MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

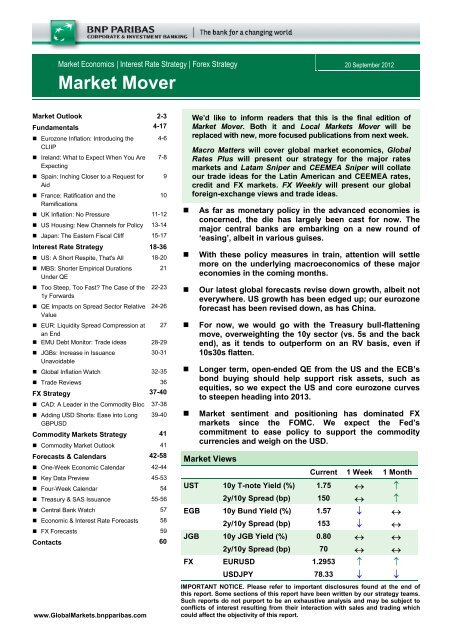

Market Economics | Interest Rate Strategy | Forex Strategy 20 September 2012<br />

Market Mover<br />

Market Outlook 2-3<br />

Fundamentals 4-17<br />

• Eurozone Inflation: Introducing the 4-6<br />

CLIIP<br />

• Ireland: What to Expect When You Are 7-8<br />

Expecting<br />

• Spain: Inching Closer to a Request for 9<br />

Aid<br />

• France: Ratification and the<br />

10<br />

Ramifications<br />

• UK Inflation: No Pressure 11-12<br />

• US Housing: New Channels for Policy 13-14<br />

• Japan: The Eastern Fiscal Cliff 15-17<br />

Interest Rate Strategy 18-36<br />

• US: A Short Respite, That's All 18-20<br />

• MBS: Shorter Empirical Durations 21<br />

Under QE<br />

• Too Steep, Too Fast? The Case of the 22-23<br />

1y Forwards<br />

• QE Impacts on Spread Sector Relative 24-26<br />

Value<br />

• EUR: Liquidity Spread Compression at 27<br />

an End<br />

• EMU Debt Monitor: Trade ideas 28-29<br />

• JGBs: Increase in Issuance<br />

30-31<br />

Unavoidable<br />

• Global Inflation Watch 32-35<br />

• Trade Reviews 36<br />

FX Strategy 37-40<br />

• CAD: A Leader in the Commodity Bloc 37-38<br />

• Adding USD Shorts: Ease into Long 39-40<br />

GBPUSD<br />

Commodity Markets Strategy 41<br />

• Commodity Market Outlook 41<br />

Forecasts & Calendars 42-58<br />

• One-Week Economic Calendar 42-44<br />

• Key Data Preview 45-53<br />

• Four-Week Calendar 54<br />

• Treasury & SAS Issuance 55-56<br />

• Central Bank Watch 57<br />

• Economic & Interest Rate Forecasts 58<br />

• FX Forecasts 59<br />

Contacts 60<br />

www.GlobalMarkets.bnpparibas.com<br />

We’d like to inform readers that this is the final edition of<br />

Market Mover. Both it and Local Markets Mover will be<br />

replaced with new, more focused publications from next week.<br />

Macro Matters will cover global market economics, Global<br />

Rates Plus will present our strategy for the major rates<br />

markets and Latam Sniper and CEEMEA Sniper will collate<br />

our trade ideas for the Latin American and CEEMEA rates,<br />

credit and FX markets. FX Weekly will present our global<br />

foreign-exchange views and trade ideas.<br />

• As far as monetary policy in the advanced economies is<br />

concerned, the die has largely been cast for now. The<br />

major central banks are embarking on a new round of<br />

‘easing’, albeit in various guises.<br />

• With these policy measures in train, attention will settle<br />

more on the underlying macroeconomics of these major<br />

economies in the coming months.<br />

• Our latest global forecasts revise down growth, albeit not<br />

everywhere. US growth has been edged up; our eurozone<br />

forecast has been revised down, as has China.<br />

• For now, we would go with the Treasury bull-flattening<br />

move, overweighting the 10y sector (vs. 5s and the back<br />

end), as it tends to outperform on an RV basis, even if<br />

10s30s flatten.<br />

• Longer term, open-ended QE from the US and the ECB’s<br />

bond buying should help support risk assets, such as<br />

equities, so we expect the US and core eurozone curves<br />

to steepen heading into 2013.<br />

• Market sentiment and positioning has dominated FX<br />

markets since the FOMC. We expect the Fed’s<br />

commitment to ease policy to support the commodity<br />

currencies and weigh on the USD.<br />

Market Views<br />

Current 1 Week 1 Month<br />

UST 10y T-note Yield (%) 1.75 ↔ ↑<br />

2y/10y Spread (bp) 150 ↔ ↑<br />

EGB 10y Bund Yield (%) 1.57 ↓ ↔<br />

2y/10y Spread (bp) 153 ↓ ↔<br />

JGB 10y JGB Yield (%) 0.80 ↔ ↔<br />

2y/10y Spread (bp) 70 ↔ ↔<br />

FX EURUSD 1.2953 ↑ ↑<br />

USDJPY 78.33 ↓ ↓<br />

IMPORTANT NOTICE. Please refer to important disclosures found at the end of<br />

this report. Some sections of this report have been written by our strategy teams.<br />

Such reports do not purport to be an exhaustive analysis and may be subject to<br />

conflicts of interest resulting from their interaction with sales and trading which<br />

could affect the objectivity of this report.

Market Outlook<br />

The die has been cast in<br />

favour of global monetary<br />

easing<br />

As far as monetary policy in the advanced economies is concerned, the die<br />

has largely been cast for now. The major central banks are embarking on a<br />

new round of ‘easing’, albeit in various guises.<br />

In the US, the easing is coming from the Federal Reserve’s conditional<br />

commitment to expand its balance sheet until it sees a sustained<br />

improvement in labour-market conditions. Meanwhile, in the eurozone, the<br />

European Central Bank has made a somewhat different commitment with its<br />

OMT bond-buying programme. Still, it is a potentially unlimited one in terms<br />

of size and duration and involves the further expansion of its balance sheet.<br />

The veil of sterilisation behind which the bank is hiding cannot really obscure<br />

the fact that it is monetary easing. We expect the ECB to sprinkle a rate cut<br />

on top of its current policy mix in December.<br />

In Japan, the BoJ this week announced a further JPY 10trn expansion of its<br />

asset-purchase programme. Meanwhile, in the UK, the Bank of England is<br />

still putting into practice its July asset-purchase extension and we expect<br />

more from it in November.<br />

Table 4: Economic Forecasts (% y/y)<br />

Our latest forecasts revise<br />

up the US (a bit) …<br />

2010 2011 2012 2013 2014 2012<br />

Q2 Q3 Q4<br />

US<br />

GDP 2.4 1.8 2.2 2.1 2.7 2.3 2.3 1.7<br />

CPI 1.6 3.2 2.1 2.2 2.0 1.9 1.7 2.1<br />

Core CPI 1.0 1.7 2.1 1.9 2.2 2.3 2.0 2.0<br />

Eurozone<br />

GDP 2.0 1.5 -0.4 0.2 1.2 -0.5 -0.7 -0.5<br />

CPI 1.6 2.7 2.5 2.0 1.5 2.5 2.5 2.5<br />

Core CPI 1.0 1.4 1.5 1.6 1.6 1.6 1.6 1.5<br />

Japan<br />

GDP 4.5 -0.8 2.2 0.6 0.2 3.2 1.5 1.3<br />

CPI -0.7 -0.3 0.1 0.0 2.0 0.2 -0.4 0.1<br />

US-Like Core CPI -1.2 -0.9 -0.4 -0.1 2.1 -0.5 -0.5 0.0<br />

China<br />

GDP 10.4 9.2 7.4 8.0 7.5 7.6 7.1 7.3<br />

CPI 3.3 5.4 3.0 3.6 3.5 2.9 2.1 3.2<br />

Source: <strong>BNP</strong> Paribas<br />

With these policy measures in train, attention will settle more on the<br />

underlying macroeconomics of these major economies in the coming<br />

months. Our view on how they will fare is fleshed out in detail in our new<br />

Global Economic Outlook. The clue is in the title: Soft-boiled recovery.<br />

To summarise, in the US, we think the outlook has improved a little of late,<br />

