Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Market</strong> Economics | Interest Rate Strategy | Forex Strategy 12 March 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

<strong>Market</strong> Outlook 2-3<br />

Fundamentals 4-21<br />

• FOMC Preview: Striving for Clarity 4-5<br />

• US Labour <strong>Market</strong>: A Slow 6-8<br />

Turning<br />

• US: Sell Short 9-10<br />

• US: Productivity Growth is 11-12<br />

Soaring<br />

• Germany: The Big Chill 13-14<br />

• UK: Election Update 15<br />

• SNB: Keeping the Ball Rolling 16<br />

• Japan: The Target of Fiscal 17-19<br />

Restructuring<br />

• Japan: Jobless Rate Slips Below 20-21<br />

5%<br />

Interest Rate Strategy 22-42<br />

• US: 3y Agency Sector Still Good 22-23<br />

for Carry<br />

• US: Playing for Wider Spreads in 24<br />

a Sell-Off<br />

• EUR: Further Flattening Ahead 25<br />

• EUR: OAT60 Launched! 26<br />

• EUR: Normalisation in the EGB 27-28<br />

Universe<br />

• EUR Vega: Rolldown<br />

29<br />

Opportunities on 10y Swap<br />

• JGBs: June - A Devil-Plagued 30<br />

Period<br />

• Global Inflation Watch 31-34<br />

• Inflation: Spring Break for 35-36<br />

Breakevens?<br />

• Europe iTraxx Credit Indices 37-39<br />

• Technical Analysis 40-41<br />

• Trade Reviews 42<br />

FX Strategy 43-49<br />

• Strategy: The Way of Wen 41-46<br />

• Technical Strategy: Commodity 47-48<br />

Currency Exhaustion<br />

• Trading Positions 49<br />

Forecasts & Calendars 50-63<br />

• 1 Week Economic Calendar 50-51<br />

• Key Data Preview 52-58<br />

• 4 Week Calendar 59<br />

• Treasury & SAS Issuance 60-61<br />

• Central Bank Watch 62<br />

• FX Forecasts 63<br />

Contacts 64<br />

www.Global<strong>Market</strong>s.bnpparibas.com<br />

• The FOMC meets next week and its ‘big picture’<br />

assessment should be similar to the last as conditions<br />

have not changed much since January’s meeting.<br />

• The Fed is likely to maintain its assertion that<br />

conditions will ‘likely warrant exceptionally low levels of<br />

the federal funds rate for an extended period’.<br />

• The conditions justifying this – including subdued<br />

inflation and stable expectations – remain in place.<br />

• Much of the recent Fed communication has centred on<br />

exit strategies. More information on reserve-draining<br />

operations could be included in the statement.<br />

• Treasury yields have risen with heavy supply and firm<br />

stock markets. The near-term strategy call is neutral. US<br />

data will be plentiful in coming days, including what we<br />

expect will be a weak, weather-affected retail sales report.<br />

• Core eurozone bond markets remain solid but a<br />

positive tone on Treasuries and/or a setback in equities will<br />

be needed for a decisive break below the 3.10-3.20% range<br />

on 10-year Bund yields.<br />

• We continue to favour 2/10s flatteners and expect<br />

further outperformance of peripheral markets.<br />

• Eurozone core HICP inflation should fall to a record low<br />

in February, with the downward pressure to continue as<br />

compensation growth decelerates.<br />

• For JGBs, a growing trend towards extension trades is<br />

likely within the short- to medium-term sector. The 5-yr<br />

sector is likely to be particularly attractive.<br />

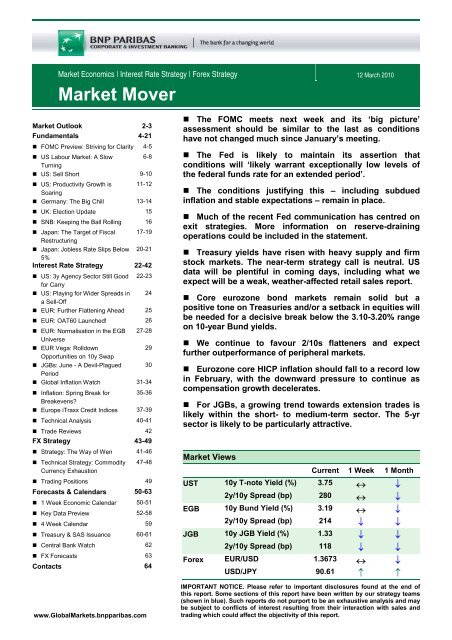

<strong>Market</strong> Views<br />

Current 1 Week 1 Month<br />

UST 10y T-note Yield (%) 3.75 ↔ ↓<br />

2y/10y Spread (bp) 280 ↔ ↓<br />

EGB 10y Bund Yield (%) 3.19 ↔ ↓<br />

2y/10y Spread (bp) 214 ↓ ↓<br />

JGB 10y JGB Yield (%) 1.33 ↓ ↓<br />

2y/10y Spread (bp) 118 ↓ ↓<br />

Forex EUR/USD 1.3673 ↔ ↓<br />

USD/JPY 90.61 ↑ ↑<br />

IMPORTANT NOTICE. Please refer to important disclosures found at the end of<br />

this report. Some sections of this report have been written by our strategy teams<br />

(shown in blue). Such reports do not purport to be an exhaustive analysis and may<br />

be subject to conflicts of interest resulting from their interaction with sales and<br />

trading which could affect the objectivity of this report.

<strong>Market</strong> Outlook<br />

Upward pressure on yields<br />

as equities do well…<br />

Bond yields have been climbing in recent days against a backdrop of heavy<br />

supply and upward moves in the major equity indices and oil prices, which<br />

are now approaching January’s highs. Having taken a bearish stance on<br />

Treasuries ahead of the supply, the strategy call is neutral for the week<br />

ahead. The market ought to regain at least some of its lost ground, however,<br />

if our forecast of a disappointing February US retail sales report is borne out.<br />

As mentioned in these pages before, getting a firm handle on the underlying<br />

state of the US and European economies is being complicated by various<br />

crosswinds at present. The ‘cold snap’ at the start of the year is one such<br />

complication. We expect it to have dampened non-essential retail sales in<br />

the US last month, contributing to our forecast of m/m declines on both a<br />

headline and ex-auto basis (consensus is for positives on both).<br />

…but near-term data flow<br />

ought to be favourable<br />

Another complication is the difference in the performance of large and small<br />

businesses. US data illustrate the contrast. The ISM is elevated, indicative of<br />

the boost for larger companies from their exposure to robust markets outside<br />

the US. Smaller businesses, in contrast, are more dependent on internal<br />

economic conditions and the supply of credit from banks.<br />

The difficulties regarding the latter continue to be reflected in the survey of<br />

independent businesses. The NFIB data also show both capex and hiring<br />

intentions at low levels (Chart 1). As small businesses are a key source of<br />

job creation, this will be an important influence on the Fed’s reaction function<br />

if, as we expect, census effects flatter payroll data in the spring.<br />

Chart 1: Size Matters<br />

15<br />

National Federation of Independent Businesses Survey<br />

10<br />

Hiring Intentions<br />

5<br />

0<br />

-5<br />

-10<br />

-15<br />

Capex Intentions<br />

-20<br />

-25<br />

R elative to M ean<br />

86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09<br />

Source : Reuters EcoWin Pro<br />

FOMC to reiterate the<br />

commitment to<br />

exceptionally low rates for<br />

an extended period…<br />

The event calendar gets busier in the coming days, including the meeting of<br />

the FOMC (with the accompanying announcement on Tuesday). Economic<br />

and financial conditions have changed little since the January meeting,<br />

suggesting the ‘big picture’ themes in the statement will not be subject to<br />

radical change. There is scope for a little tweaking though, with the outlook<br />

for business investment a candidate for an upgrade.<br />

The Fed should continue with the assertion that conditions will “likely warrant<br />

exceptionally low levels of the federal funds rate for an extended period.”<br />

