member of the Company’s Audit and Corporate<br />

Governance Committee of ATS in 2010. Chairman and Chief Executive Officer of One Wilson Place<br />

Holdings, Inc.; Director of Philippine National Oil Co.; Ramon Aboitiz Foundation, Inc., and Vice<br />

Chairman of Carlos A. Gothong Holdings, Inc. He graduated with a degree of Bachelor of Science in<br />

Commerce Major in Transportation and Utilities and Minor in Finance from the University of British<br />

Columbia, Vancouver, Canada.<br />

Mr. Francis Chua, 60 years old, Filipino, has served as an Independent Director of ATS since January<br />

2011. His current positions include Honorary Consulate General of the Republic of Peru in Manila;<br />

President and Eminent Adviser of the Philippine Chamber of Commerce and Industry; Chairman of the<br />

Philippine Chamber of Commerce and Industry Foundation, CLMC Group of Companies, and Green<br />

Army Philippines Network Foundation; President of DongFeng Automotive, Inc. and Philippine Satellite<br />

Corporation; Director of Philippine Stock Exchange, National Grid Corporation of the Philippines, Bank<br />

of Commerce, Basic Energy, and Overseas Chinese University; and Trustee of Xavier School<br />

Educational Trust Fund, and Adamson University. He graduated with a Bachelor of Science degree in<br />

Industrial Engineering the University of the Philippines.<br />

Atty. Amado R. Santiago III, 44 years old, Filipino, has served as the Corporate Secretary of ATS since<br />

December 2010. He is the Managing Partner of the Santiago & Santiago Law Offices and is engaged in<br />

the general practice of law. He specializes in corporate litigation, which includes corporate<br />

6

ehabilitation proceedings under the Securities and Exchange Commission Rules on Corporate<br />

Recovery, Interim Rules of Procedure on Corporate Rehabilitation and the Rules of Procedure on<br />

Corporate Rehabilitation. He is also engaged in the practice of taxation law. He received his Bachelor<br />

of Science degree in Management, major in Legal Management (1988) from the Ateneo de Manila<br />

University. He graduated from the Ateneo de Manila School of Law in 1992 and is a member of the<br />

Philippine Bar.<br />

Atty. Manuel Eduardo C. Carlos, 35 years old, Filipino, has served as the Assistant Corporate Secretary<br />

since December 2010. He is the Associate Lawyer of the Santiago & Santiago Law Offices. Under this<br />

law firm, he specializes in corporate mergers and acquisitions and corporate housekeeping. He is<br />

also engaged in the practice of taxation law. He acts as corporate counsel, director and/or corporate<br />

secretary/assistant corporate secretary of various corporate clients. He received his Bachelor of<br />

Science degree in Management, major in Legal Management (1997) from the Ateneo de Manila<br />

University. He graduated from the Ateneo de Manila School of Law in 2002 and is a member of the<br />

Philippine Bar.<br />

EXECUTIVE OFFICERS<br />

Ms. Lilian P. Cariaso, 51 years old, Filipino, Treasurer, Executive Vice President – Chief Finance<br />

Officer, Corporate Information Officer since 2004, and Chief Resource Officer since 2009. She has been<br />

with ATS since 2004. She is a Director of SuperCat Fast Ferry Corporation, Aboitiz One, Inc., Aboitiz<br />

Project TS Corporation and SQL Wizard. She graduated with a Bachelor of Science degree in<br />

Commerce, major in Accounting (Summa Cum Laude) from the University of San Carlos and earned<br />

her Masters degree in Business Management from the University of the Philippines.<br />

Ms. Susan V. Valdez, 50 years old, Filipino, Executive Vice President – Chief Executive Officer of the<br />

2GO Freight Division since 2004, and President and Chief Executive Officer of Aboitiz One, Inc. and<br />

Aboitiz One Distribution, Inc. since 2009. She has been with ATS since November 1981. She graduated<br />

with a Bachelor of Science degree in Commerce, major in Accounting (Cum Laude) from St. Theresa’s<br />

College and earned her Masters degree in Management, major in Business Management from the<br />

University of the Philippines. She also completed the Program for Management Development from<br />

Harvard Business School, Boston, U.S.A.<br />

Ms. Evelyn L. Engel, 58 years old, Filipino, Executive Vice President – Chief Executive Officer of the<br />

Passage Division since 2004 and President and Chief Executive Officer of ScanAsia Overseas, Inc. since<br />

2009. Her other positions include Director of Catena Services, Inc. and SQL Wizard, Inc. She has<br />

extensive experience in General Management with solid background on Sales and Marketing, Human<br />

Resource and Information Technology. She graduated with a Bachelor of Arts degree in Economics<br />

from St. Paul University.<br />

Mr. Rafael L. Sanvictores, 53 years old, Filipino, Senior Vice President for Passenger Services since<br />

2006. He has been with ATS since 1980. He graduated with a Bachelor of Arts degree in Economics<br />

from San Beda College.<br />

Mr. Wilmer A. Alfonso, 58 years old, Filipino, Vice President for Ports Services since 2006. He has been<br />

with ATS since January 1971. He holds the following positions: Chairman of Catena Services, Inc.,<br />

Attina Security Services Inc., and Vestina Security Services Inc., President of North Harbor Tugs Corp.;<br />

President of United South Dockhandlers, Inc. and President of Supersail Services Inc. Mr. Alfonso is a<br />