largely as a result of the Fed’s action. But growth is expected to be close to<br />

trend over the next few years, which doesn’t give much scope for a<br />

significant improvement in the labour market. So, we think the Fed will keep<br />

on expanding its balance sheet, lifting it by as much as USD 1.5trn. The key<br />

risk to the economy is probably the fiscal cliff, which we expect to be<br />

resolved in a sensible and relatively timely fashion.<br />

… and revise down the<br />

eurozone<br />

In the eurozone, things are, of course, more complex, with more moving<br />

parts. Overall, the growth outlook in the eurozone is worse than at the time<br />

of our July forecast. We now only expect growth of 0.2% in 2013. Surveys<br />

suggest that the contraction in output should bottom this year. But as the<br />

PMI surveys this week, especially the French numbers, highlight, there<br />

remain risks that the downturn could become more protracted.<br />

David Tinsley 20 September 2012<br />

Market Mover<br />

2<br />

www.GlobalMarkets.bnpparibas.com

Spain set to present its<br />

new budget next week<br />

Risks to the eurozone from the periphery also prevail. The Spanish<br />

government is scheduled to present its new budget next week, which should<br />

be a stepping stone on the road to an agreement on financial aid, paving the<br />

way for OMT/ESM bond purchases. But macro and political slippage is a risk<br />

here, as it is throughout the periphery.<br />

In the UK, the recent data outturns have been looking stronger and we<br />

expect a very solid growth rate in Q3. But the bar has been set high when it<br />

comes to dissuading the Monetary Policy Committee (MPC) from expanding<br />

QE again, and the Committee looks set to keep the faith that underlying<br />

inflationary pressures are soft, even if the headline rate is bubbling up.<br />

China will be stronger in<br />

2013, but there are risks<br />

that the downturn has a<br />

larger structural element<br />

The outlook for inflation<br />

hasn’t changed much<br />

For now, go with the bullflattening<br />

move in<br />

Treasuries<br />

It would be remiss in any discussion of the global outlook not to mention<br />

China. Growth here looks softer than expected and we do not expect it to<br />

bottom until later this year. We expect growth to come back up to 8% in<br />

2013, but there are risks that embedded in the slowdown is a more structural<br />

story depicting overcapacity and competitiveness.<br />

All told, then, the global economy is weaker than our July forecasts. For<br />

inflation, though, the outlook hasn’t changed much. Weaker growth in some<br />

parts of the world is offsetting supply shocks, leaving headline inflation rates<br />

little different.<br />

Near term, the reversal in the Treasury markets in the past few sessions has<br />

caused many to question whether the sell-off and steepening that happened<br />

on the back of the Fed’s QE announcement have already run their course.<br />

We think this is only a short-lived retracement, driven in part by transient<br />

factors, such as profit taking, the buyback schedule and Treasury supply in<br />

the 2y, 5y and 7y sectors next week. For these reasons, for now, we would<br />

go with the bull-flattening move, overweighting the 10y sector (vs. 5s and the<br />

back end), as it tends to outperform on an RV basis, even if 10s30s flatten.<br />

In the core eurozone markets, fundamental conditions favour a further<br />

limited rally near term. We still see room for lower yields and flatter curves.<br />

We are, therefore, maintaining our recommendation of being long Bunds in<br />

duration terms. As far as liquidity spreads are concerned, they look very tight<br />

at the moment. Core markets, in particular, now look cheap in ASW terms.<br />

Longer-term monetary<br />

loosening should support<br />

risk assets and curve<br />

steepening<br />

Sell the USD into the rally;<br />

we expect the dollar to<br />

decline<br />

Bye-bye, Market Mover<br />

Longer term, open-ended QE from the US and the ECB’s bond buying<br />

should help support risk assets, such as equities, so we expect the curve to<br />

steepen heading into 2013.<br />

In the FX market, investors have failed to leap on the Fed’s aggressive<br />

announcement as a catalyst to establish new short USD positions. To the<br />

contrary, investors have been trimming their risk-on positions and buying the<br />

greenback. Our FX positioning analysis suggests that investors are currently<br />

holding relatively light positions, suggesting the recent sell-off may be short<br />