The conditions which justify this – “low rates of resource utilization, subdued<br />

inflation trends, and stable inflation expectations” – still prevail. We expect<br />

the February CPI next week to show core inflation falling to 1.4%, matching<br />

the cycle low from August last year.<br />

Ken Wattret 12 March 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

2<br />

www.Global<strong>Market</strong>s.bnpparibas.com

…and to elaborate on the<br />

exit strategy<br />

Much of the communication from the Fed during the inter-meeting period has<br />

revolved around exit strategies. A number of Fed speakers have described a<br />

possible roadmap to Fed tightening, with reserve-draining operations as the<br />

starting point. The latter issue is likely to become a regular feature of FOMC<br />

statements, probably starting with this one.<br />

Amid a busy week, a range of business surveys for March will be released;<br />

we expect them to remain generally elevated. It will be interesting to see<br />

how NAHB sentiment, i.e. confidence among homebuilders, fares. While up<br />

by about ten percentage points from its lows sentiment is still below the level<br />

seen last autumn – indicative of a faltering housing market recovery despite<br />

the stimulus measures introduced.<br />

EGB curve flatteners and<br />

peripheral outperformance<br />

favoured<br />

Switching to Europe, core eurozone bond markets remain solid but a more<br />

constructive tone on Treasuries and/or a setback in equities will be needed<br />

for a decisive break below the 3.10-3.20% range on 10-year Bund yields.<br />

We continue to favour 2/10s flatteners and expect further outperformance of<br />

peripheral markets.<br />

The imminent release on eurozone industrial production data for January is<br />

set to be strong, highlighting the continued outperformance of externallysensitive<br />

manufacturing sector data. The y/y rate of change in output will fly.<br />

This is base effect driven, however, and central banks should focus on levels<br />

rather than rates of change. Despite the rebound since spring last year,<br />

industrial output in the eurozone is still down by almost 20% from 2008’s<br />

peak.<br />

This is crucial for the recovery and policy. In other words, as output has<br />

fallen by much more than employment even as activity picks up, firms will<br />

not have to raise headcount in response. So the virtuous circle of job gains<br />

and confidence needed to get the economy really motoring will be absent.<br />

The employment data for Q4 next week will show the sixth consecutive q/q<br />

decline, albeit a less pronounced one than in prior quarters.<br />

Core inflation headed<br />

south in the eurozone and<br />

not just this month<br />

5-yr sector preferred in<br />

JGB market<br />

We forecast that core HICP inflation in the eurozone will fall to a record low<br />

of 0.8% in February’s release. An even lower rate was on the cards prior to<br />

the revisions to German data earlier this week but this is merely a matter of<br />

time. As wage growth will continue to moderate as a lagged response to the<br />

increase in unemployment and low headline inflation, unit labour cost growth<br />

will decelerate markedly (and we think, go negative), pushing further down<br />

on core inflation. The ECB is confident that inflation expectations will remain<br />

well anchored. We are much less so.<br />

The JGB market remains in a state of deadlock, but banks' bond investment<br />

plans for the coming fiscal year should require them to take on somewhat<br />

greater risk in search of carry. Hence we anticipate a growing trend towards<br />

extension trades within the short- to medium-term sector (such as a shift out<br />

of 2s into 5s). The 5-yr sector is likely to be particularly attractive in view of<br />

its low volatility. In the near term, JGBs may benefit from tailwinds relating to<br />

the possibility of additional QE and favourable supply-demand conditions.<br />

The 5-yr JGB auction on the 11th attracted solid demand from the domestic<br />

investor base. The JGB market outstanding is projected to increase by some<br />

JPY 27.6 trillion over the course of FY 2010 but maturities up to the 10yr<br />

sector will account for just JPY 11.1 trillion of this total, with the super-long<br />

sector set to account for the lion's share. Super-long yields are therefore<br />