Certified Public Accountant. He graduated with a Bachelor of Science degree in Accounting from the<br />

University of San Carlos.<br />

Ms. Magdalena A. Anoos, 54 years old, Filipino, Vice President for Materials Management and has been<br />

with ATS since 2003. She graduated with a Bachelor of Science degree in Commerce, major in<br />

Accounting (Cum Laude) from University of San Carlos. She also completed the Senior Executive<br />

Program at Columbia Business School, New York, U.S.A. She received the ‘Division Governor of the<br />

Year’ award from the Philippine Toastmasters District 75 in 2005 and Advanced Toastmaster Gold<br />

award by Toastmasters International in 2006.<br />

7

Ms. Charity Joyce S.D. Marohombsar, 44 years old, Filipino, Vice President for Customer Interaction<br />

Center since 2003 and for RORO, and Vice President for Customer Management Group of ScanAsia<br />

Overseas, Inc. since 2009. She graduated with a Bachelor of Arts degree from the Ateneo de Naga<br />

University.<br />

Ms. Norissa L. L<br />

. Ridgwell, 55 years old, Filipino, Senior Vice President and Chief Operating Officer of<br />

2GO Freight Operations since 2009. She has been with ATS since 1994. She graduated with a Bachelor<br />

of Science degree in Commerce, major in Management from Silliman University.<br />

Ms. Shelley U. Rapes, 52 years old, Filipino, Vice President - Chief Information Officer since 2009. She<br />

has been with ATS since 1989. She graduated with a Bachelor of Science degree in Mathematics (Cum<br />

Laude) from the University of San Carlos, and finished the Management Development Program from<br />

the Asian Institute of Management<br />

Ms. Annacel A. Natividad, 41 years old, Filipino, Vice President and Chief Finance Officer of the<br />

Passage Division since 2005, and Chief Finance Officer of Scanasia since 2010. She has been handling<br />

the Risk Management Division since 2007. She has been with ATS since January 1998. She graduated<br />

with a Bachelor of Science degree in Commerce, major in Accounting from the University of Santo<br />

Tomas, and finished her Masters degree in Business Administration from De La Salle University-<br />

Graduate School of Business.<br />

Mr. Oscar Y. Go, 58 years old, Filipino, Vice President for Sales-Special Accounts since 2002. He has<br />

been with ATS since 2002. Prior to joining the company, he was Vice President of the Lorenzo Shipping<br />

Company. He graduated with a Bachelor of Science degree in Business Management from Colegio de<br />

San Juan de Letran.<br />

Mr. Joel Jesus M. Supan, 53 years old, Filipino, Vice President for Security, Safety and Compliance. He<br />

has been with ATS since 2004. He is the Founder and Proprietor of Stonewall Security Concepts;<br />

Director and President of Ethics Call System, Inc., and Founder of Balikatan ng mga Tanod ng Ari-Arian<br />

at Yaman (BANTAY). He graduated with a Bachelor of Science degree from the Philippine Military<br />

Academy in 1981.<br />

Ms. Ellen F. Bolus, 41 years old, Filipino, Vice President for 2GO Freight Operations since 2009. She<br />

has been with ATS since 1995. She graduated with a Bachelor of Science degree in Tourism from the<br />

University of the Philippines and earned her Masters degree in Business Administration from the<br />

Ateneo Graduate School of Business in 2003.<br />

Ms. Noemi G. Sebastian, 49 years old, Filipino, Vice President of Human Resources for Results and<br />

Quest Consulting Group since 2009, and Vice President of Corporate Communications since 2010. She<br />

has been with ATS since 2003. She graduated with a Bachelor of Science degree in Business<br />

Administration (Cum Laude) from the University of the Philippines.<br />

Mr. Andrew Jude D. Deyto, 39 years old, Filipino, Vice President for Sales and Marketing of the<br />

Passage Division since 2010. He has been with ATS since 1994. He graduated with a Bachelor of<br />

Science degree in Industrial Engineering from the Ateneo de Davao University, and completed the<br />

Masters degree in Business Administration of the Ateneo Regis Program from the Ateneo Graduate<br />

School of Business in 2002.<br />

Nomination Committee and Nominees for Election as Members of the Board of Directors<br />

The incumbent directors will be nominated as members of the Board of Directors for the ensuing year<br />

(2011-2012).<br />

In compliance with SEC Guidelines on the Nomination and Election of Independent Directors under SRC<br />

Rule 38, the Company Board created on February 26, 2003 a Nomination Committee (which was<br />

consolidated with the Compensation/Remuneration Committee in August, 2009.) In January 2011, the<br />

8

new composition of the Company’s Board appointed the following as Chairman and members of the<br />

Compensation/Remuneration and Nomination Committee:<br />

Chairman:<br />

Members:<br />

Mr. Sulficio O. Tagud, Jr.<br />

Mr. Mark E. Williams<br />

Ms. Michelle Lu<br />

The Compensation/Remuneration and Nomination Committee promulgated the guidelines which<br />

govern the conduct of the nomination of the members of the Company Board. It had pre-screened and<br />

short listed all candidates and came up with the following individuals as nominees for independent<br />

directors for the ensuing year (2011-2012):<br />

(1) Amb. Raul Rabe as nominated by Mr. Mark Williams<br />

(2) Mr. Francis Chua as nominated by Ms. Michelle Lu<br />

The nominating persons are not related to the nominees within the fourth degree of consanguinity.<br />

