Pioneer Independence Fund - Pioneer Investments

Pioneer Independence Fund - Pioneer Investments

Pioneer Independence Fund - Pioneer Investments

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

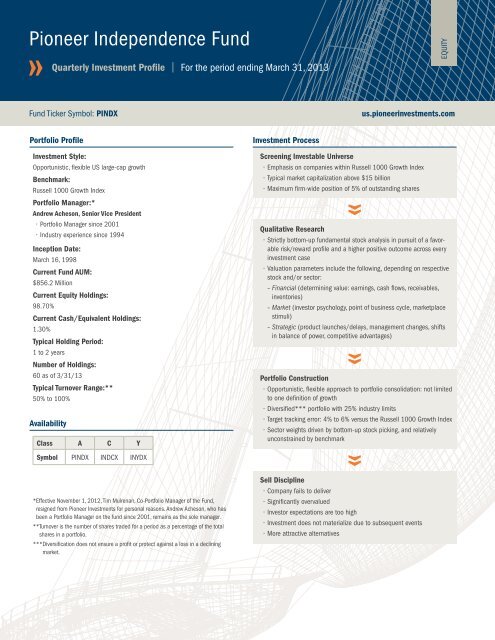

<strong>Pioneer</strong> <strong>Independence</strong> <strong>Fund</strong><br />

Quarterly Investment Profile | For the period ending March 31, 2013<br />

EQUITY<br />

<strong>Fund</strong> Ticker Symbol: PINDX<br />

us.pioneerinvestments.com<br />

Portfolio Profile<br />

Investment Style:<br />

Opportunistic, flexible US large-cap growth<br />

Benchmark:<br />

Russell 1000 Growth Index<br />

Portfolio Manager:*<br />

Andrew Acheson, Senior Vice President<br />

• Portfolio Manager since 2001<br />

• Industry experience since 1994<br />

Inception Date:<br />

March 16, 1998<br />

Current <strong>Fund</strong> AUM:<br />

$856.2 Million<br />

Current Equity Holdings:<br />

98.70%<br />

Current Cash/Equivalent Holdings:<br />

1.30%<br />

Typical Holding Period:<br />

1 to 2 years<br />

Number of Holdings:<br />

60 as of 3/31/13<br />

Typical Turnover Range:**<br />

50% to 100%<br />

Availability<br />

Class A C Y<br />

Investment Process<br />

Screening Investable Universe<br />

• Emphasis on companies within Russell 1000 Growth Index<br />

• Typical market capitalization above $15 billion<br />

• Maximum firm-wide position of 5% of outstanding shares<br />

Qualitative Research<br />

• Strictly bottom-up fundamental stock analysis in pursuit of a favorable<br />

risk/reward profile and a higher positive outcome across every<br />

investment case<br />

• Valuation parameters include the following, depending on respective<br />

stock and/or sector:<br />

– Financial (determining value: earnings, cash flows, receivables,<br />

inventories)<br />

– Market (investor psychology, point of business cycle, marketplace<br />

stimuli)<br />

– Strategic (product launches/delays, management changes, shifts<br />

in balance of power, competitive advantages)<br />

Portfolio Construction<br />

• Opportunistic, flexible approach to portfolio consolidation: not limited<br />

to one definition of growth<br />

• Diversified*** portfolio with 25% industry limits<br />

• Target tracking error: 4% to 6% versus the Russell 1000 Growth Index<br />

• Sector weights driven by bottom-up stock picking, and relatively<br />

unconstrained by benchmark<br />

Symbol PINDX INDCX INYDX<br />

*Effective November 1, 2012, Tim Mulrenan, Co-Portfolio Manager of the <strong>Fund</strong>,<br />

resigned from <strong>Pioneer</strong> <strong>Investments</strong> for personal reasons. Andrew Acheson, who has<br />

been a Portfolio Manager on the fund since 2001, remains as the sole manager.<br />

**Turnover is the number of shares traded for a period as a percentage of the total<br />

shares in a portfolio.<br />

***Diversification does not ensure a profit or protect against a loss in a declining<br />

market.<br />

Sell Discipline<br />

• Company fails to deliver<br />

• Significantly overvalued<br />

• Investor expectations are too high<br />

• Investment does not materialize due to subsequent events<br />

• More attractive alternatives

<strong>Pioneer</strong> <strong>Independence</strong> <strong>Fund</strong> (PINDX)<br />