most vulnerable to upward pressure.<br />

Ken Wattret 12 March 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

3<br />

www.Global<strong>Market</strong>s.bnpparibas.com

FOMC Preview: Striving for Clarity<br />

• Economic and financial conditions have<br />

changed little since the January FOMC meeting,<br />

so we expect little change in the Fed’s<br />

cautiously optimistic tone.<br />

Chart 1: Financial Conditions are Little<br />

Changed on Balance<br />

• With high unemployment and decelerating<br />

core inflation, we think the Fed will continue to<br />

use “extended period” to describe its rate<br />

stance.<br />

• The Fed has indicated decisions about<br />

draining excess reserves will be monetary<br />

policy decisions and we think it may begin to<br />

describe the status of its exit strategies within<br />

the FOMC statement.<br />

Source: Reuters EcoWin Pro<br />

Chart 2: The Fed is Focused on Developing<br />

Reserve Draining Tools<br />

When the FOMC meets next week, it is unlikely its<br />

economic and inflation outlook will have changed<br />

very much since the January meeting. Incoming<br />

economic data have been consistent with its<br />

expectations for a gradual economic recovery and<br />

financial market conditions have not changed much<br />

in recent months. Thus while it may upgrade the<br />

discussion of business spending on equipment and<br />

software, the economic paragraph of their policy<br />

statement is likely to express the same cautiously<br />

optimistic tone which “anticipates a gradual return to<br />

higher levels of resource utilization in a context of<br />

price stability.”<br />

Much of the communication from the Fed during the<br />

inter-meeting period has revolved around exit<br />

strategies. Chairman Bernanke produced a<br />

congressional testimony on the exit strategies under<br />

development in early February, although he didn’t<br />

actually give the testimony in person owing to snow<br />

storms that closed the federal government. While he<br />

discussed the tools they were working on at some<br />

length, he was careful to distinguish the creation and<br />

testing of reserve draining tools from decisions on<br />

monetary policy. He reiterated that economic<br />

conditions will “likely warrant exceptionally low levels<br />

of the federal funds rate for an extended period.”<br />

We expect that language to remain in the statement<br />

released next week. All of the conditions that justify<br />

such a policy, namely “low rates of resource<br />

utilization, subdued inflation trends, and stable<br />

inflation expectations” still prevail. While the<br />

unemployment rate has dipped from 10.0% to 9.7%<br />

since the Fed met last, it is still quite elevated –<br />

Source: Reuters EcoWin Pro<br />

suggesting a considerable amount of unused<br />

resources. Meanwhile, core CPI inflation<br />

unexpectedly dipped to 1.55% y/y in January from<br />

1.82% in December. In this environment, the Fed is<br />

unlikely to see the need to prepare markets for a rate<br />

hike six months down the road. Indeed, in his semiannual<br />

monetary policy testimony, Chairman<br />

Bernanke reiterated that low rates were still needed<br />

to spur the “nascent economic recovery.”<br />

A number of Fed speakers have described a possible<br />

roadmap to Fed tightening as starting with reserve<br />

draining operations that reduce excess reserves from<br />

the current USD 1.1trn to several hundred billion. It is<br />

at this point the Fed feels it will regain control of the<br />

effective fed funds rate (see Chart 2). Brian Sack, the<br />

New York Fed’s head of market operations, said in<br />

recent days that “Removing a portion of the excess<br />

reserves from the system ahead of increasing the<br />

rate paid on reserves is a cautious approach, as it<br />

should improve the Fed's control of short-term<br />

Julia Coronado 12 March 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

4<br />

www.Global<strong>Market</strong>s.bnpparibas.com

interest rates when it comes time to tighten monetary<br />

policy.” He cited Chairman Bernanke as having<br />

suggested in his testimony that “operations to drain<br />

reserves could be run on a limited basis well ahead<br />

of policy tightening, in order to give market<br />

participants time to become familiar with them, and<br />

then could be scaled up to more significant volume<br />

as we approach the time for policy tightening.” He<br />

also indicated that the Fed feels it will have its<br />

primary tools fully developed by the end of Q2.<br />

Therefore we could see the Fed beginning regular<br />

reverse repo operations in H2.<br />

Recent communication has also indicated that “the<br />

ultimate size and timing of reverse repo operations<br />

will depend on the directive from the Federal Open<br />

<strong>Market</strong>s Committee to conduct such operations.”<br />

This suggests that the status of reserve draining<br />

operations will become a regular feature of FOMC<br />

statements. Indeed, we think the Fed may begin<br />

describing the state of development of its toolkit in<br />

the March FOMC statement. In the January<br />

statement the last paragraph described the status of<br />

the liquidity operations, laying out the schedule for<br />

their phase out. We think that the March statement<br />

may indicate that these liquidity operations have<br />

been successfully completed. It may then include a<br />

brief description of the state of the reserve-draining<br />

tools, much as recent communication has. Going<br />

forward, it would seem likely that the Fed could first<br />

indicate a regular low level of operations to ready the<br />

tools in June or August. It would then likely announce<br />

an acceleration of these operations at the same time<br />

it is ready to step away from the “extended period”<br />

phrasing.<br />

Sack discussed at some length the potential for<br />

reserve draining operations to confuse markets and<br />

lead to increased market volatility. “The burden is on<br />

the Fed to mitigate this risk by communicating clearly<br />

about its policy intentions and the purpose of any<br />

operational moves it might take. In this regard, the<br />

forward-looking policy language that the FOMC is<br />

currently using in its statement is important. I would<br />

argue that this language contains much more direct<br />

and valuable information about the likely path of the<br />

short-term interest rate target than does any decision<br />

about draining reserves. Indeed, it will be difficult for<br />

market participants to make precise inferences about<br />

the timing of increases in the target interest rate from<br />

the patterns of reserve draining alone, in part<br />

because the FOMC has not specified the path of<br />

reserves it intends to achieve before raising interest<br />

rates.” Thus if we are right that these operations will<br />

be included in the March FOMC statement, it should<br />

in no way be construed as a policy signal.<br />

It should<br />

reiterate<br />

their<br />

expectation<br />

for subdued<br />

inflation.<br />

It is likely to<br />

note that that<br />

liquidity<br />

operations have<br />

been<br />

successfully<br />

completed<br />

FOMC Statement January 27, 2010<br />

Information received since the Federal Open <strong>Market</strong> Committee met in December suggests that<br />

economic activity has continued to strengthen and that the deterioration in the labor market is abating.<br />

Household spending is expanding at a moderate rate but remains constrained by a weak labor<br />

market, modest income growth, lower housing wealth, and tight credit. Business spending on<br />

equipment and software appears to be picking up, but investment in structures is still contracting and<br />

employers remain reluctant to add to payrolls. Firms have brought inventory stocks into better<br />

alignment with sales. While bank lending continues to contract, financial market conditions remain<br />

supportive of economic growth. Although the pace of economic recovery is likely to be moderate for a<br />

time, the Committee anticipates a gradual return to higher levels of resource utilization in a context of<br />

price stability.<br />

With substantial resource slack continuing to restrain cost pressures and with longer-term inflation<br />

expectations stable, inflation is likely to be subdued for some time.<br />

The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and<br />

continues to anticipate that economic conditions, including low rates of resource utilization, subdued<br />

inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the<br />

federal funds rate for an extended period. To provide support to mortgage lending and housing<br />

markets and to improve overall conditions in private credit markets, the Federal Reserve is in the<br />

process of purchasing $1.25 trillion of agency mortgage-backed securities and about $175 billion of<br />

agency debt. In order to promote a smooth transition in markets, the Committee is gradually slowing<br />

the pace of these purchases, and it anticipates that these transactions will be executed by the end of<br />

the first quarter. The Committee will continue to evaluate its purchases of securities in light of the<br />

evolving economic outlook and conditions in financial markets.<br />

In light of improved functioning of financial markets, the Federal Reserve will be closing the Asset-<br />

Backed Commercial Paper Money <strong>Market</strong> Mutual Fund Liquidity Facility, the Commercial Paper<br />

Funding Facility, the Primary Dealer Credit Facility, and the Term Securities Lending Facility on<br />

February 1, as previously announced. In addition, the temporary liquidity swap arrangements<br />

between the Federal Reserve and other central banks will expire on February 1. The Federal Reserve<br />

is in the process of winding down its Term Auction Facility: $50 billion in 28-day credit will be offered<br />

on February 8 and $25 billion in 28-day credit will be offered at the final auction on March 8. The<br />

anticipated expiration dates for the Term Asset-Backed Securities Loan Facility remain set at June 30<br />

for loans backed by new-issue commercial mortgage-backed securities and March 31 for loans<br />

backed by all other types of collateral. The Federal Reserve is prepared to modify these plans if<br />