Further, the Committee approved on July 20, 2005 the Company’s Amended By-Laws incorporating the<br />

procedures for the nomination and election of Independent Directors under Rule 38 of the Securities<br />

Regulation Code, as the same may be amended from time to time.<br />

Period in Which Directors and Executive Officers Should Serve<br />

The directors and executive officers should serve for a period of one (1) year and until the election and<br />

qualification of their successors.<br />

Terms of Office of a Director<br />

The nine (9) directors shall be stockholders and shall be elected annually by the stockholders owning a<br />

majority of the outstanding common shares of the Registrant for a term of one (1) year and shall serve<br />

until the election and qualification of their successors.<br />

Any vacancy in the board of directors other than removal or expiration of term may be filled by a<br />

majority vote of the remaining members thereof at a meeting called for that purpose if they still<br />

constitute a quorum, and the director or directors so chosen shall serve for the unexpired term.<br />

Further, in April 2011, the Board approved a resolution to increase the number of directors from nine<br />

(9) to thirteen (13). The said proposal is still subject to the ratification by the Company’s stockholders<br />

during the upcoming annual stockholders’ meeting.<br />

Significant Employees<br />

The Corporation and its subsidiaries consider the contribution of every employee important to the<br />

fulfillment of its goals.<br />

Family Relationships<br />

Messrs. Enrique M. Aboitiz, Jr. and Jon Ramon Aboitiz are cousins and are related within the fourth<br />

degree of consanguinity.<br />

Other than the ones that are disclosed above, there are no other family relationships within the fourth<br />

degree of consanguinity known to the Registrant.<br />

Involvement in Certain Legal Proceedings<br />

To the knowledge and/or information of ATS, none of its nominees for election as directors, the present<br />

members of its Board of Directors or its executive officers, is presently or during the last five (5) years<br />

9

een involved in any legal proceeding in any court or government agency on the Philippines or<br />

elsewhere which would put to question their ability and integrity to serve ATS and its stockholders.<br />

With respect to its nominees for election as directors, the present members of its Board of Directors<br />

and its executive officers, the Company is not aware that during the past five (5) years up to even date<br />

of: (a) any bankruptcy petition filed by or against any business of which such person was a general<br />

partner or executive officer either at the time of the bankruptcy or within two years prior to that time;<br />

(b) any conviction by final judgment of such person in a criminal proceeding, excluding traffic violations<br />

and other minor offenses; (c) such person being subject to any order, judgment, or decree, not<br />

subsequently reversed, suspended or vacated, by any court of competent jurisdiction, domestic or<br />

foreign, permanently or temporarily enjoining, barring, suspending or otherwise limiting such person’s<br />

involvement in any type of business, securities, commodities or banking activities; and (d) such person<br />

being found by a domestic or foreign court of competent jurisdiction (in a civil action), the Commission<br />

or comparable foreign body, or a domestic or foreign exchange or other organized trading market or<br />

self regulatory organization, to have violated a securities or commodities law or regulation and the<br />

judgment has not been reversed, suspended, or vacated.<br />

Certain Relationships and Related Transactions<br />

In the ordinary course of business, the Registrant has transactions with subsidiaries, associates, and<br />

other related companies consisting of shipmanagement services, charter hire, management services,<br />

courier services, purchases of steward supplies, availment of stevedoring, arrastre, trucking, rental<br />

and repair services. The Registrant needs these services to complement its services to the freight and<br />

passage customers.<br />

The identification of the related parties transacting business with the Registrant and how the<br />

transaction prices were determined by the parties are discussed in Note 23 of the consolidated financial<br />

statements. The Registrant will continue to engage the services of these related parties as long as it is<br />

economically beneficial to both parties.<br />

The Corporation has no transaction during the last two years or proposed transaction to which it was<br />

or is to be a party in which any of its directors, officers, or nominees for election as directors or any<br />

member of the immediate family of any of the said persons had or is to have a direct or indirect<br />

material interest.<br />

Resignation or Refusal to Stand for Re-election election by Members of the Board of Directors<br />

No Director has declined to stand for re-election to the board of directors since the date of the last<br />

annual meeting of the Registrant because of a disagreement with the Registrant on matters relating to<br />

the Registrant operations, policies and practices.<br />

In December 2010, as a result of NENACO’s purchase of AEV’s and ACO’s shares in ATS, the following<br />

directors have tendered their resignations:<br />

1. Mr. Jon Ramon M. Aboitiz, Chairman of the Board; Compensation/Remuneration and Nomination<br />

Committee (but was re-appointed in January 2011 as director and Chairman of<br />

the Board)<br />

2. Mr. Enrique M. Aboitiz, Jr., Member, President and CEO; Risk Management Committee and<br />

Compensation/Remuneration and Nomination Committee (but re-appointed as<br />

director on the same date)<br />

3. Mr. Mikel E. Aboitiz, Member; Risk Management Committee<br />

4. Mr. Erramon I. Aboitiz, Member<br />

5. Mr. Bob D. Gothong, Member; Risk Management Committee (but re-appointed as director on the<br />

same date)<br />

6. Mr. Justo A. Ortiz, Member; Audit and Corporate Governance Committee<br />

7. Mr. Sabin M. Aboitiz, Member; Audit and Corporate Governance Committee<br />

8. Mr. Washington Z. Sycip, Independent Director; Audit and Corporate Governance<br />

10

Committee and Risk Management Committee<br />

9. Ms. Emily A. Abrera, Independent Director; Compensation/Remuneration and Nomination<br />

Committee<br />

Item 6. COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS<br />

The following table summarizes certain information regarding compensation paid or accrued during<br />

the last three fiscal years and to be paid in the ensuing fiscal year to the Registrant Chief Executive<br />