For the period ending March 31, 2013<br />

Sector Weighting<br />

Information Technology<br />

27.29%<br />

28.95%<br />

Health Care<br />

Consumer Staples<br />

Consumer Discretionary<br />

13.16%<br />

12.85%<br />

13.04%<br />

12.92%<br />

12.08%<br />

16.87%<br />

Energy<br />

Industrials<br />

Financial<br />

Materials<br />

4.22%<br />

5.46%<br />

4.86%<br />

3.82%<br />

3.89%<br />

<strong>Pioneer</strong> <strong>Independence</strong> <strong>Fund</strong> A<br />

11.95%<br />

11.91%<br />

12.94%<br />

Russell 1000 Growth Index<br />

Source: <strong>Pioneer</strong> <strong>Investments</strong> Market Research<br />

Characteristics<br />

Top Ten Holdings<br />

Portfolio<br />

Index<br />

Sector<br />

Portfolio<br />

Asset (MM) $856 -<br />

Median Market Cap. (MM) $30,845 $7,113<br />

Weighted Market Cap. (MM) $77,532 $93,857<br />

Average Price/Earnings Ratio (Trailing) 26 25<br />

Average Price/Earnings Ratio (Forecast) 21 20<br />

Price/Book Ratio 6 11<br />

Number of Holdings 60 574<br />

Price/Earnings refer to the price of a stock divided by its earnings per share. It reflects<br />

weighted average of trailing 12-month price-to-earnings ratios of portfolio holdings.<br />

Average Price/Earnings ratio (Forecast) reflects the current price of a stock divided by<br />

the estimated one year projection of its earnings per share. Price/Book Ratio is the<br />

ratio of a stock’s price to its book value per share.<br />

The portfolio is actively managed and current holdings and characteristics may be<br />

different. The holdings listed should not be considered recommendations to buy or sell<br />

any particular security listed.<br />

Apple Information Technology 6.16%<br />

CVS Caremark Consumer Staples 3.33%<br />

Precision Castparts Industrials 3.00%<br />

Celgene Health Care 2.90%<br />

Qualcomm Information Technology 2.84%<br />

Mastercard Information Technology 2.81%<br />

Vertex Pharmaceutical Health Care 2.77%<br />

Anadarko Petroleum Energy 2.63%<br />

United Technologies Industrials 2.52%<br />

EMC Information Technology 2.50%<br />

Total Percentage of Portfolio 31.46%<br />

Source: <strong>Pioneer</strong> <strong>Investments</strong> Market Research

EQUITY<br />

<strong>Fund</strong> Performance as of March 31, 2013<br />

Call 1-800-225-6292 or visit us.pioneerinvestments.com for the most recent month-end performance results. Current performance may be lower or higher than the performance<br />

data quoted. The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares,<br />

when redeemed, may be worth more or less than their original cost. NAV results represent the percent change in net asset value per share. POP returns reflect deduction of maximum<br />

5.75% sales charge. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will<br />

differ. Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers fund performance would be lower. Waivers may not be in effect for<br />

all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.<br />

This material is intended for use with registered investment advisors who sell shares at net asset value.<br />

Calendar Year Returns (%) Class A Shares Average Annual Returns (%)<br />

Life<br />

YTD 2012 2011 2010 2009 2008 1-Year 3-Year 5-Year 10-Year<br />

3/16/98<br />

<strong>Pioneer</strong> <strong>Independence</strong> <strong>Fund</strong> A at NAV 8.75 13.29 -2.14 14.36 43.06 -48.76 6.45 10.12 4.31 7.29 4.21<br />

<strong>Fund</strong> at POP 2.50 6.77 -7.80 7.77 34.63 -51.76 0.30 7.96 3.08 6.65 3.80<br />

Russell 1000 Growth Index 9.54 15.26 2.64 16.71 37.21 -38.44 10.09 13.06 7.30 8.62 3.25<br />

MSTAR Large Growth Average 8.79 15.34 -2.46 15.53 35.68 -40.90 8.43 10.82 5.42 8.23 3.40<br />

Gross Expense Ratio: 1.27% Net Expense Ratio: 1.25%<br />

The Net Expense ratio reflects contractual expense limitations currently in effect through 5/1/2013 for Class A Shares. There can be no assurance that <strong>Pioneer</strong> will extend the expense<br />

limitations beyond such time. Please see the prospectus and financial statements for more information.<br />