necessary to support financial stability and economic growth.<br />

It may upgrade<br />

the assessment<br />

of business<br />

spending on<br />

equipment and<br />

software but the<br />

overall tone is<br />

likely to still be<br />

cautiously<br />

optimistic<br />

The use of<br />

“extended<br />

period” will<br />

remain intact<br />

This paragraph<br />

may be replaced<br />

with a discussion<br />

about the tools<br />

under<br />

development for<br />

reserve draining<br />

operations, with<br />

emphasis that<br />

testing of these<br />

tools should not<br />

be interpreted as<br />

monetary policy<br />

tightening<br />

Julia Coronado 12 March 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

5<br />

www.Global<strong>Market</strong>s.bnpparibas.com

US Labour <strong>Market</strong>: A Slow Turning<br />

• The February employment report was a<br />

positive surprise in that it confirmed the<br />

ongoing gradual trend toward improvement with<br />

little derailment from winter weather<br />

Chart 1: The Household Survey Has Outpaced<br />

Payrolls of Late<br />

• Stimulus driven growth appears to be giving<br />

way to organic improvement in the private<br />

sector, although troubled sectors continue to<br />

impede progress<br />

• While the February employment report was<br />

a welcome indication that the labour market<br />

continues to improve, the pace of improvement<br />

is gradual and consistent with an extended<br />

period of economic slack that will keep the Fed<br />

on hold.<br />

Source: Reuters EcoWin Pro<br />

Chart 2: Manufacturing Job Losses are Done<br />

The February employment report suggests the<br />

hand-over from stimulus-driven growth to<br />

organic growth is underway, although troubled<br />

sectors mean slow progress<br />

The February employment report on balance had a<br />

more positive tone than markets had expected.<br />

There was only a modest apparent impact from<br />

February snowstorms and private sector job losses<br />

continued to moderate. Temporary hiring remained<br />

strong despite the weather signalling that permanent<br />

hiring in the private service sector is close at hand.<br />

Meanwhile job losses in the construction sector and<br />

among state and local governments show little sign<br />

of slowing. The Census only added 15k workers after<br />

a 9k gain in January. Given its plans to hire 1mn<br />

workers this spring, we should see overall gains in<br />

nonfarm payrolls in the hundreds of thousands<br />

between March and May.<br />

Overall the slowing in job losses in recent months<br />

and a pick up in aggregate hours worked indicate<br />

that households are once again seeing modest gains<br />

in wage and salary income that will help fund further<br />

subdued gains in consumer spending. Thus the<br />

handoff from stimulus driven growth to private sector<br />

driven gains seems to be underway, albeit with<br />

continued headwinds from troubled sectors. The<br />

unemployment rate may have peaked and a slow<br />

and bumpy decline appears to be underway,<br />

although broader measures of labour utilisation still<br />

indicate a huge surplus of willing workers who will<br />

likely continue to put downward pressure on wage<br />

growth.<br />

Source: Reuters EcoWin Pro<br />

Chart 3: Temporary Hiring Continues to Point to<br />

Service Sector Gains<br />

Source: Reuters EcoWin Pro<br />

Julia Coronado 12 March 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

6<br />

www.Global<strong>Market</strong>s.bnpparibas.com

The stronger household survey numbers may<br />

point to improvement among small businesses;<br />

the impact of weather was less than expected<br />

Nonfarm payrolls fell 36k after a 26k decline, above<br />

consensus expectations for a larger decline. Census<br />

hiring only added 15k, while private sector job losses<br />

eased to 18k from 33k in January. The<br />

unemployment rate held steady at 9.7% (9.687%<br />

unrounded) in contrast to expectations for an uptick.<br />

This is even more impressive as the labour force<br />

participation rate rose to 64.8% from 64.7%.<br />

However, the household survey showed a gain in<br />

jobs of 308k after a 541k increase in January. The<br />

household survey captures small businesses<br />

whereas the payroll survey only captures firms with<br />

more than 1000 workers, so the fact that hiring in the<br />

household survey has been greater than non-farm<br />

payrolls in the first two months of the year may be an<br />

indication that small businesses are hiring.<br />

Weather proved to be less of a factor than many had<br />

anticipated. We had been above the consensus<br />

forecast as we did not think the storms would have<br />

the kind of sizable impact on payrolls that the<br />

January blizzard of 1996 did. For weather to lead to a<br />

job loss in nonfarm payrolls a worker must be on a<br />

weekly pay cycle (mainly manufacturing, temporary<br />

and construction workers), they must have missed<br />

work for an entire week due to weather and didn't get<br />

paid as a result. The January 1996 blizzard was a<br />

single huge storm that wiped out the entire eastern<br />

seaboard, while the February storms during the<br />

survey period for the employment report this year<br />

were two smaller events that affected different<br />

regions over different time frames.<br />

For example, the Northeast Snowfall Impact Scale<br />

from the National Oceanic and Atmospheric<br />

Administration ranks the January 1996 blizzard an<br />

11.78, or extreme, and the 4-7 February storm this<br />

year a 4.3, or major, and the 9-11 February storm a<br />

3.93, also major. Only one, the 9-11 February storm<br />

that hit DC, Baltimore and Philly, really seemed to<br />

shut things down for an entire week. Consequently<br />

the manufacturing sector added 1k jobs after a 20k<br />

gain in January, construction job losses actually<br />

moderated slightly to -64k after -77k a month prior,<br />

and temporary hiring barely skipped a beat with a<br />

gain of 48k after a 50k increase. These areas all saw<br />

a noticeable deviation from trend in January 1996 so<br />

we conclude the impact of weather was modest.<br />

Manufacturing and the private service sector are<br />

where improvements are most noticeable, while<br />

construction and state and local governments<br />

are still firing workers at a rapid clip<br />

Manufacturing is the sector of the economy that has<br />

seen the most robust recovery to date. As shown in<br />

Chart 2, manufacturing activity has rebounded much<br />

Chart 4: Two Sectors in Trouble: Construction<br />

and State & Local Govts<br />

Source: Reuters EcoWin Pro<br />

Chart 5: Wage & Salary Income Picking Up<br />

Source: Reuters EcoWin Pro<br />

Chart 6: The Army of Unemployed is Still<br />

Sizable<br />

Source: Reuters EcoWin Pro<br />

faster than in the prior cycle owing to a combination<br />

of the inventory cycle, the rebound in global trade<br />

and the fact that it probably overcorrected to the<br />

downside at the height of the financial crisis. The<br />

employment index in the ISM survey has been<br />

signalling a strong move into hiring, although it has<br />

not proven to be a reliable indicator of job gains in<br />

recent years. The manufacturing sector has been in<br />

longstanding decline as US firms seek to maintain<br />

margins by moving operations to lower-cost<br />

countries. This trend is likely to continue and we<br />

Julia Coronado 12 March 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

7<br />

www.Global<strong>Market</strong>s.bnpparibas.com

expect only modest gains in manufacturing<br />

employment.<br />

The private service sector does seem to be moving<br />

gradually but decisively toward job growth Chart 3).<br />

Temporary hiring has been strong, averaging 46k per<br />

month in job creation over the past six months. This is<br />

an indication that many companies have seen activity<br />

recover to the point that they need additional labour but<br />

are not yet willing to commit to permanent employees.<br />

Nonetheless, the relationship between temporary<br />

hiring and permanent private service sector job gains<br />

looks to be intact and suggests a move into positive<br />

territory in the near future. Job losses in the<br />

professional and technical sector, which includes<br />

legal and accounting services among other areas,<br />

appear to be near an end while education and health<br />

care continue to steadily add 30k jobs per month. We<br />

expect the private service sector will carry the burden<br />

of leading the recovery in jobs, but the sector<br />

appears to be at a turning point.<br />

The news is not as good in the construction and state<br />

and local government sectors where job losses show<br />

few signs of slowing. The construction sector has<br />

been affected by the cold and snowy winter that<br />

began in December with the average 3-month job<br />

loss through February at 59k after slowing a little.<br />

However, the hiring numbers are not particularly out<br />

of synch with incoming data on the commercial and<br />

residential real estate sectors where demand<br />

remains weak and supply overhang is still an issue<br />

holding down activity.<br />

State and local governments continue to reel from<br />

