MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Europe ITraxx Credit Indices<br />

• XO/MAIN: we advise to take profit on the<br />

compression trade we recommended last week;<br />

more than 20bp gain. Compression will remain a<br />

major theme in the coming months and we are<br />

now waiting for a better entry level to re-position<br />

it.<br />

• SUB/SEN: the more mixed picture in Bank<br />

Capital instruments –T1 being the sole<br />

exception– should trigger the underperformance<br />

of FIN SUB. Given the recent collapse of the<br />

SUB/SEN ratio, we think it makes sense to take<br />

profit on our compression trade “long risk FIN<br />

SUB / Short risk FIN SEN x1.5” even if further<br />

pressure on GIIPS could further compress the<br />

ratio. Net gain on the trade: 11bp.<br />

• MAIN/CDX: the increase in GIIPS sovereign<br />

risk and decrease in concerns of a double-dip<br />

scenario are making iTraxx MAIN unlikely to<br />

outperform CDX IG. Our trade “long Europe /<br />

short US” which is back to entry level will be<br />

closed as soon as MAIN has retraced from<br />

current oversold levels.<br />

• MAIN 5/10y: the 5/10y is now too steep vs.<br />

the 5y and the forward is very toppish; we<br />

advise to buy the 5y in 5y. Entry levels: 10y:<br />

129; 5y: 119.<br />

• MAIN 3/5y: the 3/5y is steep vs. the 5y and<br />

the forward is high but it has not reached a nobrainer<br />

level. We stay away for now.<br />

• XO 5/10y: we take profit on our 5/10y<br />

steepener in s13 which trades now too steep<br />

given the level of the 5y. The total P&L of the<br />

trade, including carry, is equivalent to a<br />

steepening of 20bp.<br />

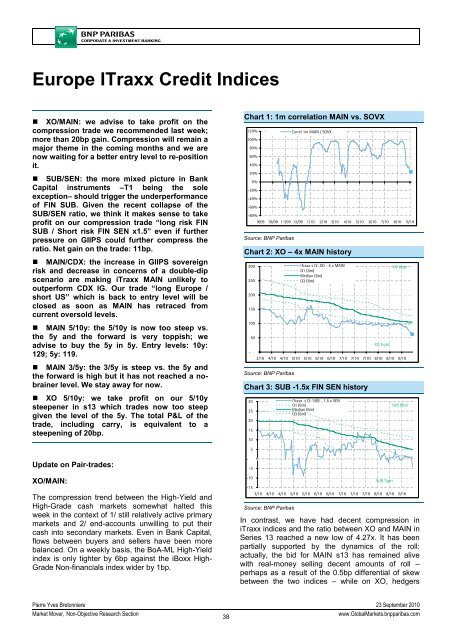

Chart 1: 1m correlation MAIN vs. SOVX<br />

120%<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

-20%<br />

-40%<br />

-60%<br />

-80%<br />

9/09 10/09 11/09 12/09 1/10 2/10 3/10 4/10 5/10 6/10 7/10 8/10 9/10<br />

Source: <strong>BNP</strong> Paribas<br />

Correl 1m MAIN / SOVX<br />

Chart 2: XO – 4x MAIN history<br />

300<br />

250<br />

200<br />

150<br />

100<br />

-<br />

50<br />

3/10 4/10 4/10 5/10 5/10 6/10 6/10 7/10 7/10 7/10 8/10 8/10 9/10<br />

Source: <strong>BNP</strong> Paribas<br />

iTraxx s12: XO - 4 x MAIN<br />

Q1 (6m)<br />

Median (6m)<br />

Q3 (6m)<br />

Chart 3: SUB -1.5x FIN SEN history<br />

30<br />

25<br />

20<br />

15<br />

10<br />

iTraxx s12: SUB - 1.5 x SEN<br />

Q1 (6m)<br />

Median (6m)<br />

Q3 (6m)<br />

XO Tight<br />

XO Wide<br />

SUB Wide<br />

5<br />

Update on Pair-trades:<br />

XO/MAIN:<br />

The compression trend between the High-Yield and<br />

High-Grade cash markets somewhat halted this<br />

week in the context of 1/ still relatively active primary<br />

markets and 2/ end-accounts unwilling to put their<br />

cash into secondary markets. Even in Bank Capital,<br />

flows between buyers and sellers have been more<br />

balanced. On a weekly basis, the BoA-ML High-Yield<br />

index is only tighter by 6bp against the iBoxx High-<br />

Grade Non-financials index wider by 1bp.<br />

-<br />

-5<br />

-10<br />

-15<br />

3/10 4/10 4/10 5/10 5/10 6/10 6/10 7/10 7/10 7/10 8/10 8/10 9/10<br />

Source: <strong>BNP</strong> Paribas<br />

SUB Tight<br />

In contrast, we have had decent compression in<br />

iTraxx indices and the ratio between XO and MAIN in<br />

Series 13 reached a new low of 4.27x. It has been<br />

partially supported by the dynamics of the roll:<br />

actually, the bid for MAIN s13 has remained alive<br />

with real-money selling decent amounts of roll –<br />

perhaps as a result of the 0.5bp differential of skew<br />

between the two indices – while on XO, hedgers<br />

Pierre Yves Bretonniere 23 September 2010<br />

Market Mover, Non-Objective Research Section<br />

38<br />

www.GlobalMarkets.bnpparibas.com