lived. We expect the USD to weaken against the commodity currencies in<br />

the months ahead and favour long NZDUSD positions. In Europe, we expect<br />

improving sentiment to continue to support EURCHF. Meanwhile, we expect<br />

GBPUSD to rally substantially this year, but are waiting for a better<br />

opportunity to establish a long position.<br />

Our very first issue of Market Mover noted that the rebound from the Asian<br />

crisis owed “a good deal to easy monetary policy in the US and Europe”. We<br />

can only hope that our new, more focused global and regional publications<br />

from next week will be able to make a similar claim before too long.<br />

David Tinsley 20 September 2012<br />

Market Mover<br />

3<br />

www.GlobalMarkets.bnpparibas.com

Eurozone Inflation: Introducing the CLIIP<br />

• Consumer price inflation is determined by a<br />

mix of demand-pull and cost-push factors, as well<br />

as broader financial and monetary conditions.<br />

Chart 1: Eurozone Core and Headline Inflation<br />

• We have created a Composite Leading<br />

Indicator of Inflationary Pressure (CLIIP) for the<br />

eurozone, designed to provide an indication of<br />

the outlook for core inflation in the months ahead.<br />

• Our indicator suggests that disinflationary<br />

pressure will dominate in the coming months.<br />

A composite leading indicator can be a useful tool<br />

when gauging the likely future direction of an<br />

economic variable of interest. We have created a<br />

Composite Leading Indicator of Inflationary Pressure<br />

(CLIIP), which standardises and combines a<br />

selection of the numerous influences on inflation into<br />

a single data series, providing a summary measure<br />

of underlying inflationary pressure.<br />

Choosing a reference indicator<br />

Any leading indicator needs a reference indicator – a<br />

series the leading indicator aims to predict and<br />

against which its performance can be assessed.<br />

Measures of underlying consumer prices, such as<br />

the core HICP, attempt to strip out the most common<br />

temporary disturbances to prices by excluding<br />

consumer energy and food prices from the index. For<br />

this reason, HICP core inflation tends to be more<br />

stable than the headline measure and allows for<br />

examination of the underlying trends in pricing<br />

behaviour. For this reason, we have chosen to make<br />

it our reference indicator.<br />

Chart 1 shows the behaviour of core and headline<br />

inflation over the past 15 years and demonstrates<br />

core’s relative stability. By the core HICP measure,<br />

underlying inflation in the eurozone has averaged<br />

1.5% y/y since 1997.<br />

Our composite leading indicator<br />

We have drawn on OECD methodology in creating<br />

our indicator 1 . The 10 time series we have selected<br />

have predictive power for consumer price inflation<br />

and can be categorised as indicators of cost-push<br />

pressure on prices, of demand-pull price pressure<br />

and indicators of financial conditions. Unless<br />

otherwise stated, all relate to the eurozone.<br />

Source: Reuters EcoWin Pro<br />

The cost-push components<br />

The components we include to capture supply-side<br />

price pressures include both surveys and hard data.<br />

We include the manufacturers’ selling-price survey<br />

conducted as part of the European Commission’s<br />

monthly business and consumer survey and the<br />

Markit input price PMI as two forward-looking<br />

measures of pipeline price pressures. Unit labour<br />

costs are included as a measure of domestic input<br />

price pressure, labour being an input to production.<br />

The PPI is included to capture factory-gate prices. A<br />

weaker euro increases the cost of imports to euro<br />

countries, so we include the ECB’s EER-40 real<br />

effective exchange rate (inverted) to capture<br />

imported inflation.<br />

Demand-pull components<br />

To measure the extent to which consumer and<br />

company demand are exerting upward pressure on<br />

prices, we include eurozone industrial production as<br />

a proxy for economic activity. To capture the strength<br />

of global demand, we include world trade volumes.<br />

To gauge the strength of domestic consumer<br />

demand, we use unemployment (inverted) and the<br />

DG ECFIN consumer financial conditions survey,<br />

which indicates consumers’ optimism about their<br />

income prospects.<br />

Financial component<br />

We include the <strong>BNP</strong>P Financial and Monetary<br />

Conditions Indicator (FMCI) as a broad measure of<br />

the tightness of financial conditions in the eurozone.<br />

The FMCI is inverted for inclusion in the CLIIP, as<br />

tighter monetary conditions are inflation negative.<br />

1 http://www.oecd.org/dataoecd/37/42/42495745.pdf<br />

Catherine Colebrook 20 September 2012<br />

Market Mover<br />

4<br />

www.GlobalMarkets.bnpparibas.com

The methodology<br />

All of the above indicators can be expected to impact<br />

consumer price inflation with varying lags. For<br />

example, monetary conditions can be expected to<br />

affect prices with a lag of 1-2 years, according to<br />

ECB analysis 2 . Shocks to producer prices tend to be<br />

passed through more quickly, within 6-8 months.<br />

Furthermore, these relationships are not static over<br />

time; in general, the lags look to have shortened<br />

since the early 2000s.<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

Chart 2: Core HICP and the CLIIP<br />

Core HICP (%y/y)<br />

We chose the optimal lag to apply to each of the<br />

variables according to our view of the current speed<br />

of transmission, using correlation coefficients as a<br />

guide.<br />

To prepare the series for aggregation, we remove<br />

any seasonality or trends, invert where appropriate,<br />

smooth the series using a Hodrick-Prescott filter, and<br />

normalise them (ie. such that they all have mean 0<br />

and standard deviation 1). The series are all given<br />

equal weight in the aggregation. The final stage is to<br />

transform the index such that it has a mean and<br />

standard deviation equal to core inflation, so that the<br />

index corresponds to an implied level of annual core<br />

inflation. The final CLIIP index is plotted against core<br />

inflation in Chart 2.<br />

Over the sample from January 2003 to present, the<br />

CLIIP has a correlation coefficient with core inflation of<br />

0.67. Between January 2009 and May 2012, the<br />

coefficient rises to 0.84. The components with the<br />

quickest transmission to core inflation are the consumer<br />

financial conditions survey and unemployment, both of<br />

which are incorporated into the index with a lag of six<br />

months. The index thus gives us a leading indicator for<br />

inflationary pressure that extends six months into the<br />

future.<br />

What does it tell us about inflation?<br />

Table 1 lists the components of the leading indicator<br />

for core inflation, their level at the last available CLIIP<br />

data point (which corresponds to expected inflation in<br />

January 2013) and whether each is positive,<br />

negative, or neutral for inflation on that horizon. The<br />

components are listed in normalised form, meaning<br />

that a value above zero implies a positive impact on<br />

core inflation; a negative number means a negative<br />

impact.<br />

As we might expect given that the eurozone<br />

economy is currently operating below potential,<br />

components indicative of economic slack and a<br />

subdued labour market are all inflation-negative: the<br />

level of unemployment, consumer expectations, and<br />

unit labour costs are all at levels consistent with<br />

disinflationary pressure.<br />

2 http://www.ecb.europa.eu/pub/pdf/other/mb201005en_pp85-98en.pdf<br />

0.5<br />

0.0<br />

00 01 02 03 04 05 06 07 08 09 10 11 12 13<br />

Source: Reuters EcoWin Pro<br />

Chart 3: Unemployment and IP CLIIP Components<br />

3<br />

2<br />

1<br />

0<br />

-1<br />

-2<br />

-3<br />

-4<br />

Unemployment (6-m lag)<br />

-0.4<br />

99 00 01 02 03 04 05 06 07 08 09 10 11 12 13<br />

Source: Reuters EcoWin Pro, <strong>BNP</strong> Paribas<br />

Core HICP (% y/y, RHS)<br />

Financial and monetary conditions are also inflationnegative;<br />

given that the monetary policy transmission<br />

mechanism is still impaired, several years after the<br />

credit crunch, this is not surprising either.<br />

Recent large falls in the euro can be expected to<br />

push up import prices and, therefore, domestic<br />

inflation in the eurozone in the coming months,<br />

although at 0.2 – less than one standard deviation<br />

away from its the long-run average – the normalised<br />

level of the REER component suggests the effect will<br />

3 All component data are normalised, while the CLIIP itself corresponds to a<br />

level of annual core inflation<br />

CLIIP<br />

Industrial<br />

Production (12-m lag)<br />

Table 1: CLIIP Component Breakdown<br />

Component Jan 2013<br />

Value 3<br />

2.6<br />

2.1<br />

1.6<br />

1.1<br />

0.6<br />

0.1<br />

Implication for<br />

Inflation<br />

Consumer financial conditions survey -1.8 Negative<br />

Unemployment rate -1.7 Negative<br />

<strong>BNP</strong>P FMCI -0.8 Negative<br />

Unit labour costs -0.8 Negative<br />

PMI input prices -0.3 Negative<br />

Real effective exchange rate 0.2 Positive<br />

Manufacturers’ selling price expectations 0.3 Positive<br />

Eurozone industrial production 0.4 Positive<br />

World trade 0.5 Positive<br />

Producer price index 0.6 Positive<br />

CLIIP (normalised value) -1.05 Negative<br />

Source: <strong>BNP</strong> Paribas<br />

Catherine Colebrook 20 September 2012<br />

Market Mover<br />

5<br />

www.GlobalMarkets.bnpparibas.com

e moderate in comparison with other component<br />

effects.<br />

