MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Market Outlook<br />

Fed opens the door to<br />

more stimulus…<br />

…as it fails to deliver on its<br />

mandated objectives<br />

The outcome of the FOMC meeting pretty much matched our expectations,<br />

with the Fed opening the door to “additional accommodation if needed” to<br />

“support the economic recovery” and “return inflation, over time, to levels<br />

consistent with its mandate”. This formalised the bias to ease which had<br />

been laid out in Chairman Bernanke’s speech at Jackson Hole.<br />

We had suggested prior to the FOMC meeting that failure to deliver on its<br />

dual mandate of price stability and maximum sustainable employment would<br />

figure prominently in the Fed’s thinking and so it proved. The change in the<br />

language in the statement with regard to inflation was particularly striking. To<br />

quote: "Measures of underlying inflation are currently at levels somewhat<br />

below those the Committee judges most consistent, over the longer run, with<br />

its mandate to promote maximum employment and price stability”.<br />

If the data continue to paint a picture of sub-par growth, the Fed will continue<br />

to fail to achieve its mandated objectives and additional accommodation will<br />

be required. The bar for action, therefore, is set low: more of the same will<br />

be sufficient to prompt the next phase of balance sheet expansion – which<br />

we continue to believe is most probable at the November FOMC meeting. A<br />

marked improvement in incoming data will be required to forestall the Fed<br />

taking such action.<br />

70<br />

65<br />

60<br />

55<br />

50<br />

45<br />

40<br />

35<br />

30<br />

25<br />

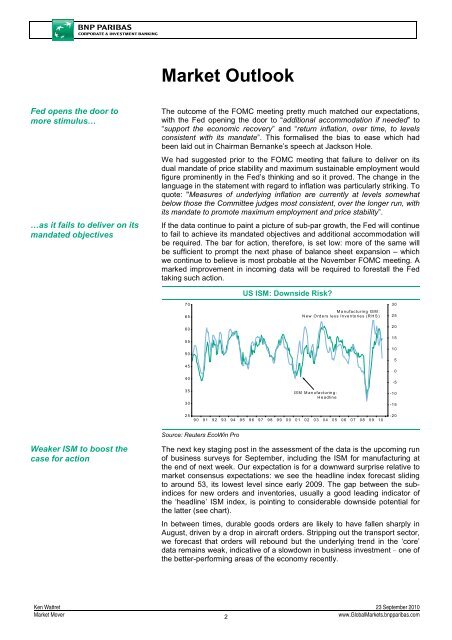

US ISM: Downside Risk?<br />

Manufacturing ISM:<br />

New Orders less Inventories (RHS)<br />

ISM Manufacturing:<br />

Headline<br />

90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

-5<br />

-10<br />

-15<br />

-20<br />

Source: Reuters EcoWin Pro<br />

Weaker ISM to boost the<br />

case for action<br />

The next key staging post in the assessment of the data is the upcoming run<br />

of business surveys for September, including the ISM for manufacturing at<br />

the end of next week. Our expectation is for a downward surprise relative to<br />

market consensus expectations: we see the headline index forecast sliding<br />

to around 53, its lowest level since early 2009. The gap between the subindices<br />

for new orders and inventories, usually a good leading indicator of<br />

the ‘headline’ ISM index, is pointing to considerable downside potential for<br />

the latter (see chart).<br />

In between times, durable goods orders are likely to have fallen sharply in<br />

August, driven by a drop in aircraft orders. Stripping out the transport sector,<br />

we forecast that orders will rebound but the underlying trend in the ‘core’<br />

data remains weak, indicative of a slowdown in business investment – one of<br />

the better-performing areas of the economy recently.<br />

Ken Wattret 23 September 2010<br />

Market Mover<br />

2<br />

www.GlobalMarkets.bnpparibas.com