MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

EUR: Outlook for the Curve<br />

• The Fed has clearly opened the door for<br />

QEII. QEI was favourable for govvies and<br />

mortgages but also for equities as the liquidity<br />

bonanza supported risk appetite.<br />

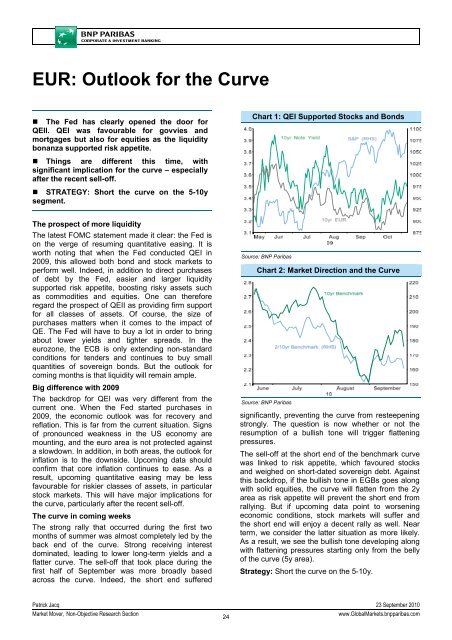

Chart 1: QEI Supported Stocks and Bonds<br />

• Things are different this time, with<br />

significant implication for the curve – especially<br />

after the recent sell-off.<br />

• STRATEGY: Short the curve on the 5-10y<br />

segment.<br />

The prospect of more liquidity<br />

The latest FOMC statement made it clear: the Fed is<br />

on the verge of resuming quantitative easing. It is<br />

worth noting that when the Fed conducted QEI in<br />

2009, this allowed both bond and stock markets to<br />

perform well. Indeed, in addition to direct purchases<br />

of debt by the Fed, easier and larger liquidity<br />

supported risk appetite, boosting risky assets such<br />

as commodities and equities. One can therefore<br />

regard the prospect of QEII as providing firm support<br />

for all classes of assets. Of course, the size of<br />

purchases matters when it comes to the impact of<br />

QE. The Fed will have to buy a lot in order to bring<br />

about lower yields and tighter spreads. In the<br />

eurozone, the ECB is only extending non-standard<br />

conditions for tenders and continues to buy small<br />

quantities of sovereign bonds. But the outlook for<br />

coming months is that liquidity will remain ample.<br />

Big difference with 2009<br />

The backdrop for QEI was very different from the<br />

current one. When the Fed started purchases in<br />

2009, the economic outlook was for recovery and<br />

reflation. This is far from the current situation. Signs<br />

of pronounced weakness in the US economy are<br />

mounting, and the euro area is not protected against<br />

a slowdown. In addition, in both areas, the outlook for<br />

inflation is to the downside. Upcoming data should<br />

confirm that core inflation continues to ease. As a<br />

result, upcoming quantitative easing may be less<br />

favourable for riskier classes of assets, in particular<br />

stock markets. This will have major implications for<br />

the curve, particularly after the recent sell-off.<br />

The curve in coming weeks<br />

The strong rally that occurred during the first two<br />

months of summer was almost completely led by the<br />

back end of the curve. Strong receiving interest<br />

dominated, leading to lower long-term yields and a<br />

flatter curve. The sell-off that took place during the<br />

first half of September was more broadly based<br />

across the curve. Indeed, the short end suffered<br />

Source: <strong>BNP</strong> Paribas<br />

Chart 2: Market Direction and the Curve<br />

Source: <strong>BNP</strong> Paribas<br />

significantly, preventing the curve from resteepening<br />

strongly. The question is now whether or not the<br />

resumption of a bullish tone will trigger flattening<br />

pressures.<br />

The sell-off at the short end of the benchmark curve<br />

was linked to risk appetite, which favoured stocks<br />

and weighed on short-dated sovereign debt. Against<br />

this backdrop, if the bullish tone in EGBs goes along<br />

with solid equities, the curve will flatten from the 2y<br />

area as risk appetite will prevent the short end from<br />

rallying. But if upcoming data point to worsening<br />

economic conditions, stock markets will suffer and<br />

the short end will enjoy a decent rally as well. Near<br />

term, we consider the latter situation as more likely.<br />

As a result, we see the bullish tone developing along<br />

with flattening pressures starting only from the belly<br />

of the curve (5y area).<br />

Strategy: Short the curve on the 5-10y.<br />

Patrick Jacq 23 September 2010<br />

Market Mover, Non-Objective Research Section<br />

24<br />

www.GlobalMarkets.bnpparibas.com