The index suggests that the key sources of price<br />

pressure over the next 6 months will be the external<br />

economic environment and upstream prices.<br />

Producer price inflation has been falling since mid-<br />

2011, but the effects of previous rapid price<br />

increases are still feeding through to prices<br />

downstream. Although now slowing, global growth<br />

was robust last year, and this is also still feeding<br />

through to prices.<br />

At first glance, the fact that the eurozone industrial<br />

production component is inflation positive seems<br />

counter-intuitive, considering the levels of other<br />

output gap-related components. Its positive influence<br />

on inflation stems from two related factors: first, it<br />

affects inflation with a much longer lag than other<br />

drivers, and second, industrial production had initially<br />

picked up post-crisis, as global growth accelerated in<br />

late 2010 and early 2011. Although industrial<br />

production growth has slowed subsequently, this<br />

period of above-trend production is still feeding<br />

through to inflation (Chart 3).<br />

Putting all of this together, the CLIIP suggests that,<br />

overall, underlying inflationary pressure is set to<br />

moderate. The normalised index has a value of -1.05<br />

in January 2013, which is consistent with core<br />

inflation of 1.1% y/y (versus the current level of<br />

1.5% y/y). The CLIIP suggests that inflationary<br />

pressure peaked at the start of 2012, and is now on a<br />

declining trend.<br />

Of course, idiosyncratic factors, such as the<br />

methodological change applied to seasonal items<br />

from last year, or adjustments to national VAT rates<br />

and structure, mean that core inflation does not<br />

always move according to underlying price pressure.<br />

But in terms of the underlying fundamentals,<br />

inflationary pressure in the eurozone is moderating.<br />

Conclusion<br />

Our composite leading indicator provides a quickreference<br />

guide to the level of inflationary pressure<br />

building in an economy. Inflation in the eurozone is<br />

currently above target, but our indicator suggests<br />

that, on balance, the macroeconomic conditions that<br />

have provided support to prices of late have already<br />

begun to ease and that we should see more<br />

evidence of this in the core HICP index in the coming<br />

months.<br />

Catherine Colebrook 20 September 2012<br />

Market Mover<br />

6<br />

www.GlobalMarkets.bnpparibas.com

Ireland: What to Expect When You Are Expecting<br />

• June’s eurozone summit raised expectations<br />

of a refinancing of the Irish banking bailout.<br />

• Ireland’s ‘prize’ from such a deal is potentially<br />

high, with the gross cost of the bailout to date at<br />

around 40% of GDP.<br />

• Any deal will not necessarily lower its debt-to-<br />

GDP ratio from its 120% peak, but it would alleviate<br />

Ireland’s funding needs significantly over the next<br />

few years.<br />

• It is ultimately in the interest of most of the<br />

parties in the negotiations to produce a deal that<br />

will move Ireland towards sustainable finances.<br />

• It could also serve as a carrot for other<br />

programme countries, alongside the usual sticks.<br />

Statement of intent<br />

The statement following the eurozone summit at the<br />

end of June was widely considered to be very<br />

favourable to Ireland. Specifically, the end of the first<br />

paragraph contained a commitment to “examine the<br />

situation of the Irish financial sector with the view of<br />

further improving the sustainability of the wellperforming<br />

adjustment programme.” That was<br />

interpreted as meaning that once a single supervisory<br />

framework for eurozone banks was up and running, the<br />

Irish could hope for some of the huge cost of their bank<br />

bailout to be refinanced ex post through the ESM.<br />

Big envelopes<br />

The potential ‘prize’ from any re-engineering of the<br />

Irish bailout is considerable. The total gross cost to the<br />

Irish state of the banking-sector bailout is put at<br />

EUR 62.8bn. That is equivalent to a staggering 40% of<br />

the island’s GDP. At this size, the IMF considers the<br />

bailout to be the second-costliest banking crisis in an<br />

advanced economy since the Great Depression, at<br />

least, only pipped to the post – just – by Iceland.<br />

Table 1 sets out the key elements of the bailout to<br />

date. Around half of the increase in total funds injected<br />

into the Irish banks is due to the promissory notes<br />

injected into Anglo Irish, which is now part of the Irish<br />

Bank Resolution Corporation Limited – in effect, the<br />

legacy wind-down bank for Anglo and Irish<br />

Nationwide. The other half of the bailout injections are<br />

from government and national pension-fund (NPRF)<br />

equity and capital injections.<br />

In terms of the possible scope of any agreement<br />

between the Irish government and the eurozone/ECB<br />

to restructure the broad bank bailout, it makes sense<br />

Table 1: Gross Costs of Ireland’s Bank Bailout<br />

EUR bn Body Date Total<br />

Government preference shares NPRF 2009 7<br />

Promissory notes/special<br />

investment shares Exchequer 2010 31.6<br />

Ordinary share capital Exchequer 2009 4<br />

Ordinary share capital NPRF 2010 3.7<br />

Total pre-PCAR 2011 46.3<br />

Following PCAR 2011<br />

Capital Exchequer 2011 6.5<br />

Capital NPRF 2011 10<br />

Post-PCAR 2011 16.5<br />

Total costs 62.8<br />

Source: NTMA<br />

to think about the promissory notes as distinct from<br />

the other injections.<br />

As a reminder, the EUR 31bn of promissory notes<br />

injected into IBRC are just that, a promise from the<br />

Irish sovereign to pay the bank cash each year. The<br />

repayment schedule for these notes stretches out over<br />

the next 20 years. For the next decade, the Irish<br />

government is on the hook for EUR 3.1bn a year.<br />

The full value of the promissory notes has already been<br />

booked and is one of the major causes of the increase<br />

in Ireland’s debt-to-GDP ratio from 64.9 % in 2009 to<br />

92.2% in 2010. But in a cashflow sense, the funds for<br />

the notes will be raised in the year they fall due. And<br />

they will be a significant cash call on the sovereign<br />

each year, with EUR 3.1bn equivalent to 1.9% of the<br />

country’s GDP. Or, to put it another way, with an IMFforecast<br />

Exchequer cash deficit for 2013 of EUR<br />

14.5bn, funding the notes will be very costly indeed.<br />

The promissory note issue is intimately bound up with<br />

the provision of emergency liquidity assistance (ELA)<br />

owed to the Central Bank of Ireland. Emergency<br />

liquidity assistance is a form of monetary financing<br />

that the ECB requires to be paid off post haste. The<br />

idea is that as the promissory notes pay up, so they<br />

will be used to pay down the EUR 42.3bn in ELA<br />

funding to the IBRC. The key role of the ECB in<br />

discussions on the promissory notes can, therefore,<br />

be appreciated, as any re-jig of the notes impinges on<br />

commitments to wind down the ELA.<br />

In the past, the ECB has shown some reluctance to<br />

re-open discussions on the promissory notes, though<br />

it appears this reticence has softened somewhat of<br />

late. ECB executive board member Joerg Asmussen<br />

said at a press conference last week that the bank<br />

was in “intense discussions” on the Irish programme.<br />

That shows, at least, that the ECB is engaging on the<br />

issue, which is a change from its previous stance.<br />

David Tinsley 20 September 2012<br />

Market Mover 7<br />

www.GlobalMarkets.bnpparibas.com

There are a number of possibilities with regard to a<br />

refinancing of the promissory notes. Following the<br />

June summit, it appeared that a loan from the ESM<br />

could be extended to the IBRC to replace the notes<br />

and that this loan could, in turn, be used to pay down<br />

the ELA. However, reports this week suggest the Irish<br />

government is now looking at refinancing the notes via<br />

a long-term, possibly 40-year, Irish bond. This would<br />

then be pledged as collateral with the ECB.<br />

The advantage of such an approach is that it could be<br />

easier to clear through the hurdles of eurozone<br />

decision making. For Ireland, the sovereign would still<br />

be on the hook for the full value of the notes, meaning<br />

the only reduction in the debt-to-GDP ratio would<br />

come from savings on servicing costs. But the<br />

repayment on the bond would be kicked a long way<br />

down the road and the financing requirements over<br />

the next few years would be alleviated significantly.<br />

Until a single supervisory framework is agreed within<br />

the eurozone, the option for the Irish of mutualising the<br />

debt is not on the table, so any sort of deal – ESM loan<br />

or Irish bonds – will keep the debt on the Irish balance<br />

sheet. And it is not clear that agreement will be reached<br />

on supervision as fast as the European Commission<br />

would like. In addition, the next payment on the<br />

promissory notes is not due until the end of March<br />

2013. So, although the original ambition was to reach<br />

an agreement on a refinancing of the Irish banking<br />

sector by the time of the late October EU summit, there<br />

may be some temptation for both Ireland and the<br />

eurozone/ECB to let that deadline slip a little.<br />

Equity injections<br />

The position on equity injections is not particularly any<br />

clearer. EUR 28.2bn has been injected into the other<br />

(non-IBRC) banks since 2009, split between the<br />

Exchequer and the national pension fund. At face<br />

value, a deal in which the ESM takes over these stakes<br />

and reimburses Ireland has the potential to knock 18<br />