the worst budget crisis since the 1930s and they are<br />

shrinking their workforce at an unprecedented rate.<br />

While construction job losses are likely to slow<br />

somewhat in the spring, the prospects for state and<br />

local governments are less clear and these two<br />

sectors will slow the overall recovery in the labour<br />

market through much of the year.<br />

The gains in hours worked in recent months are<br />

starting to produce income gains for consumers,<br />

although the huge surplus of unemployed<br />

workers continues to suggest the Fed will remain<br />

on hold<br />

Aggregate hours worked gave up some of their<br />

recent gains in February, falling 0.6% after rising<br />

1.0% over the prior three months. This is likely where<br />

weather had the biggest impact. For example<br />

manufacturing hours worked fell 0.9% even though<br />

the ISM signalled continued expansion in orders and<br />

activity. We therefore expect to see a significant<br />

rebound in the March report. However, even with the<br />

backtracking in February, hours worked are rising<br />

over the past several months indicating a modest<br />

pick up in wage and salary income for households<br />

(see Chart 5). This makes it likely that we will see<br />

continued modest gains in consumer spending in the<br />

months ahead even as actual job gains pick up only<br />

gradually.<br />

While the unemployment rate held steady, the<br />

expanded U6 unemployment rate rose to 16.8% from<br />

16.5% an indication there is still a considerable<br />

amount of entrenched unemployment. Average<br />

hourly earnings rose a meager 0.1%, and are rising<br />

just 1.9% y/y as the weak labour market keeps<br />

downward pressure on wage growth. These<br />

measures are an indication of how far the labour<br />

market has to go to make up lost ground and<br />

highlight that the Fed is unlikely to raise rates any<br />

time soon despite the improving trend.<br />

The February employment report was a welcome<br />

indication that the labour market continues to<br />

improve and suggests further easing in the risk of a<br />

double dip recession. However the pace of<br />

improvement is gradual and suggestive of healthy<br />

but subdued economic growth relative to prior<br />

recoveries, which means an extended period of<br />

economic slack that will keep the Fed on hold.<br />

Julia Coronado 12 March 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

8<br />

www.Global<strong>Market</strong>s.bnpparibas.com

US: Sell Short<br />

• The extended and expanded home buyers’<br />

tax credit programme has not yielded the<br />

hoped-for boost to home sales.<br />

Chart 1: Housing Demand Remains Depressed<br />

• Even accounting for negative weather<br />

effects, the underlying trend of housing demand<br />

remains disappointingly weak.<br />

• Existing homeowners must first sell their<br />

current primary residence before purchasing a<br />

new one.<br />

• Almost one-quarter of all residential<br />

properties with mortgages were ‘under water’ in<br />

the last quarter of 2009.<br />

• Homeowners with negative equity are<br />

concentrated in five states: Nevada, Arizona,<br />

Florida, Michigan and California.<br />

• Once a mortgaged property is underwater<br />

by more than 25%, the probability that a<br />

homeowner will default is the same as that for<br />

an investor.<br />

• A new government plan scheduled to take<br />

effect in early April would encourage delinquent<br />

borrowers to get rid of their properties by<br />

means of a short sale.<br />

• This plan should set the stage for a quicker<br />

recovery but lead to a more painful adjustment<br />

in the short-term.<br />

No bang for your buck<br />

Last year, the first-time home buyers’ tax credit (in<br />

effect from January to November 2009) contributed<br />

to successfully lift demand for existing homes.<br />

Indeed, the National Association of Realtors<br />

estimates that 2 million resale properties benefited<br />

from the tax credit in 2009. Given this success, the<br />

tax credit program was extended until the end of April<br />

2010 for mortgages that close in June and expanded<br />

to include more affluent and repeat home buyers. So<br />

far, the second instalment of the programme has not<br />

yielded the hoped-for boost to home sales.<br />

Existing home sales declined by 7.2% m/m in<br />

January, following a 16.2% m/m decline in the<br />

previous month, leaving resale volumes at 5.05mn<br />

annualised units, the lowest level in seven months. In<br />

addition, new home sales plunged by 11.2% m/m in<br />

January to 309k annualised units, falling well below a<br />

previous historical low of 329k reached at the<br />

Source: Reuters EcoWin Pro<br />

beginning of 2009. Adverse winter conditions likely<br />

played a role, suggesting weakness is likely to<br />

intensify in February. Indeed, pending home sales,<br />

which lead developments in resale volumes by one<br />

to two months, declined by 7.6% m/m in January,<br />

suggesting existing home sales are likely to remain<br />

depressed over the next few months.<br />

However, even accounting for negative weather<br />

effects, the underlying trend of housing demand<br />

remains disappointingly weak, as declines in home<br />

sales appear widespread across regions and predate<br />

the heavy snow storms that pummelled the country in<br />

February.<br />

The apparent ineffectiveness of the expanded home<br />

buyers’ tax credit is likely the result of several<br />

reasons. First, because the January to November<br />

2009 tax credit probably borrowed strength from the<br />

future, demand from prospective first-time home<br />

buyers is now lower than it would have otherwise<br />

been. Second, while the tax credit was extended to<br />

existing home owners, this additional pool of<br />

prospective buyers is probably rather shallow as<br />

most homeowners must first sell their current primary<br />

residence before purchasing a new one.<br />

Under water<br />

Given that house prices have declined by around<br />

30% from their peak in mid-2006, a significant share<br />

of homeowners owe more on their mortgage than<br />

their homes are currently worth. According to<br />

FirstAmerican CoreLogic, 24% of all residential<br />

properties with mortgages were in negative equity in<br />

the last quarter of 2009, equivalent to 11.3 million<br />

Anna Piretti 12 March 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

9<br />

www.Global<strong>Market</strong>s.bnpparibas.com

properties. Worse still, an additional 2.3 million<br />

mortgages were approaching negative equity,<br />

meaning they had less than 5% equity in the home.<br />

Chart 2: Boom and Bust<br />

Homeowners with negative equity are concentrated<br />

in five states: Nevada (with 70% of mortgages<br />

underwater at the end of last year), Arizona (51%),<br />

Florida (48%), Michigan (39%) and California (35%).<br />

Together, these five states had an average negative<br />

equity share of 42% compared to “only” 15% in the<br />

remaining 45 states.<br />

As negative equity increases (because of declining<br />

home values or increasing mortgage debt),<br />

homeowners have a smaller and smaller incentive to<br />

remain current on their mortgage payments, leading<br />

to higher foreclosures rates. In particular,<br />

FirstAmerican CoreLogic found that once a<br />

mortgaged property is underwater by more than<br />

25%, the probability that a homeowners will default is<br />

the same as that for an investor.<br />

Paying you to get out<br />

In the current climate of rising foreclosures, the<br />

administration has so far focused its efforts on<br />

keeping struggling homeowners in their homes by<br />

working with lenders to renegotiate mortgage terms.<br />

This approach has shown disappointing results<br />

especially for deeply underwater loans and for<br />

homeowners who lost their job and might therefore<br />

be unable to remain current on their mortgage<br />

payments even if these are lowered. In contrast, a<br />

new plan scheduled to take effect in early April would<br />

actually encourage delinquent borrowers to get rid of<br />

their properties by means of a short sale, whereby a<br />

property is sold for less than the value of the<br />

mortgage. Participating lenders would have to forgive<br />

the difference between the lower market value of the<br />

home and the higher value of the loan. The aim of<br />

the plan is to streamline and standardise the short<br />

sale process and to facilitate an agreement between<br />

borrowers and lenders. In order to do this, the<br />

government would pay USD 1,500 to homeowners<br />

for “relocation assistance”, while banks would receive<br />

USD 1,000. The plan has a number of advantages<br />

for all interested parties. In addition to receiving a<br />

government cheque, homeowners are likely to see a<br />

much smaller deterioration in their credit score than if<br />

they embarked on a foreclosure process. Lenders<br />

and investors in mortgage pools have the prospect of<br />

receiving a higher payment than they would if the<br />

Source: Reuters EcoWin Pro<br />

Chart 3: Owners’ Equity Rose and Fell with<br />

House Prices<br />

Source: Reuters EcoWin Pro<br />

