Pioneer PRISM XC Variable Annuity - Pioneer Investments

Pioneer PRISM XC Variable Annuity - Pioneer Investments

Pioneer PRISM XC Variable Annuity - Pioneer Investments

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

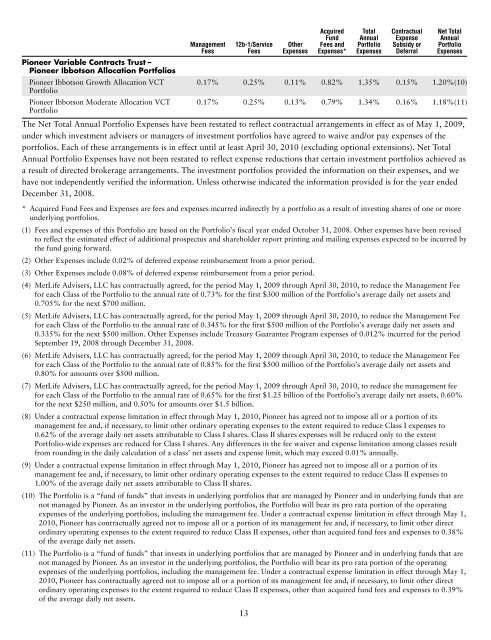

<strong>Pioneer</strong> <strong>Variable</strong> Contracts Trust –<br />

<strong>Pioneer</strong> Ibbotson Allocation Portfolios<br />

<strong>Pioneer</strong> Ibbotson Growth Allocation VCT<br />

Portfolio<br />

<strong>Pioneer</strong> Ibbotson Moderate Allocation VCT<br />

Portfolio<br />

Management<br />

Fees<br />

12b-1/Service<br />

Fees<br />

Other<br />

Expenses<br />

Acquired<br />

Fund<br />

Fees and<br />

Expenses*<br />

Total<br />

Annual<br />

Portfolio<br />

Expenses<br />

Contractual<br />

Expense<br />

Subsidy or<br />

Deferral<br />

Net Total<br />

Annual<br />

Portfolio<br />

Expenses<br />

0.17% 0.25% 0.11% 0.82% 1.35% 0.15% 1.20%(10)<br />

0.17% 0.25% 0.13% 0.79% 1.34% 0.16% 1.18%(11)<br />

The Net Total Annual Portfolio Expenses have been restated to reflect contractual arrangements in effect as of May 1, 2009,<br />

under which investment advisers or managers of investment portfolios have agreed to waive and/or pay expenses of the<br />

portfolios. Each of these arrangements is in effect until at least April 30, 2010 (excluding optional extensions). Net Total<br />

Annual Portfolio Expenses have not been restated to reflect expense reductions that certain investment portfolios achieved as<br />

a result of directed brokerage arrangements. The investment portfolios provided the information on their expenses, and we<br />

have not independently verified the information. Unless otherwise indicated the information provided is for the year ended<br />

December 31, 2008.<br />

* Acquired Fund Fees and Expenses are fees and expenses incurred indirectly by a portfolio as a result of investing shares of one or more<br />

underlying portfolios.<br />

(1) Fees and expenses of this Portfolio are based on the Portfolio’s fiscal year ended October 31, 2008. Other expenses have been revised<br />

to reflect the estimated effect of additional prospectus and shareholder report printing and mailing expenses expected to be incurred by<br />

the fund going forward.<br />

(2) Other Expenses include 0.02% of deferred expense reimbursement from a prior period.<br />

(3) Other Expenses include 0.08% of deferred expense reimbursement from a prior period.<br />

(4) MetLife Advisers, LLC has contractually agreed, for the period May 1, 2009 through April 30, 2010, to reduce the Management Fee<br />

for each Class of the Portfolio to the annual rate of 0.73% for the first $300 million of the Portfolio’s average daily net assets and<br />

0.705% for the next $700 million.<br />

(5) MetLife Advisers, LLC has contractually agreed, for the period May 1, 2009 through April 30, 2010, to reduce the Management Fee<br />

for each Class of the Portfolio to the annual rate of 0.345% for the first $500 million of the Portfolio’s average daily net assets and<br />

0.335% for the next $500 million. Other Expenses include Treasury Guarantee Program expenses of 0.012% incurred for the period<br />

September 19, 2008 through December 31, 2008.<br />

(6) MetLife Advisers, LLC has contractually agreed, for the period May 1, 2009 through April 30, 2010, to reduce the Management Fee<br />

for each Class of the Portfolio to the annual rate of 0.85% for the first $500 million of the Portfolio’s average daily net assets and<br />

0.80% for amounts over $500 million.<br />

(7) MetLife Advisers, LLC has contractually agreed, for the period May 1, 2009 through April 30, 2010, to reduce the management fee<br />

for each Class of the Portfolio to the annual rate of 0.65% for the first $1.25 billion of the Portfolio’s average daily net assets, 0.60%<br />

for the next $250 million, and 0.50% for amounts over $1.5 billion.<br />

(8) Under a contractual expense limitation in effect through May 1, 2010, <strong>Pioneer</strong> has agreed not to impose all or a portion of its<br />

management fee and, if necessary, to limit other ordinary operating expenses to the extent required to reduce Class I expenses to<br />

0.62% of the average daily net assets attributable to Class I shares. Class II shares expenses will be reduced only to the extent<br />

Portfolio-wide expenses are reduced for Class I shares. Any differences in the fee waiver and expense limitation among classes result<br />

from rounding in the daily calculation of a class’ net assets and expense limit, which may exceed 0.01% annually.<br />

(9) Under a contractual expense limitation in effect through May 1, 2010, <strong>Pioneer</strong> has agreed not to impose all or a portion of its<br />

management fee and, if necessary, to limit other ordinary operating expenses to the extent required to reduce Class II expenses to<br />

1.00% of the average daily net assets attributable to Class II shares.<br />

(10) The Portfolio is a “fund of funds” that invests in underlying portfolios that are managed by <strong>Pioneer</strong> and in underlying funds that are<br />

not managed by <strong>Pioneer</strong>. As an investor in the underlying portfolios, the Portfolio will bear its pro rata portion of the operating<br />

expenses of the underlying portfolios, including the management fee. Under a contractual expense limitation in effect through May 1,<br />

2010, <strong>Pioneer</strong> has contractually agreed not to impose all or a portion of its management fee and, if necessary, to limit other direct<br />

ordinary operating expenses to the extent required to reduce Class II expenses, other than acquired fund fees and expenses to 0.38%<br />

of the average daily net assets.<br />

(11) The Portfolio is a “fund of funds” that invests in underlying portfolios that are managed by <strong>Pioneer</strong> and in underlying funds that are<br />

not managed by <strong>Pioneer</strong>. As an investor in the underlying portfolios, the Portfolio will bear its pro rata portion of the operating<br />

expenses of the underlying portfolios, including the management fee. Under a contractual expense limitation in effect through May 1,<br />

2010, <strong>Pioneer</strong> has contractually agreed not to impose all or a portion of its management fee and, if necessary, to limit other direct<br />

ordinary operating expenses to the extent required to reduce Class II expenses, other than acquired fund fees and expenses to 0.39%<br />

of the average daily net assets.<br />

13