percentage points off of the debt-to-GDP ratio.<br />

But the problem here is that even when the ESM is in<br />

a position to take over the liability for these<br />

investments, it is not clear at what value it would do<br />

so. This is because the value of the government’s<br />

stake in these banks has fallen sharply. The national<br />

pension fund’s investments in AIB and Bank of<br />

Ireland, for example, were valued at EUR 8.1bn at<br />

the end of June 2012, compared with the<br />

EUR 20.7bn it invested.<br />

post refinancing too. But it may be difficult for the<br />

Irish to pass on the full extent of the loss to the ESM<br />

retrospectively, as presumably this would be a pretty<br />

tough sell for eurozone governments to their<br />

respective electorates, even if the absolute numbers<br />

involved were not that large.<br />

Implications for sustainability<br />

In its recent Article IV, the IMF usefully considers<br />

what a deal to refinance the promissory notes plus<br />

an equity injection from the ESM would do for debt<br />

sustainability. The conclusion is that it could lower<br />

the debt-to-GDP ratio in 2013 to around 105% of<br />

GDP from a baseline 119.3%. And the debt-to-GDP<br />

ratio would be below 80% by 2020.<br />

That would be an impressive achievement, but the<br />

IMF analysis is predicated on the ESM paying the full<br />

value of the equity injection into the banks. On the<br />

assumption that the ESM paid something closer to<br />

current valuations, the peak debt-to-GDP ratio might<br />

instead fall to 112% of GDP, which might look like a<br />

disappointment on announcement.<br />

A carrot to add to the sticks?<br />

On current official troika forecasts, Ireland will be<br />

running a primary surplus in 2014 of 0.9%,<br />

increasing to a whopping 7.0% in 2017. And with the<br />

benefits of a deal on the promissory notes coming<br />

through along the debt trajectory via savings on debtservicing<br />

costs, a deal that looks a little disappointing<br />

in terms of headline numbers could still make a<br />

substantial contribution to moving the country<br />

towards debt sustainability.<br />

But even under a deal on the bank bailout, especially<br />

a ‘disappointing’ one in headline terms, Ireland will<br />

continue to remain more open than it might like to<br />

disappointments on growth or fiscal slippages in<br />

future years. There, in effect, lies the rub. With<br />

Ireland having been feted so strongly in its delivery of<br />

programme targets, it must ultimately be very much<br />

in the interest of the eurozone partners and the ECB<br />

to come up with a deal that robustly cements the<br />

success of the programme, albeit without providing<br />

incentives for back-sliding. A successful Ireland<br />

would be a useful carrot to add to the numerous<br />

sticks that are wielded at programme countries. So<br />

while a final deal will doubtless be complex, we<br />

would expect it to make a substantial contribution to<br />

reducing Ireland’s financing needs medium term.<br />

Now, it could be argued that were the ESM in<br />

existence back at the time of these re-caps it would<br />

be carrying the loss and so should do so in an ex-<br />

David Tinsley 20 September 2012<br />

Market Mover 8<br />

www.GlobalMarkets.bnpparibas.com

Spain: Inching Closer to a Request for Aid<br />

• Spain is inching closer to asking for financial<br />

aid, but it is still only inching.<br />

• In the latter half of next week, Spain will have<br />

an action-packed agenda. It will present its 2013<br />

budget, announce its planned structural reforms<br />

and publish the result of the bottom-up bank audit.<br />

• Any subsequent bailout could be marketed as<br />

a reward for reform and potentially remove part of<br />

the stigma attached to a bailout.<br />

• The country’s regional elections on 21 October<br />

could be the last obstacle to a request.<br />

• Any unused funds from the bank bailout could<br />

be used to lower the final cost of a sovereign<br />

bailout, something that should please Germany.<br />

The timetable seems clearer<br />

After last weekend’s Ecofin meeting and confirmation<br />

of the publication date of the bottom-up review of the<br />

Spanish banks, the timeline of and next steps<br />

towards a Spanish aid request seem to be clearer.<br />

After the Eurogroup meeting, Spanish Economic<br />

Minister Luis de Guindos said Spain would present<br />

its 2013 budget on 27 September. The day after, the<br />

Spanish government will present its planned<br />

structural reforms and, more importantly, the results<br />

of the bottom-up audit of the Spanish banks.<br />

The next Ecofin meeting on 8 October will assess the<br />

reforms and the budget, as well as the details of the<br />

bank reforms to be undertaken as soon the first<br />

tranches of the bank bailout funds are released.<br />

Comments over the weekend suggest that the<br />

reforms and budget have been drafted with some<br />

knowledge or help from the IMF and the European<br />

Commission. Indeed, IMF chief Christine Lagarde<br />

confirmed that an IMF team has been in Madrid<br />

since early last week, helping on the 2013 budget.<br />

First the reforms, then the support<br />

So, as things currently stand, Spain seems to be<br />

already negotiating the conditions under which it<br />

might receive financial aid. Spain will only request<br />

help after it has put in place the reforms required by<br />

the Troika, as it would be easier to sell domestically.<br />

ESM and ECB support will be seen more as a<br />

reward for the government’s efforts and less as a<br />

punishment for fiscal laxity.<br />

The big question is the exact timing. As Spain will<br />

face its biggest liquidity squeeze at the end of<br />

October, when EUR 20bn of bonds mature, Spain<br />

still has some time to play. But it is not unlimited and<br />

there are several factors that could influence the<br />

timing of a request.<br />

France and Italy are among those countries with the<br />

bigger interest in Spain asking for aid before the EU<br />

summit on 18-19 October. Germany, in contrast,<br />

would prefer, for domestic reasons, to postpone any<br />

Spanish bailout, especially as Spain will first receive<br />

the initial tranches of its bank recapitalisation funds.<br />

And Spanish Prime Minister Mariano Rajoy seems<br />

more inclined to wait until after the 21 October<br />

regional elections in Galicia and the Basque country.<br />

The latter is not an issue, as his Partido Popular has<br />

little chance of winning there anyway. But Galicia is<br />

Mr Rajoy’s home region and according to the latest<br />

polls, the PP could lose its control. A request before<br />

that vote would be a bitter blow to the campaign and<br />

would be seen as a personal defeat for Mr Rajoy.<br />

Recent comments by members of his party suggest<br />

that Mr Rajoy may be increasingly isolated in his<br />

position, though. So, Spain could end up asking for<br />

support before the elections on 21 October, but after<br />

the Ecofin meeting on 8 October.<br />

Bank bailout funds to soften German resistance<br />

The EU has already set aside EUR 100bn for a<br />

programme to recapitalise the Spanish banks and,<br />

according to the latest reports, their capital needs<br />

may be just EUR 60bn, leaving EUR 40bn over.<br />

Media reports suggest that one possibility could be<br />

for Spain to transfer its unused bank bailout money<br />

to the government. This would please Germany, as it<br />

could be done by changing the MoU for the bank<br />

bailout and would not require parliamentary approval.<br />

However, beyond any possible legal objections, for<br />

ECB intervention to occur, a country either has to be<br />

under a “full programme” or have requested a<br />

precautionary one. So, even if Spain were to go<br />

down this route and the other European countries<br />

were to agree, a new MoU would have to be signed,<br />

with all of the conditions that go with it. And this<br />

might not be enough. Spain’s funding needs for the<br />

next 12 months are close to EUR 180bn. If an ESM<br />

programme were to fund only 50% of Spanish<br />

issuance, this would mean it would need a capacity<br />

of close to EUR 90bn, far more than the EUR 40bn<br />

that might be left over from the bank bailout.<br />

So, the most likely scenario, in our view, is that Spain<br />

will still have to request further financing, even if the<br />

unused bank-bailout funds can be transferred. And<br />

despite having some time left, we think Spain will<br />

request support in October.<br />

Ricardo Santos 20 September 2012<br />

Market Mover<br />

9<br />

www.GlobalMarkets.bnpparibas.com

France: Ratification and the Ramifications<br />

• France is set to ratify the EU fiscal compact in<br />

October and the debt-brake rule after that.<br />

• The ECB’s OMT bond-buying plan is likely to<br />

be well received by French policymakers, though<br />

a possible downgrade of French sovereign debt<br />

by Moody's and a harsh budget will cause some<br />

unease among left-leaning politicians.<br />

• While ratification is not in doubt, President<br />

Hollande will need to solidify his majority ahead<br />

of votes on the 2013 budget and structural reform.<br />

French President François Hollande said right after<br />

the EU summit at the end of June that he was<br />

satisfied with the bloc’s pro-growth pact. He<br />

subsequently decided that he would present the bill<br />

to parliament for ratification together with the EU<br />

fiscal compact, EU banking-union legislation and a<br />

bill on an EU financial transaction tax. On the latter,<br />

Europe is still dragging its feet. The European<br />

Commission’s proposal on the first steps towards<br />

banking union, meanwhile, is far from final, so a vote<br />