Volatility/Return Comparison<br />

5-Year Period Ended March 31, 2013<br />

9%<br />

Return<br />

Standard<br />

Deviation<br />

6%<br />

3%<br />

0%<br />

0% 10% 20% 30% 40%<br />

Standard Deviation %<br />

5-Year Upside/Downside<br />

Return %<br />

◆<br />

Class A Shares at NAV as of March 31, 2013<br />

130%<br />

120%<br />

H <strong>Pioneer</strong> <strong>Independence</strong> <strong>Fund</strong> A 4.31% 23.30%<br />

u Russell 1000 Growth Index 7.30% 19.03%<br />

n MSTAR Large Growth Average 5.42% 19.71%<br />

Source: Morningstar<br />

Russell 1000 Growth Index measures the performance of large-cap U.S. growth stocks.<br />

Morningstar (MSTAR) Large Growth Average measures the performance of funds in the<br />

large-cap universe. The Morningstar Large Growth category represents the performance<br />

of large growth funds tracked by Morningstar.<br />

Indices are unmanaged and their returns assume reinvestment of dividends and,<br />

unlike mutual fund returns, do not reflect any fees or expenses associated with<br />

a mutual fund. It is not possible to invest directly in an index.<br />

Standard Deviation–a measure of return variability (risk), above and below an average<br />

rate of return. A higher standard deviation suggests more variability in returns from<br />

quarter to quarter.<br />

Up Capture<br />

vs. Market<br />

Down Capture<br />

vs. Market<br />

H <strong>Pioneer</strong> <strong>Independence</strong> <strong>Fund</strong> A 115.49% 131.34%<br />

u Russell 1000 Growth Index 100.00% 100.00%<br />

n MSTAR Large Growth Average 99.33% 108.56%<br />

Upside %<br />

110%<br />

100%<br />

◆<br />

90%<br />

90% 100% 110% 120% 130%<br />

Downside %<br />

140%<br />

Source: Morningstar<br />

Up Market/Down Market – a measure of relative performance versus an index during<br />

either those quarters when the index had only positive returns or those periods where the<br />

index had only negative returns. An up market ratio of 110% suggests outperformance of<br />

the index by 10% during quarters with positive returns. Contrarily, a down market ratio of<br />

90% suggests outperformance of the index by 10% during quarters with negative returns.<br />

The performance data quoted represents past performance, which is no guarantee<br />

of future results. Investment return and principal value will fluctuate, and shares,<br />

when redeemed, may be worth more or less than their original cost. NAV results<br />

represent the percent change in net asset value per share. Returns would have been<br />

lower had sales charges been reflected.

Risk Measures (5 Years)<br />

Alpha<br />

Tracking<br />

Error<br />

Information<br />

Ratio<br />

Beta<br />

R-Squared<br />

Sharpe<br />

Ratio<br />

Sortino<br />

Ratio<br />

Standard<br />

Deviation<br />

<strong>Pioneer</strong> <strong>Independence</strong> <strong>Fund</strong> A -3.49 7.13 -0.42 1.18 92.81 0.29 0.40 23.30<br />

Russell 1000 Growth Index - - - 1.00 100.00 0.45 0.63 19.03<br />

Source: Morningstar<br />

Alpha–incremental return generated versus an index after accounting for volatility in the form<br />

of beta. A positive alpha suggests risk-adjusted value added by the money manager versus<br />

the index.<br />

Beta–a measure of volatility (risk) compared to that of an appropriate index. For example,<br />

a beta of 1.2 suggests 20% more volatility in returns than the benchmark index, which is<br />

assigned a beta of 1.0.<br />

Information Ratio–a measure of portfolio management’s performance against risk and<br />

return relative to a benchmark or alternative measure.<br />

Tracking Error–reported as a “standard deviation percentage” difference – the difference<br />

between the return received on an investment and that of the investment’s benchmark.<br />

R-Squared–a measure of the reliability of beta and alpha, indicates whether the comparison<br />

benchmark is appropriate. An R-Squared rating above 70 is desirable.<br />

Sharpe Ratio–a measure of excess return per unit of risk, as defined by standard deviation.<br />

A higher Sharpe ratio suggests better risk-adjusted performance.<br />

Sortino Ratio –measure of excess return per unit of risk based on downside semi-variance,<br />

instead of total risk (standard deviation) used by the Sharpe Ratio. Since the Sortino Ratio<br />

takes into account only the downside size and frequency of returns, it measures the reward to<br />

negative volatility trade-off.<br />

Standard Deviation–a measure of return variability (risk), above and below an average rate of<br />

return. A higher standard deviation suggests more variability in returns from quarter to quarter.<br />

