MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

We are comfortable with the directional exposure<br />

given our bullish view into year-end, although one<br />

could buy less notional in 4y1y to account for this.<br />

We choose to use receivers rather than straddles<br />

because this helps the position trade ‘conditional’ on<br />

a scenario of low rates. The position would still be<br />

underwater in a near-term selloff, although the<br />

sensitivity of the position would drop. Finally, we<br />

choose to strike the receivers 50bp below the<br />

forwards so that after one year the strikes are closer<br />

to the forwards, making it easier from a liquidity<br />

standpoint to get out of the position.<br />

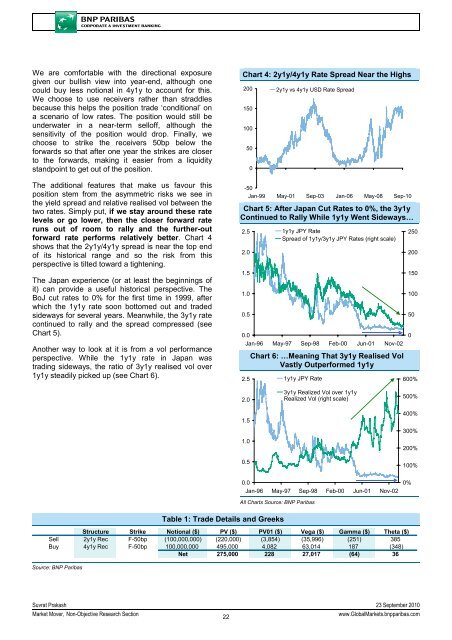

The additional features that make us favour this<br />

position stem from the asymmetric risks we see in<br />

the yield spread and relative realised vol between the<br />

two rates. Simply put, if we stay around these rate<br />

levels or go lower, then the closer forward rate<br />

runs out of room to rally and the further-out<br />

forward rate performs relatively better. Chart 4<br />

shows that the 2y1y/4y1y spread is near the top end<br />

of its historical range and so the risk from this<br />

perspective is tilted toward a tightening.<br />

The Japan experience (or at least the beginnings of<br />

it) can provide a useful historical perspective. The<br />

BoJ cut rates to 0% for the first time in 1999, after<br />

which the 1y1y rate soon bottomed out and traded<br />

sideways for several years. Meanwhile, the 3y1y rate<br />

continued to rally and the spread compressed (see<br />

Chart 5).<br />

Another way to look at it is from a vol performance<br />

perspective. While the 1y1y rate in Japan was<br />

trading sideways, the ratio of 3y1y realised vol over<br />

1y1y steadily picked up (see Chart 6).<br />

Chart 4: 2y1y/4y1y Rate Spread Near the Highs<br />

200<br />

150<br />

100<br />

50<br />

0<br />

2y1y vs 4y1y USD Rate Spread<br />

-50<br />

Jan-99 May-01 Sep-03 Jan-06 May-08 Sep-10<br />

Chart 5: After Japan Cut Rates to 0%, the 3y1y<br />

Continued to Rally While 1y1y Went Sideways…<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

0.0<br />

Jan-96 May-97 Sep-98 Feb-00 Jun-01 Nov-02<br />

2.5<br />

1y1y JPY Rate<br />

Spread of 1y1y/3y1y JPY Rates (right scale)<br />

Chart 6: …Meaning That 3y1y Realised Vol<br />

Vastly Outperformed 1y1y<br />

1y1y JPY Rate<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

600%<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

3y1y Realized Vol over 1y1y<br />

Realized Vol (right scale)<br />

500%<br />

400%<br />

300%<br />

200%<br />

100%<br />

0.0<br />

Jan-96 May-97 Sep-98 Feb-00 Jun-01 Nov-02<br />

0%<br />

All Charts Source: <strong>BNP</strong> Paribas<br />

Table 1: Trade Details and Greeks<br />

Structure Strike Notional ($) PV ($) PV01 ($) Vega ($) Gamma ($) Theta ($)<br />

Sell 2y1y Rec F-50bp (100,000,000) (220,000) (3,854) (35,996) (251) 385<br />

Buy 4y1y Rec F-50bp 100,000,000 495,000 4,082 63,014 187 (348)<br />

Net 275,000 228 27,017 (64) 36<br />

Source: <strong>BNP</strong> Paribas<br />

Suvrat Prakash 23 September 2010<br />

Market Mover, Non-Objective Research Section<br />

22<br />

www.GlobalMarkets.bnpparibas.com