here would be premature. However, on 2 October,<br />

parliament should start debating the EU fiscal<br />

compact signed in March and the pro-growth<br />

agreement reached in late June.<br />

Ratification process<br />

While Mr Hollande ran for election on a platform of<br />

renegotiating the fiscal compact, he clearly did not<br />

manage to do so. It had already been signed by his<br />

predecessor, Nicolas Sarkozy, so it could not be<br />

undone. Some of Mr Hollande’s supporters have<br />

indicated that they are reluctant to vote the compact<br />

into law in its current form. The Communists and<br />

supporters of the Left Front’s Jean-Luc Mélenchon<br />

are also likely to vote against it. The president is<br />

trying his best to secure an abstention (if not a<br />

favourable vote) from the Greens. And even a few<br />

Socialists have said they will not approve the pact.<br />

Legislation governing the EU debt-brake rule, which<br />

is required under the fiscal compact, is also due to be<br />

presented to parliament, possibly as soon as 8<br />

October. It requires a separate vote. The EU debtbrake<br />

rule, known in France as the ‘golden rule’, will<br />

not be added to the constitution, but voted into law by<br />

way of a special loi organique. The usual lag<br />

between such a bill being presented and a<br />

parliamentary vote is six weeks (though a fast-track<br />

option does exist). An absolute majority is required<br />

(rather than the usual relative, or simple, majority).<br />

The French Constitutional Court said in August that<br />

going down the loi organique route would be<br />

compliant with the compact and the French<br />

constitution, as Article 34 of the country’s basic law<br />

already states that "the multi-year framework for<br />

public accounts is aimed at balanced accounts." It<br />

says that this framework and the rules applicable to<br />

the annual budget may be set out in a supplementary<br />

loi organique.<br />

Approval is not an issue, as opposition conservative<br />

parliamentarians will vote en masse for ratification and<br />

the ‘golden rule’ for three reasons: (i) they have always<br />

been behind the pact, which they believe to be good for<br />

France, (ii) to underscore that Mr Hollande has done a<br />

U-turn on the issue and (iii) to up the pressure on the<br />

government in the hope that subsequent austerity<br />

measures will boost their chances of winning the 2014<br />

local and 2017 national elections.<br />

Good news and bad news<br />

Mr Hollande would prefer to see this treaty approved<br />

with a majority of his own. We believe he can<br />

achieve this. One thing that may help him convince<br />

his own ranks is the recent OMT announcement. He<br />

said before being elected that then President<br />

Sarkozy should have asked for more involvement by<br />

the ECB in searching for a solution to the euro crisis.<br />

Mr Hollande has not claimed to have played any role<br />

in the ECB’s new policy line. However, the bank’s<br />

change of heart can only help him backstage.<br />

When changing its outlook for Germany and the<br />

Netherlands on 23 July, Moody's said that "by the<br />

end of the third quarter, Moody's will also assess the<br />

implications of these developments [the rising risk of<br />

a Greek exit, the growing likelihood of collective<br />

support for other euro-area sovereigns and stalled<br />

economic growth] for Aaa-rated Austria and France,<br />

whose rating outlooks were moved to negative from<br />

stable in February." Since then, we have had nothing<br />

further. Back in February Moody's said France's debt<br />

metrics, were “among the weakest of France's Aaarated<br />

peers". So, the risk of a downgrade persists<br />

(S&P did just that last January), which may upset<br />

some left-leaning MPs just before they are asked to<br />

approve a framework for future austerity.<br />

Solidifying his majority in parliament<br />

President Hollande will have to submit to parliament<br />

a restrictive 2013 budget and some structural<br />

reforms to improve France’s competitiveness. This<br />

was not highlighted during his campaign. To get<br />

these approved, he needs to ensure that his majority<br />

is solid. The votes on the fiscal compact and the<br />

golden rule will be real tests in this regard.<br />

Dominique Barbet 20 September 2012<br />

Market Mover<br />

10<br />

www.GlobalMarkets.bnpparibas.com

UK Inflation: No Pressure<br />

• UK inflation ticked up in July, raising concerns<br />

that underlying pressures might be firming. The<br />

subsequent drop in August looks reassuring.<br />

• Headline inflation over the rest of 2012 will<br />

certainly be higher than the Bank of England<br />

forecast in its August Inflation Report. But most of<br />

the difference looks to be down to food and<br />

energy.<br />

• The MPC will look through that, giving it room<br />

to carry out more QE in November.<br />

• RPI inflation has specific methodological risks<br />

attached to it. A consultation has been announced<br />

that could see the average gap between RPI and<br />

CPI narrowed significantly.<br />

5.5<br />

5.0<br />

4.5<br />

4.0<br />

3.5<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

Chart 1: UK Headline and core CPI (% y/y)<br />

CPI (% y/y)<br />

Core (% y/y)<br />

02 03 04 05 06 07 08 09 10 11 12<br />

• The timetable for changes next year is tight.<br />

But the ONS and the government appear keen.<br />

Inflation reared its ugly head in July<br />

Inflation reappeared on the radar of UK policymakers<br />

last month after a surprising rise in the CPI annual rate<br />

to 2.6% from 2.4% in June. That was against market<br />

expectations of a decline in annual inflation in July.<br />

One of the worrying things, potentially, about the rise<br />

in inflation in July was the fairly broad-based nature of<br />

the increase. Clothing prices, for example, showed a<br />

smaller fall than usual for the month and contributed<br />

0.05pp to the annual rate increase. And other notable<br />

increases came from recreation and culture. Within<br />

this category, games, toys and hobbies, newspapers<br />

and periodicals and package holidays were sizeable<br />

upward influences. Away from recreation and culture,<br />

restaurants and hotels, alcohol and tobacco and<br />

housing and household services also made small<br />

upward contributions.<br />

With the UK PMI surveys also surprising to the upside<br />

in August, there was a hint that we might be about to<br />

embark on one of the periodic episodes of inflation<br />

anxiety that result in monetary-policy expectations<br />

being revised in a more hawkish direction. For<br />

example, earlier this year high-side inflation releases<br />

in February and March, along with firmer surveys,<br />

resulted in an extension of QE being taken off the<br />

table at the May MPC meeting.<br />

But it went back in its shell in August, mostly<br />

This week’s August inflation release goes some way<br />

to assuaging concerns about underlying inflation. The<br />

annual rate of CPI inflation fell back to 2.5%, a 0.1pp<br />

Source: ONS, <strong>BNP</strong> Paribas<br />

reduction. On its own of course that still puts inflation<br />

above the level it was at two months ago.<br />

But additional reassurance can probably be gleaned<br />

from that fact that the fall in inflation was fairly broadly<br />

based. Clothing prices rose less this year than last,<br />

contributing 0.04pp to the fall in annual inflation.<br />

Meanwhile furniture and household goods prices<br />

contributed 0.08pp to the annual change and<br />

housing and household services also made a<br />

downward contribution, as a gas and electricity price<br />

rise in 2011 fell out of the calculation. On the upside,<br />

transport prices added upward pressure to the<br />

annual rate, as did recreation and cultural goods.<br />

Higher inflation largely due to energy and food<br />

This fairly widespread fall-off means the reason that<br />

the headline rate of inflation is higher than in June<br />

largely comes down to higher energy and food<br />

prices. The core rate of inflation actually fell in the<br />

August figures to 2.1%, just a shade above the Bank<br />

of England’s 2.0% target for the headline rate.<br />

There have been several developments of late that<br />

mean the headline rate of inflation will finish this year<br />

significantly higher than expected a few months ago.<br />

Most obviously, the price of a litre of petrol keeps<br />

rising. Indeed, petrol prices are now higher than they<br />

have been since early May, even though the sterling<br />

price of a barrel of crude is lower than it was then.<br />

Other recent upside developments include an<br />

announced rise in gas and electricity bills by one<br />

supplier from October and the expectation that food<br />

prices will firm in due course to reflect higher<br />

David Tinsley 20 September 2012<br />

Market Mover<br />

11<br />

www.GlobalMarkets.bnpparibas.com

commodity prices, though the rise in sterling offsets<br />

this effect to some extent.<br />

The MPC will still have room for more QE<br />

The bottom line is that the August BoE forecast for<br />

consumer price inflation of 2.2% in the fourth quarter<br />

of this year is looking a bit of a stretch. Our own<br />

forecast is for the rate in Q4 to average 2.5%.<br />

But because most of the reasons for the upside news<br />

appear to be supply shock-driven price rises in<br />

energy and food, rather than anything more broadly<br />

based, this gives licence to the Monetary Policy<br />

Committee to look through the firmer headline rate.<br />

Average earnings growth remains at or below 2%,<br />

according to the most recent data. And as unit labour<br />

cost growth has been pushed up by falling GDP<br />