Lipper Rankings<br />

as of 3/31/13<br />

1-Year 3-Year 5-Year 10-Year<br />

Rank/Total Percentile Rank/Total Percentile Rank/Total Percentile Rank/Total Percentile<br />

<strong>Pioneer</strong> <strong>Independence</strong> <strong>Fund</strong> A 429<br />

386<br />

388<br />

233<br />

62%<br />

63%<br />

71%<br />

Large Cap Growth <strong>Fund</strong>s 702 621 553 377<br />

62%<br />

Lipper rankings do not take into account sales charges. Rankings are based on past performance, which is no guarantee of future results. Rankings are based on average annual total returns<br />

for the 1, 3, 5, 10 year/life periods in the Lipper Categories listed above. Keep in mind, a high relative ranking does not always mean the fund achieved a positive return during the period.<br />

Lipper performance rankings above apply to Class A shares. Other share classes are available for which performance and expenses will differ.<br />

Morningstar Ratings<br />

Large Growth <strong>Fund</strong>s<br />

Overall Rating<br />

3-Year 5-Year 10-Year<br />

Rank/Total Rating Rank/Total Rating Rank/Total Rating<br />

Load Waived HH 953 HH 899 HH 609 HH<br />

Load Reflected H 1482 HH 1278 H 856 H<br />

Please see a prospectus for complete information pertaining to load waived eligibility (such as large purchases or certain types of group plan participants). Morningstar load waived ratings<br />

are based on the standard Morningstar rating methodology with the exception that they are recalculated without the effects of the front load sales charge. Morningstar proprietary ratings<br />

reflect risk-adjusted performance as of 3/31/13. For each fund with at least a three-year history, Morningstar calculates a Morningstar Rating based on a Morningstar Risk-Adjusted Return<br />

measure that accounts for variation in a fund’s monthly performance (including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and<br />

rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and<br />

the bottom 10% receive 1 star. (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages.)<br />

The Overall Morningstar Rating for a fund is derived from a weighted-average of the performance figures associated with its three-, five- and ten-year (if applicable) Morningstar Rating<br />

metrics. <strong>Pioneer</strong> <strong>Fund</strong>s listed were rated exclusively against the specific fund category listed. The Morningstar Rating is for Class A shares only; other classes may have different performance<br />

characteristics. The Morningstar information contained herein: (1) is proprietary to Morningstar; (2) may not be copied; and (3) is not warranted to be accurate, complete or timely. Neither<br />

Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Morningstar Load Waived ratings do not take into account class A<br />

sales charges. ©2013 Morningstar, Inc. All Rights Reserved.<br />

The performance data quoted represents past performance, which is no guarantee of future results.<br />

A Word About Risk: Investing in foreign and/or emerging markets securities involves risks relating to interest rates, currency exchange rates, economic, and political conditions. At times, the<br />

<strong>Fund</strong>’s investments may represent industries or industry sectors that are interrelated or have common risks, making it more susceptible to any economic, political, or regulatory developments<br />

or other risks affecting those industries and sectors. Investing in a concentrated, narrowly focused fund may entail greater risks than is normally associated with more widely diversified funds.<br />

The Russell 1000 Growth Index measures the performance of large-cap U.S. growth stocks. Indices are unmanaged and their returns assume reinvestment of dividends and, unlike mutual<br />

fund returns, do not reflect any fees or expenses associated with a mutual fund. It is not possible to invest directly in an index.<br />

Contact your financial advisor or visit us.pioneerinvestments.com for more information about the <strong>Pioneer</strong> investment products and programs that may be best<br />

for your needs.<br />

Before investing, consider the product’s investment objectives, risks, charges and expenses. Contact your advisor or <strong>Pioneer</strong> <strong>Investments</strong> for a prospectus or<br />

summary prospectus containing this information. Read it carefully.<br />

Neither <strong>Pioneer</strong>, nor its representatives are legal or tax advisors. In addition, <strong>Pioneer</strong> does not provide advice or recommendations. The investments you choose should<br />

correspond to your financial needs, goals, and risk tolerance. For assistance in determining your financial situation, please consult an investment professional.<br />

Not FDIC insured May lose value No bank guarantee<br />

Securities offered through <strong>Pioneer</strong> <strong>Fund</strong>s Distributor, Inc., 60 State Street, Boston, Massachusetts 02109<br />

Underwriter of <strong>Pioneer</strong> mutual funds, Member SIPC<br />

©2013 <strong>Pioneer</strong> <strong>Investments</strong> • us.pioneerinvestments.com • 23704-12-0413