Officer and each of the Registrant four other most highly compensated executive officers:<br />

SUMMARY OF COMPENSATION TABLE<br />

Amounts in Thousands of Pesos (‘000s)<br />

TOP FIVE HIGHLY COMPENSATED EXECUTIVES:<br />

ENRIQUE M. ABOITIZ JR.* – CHIEF EXECUTIVE OFFICER<br />

EVELYN L. ENGEL – CHIEF EXECUTIVE OFFICER – PASSAGE AND<br />

PRESIDENT-CEO SCANASIA, INC.<br />

SUSAN V. VALDEZ – CHIEF EXECUTIVE OFFICER – FREIGHT AND<br />

PRESIDENT-CEO OF ABOITIZ ONE INC. GROUP<br />

LILIAN P. CARIASO – CHIEF FINANCE OFFICER, CORPORATE<br />

INFORMATION OFFICER AND CHIEF RESOURCE<br />

OFFICER<br />

NORISSA L. RIDGWELL – SVP-COO 2GO FREIGHT (2010 ONLY)<br />

CHARITY JOYCE MAROHOMBSAR – CUSTOMER CARE<br />

MANAGEMENT OF 2GO SCANASI A (2011 ONLY)<br />

All above named officers as a group<br />

All officers and directors as group unnamed<br />

SALARY<br />

BONUS<br />

(13 th and 14 th<br />

Months Pay)<br />

OTHER<br />

COMPENSATION<br />

2009 22,372 3,729 -<br />

2010 29,640 4,960 -<br />

Projected<br />

21,955 3,659 -<br />

2011<br />

2009 23,911 2,545 -<br />

2010 25,938 4,830 -<br />

Projected<br />

2011<br />

25,213 4,202 -<br />

The Company has no significant or special arrangements of any kind as regard to the compensation of<br />

all officers and directors other than the funded, noncontributory tax-qualified retirement plans<br />

covering all regular employees.<br />

Each director receives a monthly allowance of P80,000 except for the Chairman of the Board who<br />

receives P120,000 a month. Further, a per diem of P30,000 is given to each Director and P45,000 for<br />

the Chairman for every Board meeting attended. As agreed with NENACO, ATS’ parent company, such<br />

allowances and per diems will be shared equally by both companies whenever meetings are held on<br />

the same day.<br />

Except for the regular company retirement plan, which by its very nature will be received by the<br />

officers concerned only upon retirement from the Company, the above-mentioned directors and<br />

officers do not receive any profit sharing nor any other compensation in the form of warrants, options,<br />

bonuses, etc.<br />

Likewise, there are no standard arrangements that compensate directors directly or indirectly, for any<br />

services provided to the Company either as director or as committee member or both or for any other<br />

special assignments.<br />

Item 7. INDEPENDENT PUBLIC ACCOUNTANTS<br />

The accounting firm of SGV & Co. (SGV) has been ATS' Independent Public Accountant since year 1977.<br />

This is reckoned to be the approximate date based on the available records. Representatives of SGV<br />

will be present during the annual meeting and will be given the opportunity to make a statement if they<br />

so desire. They are also expected to respond to appropriate questions if needed.<br />

11

In August 2009, the Board of Directors of ATS approved the consolidation of its Audit Committee to the<br />

newly created Audit and Corporate Governance Committee. The incumbent members of the said<br />

Committee are Francis Chua as chairperson, Michelle Lu and Mark Williams as members, and Evan<br />

McBride and Geoffrey Seeto as ex-officio members.<br />

At its regular board meeting on April 23, 2009, the Board of Directors approved a resolution to<br />

delegate to the Board of Directors the authority to appoint the Company’s external auditors. The<br />

stockholders ratified the same resolution during its annual stockholders meeting.<br />

In compliance with SEC guidelines on the rotation of external auditors under its SRC Rule 68,<br />

Paragraph 3(b)(iv), ATS has already adopted and incorporated the said guidelines in its Code of<br />

Corporate Governance.<br />

Mr. Ladislao Z. Avila Jr. has been the signing partner since fiscal year 2006. He will be replaced<br />

starting fiscal year 2011 in compliance with the five years rotation requirement under SRC Rule 68,<br />

Paragraph 3(b)(iv).<br />

(1) External Audit Fees and Services<br />

Audit Fees<br />

Audit-Related Fees<br />

All Other Fees<br />

Estimates for<br />

December 31, 2011<br />

Year ended<br />

December 31, 2010<br />

P 1,000,000 P 1,000,000<br />

Year ended December<br />

31, 2009<br />

P 1,000,000<br />

TOTAL P 1,000,000 P 1,000,000 P 1,000,000<br />

Audit Fees<br />

This represents professional fees for financial assurance services rendered for the Company’s Annual<br />

Financial Statements, review and opinion for SEC Annual Report.<br />

Audit-Related Fees<br />

This represents professional fees for technology and security risk services rendered by the external<br />

auditor in connection with the Audit on Company’s Annual Financial Statements.<br />

All Other Fees<br />

This represents fees for services rendered in reviewing and issuing opinion with regards to the<br />

Company’s annual reportorial requirement with Maritime Industry Authority (MARINA).<br />