alongside still rising employment, we would not expect<br />

that productivity squeeze to last much longer. Indeed,<br />

a big rise in GDP in Q3 should provide an opportunity<br />

for some correction here. So, the underlying position<br />

on domestically generated inflationary pressure from<br />

the labour market is fairly benign.<br />

This all means that on the current constellation of<br />

data, the MPC is still likely to see room for more<br />

quantitative easing at its November meeting, when<br />

the current tranche of buying is completed.<br />

A further downside risk to RPI<br />

Alongside constrained consumer price pressures,<br />

there are further downward risks to the retail price<br />

index (RPI). This is, of course, the index to which<br />

indexed-linked sovereign UK debt is anchored.<br />

Most countries with index-linked debt link their bonds<br />

to some version of a consumer price index. The UK<br />

differs in that the RPI is, in effect, a fairly old, legacy<br />

index that uses what might be called an antiquated<br />

aggregation procedure in some parts of its<br />

construction. The result is that UK RPI inflation,<br />

which also includes a mortgage-based measure of<br />

housing costs, has tended over a long run of data to<br />

average 0.5pp higher than CPI inflation. And since<br />

2010, that difference has been 0.9pp.<br />

A methodological group within the Office for National<br />

Statistics (ONS), the Consumer Prices Advisory<br />

Committee (CPAC), is currently considering the case<br />

for making methodological changes to RPI that will<br />

move it closer in construction to the CPI. A statement<br />

from the National Statistician, alongside the CPAC<br />

3<br />

2<br />

1<br />

-1<br />

-2<br />

-3<br />

-4<br />

Chart 3: UK RPI vs. CPI Inflation (%)<br />

0<br />

1991 1994 1997 2000 2003 2006 2009 2012<br />

Source: ONS, <strong>BNP</strong> Paribas<br />

average 1991 onw ards<br />

average 2002 onw ards<br />

average 2010 onw ards<br />

minutes released this week, revealed the intention to<br />

put out to public consultation a range of options to<br />

change the aggregation of the RPI. At their most<br />

extreme, this would involve aggregating the RPI<br />

using the same formulae as in the CPI. That could, in<br />

effect, narrow the gap between CPI and RPI inflation<br />

from the aggregation bias to more-or-less zero.<br />

The attraction to the government of such a move is<br />

obvious. Changing the basis on which RPI is<br />

calculated and thereby lowering its rate could, in<br />

principle, save the sovereign GBP 3bn or so a year<br />

in interest costs. At a time of fiscal austerity, this is<br />

nothing to be scoffed at. On the other hand,<br />

changing the nature of the index used for indexlinked<br />

gilts might risk upsetting a key investor<br />

community upon which the government relies for<br />

considerable funding.<br />

Major methodological change cannot be ruled out<br />

The consultation on the changes to RPI will conclude<br />

in late November and we should know by January<br />

how the ONS is going to proceed. Any final decision<br />

to change the RPI index will rest with the Chancellor<br />

of the Exchequer. It is possible that comprehensive<br />

changes to the RPI could come in the February 2013<br />

inflation data, published in March. The timetable<br />

between a decision to go ahead with a change and<br />

publication looks exceptionally tight, however, and a<br />

delay until March 2014 may be possible. But<br />

contingent on the consultation, the ONS and CPAC<br />

appear keen to press ahead with significant changes<br />

to the RPI.<br />

David Tinsley 20 September 2012<br />

Market Mover<br />

12<br />

www.GlobalMarkets.bnpparibas.com

US Housing: New Channels for Policy<br />

• The housing sector has been the US<br />

economy’s bright spot in an otherwise<br />

disappointing economic performance in 2012.<br />

Chart 1: Rental Homes on the Rise<br />

• The improvement has not been driven by a<br />

recovery in household formation and demand for<br />

homeownership, which continue to be weak.<br />

• Rather, the rise in rents and decline in home<br />

values have boosted rental yields to the point that<br />

investors have begun to clear excess housing<br />

supply.<br />

• The Fed’s aggressive policies have depressed<br />

yields on safe assets to the point that solid<br />

nominal rental yields are quite attractive.<br />

• Thus, Fed policy is finally reaching housing,<br />

through a less conventional channel, and may<br />

even have a greater impact at the margin than in<br />

the past.<br />

Housing has turned a corner, despite the lack of<br />

demand for homeownership<br />

Housing has been a bright spot in the otherwise<br />

dismal US economic performance this year, raising<br />

hopes that QE might stimulate this critical sector with<br />

greater force now that the sector appears to be turning<br />

a corner. We think monetary policy, indeed, will have<br />

more oomph, but in a different way than it has in the<br />

past.<br />

Single-family home sales are up roughly 10% over a<br />

year earlier, home prices are up in the low-single digits<br />

and measures of excess supply have shown marked<br />

improvement. Yet, this is not a typical story of low<br />

mortgage rates stimulating increased demand. Owneroccupied<br />

housing units have not increased over the<br />

past year and are still down from the peak reached in<br />

2006 (see Chart 1).<br />

There appears to be little demand for homeownership.<br />

Mortgage applications for purchase have been<br />

essentially flat over the past several years (Chart 2).<br />

Despite mortgage rates hitting record lows,<br />

homeownership rates continue to drop, hitting levels<br />

not seen since 1997 (Chart 3), and total outstanding<br />

mortgage debt is still declining as households seek to<br />

deleverage and rebuild home equity. The New York<br />

Fed Quarterly Report on Household Debt and Credit<br />

published at the end of August indicated that<br />

consumer debt continued to decline in Q2, shrinking<br />

by another USD 52bn to USD 11.38trn. Mortgage debt<br />

has been on a constant downward trend since the<br />

financial crisis began in Q3 2008 (see Chart 4). The<br />

Source: Reuters EcoWin Pro<br />

Chart 2: Housing Demand Unmoved by QE<br />

Source: Reuters EcoWin Pro<br />

trend away from homeownership and housing<br />

leverage has continued unabated, despite the Fed’s<br />

aggressive monetary interventions.<br />

We have long been of the view that much of the lack<br />

of demand for housing is probably a structural<br />

phenomenon; younger households need mobility and<br />

liquidity in a weak labour market and have learned the<br />

hard lessons from their parents that housing is hardly<br />

a safe investment. The overall pace of household<br />

formation continues to run below prior norms, driven<br />

by new views on homeownership and the weakness in<br />

the economy. The share of people aged 25-34, the<br />

peak years for household formation, who are living<br />

with their parents remained unchanged at nearly 14%<br />

in 2011, well above the share closer to 11% that<br />

prevailed before the crisis.<br />

Investors are the new homeowners<br />

If there is no demand from housing, what is driving the<br />

improvement? It appears that rents have risen and<br />

home prices have declined to the point where<br />

investors see value in buying real estate for<br />

conversion to rental. While there is no growth in<br />

Julia Coronado and Yelena Shulyatyeva 20 September 2012<br />

Market Mover<br />

13<br />

www.GlobalMarkets.bnpparibas.com

owner-occupied housing units, renter-occupied<br />

housing units have been on a sharp, upward trend,<br />

adding about 1mn per year over the past two years<br />

(Chart 1). Rental yields, calculated as annual rent<br />

divided by home prices, have now reached their<br />

highest levels as far back as we have data, even as<br />

yields on other assets have been declining steadily<br />

(see Chart 5).<br />

As investors seek returns, housing looks increasingly<br />

attractive. A lot of increased activity has come from<br />

cash buyers; the National Association of Realtors<br />

reports that the share of existing single-family home<br />

sales purchased by cash buyers has risen to just<br />

below 30% from 20% a few years ago. Private equity<br />

investors have also been reportedly buying blocks of<br />

homes for rental conversion, although comprehensive<br />

data on this source of demand is unavailable. If prices<br />

remain stable, banks could become more willing to<br />

lend to potential landlords. Indeed, The Wall Street<br />

Journal reported this week that ratings agencies are<br />

exploring rating securities backed by home rental<br />

contracts. A market for securitized rental contracts<br />

could significantly increase the investor demand base.<br />

Broadening the investor/rental market is no simple<br />

task. Some regions have higher rental yields than<br />

others, and each state has its own legal framework for<br />

rental contracts and protections for renter occupants.<br />

Regions that experienced more of a housing boom<br />

and bust, like the South and West, currently offer the<br />

highest rental yields. Despite the complexities<br />

involved, rental yields are increasingly compelling on<br />

the back of negative real yields on safe assets, and<br />

we would expect this market to continue to grow.<br />

A new channel for monetary policy<br />

The Fed has tried valiantly to stimulate housing with<br />

its unconventional policies. It has acquired a net USD<br />

844bn in mortgage securities and roughly USD 1ttrn<br />

in Treasuries since the crisis began. Mortgage rates<br />

have dropped to record lows. Yet, demand for<br />

homeownership remains dismal by historical<br />