bank were to repossess the home. Communities<br />

would benefit because homes would be sold rather<br />

than languish empty for months as a target for<br />

vandals waiting for the lender to sell the property.<br />

Details of this plan still have to be finalized and a<br />

number of outstanding issues remain. For example,<br />

many distressed properties have second or even<br />

third mortgages, often with different banks,<br />

suggesting the short-sale process is unlikely to be<br />

straightforward as all parties have to be in<br />

agreement. Nevertheless, by speeding up the<br />

correction, this plan should set the stage for a<br />

quicker recovery. An increase in short sales would<br />

also exert additional downward pressure on prices as<br />

“bad loans” would be worked off quicker than through<br />

the regular foreclosure process. While positive in the<br />

long term, this would lead to a more painful<br />

adjustment in the short term.<br />

Anna Piretti 12 March 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

10<br />

www.Global<strong>Market</strong>s.bnpparibas.com

US: Productivity Growth Climbing<br />

• Non-farm productivity soared in 2009 well<br />

above trend and is expected to continue rising<br />

in 2010, albeit at a slower pace.<br />

Chart 1: Productivity Growth Picking Up<br />

• Higher productivity and lower unit labour<br />

costs boost profit margins and raise overall<br />

profitability.<br />

• Businesses have turned to capital investment<br />

rather than employment early in the recovery,<br />

which could keep productivity growth strong.<br />

• Another result is that corporate free cash<br />

flow is unusually high, implying a possible<br />

corporate buying spree.<br />

Productivity is booming<br />

Non-farm businesses are enjoying a boom in<br />

productivity growth. In 2009, productivity soared<br />

5.8%, hitting a peak in Q4 when non-farm<br />

productivity was up 6.9%. Businesses continued<br />

slashing payrolls and cutting hours worked through<br />

the end of last year despite significant growth in<br />

output. In Q4 2009, non-farm business output<br />

jumped 7.6%. Some of this surge in productivity is a<br />

normal cyclical phenomenon; however, the recent<br />

pick-up in equipment and software investment<br />

suggests some capital deepening that could keep<br />

productivity rising.<br />

Plunging labour costs boost profitability<br />

The major benefit from above-trend growth in<br />

productivity is significantly lower unit labour costs.<br />

Lower labour costs raise domestic competitiveness in<br />

global markets and make a substantial boost to<br />

corporate profitability. In the fourth quarter of 2009,<br />

unit labour costs were down 4.7% y/y, creating a very<br />

positive environment for corporate profitability.<br />

Margins, estimated as the non-farm price per unit<br />

less the estimated total unit costs, jumped by 1.3%<br />

y/y in Q4, one of the largest annual increases in the<br />

past 60 years. In addition to lower labour costs,<br />

which are the largest cost component of business,<br />

and greater profitability, the boom in productivity will<br />

enable companies to absorb any other input price<br />

increases. For example, increases in commodity<br />

prices (or other import prices) can be absorbed<br />

without having to pass along these cost increases<br />

into final prices in a very competitive domestic<br />

market place.<br />

Domestic profits up in 2009<br />

In the previous expansion, the growth in corporate<br />

profits had come mainly from the external sector. In<br />

contrast, in the first few quarters of the current<br />

Source: Reuters EcoWin Pro, <strong>BNP</strong> Paribas<br />

Chart 2: <strong>Investment</strong> in Equipment Forecast to<br />

Grow<br />

Source: Reuters EcoWin Pro, <strong>BNP</strong> Paribas<br />

Chart 3: Rising <strong>Investment</strong> Can Lead to Greater<br />

Productivity<br />

Source: Reuters EcoWin Pro, <strong>BNP</strong> Paribas<br />

expansion, profits from international operations were<br />

still declining with all of the profit growth in the past<br />

three quarters coming from domestic sources. In<br />

2009, profits from domestic operations increased in<br />

every quarter and now account for 76% of the total<br />

(having dropped to a low of 70% in 2008). Financial<br />

Brian Fabbri 12 March 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

11<br />

www.Global<strong>Market</strong>s.bnpparibas.com

profits soared in 2009, growing by an estimated<br />

215%, albeit from the exceptionally low level reached<br />

in 2008 when banks were under siege. Domestic<br />

non-financial profits also grew in 2009, but much<br />

more slowly; they only started to rise in Q2. For the<br />

full year, they rose by an estimated 7.7%. The restof-world<br />

profits at US non-farm corporations fell in<br />

the first half and began rising in Q3. For the year,<br />

profits from rest-of-world operations are estimated to<br />

have been roughly flat y/y, as a return to world trade<br />

growth in H2 2009 helped make US affiliates abroad<br />

profitable again.<br />

Profits’ share going higher<br />

The boost to corporate profits came at the expense<br />

of labour. Profits’ share of national income jumped to<br />

an estimated share of 11.1% in Q3 of 2009, while<br />

labour compensation’s share sank to 63.2%. The<br />

profits outlook for this year is also promising. Growth<br />

in private payrolls will probably strengthen throughout<br />

the year, but at a relatively slow pace compared with<br />

output growth. Businesses usually take a significant<br />

amount of time before they run out of opportunities to<br />

produce incremental productivity. When they<br />

eventually do, they shift to accelerated hiring to<br />

maintain output growth. Business cycle history<br />

suggests that this time lag fluctuates between one<br />

and two years. Thus, profits’ share of national<br />

income probably will rise further and challenge the<br />

peak proportion (13.7%) reached in Q3 2006.<br />

<strong>Investment</strong> begins first<br />

Non-farm businesses have turned first to investment<br />

in new capital early in the recovery to garner further<br />

productivity-boosted profits rather than to<br />

employment. In contrast, new investment in<br />

commercial real estate is unlikely to begin for at least<br />

another year given the significant supply overhang<br />

and difficult financing conditions in this sector.. In<br />

past expansions, once business began increasing<br />

investing in equipment, growth has been many times<br />

larger than overall GDP growth. For example, in the<br />

expansion of the 1980s, capital investment jumped to<br />

nearly 20% in the 12 months after the start of the<br />

new expansion and then decelerated thereafter. In<br />

the 1990s, accelerated expansion of capital<br />

investment in equipment started about 18 months<br />

after the end of the 1991 recession, but remained<br />

well above trend growth for several years. In the last<br />

expansion, business took longer before committing to<br />

faster-than-trend growth in equipment investment<br />

partly because of the Sarbanes Oxley law of 2002<br />

and the overhang from the previous investment<br />

boom. Above-trend investment growth finally started<br />

in 2005, three years into the expansion.<br />

Record corporate free cash flow<br />

Chart 4: Domestic Profits Surging<br />

Source: Reuters EcoWin Pro, <strong>BNP</strong> Paribas<br />

Chart 5: Profits Share is Rising<br />

Source: Reuters EcoWin Pro, <strong>BNP</strong> Paribas<br />

Chart 6: Corporate Free Cash Flow is Soaring<br />

Source: Reuters EcoWin Pro, <strong>BNP</strong> Paribas<br />

enjoying an unprecedented free cash flow position.<br />

Chart 6 highlights the extraordinarily flush position<br />

US corporations are enjoying relative to their free<br />

cash position over the past 60 years. Free cash flow<br />

is defined as retained earnings less capital<br />

investment and in Chart 6 is shown as a ratio to<br />

GDP. Clearly, non-farm businesses are in a rare<br />

position to use this free cash flow to increase<br />

investment in productivity-enhancing IT, and to<br />

engage in strategic acquisitions. Consequently, we<br />

estimate that business investment in equipment and<br />

software will surge over the next two years, rising by<br />

an annual rate of double its long-term average<br />

growth (7.1%) in 2010 and 2011 before easing to<br />

In this cycle, non-financial corporations are not<br />

burdened with new legislation, or recovering from the<br />

aftermath of an investment boom, as they were at the<br />

beginning of the last decade. Moreover, they are above-average growth in 2012.<br />

Brian Fabbri 12 March 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

12<br />

www.Global<strong>Market</strong>s.bnpparibas.com

Germany: The Big Chill<br />

• Construction activity has been hit very hard<br />

by exceptionally cold weather early in Q1.<br />

• This increases the risk of a q/q contraction<br />

in GDP in Q1, though other indicators have been<br />

more positive for growth.<br />

• The manufacturing sector is doing well, with<br />

survey strength now starting to pass through to<br />

‘hard’ data such as new orders.<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