Audit services provided to the Company by external auditor, SGV, have been pre-approved by the Audit<br />

and Corporate Governance Committee. The Audit and Corporate Governance Committee has reviewed<br />

the magnitude and nature of these services to ensure that they are compatible with maintaining the<br />

independence of the external auditor.<br />

(2) Changes in and Disagreements With Accountants on Accounting and Financial Disclosure<br />

There was no event in the past years where SGV and the Company had any disagreements with regard<br />

to any matter relating to accounting principles or practices, financial statement disclosure or auditing<br />

scope or procedure.<br />

12

C. OTHER MATTERS<br />

Item 8. MERGERS, CONSOLIDATIONS, ACQUISITIONS AND SIMILAR MATTERS<br />

Investment in Supercat Fast Ferry Corporation<br />

In November 2010, the board of ATS approved a resolution to increase its investment in SFFC by<br />

350,000 common shares at a subscription price of P70 million thereby increasing its ownership from<br />

160,000 common shares to 510,000 common shares.<br />

SFFC is in the business of providing fast craft passenger services under the SuperCat brand name.<br />

Disposition of investments in ABOJEB, AJMSI, JMI and JMBVI<br />

In December 2010, the ATS’ board approved the sale of ATS’ 62.5% equity in Aboitiz Jebsen Bulk<br />

Transport Corporation, Aboitiz Jebsen Manpower Solutions, Inc. and Jebsen Maritime, Inc, to Aboitiz<br />

Equity Ventures, Inc. (AEV) for a total price of P 355,908,432. The companies are engaged in bulk<br />

transport, manning and crew management, and ship management.<br />

The board also approved the sale of the 50% interest of ATS in Jebsen Maritime (BVI) Limited, a<br />

chartering company, to Aboitiz & Company, Inc. (ACO) for P 44,000,000.<br />

The sale of ATS’ shareholdings in the Aboitiz Jebsen companies is in line with the sale of AEV’s and<br />

ACO’s respective shares in ATS. The said sale of AEV’s and ACO’s investments in ATS, however, does<br />

not include its interests in its joint venture companies with the Jebsen Group of Norway.<br />

Item 9. ACTION WITH RESPECT TO REPORTS<br />

The minutes of the last special stockholders’ meeting held on July 15, 2010 and the Annual Report of<br />

Management for the year ended December 31, 2010 will be submitted to the stockholders for their<br />

approval.<br />

Item 10. MATTERS NOT REQUIRED TO BE SUBMITTED<br />

All corporate actions to be taken up at the annual stockholders’ meeting this June 22, 2011 will be<br />

submitted to the stockholders of the Registrant for their approval in accordance with the requirements<br />

of the Corporation Code.<br />

Item 11. AMENDMENT OF O<br />

ARTICLES OF INCORPORATION AND BY-LAWS<br />

For approval of the stockholders this June 22, 2011 meeting is the resolution of the Board to amend<br />

the First Article of the Articles of Incorporation of the Company as follows (proposed amendment<br />

underscored):<br />

"FIRST: That the name of the corporation shall be<br />

ATS CONSOLIDATED (ATSC), INC.<br />

(formerly "Aboitiz Transport System (ATSC) Corporation")<br />

Doing business under the name and style of "ATS”, “2GO”, “2GO Together”, “SuperFerry", “SuperFerry<br />

Travel and Leisure”, and “Cebu Ferries”<br />

This amendment is in relation to the terms of the acquisition by NENACO of AEV’s and ACO’s<br />

shareholdings in ATS, wherein the Aboitiz family required NENACO, within a reasonable period, to<br />

13

emove any reference of the name “Aboitiz” from the corporate name, letterheads and other corporate<br />

profiles of ATS.<br />

Further, the Board resolved to amend the Second Article of the Articles of Incorporation of the<br />

Company to include the following purposes:<br />

(a) The business of rendering technical services requirement to customers nationwide for<br />

refrigerated marine container vans and related equipments or accessories including but not<br />

limited to repair and maintenance, equipment rental and leasing, technical consultancy and<br />

training, selling of spare parts, components and accessories, service contracting and to act as<br />

service agent on behalf of the various domestic and foreign container manufacturer with<br />

services but not limited to performing warranty and non- warranty repair services, selling of<br />

service parts, components and accessories, and consultancy services; and<br />

(b) To conduct and transact any and all lawful business, and to do or cause to be done any one or<br />

more of the acts and things herein set forth as its purposes, within or without the Philippines,<br />

and in any and all foreign countries, and to do everything necessary, desirable or incidental to<br />

the accomplishment of the purposes or the exercise of any one of more of the powers herein<br />

enumerated, or which shall at any time appear conducive to or expedient for the protection or<br />

benefit of this corporation.<br />

The purpose of the above-mentioned amendment is to include the business purposes of Reefer Van<br />

Specialist, Inc., which was merged into ATS.<br />

The Board also resolved to amend the Sixth Article of the Articles of Incorporation and Section 2,<br />

Article III of the By-Laws, of the Company, to increase the number of directors from nine (9) to thirteen<br />

(13). The purpose of the said amendments is to mirror the board of ATS with that of its parent<br />

company.<br />

The foregoing resolutions will be submitted to the stockholders of the Company during the June 22,<br />