standards. It is tempting to conclude that the Fed’s<br />

new efforts will have little-to-no impact on this critical<br />

sector (Chart2).<br />

However, the portfolio balance channel appears to<br />

finally be reaching the housing market. QE has been<br />

quite successful driving down yields on safe assets<br />

and forcing investors into riskier assets, such as<br />

corporate bonds and equities. It appears that housing<br />

is increasingly becoming an important beneficiary as<br />

investors are driven toward the now relatively much<br />

more attractive investment of rental housing. This is<br />

good news from a macroeconomic standpoint, as well,<br />

since increased rental supply will help meet our<br />

expectation of continued growth in rental demand.<br />

Greater investor activity should lead to further stability<br />

Chart 3: Homeownership Is Plunging<br />

Source: Reuters EcoWin Pro<br />

Chart 4: Mortgage Deleveraging Continues<br />

Source: Reuters EcoWin Pro<br />

Chart 5: Housing Is a Great <strong>Investment</strong><br />

Source: Reuters EcoWin Pro<br />

or modest gains in home prices, and temper the<br />

recent rise in rents, thereby, relieving upward pressure<br />

on core inflation.<br />

The rise in housing investors will not boost all<br />

segments of the housing market; higher-end suburban<br />

markets are not good candidates for investors seeking<br />

a liquid rental market. However, many middle- and<br />

lower-end neighbourhoods and urban areas should<br />

continue to see improved demand dynamics on the<br />

back of the Fed’s aggressive new policy stance and<br />

may even lead to an increased marginal impact from<br />

their interventions.<br />

Julia Coronado and Yelena Shulyatyeva 20 September 2012<br />

Market Mover<br />

14<br />

www.GlobalMarkets.bnpparibas.com

Japan: The Eastern Fiscal Cliff<br />

• Due to its inability to enact deficit-financing<br />

legislation, the government has decided to<br />

suspend for three months the disbursal of<br />

roughly JPY 5trn in expenditure. While this<br />

should have little economic impact, failure to<br />

enact this legislation by December could trigger<br />

more drastic spending cuts of roughly JPY 7trn<br />

(almost 5.7% of GDP) in December.<br />

• To avoid such a disastrous development, debtfinancing<br />

legislation needs to be enacted as<br />

soon as possible, something that will require<br />

some kind of deal with the opposition LDP. And<br />

here, there are two main possibilities.<br />

• The straightforward deal would be to agree to<br />

dissolve the lower house in exchange for<br />

opposition support for the legislation. This would<br />

mean a snap election by year end (or slightly<br />

thereafter, if Prime Minister Yoshihiko Noda<br />

insists on passing a supplementary budget).<br />

• The other option would be for the LDP to make<br />

its cooperation contingent on an agreement to<br />

forswear using such legislation as a political<br />

trump card, something that would benefit the<br />

LDP should it return to power (as seems likely).<br />

This would leave the dissolution of the lower<br />

house at Prime Minister Noda’s discretion,<br />

essentially pushing the general election back to<br />

next summer.<br />

Budgetary disbursement delayed for first time in<br />

postwar era<br />

Non-essential budgetary spending has been<br />

postponed for the first time in the post-war era. The<br />

government has moved to conserve cash, because<br />

the Diet session was drawing to a close (on 8<br />

September) without action being taken on legislation<br />

authorising the issue of deficit-financing bonds. As<br />

almost half of the spending in the general account<br />

budget is covered by deficit-financing bonds, it will be<br />

impossible to implement the budget as planned<br />

without this key legislation. With the fate of the debtfinancing<br />

bill still uncertain owing to the political<br />

stalemate in the divided Diet, there is a risk that the<br />

government could run out of cash by late October.<br />

Consequently, in an effort to tide things over at least<br />

through November, the government on 7 September<br />

decided to conserve cash by suspending for three<br />

months the disbursal of roughly JPY 5trn in spending.<br />

These funds had been destined for (1) administrative<br />

expenses (telephone and photocopying charges,<br />

etc.), (2) subsidies to independent organisations,<br />

such as national universities, (3) tax-revenue grants<br />

to local governments, and (4) transfers to the special<br />

accounts (including the public pension-fund special<br />

account). To limit the impact on people’s lives and<br />

the economy, all essential spending (social welfare,<br />

defence, reconstruction, etc.) will not be affected.<br />

That said, if the debt-financing legislation remains in<br />

limbo, drastic spending cuts will become inevitable,<br />

resulting in a partial shutdown of government. And<br />

this would have serious ramifications for the<br />

economy and daily life.<br />

US faced government shutdown risk last summer<br />

While one might shudder at the idea of a government<br />

shutdown, it is worth remembering that the US faced<br />

a similar risk last July because of the debt-ceiling<br />

crisis. As in Japan, the US federal budget and the<br />

amount the government can borrow to service the<br />

budget deficits (debt ceiling) are agreed separately.<br />

Congressional authorisation is required whenever the<br />

debt ceiling is raised. In the US, where control of<br />

Congress can often be divided between government<br />

and opposition, negotiations on raising the debt<br />

ceiling ran into difficulty when Democrat and<br />

Republican views on fiscal affairs collided. And for a<br />

while, there was a growing risk that an agreement<br />

might not be reached, which could have resulted not<br />

only in the delayed disbursement of social security<br />

benefits and other payments, but also sovereign<br />

default. While an accord was reached at the eleventh<br />

hour, financial markets were destabilised for a while.<br />

Little economic impact from delaying JPY 5trn<br />

Getting back to Japan, the recent decision to save<br />

roughly JPY 5trn basically involves the delayed<br />

disbursal of funds, though there also is the possibility<br />

that some of this spending might be eliminated<br />

altogether. The targeted administrative expenses and<br />

subsidies to independent organisations could be<br />

axed. Together, this could save the government<br />

roughly JPY 600bn, a fairly insignificant amount in<br />

macro terms (ultimately, we suspect little spending<br />

will actually be cut). The lion’s share of the spending<br />

delays come from transfers to the special accounts<br />

(JPY 2.3trn) and tax-revenue grants to local<br />

government (JPY 2.1trn), which cannot be cut.<br />

Accordingly, as these disbursements will only be<br />

delayed for three months and duly paid out from<br />

December, the economic impact, when averaged out<br />

over the full period, should be pretty neutral.<br />

Ryutaro Kono/ Makoto Watanabe 20 September 2012<br />

Market Mover<br />

15<br />

www.GlobalMarkets.bnpparibas.com

Potential cash shortages ahead<br />

But if the debt-financing legislation remains blocked by<br />

the time December comes, drastic spending cuts and<br />

a partial shutdown of government will be unavoidable.<br />

The impact on the economy would be severe.<br />

Budgetary outlays are prevalent in December. For<br />

example, in December 2011, expenditures exceeded<br />

revenue (excluding government bonds) by almost JPY<br />

7trn (equivalent to roughly 5.7% of Q4 GDP). In the<br />

final quarter of FY2011, revenue exceeded spending<br />

by roughly JPY 2trn in January, but this was followed<br />

by shortfalls of more than JPY 5trn in February and<br />

roughly JPY 10trn in March, for a combined quarterly<br />

shortage of JPY 13trn (equivalent to about 11.1% of<br />

Q1 GDP). As the budget balance this fiscal year will<br />

likely be similar, very drastic spending cuts could<br />

become necessary. Of course, all spending does not<br />

directly affect the economy (delaying transfers to<br />

special accounts absorbs the reserve surpluses<br />

parked in some special accounts). But even if the<br />

amount were reduced by half, the impact on the<br />

economy would be substantial. Currently, with exports<br />

trending lower as a result of the slowing global<br />

economy and with economic support ending from the<br />

eco-car subsidy programme and income transfers to<br />

households in quake-hit areas, we expect the<br />

economy to enter another soft patch from Q3. But if<br />

the deficit-financing bill is not enacted by December,<br />

cuts in government spending will make conditions far<br />

worse than just a soft patch.<br />

Election by year end seems likely<br />

To avoid this, the debt-financing legislation needs to<br />

be enacted as soon as possible. But that is easier<br />

said than done. To win cooperation from the<br />

opposition LDP and New Komeito, Prime Minister<br />

Noda will have to make some kind of deal, and we<br />

see two main possibilities here. The most<br />

straightforward deal under current circumstances and<br />

based on past experience would be to agree to<br />

dissolve the lower house in exchange for opposition<br />

support of the debt-financing legislation and another<br />

vital bill involving electoral reform to rectify vote-value<br />

disparities. As both the DPJ and LDP are slated to<br />

hold leadership elections shortly (the DPJ on 21<br />

September, the LDP on 26 September), followed by<br />

an extraordinary Diet session in early October, such<br />

a deal would likely mean passing the debt-financing<br />

bill and electoral reform in October, then dissolving<br />