-5<br />

-10<br />

Chart 1: Construction Output (% q/q)<br />

-15<br />

Data distortions<br />

The economic activity data in the eurozone can be<br />

noisy at the best of times and, in the period since the<br />

global financial crisis, it has been deafening. It is not<br />

likely to quieten down any time soon given the<br />

combination of: distortions related to the introduction<br />

and expiry of various growth stimuli; divergence of<br />

national and sectoral activity trends; and the time of<br />

year. Aspirin, please!<br />

Shaded Area = GDP Contractions<br />

-20<br />

91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09<br />

Source: Reuters EcoWin Pro<br />

Chart 2: Construction Output & Expenditure<br />

25<br />

12.5<br />

20<br />

Construction Output (% q/q)<br />

10.0<br />

15<br />

7.5<br />

10<br />

5.0<br />

The turn of the year is particularly problematic for the<br />

activity data in Germany given the disruption caused<br />

by the weather. Data watchers in Germany will be all<br />

too familiar with the confusion caused by periods of<br />

weather-induced volatility in the past.<br />

5<br />

0<br />

-5<br />

-10<br />

-15<br />

Construction Expenditure (% q/q RHS)<br />

2.5<br />

0.0<br />

-2.5<br />

-5.0<br />

-7.5<br />

A particularly painful example occurred in early 2008<br />

when unusually mild winter weather early in the year<br />

prompted a bringing forward of construction sector<br />

activity in Germany, contributing to a misleadingly<br />

robust expansion in GDP. The strong GDP figures for<br />

Q1 were released in mid-Q2 and were a contributory<br />

factor to the ECB’s decision to increase its<br />

refinancing rate just as the global financial crisis was<br />

intensifying.<br />

Cold snap hits construction<br />

The opposite effect is now happening, with the<br />

exceptionally cold weather in Germany at the start of<br />

the year now starting to make its presence felt in the<br />

construction-related data. Output in the sector fell by<br />

a massive 14% m/m in January, the second biggest<br />

m/m fall in the series' history.<br />

A q/q contraction in double digits looks very likely for<br />

construction output in Q1. By way of illustration, if<br />

output in the sector was flat in both February and<br />

March, the q/q decline in Q1 would be in the region<br />

of 15%. As we know that the weather was also<br />

unfavourable in February, another fall is possible in a<br />

month’s time.<br />

-20<br />

91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09<br />

Source: Reuters EcoWin Pro<br />

On the three occasions in the past two decades that<br />

a double-digit q/q decline in construction output has<br />

occurred, in Q1 1996, Q1 1997 and Q2 2008, GDP<br />

registered a q/q contraction (Chart 1).<br />

In its latest press conference, the ECB explicitly cited<br />

adverse weather in some parts of the eurozone as a<br />

downside risk to growth in Q1.<br />

Measuring the impact<br />

Based on the national accounts data for Germany,<br />

construction spending currently accounts for just<br />

under half of total gross fixed capital formation on a<br />

constant price basis. Its share of GDP on the same<br />

basis is roughly 10%.<br />

A complication is that large changes in construction<br />

output have not passed fully into the changes in<br />

construction expenditure (Chart 2). The pass-through<br />

from output to expenditure data in the past has<br />

typically been about half.<br />

-10.0<br />

Ken Wattret 12 March 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

13<br />

www.Global<strong>Market</strong>s.bnpparibas.com

Assuming this relationship holds, a 10% q/q decline<br />

in construction output in Q1 would translate into a 5%<br />

q/q fall in expenditure. Given the latter’s share in<br />

GDP, this would imply a drag on GDP of around half<br />

a percentage point. It could be bigger still, of course,<br />

if construction output fails to rebound in the next<br />

couple of months.<br />

Sliding surplus<br />

German trade data for January also augur poorly for<br />

Q1 GDP, with the monthly surplus almost halving. It<br />

fell from EUR 16.6bn in December to EUR 8.7bn, the<br />

lowest surplus in almost a year.<br />

65<br />

60<br />

55<br />

50<br />

45<br />

40<br />

35<br />

30<br />

Chart 3: Divergent PMIs<br />

Manufacturing<br />

<strong>Services</strong><br />

98 99 00 01 02 03 04 05 06 07 08 09 10<br />

Exports unexpectedly collapsed by 6.3% m/m in<br />

January following a series of robust gains since last<br />

spring. The fall was one of the biggest on record and<br />

goes against the positive indicators of global trade<br />

dynamics recently: e.g. a surge in world trade<br />

volumes as reported by the CPB in the Netherlands<br />

and much improved manufacturing surveys including<br />

the PMI in Germany. Given this, the drop in January<br />

looks like a blip and could well be another weatherrelated<br />

distortion.<br />

Positive pointers<br />

The recent bad news from the construction and trade<br />

data does not guarantee a negative q/q outcome for<br />

German Q1 GDP as other factors are more positive.<br />

One is the likelihood of at least a partial reversal of<br />

the unusually large drag on Q4’s q/q growth rate from<br />

inventories (in excess of a percentage point).<br />

Recent strength in domestic capital goods orders<br />

also suggests that capex might bounce back in Q1,<br />

having fallen unexpectedly sharply in Q4.<br />

Source: Reuters EcoWin Pro<br />

125<br />

119<br />

113<br />

107<br />

101<br />

95<br />

89<br />

83<br />

77<br />

Chart 4: Level of Orders & Output<br />

Source: Reuters EcoWin Pro<br />

Manufacturing Orders<br />

(Index 2000 = 100, 3Mth Lag, RHS)<br />

Industrial Production<br />

(Index 2000 = 100)<br />

133<br />

123<br />

113<br />

103<br />

93<br />

83<br />

73<br />

63<br />

Amid the various crosswinds, it is going to be more<br />

difficult than usual to get a handle on the underlying<br />

trend in activity. In short, we see it like this: the more<br />

externally-sensitive manufacturing sector data will do<br />

comparatively well but the consumer-driven data will<br />

struggle and, in the absence of a pick up in the latter,<br />

the expansion will remain subdued.<br />

The contrast between the two is illustrated in the<br />

recent divergence of the manufacturing and services<br />

PMIs in Germany (Chart 3). The improvement in the<br />

manufacturing data has not been confined to the<br />

surveys alone.<br />

The m/m rise in manufacturing orders in Germany in<br />

January was a whopping 4.3%, well above market<br />

consensus expectations and the strongest increase<br />

of the expansion to date. The orders data got Q1 off<br />

to a very strong start. Even given flat m/m outcomes<br />

in February and March, the q/q increase in orders in<br />

Q1 would be around 4%.<br />

Domestic orders surged by a remarkable 7.1% m/m<br />

in January, the second biggest increase on record.<br />

Domestic orders for capital goods specifically were<br />

even stronger still, rising by a mammoth 10% m/m –<br />

hence the prior mention of the possibility of a Q1<br />

rebound in capex.<br />

In perspective<br />

A note of caution, however. The y/y rate of increase<br />

in German manufacturing orders is now running at<br />

almost 20% but this rate of increase is being flattered<br />

by base effects related to the collapse in activity in<br />

the corresponding period of last year during the<br />

intensification of the financial crisis.<br />

Note also that the level of orders and output in<br />

Germany remains well down on the pre-crisis peaks<br />

(Chart 4). Despite the rebound in industrial output<br />

since last spring, it is still down by almost 20% in net<br />

terms from its 2008 high.<br />

Ken Wattret 12 March 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

14<br />

www.Global<strong>Market</strong>s.bnpparibas.com

UK: Election Update<br />

• The Budget will be delivered on 24 March.<br />

Chart 1: UK Political Opinion Polls<br />

• We expect the latest net borrowing estimate<br />

to be revised down, though the government is<br />