2011 stockholders’ meeting for ratification.<br />

Item 12. OTHER PROPOSED ACTIONS<br />

The following matters shall likewise be submitted, for ratification, to the stockholders representing at<br />

least a majority of the outstanding voting capital stock of the Registrant:<br />

a) Ratification of all acts of the Board of Directors and Board Committee for the period<br />

covering May 28, 2010 through April 28, 2011 adopted primarily in the ordinary course of<br />

business (including those which have been the subject of previous disclosures to the<br />

Securities and Exchange Commission and the Philippine Stock Exchange during said<br />

period), such as:<br />

i. approvals for the acquisition, lease, disposition of vessels as well as other personal<br />

and/or real properties;<br />

ii. approval to lease space for CDO Ticketing Office;<br />

iii. appointment of lawyers and/or attorneys-in-fact in connection with legal<br />

proceedings (including amicable settlement proceedings) affecting the Registrant<br />

and/or its assets;<br />

iv. appointment of replacement to directors/officers who rendered their respective<br />

resignations;<br />

v. appointment of authorized representative in negotiations with Keppel Cebu<br />

Shipyard, Inc.;<br />

vi. confirmation of authorized representative appointed in dealing with PDTC;<br />

vii. approval for the availment of certain credit facilities, execution of a collateral trust<br />

agreement and appoinment of UBP as trust agent;<br />

14

viii. approval for treasury matters related to opening of accounts and bank transactions<br />

(including removal of/revisions to authorized bank signatories);<br />

ix. authority to apply for VAT exemption under RA 9295;<br />

x. authority to apply for local government permits;<br />

xi. authority to apply for registration of certain trademarks;<br />

xii. authority to enter into asset swap transaction;<br />

xiii. authority to subscribe additional shares in SFFC;<br />

xiv. authority to accept BOI terms and conditions;<br />

xv. authority to enter shipping agreements with Nestle Philippines, Inc.;<br />

xvi. appointment of authorized representatives to make purchases for loyalty awards<br />

and prizes;<br />

xvii. authority to sell its investments in ABOJEB, AJMSI, JMI and JMBVI; and<br />

xviii. authority to declare cash dividends.<br />

xix. approval of the 2011 Budget;<br />

xx. acceptance of pre-approval’s terms and conditions of the company’s registration<br />

with BOI;<br />

xxi. general authority of the president to pass resolutions for day-to-day operations of<br />

the company;<br />

xxii. approval of the 2010 audited financial statements;<br />

xxiii. approval for the availment of credit facilities with BDO;<br />

xxiv. approval of the execution of suretyship in favor of BPI;<br />

b) Minutes of Stockholders Meeting held last July 15, 2010<br />

During the Special Stockholders Meeting held, stockholders representing at least twothirds<br />

of the outstanding capital stock of the Corporation approved the statutory merger of<br />

ATS and its wholly owned subsidiary Reefer Van Specialists Inc. with ATS as the surviving<br />

corporation.<br />

Item 13. VOTING PROCEDURES<br />

As to each matter, which is to be submitted to a vote of security holders, furnish the following<br />

information:<br />

(a)<br />

Vote required for Approval<br />

The affirmative vote of stockholders representing at least a majority of the<br />

outstanding voting common shares of the Registrant is required for the approval<br />

and/or ratification:<br />

i. Minutes of Previous Special Stockholders’ Meeting;<br />

ii.<br />

iii.<br />

iv.<br />

Management Annual Reports for the preceding year;<br />

Election of the Board of Directors; and<br />

All Acts and Resolutions of the Board of Directors and Management since May<br />

28, 2010.<br />

The affirmative vote of stockholders representing at least two-thirds (2/3) of the<br />

outstanding capital stock of the Registrant is required for the approval and/or<br />

ratification of the following matters:<br />

i. Amendments to the First, Second and Sixth Articles of the Company’s Articles<br />

of Incorporation, changing the Company’s corporate name, business purpose,<br />

and increase the number of directors;<br />

15

ii.<br />

Amendment of Section 2, Article III of the Company’s By-Laws, to increase the<br />

number of directors;<br />

(b)<br />

Method by which Votes will be counted<br />

At each meeting of the stockholders, every stockholder shall be entitled to vote in<br />

person or by proxy, for each share of stock held by him, which has voting power upon<br />

the matter in question. As provided in Section 7, Article II of the By-laws of the<br />

Registrant, except upon demand by any stockholder, the votes upon any question<br />

before the meeting, except with respect to procedural questions that shall be<br />

determined by the Chairman of the meeting, shall be by viva voce or show of hand.<br />

The method and manner of counting the votes of shareholders shall be in accordance<br />

with the general provision of the Corporation Code of the Philippines. The counting of<br />

votes shall be witnessed by representatives from the Company’s external auditor,<br />

SGV, stock and transfer agent Securities Transfer Services, Inc. (STSI) and the<br />

Company’s Corporate Secretary.<br />

16

SIGNATURE PAGE<br />

After reasonable inquiry and to the best of my knowledge and belief, I certify that the<br />

information set forth in this report is true, complete and correct. This report is signed in the<br />

