MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

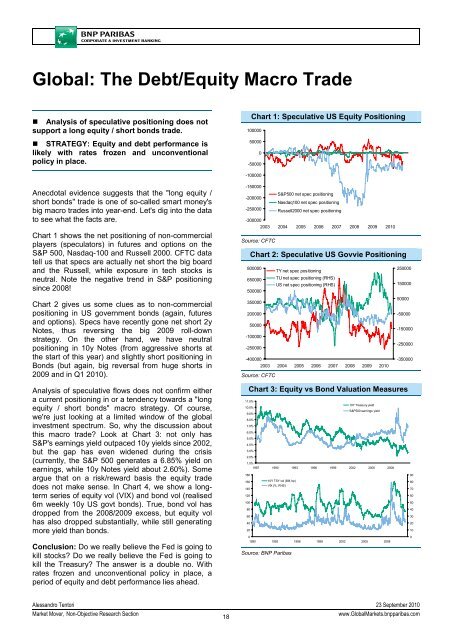

Global: The Debt/Equity Macro Trade<br />

• Analysis of speculative positioning does not<br />

support a long equity / short bonds trade.<br />

• STRATEGY: Equity and debt performance is<br />

likely with rates frozen and unconventional<br />

policy in place.<br />

Chart 1: Speculative US Equity Positioning<br />

100000<br />

50000<br />

0<br />

-50000<br />

-100000<br />

Anecdotal evidence suggests that the "long equity /<br />

short bonds" trade is one of so-called smart money's<br />

big macro trades into year-end. Let's dig into the data<br />

to see what the facts are.<br />

Chart 1 shows the net positioning of non-commercial<br />

players (speculators) in futures and options on the<br />

S&P 500, Nasdaq-100 and Russell 2000. CFTC data<br />

tell us that specs are actually net short the big board<br />

and the Russell, while exposure in tech stocks is<br />

neutral. Note the negative trend in S&P positioning<br />

since 2008!<br />

Chart 2 gives us some clues as to non-commercial<br />

positioning in US government bonds (again, futures<br />

and options). Specs have recently gone net short 2y<br />

Notes, thus reversing the big 2009 roll-down<br />

strategy. On the other hand, we have neutral<br />

positioning in 10y Notes (from aggressive shorts at<br />

the start of this year) and slightly short positioning in<br />

Bonds (but again, big reversal from huge shorts in<br />

2009 and in Q1 2010).<br />

Analysis of speculative flows does not confirm either<br />

a current positioning in or a tendency towards a "long<br />

equity / short bonds" macro strategy. Of course,<br />

we're just looking at a limited window of the global<br />

investment spectrum. So, why the discussion about<br />

this macro trade? Look at Chart 3: not only has<br />

S&P's earnings yield outpaced 10y yields since 2002,<br />

but the gap has even widened during the crisis<br />

(currently, the S&P 500 generates a 6.85% yield on<br />

earnings, while 10y Notes yield about 2.60%). Some<br />

argue that on a risk/reward basis the equity trade<br />

does not make sense. In Chart 4, we show a longterm<br />

series of equity vol (VIX) and bond vol (realised<br />

6m weekly 10y US govt bonds). True, bond vol has<br />

dropped from the 2008/2009 excess, but equity vol<br />

has also dropped substantially, while still generating<br />

more yield than bonds.<br />

Conclusion: Do we really believe the Fed is going to<br />

kill stocks? Do we really believe the Fed is going to<br />

kill the Treasury? The answer is a double no. With<br />

rates frozen and unconventional policy in place, a<br />

period of equity and debt performance lies ahead.<br />

-150000<br />

S&P500 net spec positioning<br />

-200000<br />

Nasdaq100 net spec positioning<br />

-250000 Russell2000 net spec positioning<br />

-300000<br />

2003 2004 2005 2006 2007 2008 2009 2010<br />

Source: CFTC<br />

Chart 2: Speculative US Govvie Positioning<br />

800000<br />

650000<br />

TY net spec positioning<br />

TU net spec positioning (RHS)<br />

US net spec positioning (RHS)<br />

250000<br />

150000<br />

500000<br />

50000<br />

350000<br />

200000<br />

-50000<br />

50000<br />

-150000<br />

-100000<br />

-250000<br />

-250000<br />

-400000<br />

-350000<br />

2003 2004 2005 2006 2007 2008 2009 2010<br />

Source: CFTC<br />

Chart 3: Equity vs Bond Valuation Measures<br />

11.0%<br />

10Y Treasury yield<br />

10.0%<br />

S&P500 earnings yield<br />

9.0%<br />

8.0%<br />

7.0%<br />

6.0%<br />

5.0%<br />

4.0%<br />

3.0%<br />

2.0%<br />

1.0%<br />

1987 1990 1993 1996 1999 2002 2005 2008<br />

180<br />

90<br />

160<br />

10Y TSY vol (6M, bp)<br />

VIX (%, RHS)<br />

80<br />

140<br />

70<br />

120<br />

60<br />

100<br />

50<br />

80<br />

40<br />

60<br />

30<br />

40<br />

20<br />

20<br />

10<br />

0<br />

0<br />

1990 1993 1996 1999 2002 2005 2008<br />

Source: <strong>BNP</strong> Paribas<br />

Alessandro Tentori 23 September 2010<br />

Market Mover, Non-Objective Research Section<br />

18<br />

www.GlobalMarkets.bnpparibas.com