MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

isk in market participants’ minds, the trade is highly<br />

unlikely to post strong gains now.<br />

That being said, MAIN trades much too wide when<br />

compared to other risky asset markets; a simple<br />

model based on European equities and equity<br />

volatility is pricing MAIN about 7bp below its current<br />

valuations. In the US, the similar model indicates that<br />

IG is trading fair-value vs. the S&P500 and VIX<br />

indices. With this in mind, we think MAIN could<br />

momentarily outperform IG and we aim at closing the<br />

“Long Europe / Short US” trade as soon as we<br />

achieve 2 or 3bp of outperformance.<br />

What’s the call? Increase in GIIPS sovereign risk<br />

and decrease in concerns of a double-dip scenario<br />

are making iTraxx MAIN unlikely to outperform CDX<br />

IG. We aim at closing our “long Europe / short US” as<br />

soon as MAIN retraced from current oversold levels.<br />

Update on Curves:<br />

steepener recommendation (dated 25-Mar) to take<br />

profit at current levels.<br />

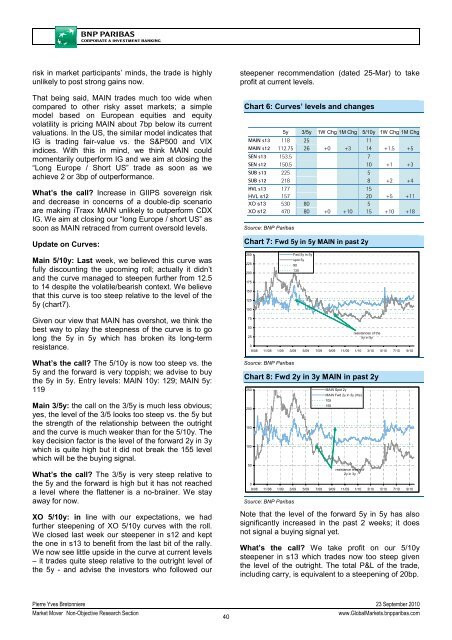

Chart 6: Curves’ levels and changes<br />

5y 3/5y 1W Chg 1M Chg 5/10y 1W Chg 1M Chg<br />

MAIN s13 118 25 11<br />

MAIN s12 112.75 26 +0 +3 14 +1.5 +5<br />

SEN s13 153.5 7<br />

SEN s12 150.5 10 +1 +3<br />

SUB s13 225 5<br />

SUB s12 218 8 +2 +4<br />

HVL s13 177 15<br />

HVL s12 157 20 +5 +11<br />

XO s13 530 80 5<br />

XO s12 470 80 +0 +10 15 +10 +18<br />

Source: <strong>BNP</strong> Paribas<br />

Chart 7: Fwd 5y in 5y MAIN in past 2y<br />

Main 5/10y: Last week, we believed this curve was<br />

fully discounting the upcoming roll; actually it didn’t<br />

and the curve managed to steepen further from 12.5<br />

to 14 despite the volatile/bearish context. We believe<br />

that this curve is too steep relative to the level of the<br />

5y (chart7).<br />

250<br />

225<br />

200<br />

175<br />

150<br />

125<br />

100<br />

Fwd 5y in 5y<br />

spot 5y<br />

90<br />

130<br />

Given our view that MAIN has overshot, we think the<br />

best way to play the steepness of the curve is to go<br />

long the 5y in 5y which has broken its long-term<br />

resistance.<br />

What’s the call? The 5/10y is now too steep vs. the<br />

5y and the forward is very toppish; we advise to buy<br />

the 5y in 5y. Entry levels: MAIN 10y: 129; MAIN 5y:<br />

119<br />

Main 3/5y: the call on the 3/5y is much less obvious;<br />

yes, the level of the 3/5 looks too steep vs. the 5y but<br />

the strength of the relationship between the outright<br />

and the curve is much weaker than for the 5/10y. The<br />

key decision factor is the level of the forward 2y in 3y<br />

which is quite high but it did not break the 155 level<br />

which will be the buying signal.<br />

What’s the call? The 3/5y is very steep relative to<br />

the 5y and the forward is high but it has not reached<br />

a level where the flattener is a no-brainer. We stay<br />

away for now.<br />

XO 5/10y: in line with our expectations, we had<br />

further steepening of XO 5/10y curves with the roll.<br />

We closed last week our steepener in s12 and kept<br />

the one in s13 to benefit from the last bit of the rally.<br />

We now see little upside in the curve at current levels<br />

– it trades quite steep relative to the outright level of<br />

the 5y - and advise the investors who followed our<br />

75<br />

50<br />

25<br />

0<br />

9/08 11/08 1/09 3/09 5/09 7/09 9/09 11/09 1/10 3/10 5/10 7/10 9/10<br />

Source: <strong>BNP</strong> Paribas<br />

resistances of the<br />

5y in 5y<br />

Chart 8: Fwd 2y in 3y MAIN in past 2y<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

9/08 11/08 1/09 3/09 5/09 7/09 9/09 11/09 1/10 3/10 5/10 7/10 9/10<br />

Source: <strong>BNP</strong> Paribas<br />

MAIN Spot 2y<br />

MAIN Fwd 2y in 3y (rhs)<br />

105<br />

155<br />

resistance levels of<br />

2y in 3y<br />

Note that the level of the forward 5y in 5y has also<br />

significantly increased in the past 2 weeks; it does<br />

not signal a buying signal yet.<br />

What’s the call? We take profit on our 5/10y<br />

steepener in s13 which trades now too steep given<br />

the level of the outright. The total P&L of the trade,<br />

including carry, is equivalent to a steepening of 20bp.<br />

Pierre Yves Bretonniere 23 September 2010<br />

Market Mover Non-Objective Research Section<br />

40<br />

www.GlobalMarkets.bnpparibas.com