City of Manila on May 24, 2011.<br />

Lilian P. Cariaso<br />

Corporate Information Officer<br />

17

MANAGEMENT REPORT<br />

I. CONSOLIDATED AUDITED FINANCIAL STATEMENTS<br />

1<br />

The Consolidated Audited Financial Statements for the year ended and as of December 31, 2010 are<br />

attached to this report.<br />

II. DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURES<br />

There was no event in the past years where SGV and the Corporation had any disagreements with<br />

regard to any matter relating to accounting principles or practices, financial statement disclosure or<br />

auditing scope or procedure.<br />

III. MANAGEMENT’S DISCUSSION AND ANALYSIS<br />

Key Performance Indicators (KPI)<br />

The following KPI’s are used to evaluate the financial performance of ATS and its subsidiaries:<br />

a. Revenues – ATS revenues are mainly composed of freight and passage revenues and they are<br />

recognized when the related services are rendered. Total Revenue for the three months ended<br />

March 31, 2011 is P3.0 billion. Further, in 2010, total revenue is P11.6 billion compared to P10.5<br />

billion in 2009.<br />

b. Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) - is calculated by adding<br />

back interest expense, amortization and depreciation into income before income tax, excluding<br />

extraordinary gains or losses. EBITDA for March 31, 2011 is P115 million while in 2010, the<br />

Company’s EBITDA is P742million.<br />

c. Income before income tax (IBT)<br />

– is the earnings of the company before income tax expense. The<br />

Loss Before Income Tax for 2010 is P1.5 billion, 326% lower compared to P679.0 million in 2009.<br />

ATS reflected close to P897 million other charges brought about by Impairment loss on ships in<br />

operation and finance costs. The Loss Before Income Tax for March 31, 2011 is P320.3 million.<br />

d. Debt-to<br />

to-equity ratio – is determined by dividing total liabilities over stockholders’ equity. ATS’<br />

debt-to-equity ratio in 2010 is 2.14:1:00. ATS’ debt-to-equity ratio in 2011 is 2.37:1:0. Total<br />

liabilities increased by P304 million due to additional borrowings and Total equity stood at P3. 7<br />

billion or 7% lower compared to 2010 due to the loss for the first quarter of 2011.<br />

e. Current ratio – is measured by dividing total current assets by total current liabilities. The<br />

Company’s current ratio in 2010 is 0.56:1:00. Further, the Company’s current ratio as of March 31,<br />

2011 is 1.05:1:00. Total current assets is P5 billion or 6% higher than 2010. Total current liabilities<br />

are P4.7 billion or 43% decrease compared to 2010.<br />

The following table shows comparative figures of the Top Five key performance indicators (KPI) for<br />

2010, 2009, and 2008 (amounts in millions except for the financial ratios) based on the consolidated<br />

financial statements of ATS as well as each of its subsidiaries:<br />

Consolidated ATS and Subsidiaries<br />

March 31, 2011 Dec. 31, 2010 Dec. 31, 2009 Dec. 31, 2008<br />

Revenues 3,048 11,611 10,510 10,273<br />

EBITDA (a) 115 742 1,394 944<br />

IBT (b) (320) (1,536) 679 119<br />

Debt-to-Equity Ratio (c) 2.37:1.0 2.14:1.00 1.05:1.00 1.1:1.00<br />

Current Ratio (d) 1.05:1.00 0.56:1.00 0.9:1.00 0.9:1.00<br />

18

Consolidated Aboitiz One, Inc and Subsidiaries<br />

Dec. 31, 2010 Dec. 31, 2009 Dec. 31, 2008<br />

Revenues 4,770 3,876 2,987<br />

EBITDA (a) 317 210 219<br />

IBT (b) 216 191 139<br />

Debt-to-Equity Ratio (c) 3.34:1.00 4.0:1.0 3.9:1.0<br />

Current Ratio (d) 0.9:1.00 0.9:1.0 0.9:1.0<br />

Supercat Fast Ferry Corporation<br />

Dec. 31, 2010 Dec. 31, 2009 Dec. 31, 2008<br />

Revenues 599 443 377<br />

EBITDA (a) 219 147 42<br />

IBT (b) 27 79 (19)<br />

Debt-to-Equity Ratio (c) 2.3:1.00 4.9:1.0 11.7:1.0<br />

Current Ratio (d) 0.1:1.0 0.1:1.00 0.1:1.0<br />

MCC Transport Philippines, Inc.<br />

Dec. 31, 2010 Dec. 31, 2009 Dec. 31, 2008<br />

Revenues 1050 966 863<br />

EBITDA (a) 126 197 (132)<br />

IBT (b) 137 195 (131)<br />

Debt-to-Equity Ratio (c) 2.20:1.00 6.34:1.00 -6.81:1.00<br />

Current Ratio (d) 1.46:1.00 1.18:1.00 0.87:1.00<br />

a) Earnings before interest, taxes, depreciation and amortization (calculated by adding back<br />

interest expense and amortization and depreciation into income before income tax, excluding<br />

extraordinary gains and losses).<br />

b) Income before income tax<br />

c) Total liabilities / total stockholders’ equity<br />

d) Total current assets / total current liabilities<br />

Quarter Ended March 31, 2011<br />

Consolidated Income Statement<br />

ATS’ first quarter 2011 revenues reached P3.0 billion. Total revenues reflects a 3% decline versus last<br />

year since 2010 still includes the Aboitiz Jebsen Group of Companies, including international ship<br />

chartering , shipmanagement and crewing businesses.<br />

In December 2010, ATS then principal shareholders, Aboitiz Equity Ventures, Inc. (AEV) and Aboitiz and<br />

Company (ACO), sold their combined shareholdings of 93.2% in ATS to Negros Navigation (NENACO)<br />

for a price of P1.8813 per share or a total of P4.3 billion. The sale however excluded the Aboitiz Jebsen<br />

group of companies. The Company sold its 62.5% equity stake in each of Aboitiz Jebsen Bulk<br />

Transport Corporation, Aboitiz Jebsen Manpower Solutions, Inc. and Jebsen Maritime Inc. to AEV for a<br />

total price of P 355.9 million. .It also sold its 50% equity stake in Jebsen Management (BVI) Limited to<br />

AEV for P 44.0 million. Buyers AEV and ACO paid the full price last January 2011.<br />

Local freight business of ATS reflected a 6% increase versus last year as both volumes and freight<br />

rates were higher. Similarly, passage business increased 7%. ATS has all 18 vessels operating during<br />

the quarter. Last year, three of the Company’s large SuperFerry vessels were under maintenance and<br />

drydocking, limiting its operating capacity.<br />

Supply chain business continues to grow with revenues from the sale of goods generated by the<br />

trading business posting a 32% increase due to a rise in number of principals.<br />

19

Vessel fuel costs, the Company’s single largest expense, posted a 21% increase due to higher fuel<br />

prices and volume. ATS has responded by implementing upward rate adjustments to its freight rates.<br />

Another set of adjustments are set to be applied during the second quarter of the year. Terminal<br />

expenses increased because of higher transshipment and outside service expenses. Cost of sales also<br />

increased from higher sale of goods. 2010 overhead and charter hire expenses includes those relating<br />

to the sold international ship charter business.<br />

The rise in expenses coupled by higher finance costs from higher debt contributed to a P228 million<br />

loss.<br />

Earnings per Share<br />

Earnings Per Share is computed by dividing Net Income Attributable to Equity Holders of the Parent<br />

over weighted average number of common shares outstanding for the year. Earnings per share for the<br />

first three months of 2011 stood at (P0.09)/share compared to (P0.06)/share last year.<br />

The figures above are in P’MM except otherwise indicated<br />

Other changes (+/-5% or more) in the financial statement not covered in the above discussion<br />

None.<br />

Balance Sheet<br />

Current assets reached close to P5.0 billion. Receivables of P2.7 billion posted an 8% increase<br />

brought about by higher other trade receivables. Property and equipment reduced by P299 million to<br />

total P5.8 billion largely due to depreciation.<br />

Interest bearing debt rose P1.3 billion to reach P5.3 billion in March 2011. P4.0 billion of short term<br />

debt was refinanced to long term. Accounts payable of P3.4 billion lowered by 22% as last year’s dry<br />

20

docking costs of vessels are being settled. Total equity of P3.7 billion decreased by P248 million or 6%<br />

due to lower retained earnings brought about by losses incurred during the first quarter of 2011.<br />

The figures above are in P’MM except otherwise indicated<br />

Other changes (+/-5% or more) in the financial statement not covered in the above discussion<br />

None.<br />

Cashflow Statement<br />

ATS borrowed funds to pay down its payables. Total capital expenditures of P346 million is much lower<br />

versus P1.3 billion last year as most of the vessels in 2010 were on scheduled drydocking and<br />

maintenance and there were vessel acquisitions last year. Cash and cash equivalents at the end of the<br />

period stood at P863.4 million.<br />

21

Fiscal Year 2010 vs. 2009<br />

Consolidated Income Statement<br />

Aboitiz Transport System (ATSC) Corporation (ATS), for the most part of 2010, operated on limited<br />

capacity as most of its fleet was on scheduled dry-docking and maintenance.<br />

Consolidated revenues increased by P1.1 billion compared to the previous year to reach P11.6 billion.<br />

Revenue from supply chain solutions, specifically trading, contributed to higher revenues overall.<br />

Local freight business also registered an increase of 1%, contributing a total of P5.3 billon in 2010.<br />

The market was being served by chartering freighter vessels in the absence of its own vessels that<br />

were on drydock and maintenance. Freight utilization reached 94% on SuperFerry vessels.<br />

2GO has fully integrated its total supply chain solutions business, the objective of which is to provide a<br />

more seamless solution to clients. Both Zoom in Packages (ZIP) and Reefer Van Specialists (RVSI)<br />

have been merged with ATS. ZIP’s business focus is on full container load (FCL) and loose container<br />

load (LCL) cargo while RVSI focuses on the cold chain business, which involves the transport of frozen<br />

and perishable goods. Merging these companies is seen to result in cost efficiencies and better<br />

synergies and ultimately serving customers better.<br />

Passenger business, inclusive of auxiliary revenues, reduced by P59 million or 3% to register at P2.18<br />

billion revenues from P2.24 billion in 2009. It was able to however, maximize its limited operating<br />

capacity achieving load factors of 79%.<br />

Total cost and expenses reached P12.2 billion, 21% higher than 2009. This is largely brought about by<br />

higher fuel expense as a result of rising average fuel prices. Given the uncertain fuel price behavior,<br />

ATS continues to undertake various initiatives to mitigate its negative impact including the use of less<br />

expensive type of fuel. Terminal expenses increased due higher outside services costs. The<br />

expanding trading business also contributed to higher cost of sales.<br />

ATS registered a P808.7 million Net Loss Attributable to Holders of the Parent. ATS booked a onetime<br />

Impairment loss on ships in operation of P778.8 million. Finance costs of P228.8 million are<br />

substantially higher versus last year from increased interest bearing loans. ATS borrowed funds to<br />

finance the purchase of three roll-on roll-off passenger vessels and two fast crafts. ATS also<br />