likely to spend at least some of this ‘windfall’.<br />

• Recent opinion polls continue to highlight<br />

the significant risk of a hung parliament.<br />

Under starter’s orders…<br />

Gordon Brown moved closer to announcing the date<br />

of the general election this week by confirming the<br />

Budget will be delivered on 24 March. That is likely to<br />

be one of the final key set pieces ahead of firing the<br />

starting pistol for the election campaign by dissolving<br />

parliament. As such, and with very little leeway on<br />

the public finances, we expect the Budget to be<br />

heavy on politics and light on substance. Our full<br />

Budget preview will be published next week. Having<br />

seen the Conservatives’ rating in the opinion polls<br />

slip in recent months, we think the Chancellor will not<br />

deviate from the strategy set out so far. Part of the<br />

erosion in the Conservatives’ lead has probably<br />

resulted from its promise to tackle the budget deficit<br />

more aggressively, thus delivering more pain.<br />

When announcing the date of the Budget, Brown<br />

highlighted that the pay of senior civil servants (and<br />

senior military personnel) will be frozen. Moreover<br />

the prime minister said that the Budget would give<br />

more details on how the deficit will be cut – i.e.<br />

attempting to add some substance to the<br />

government’s claim that it would halve the deficit in<br />

the next four years. There may also be some token<br />

giveaways. If the Chancellor announces even<br />

tougher fiscal tightening, it will blur the dividing lines<br />

between the two main parties and undermine the<br />

Labour Party’s criticism of the Tories’ tougher stance.<br />

The greater than expected windfall from the raid on<br />

bankers’ bonuses (around GBP 2bn) is likely to be<br />

channelled towards ‘deserving causes’. Furthermore,<br />

although the latest month’s public finances data were<br />

awful, the prior months’ outcomes were surprisingly<br />

robust. In fact, we suspect that the Chancellor could<br />

revise down the estimate of Public Sector Net<br />

Borrowing (PSNB) for the 2009/10 fiscal year of GBP<br />

178bn by as much as GBP 10bn. However, it seems<br />

likely that at least part of the ‘windfall’ is spent<br />

supporting the recovery and thereby increasing<br />

Labour’s chances at the election.<br />

Opinion poll update<br />

If the election date is 6 May as most expect, the<br />

latest the election can be called is 12 April. More<br />

Source: UKpollingreport.co.uk<br />

Chart 2: Opinion Polls – Recent Evolution<br />

Source: UKpollingreport.co.uk<br />

likely, the announcement will come a few days<br />

earlier.<br />

Recent opinion polls have shown that the<br />

Conservatives’ lead continues to narrow. For March<br />

so far, the average lead is down to 6pp from 8pp in<br />

February and 10.5pp in January (Chart 1). Two polls<br />

have shown the lead down to just 2pp, with the<br />

biggest margin of any poll at just 9pp. Translating the<br />

latest polls into seats in the House of Commons<br />

gives the Conservatives roughly 298 seats – 28 short<br />

of an overall majority. Labour are on 276 seats with<br />

the Liberal Democrats on 46.<br />

These polls reinforce our view that the most likely<br />

outcome is a hung parliament. We suspect that the<br />

Conservatives will opt to govern as a minority<br />

government with tacit support from the Liberal<br />

Democrats. However, if the Conservatives’ lead in<br />

the polls continues to narrow, there is a significant<br />

risk of a Labour-Lib Dem coalition. After all, in the<br />

first instance, it is the incumbent prime minister that<br />

gets the first choice to set up a government.<br />

Alan Clarke 12 March 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

15<br />

www.Global<strong>Market</strong>s.bnpparibas.com

SNB: Outlook Firming<br />

• The SNB left rates on hold as expected.<br />

Chart 1: SNB Policy Rates<br />

• The growth outlook was revised higher, with<br />

the back end of the inflation projection rising by<br />

virtue of the forecast moving forward a quarter.<br />

• We continue to expect the first hike in Q3,<br />

but its timing remains sensitive to<br />

developments in the franc.<br />

‘Expansionary’ monetary policy maintained<br />

As widely expected, the SNB left rates on hold in<br />

March, maintaining its target for 3m Libor towards the<br />

bottom of the 0-0.75% range. An apparent softening<br />

of the language on FX intervention appears to have<br />

been a translation error but there was an upward<br />

revision to the growth outlook. The furthest point of<br />

the inflation projection also moved higher, by virtue of<br />

the forecast kicking on by one quarter.<br />

The key points of the press release accompanying<br />

March’s decision are as follows:<br />

1. An apparent adjustment in the language on FX<br />

intervention appears to have been a translation<br />

error.<br />

The statement said the SNB will act decisively to<br />

prevent “an excessive appreciation” rather than “any<br />

excessive appreciation” of the Swiss franc against<br />

the euro. However, the German press release carried<br />

an identical statement on intervention to the<br />

December press release.<br />

2. The central bank upgraded its assessment of<br />

the economic recovery…<br />

First, the signs of an economic recovery are now<br />

“becoming more tangible” rather than just “gathering<br />

strength”. Second, and more importantly, the SNB<br />

revised its forecast for growth this year to “about<br />

1.5%” – in line with our forecast. This had looked<br />

inevitable; after Q4’s 0.7% q/q GDP print, the SNB’s<br />

previous forecast for 2009 growth of 0.5-1.0% could<br />

have been achieved even with zero growth each<br />

quarter through 2010.<br />

3. ...but maintained a cautious tone<br />

Despite this more positive assessment of the<br />

recovery, the SNB maintained its cautious language<br />

about the outlook. The revival in the economy<br />

“remains fragile” and “is associated with<br />

uncertainties”. The central bank sees the global<br />

economy as on “a moderate upward trend”, and<br />

differentiated between “surprisingly positive” growth<br />

Source: Reuters EcoWin Pro<br />

in the US and the “disappointing” performance in<br />

Europe.<br />

4. The inflationary risk posed by strong money<br />

growth was explicitly addressed<br />

One of the key elements of our argument that the<br />

SNB will hike well before the ECB is that, with no<br />

signs of a credit crunch in the economy, the slug of<br />

narrow money created over the past year represents<br />

a more significant risk to medium-term price stability<br />

than elsewhere. This was acknowledged in the press<br />

release: “Although the monetary base has declined, it<br />

is still very high…[and] needs to be reduced in good<br />

time”. So too was the fact that mortgage lending has<br />

actually been accelerating, with the SNB requesting<br />

banks and borrowers “to be extremely cautious, in<br />

view of the growth in mortgage loans and the<br />

continuing increase in residential real estate prices”.<br />

5. The inflation forecast was changed only<br />

marginally<br />

The inflation forecast was revised up marginally near<br />

term (reflecting the surprise to GDP) but was revised<br />

down marginally in the medium term. The back end<br />

is now higher at 2.75% (2.55% in December), purely<br />

by virtue of the forecast kicking on by one quarter.<br />

As we wrote last week, we expect the SNB to hike<br />

only when it is confident that the economy will be<br />

resilient to the additional currency appreciation the<br />

first hike will likely bring. Comments on the fragility of<br />

the recovery in the press release suggest the SNB<br />

does indeed want further confirmation of the vibrancy<br />

of the rebound. We expect it to get such<br />

confirmation. Our forecast for the first hike remains<br />

Q3, but the timing remains sensitive to developments<br />

in the franc.<br />

Eoin O’Callaghan 12 March 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

16<br />

www.Global<strong>Market</strong>s.bnpparibas.com

Japan: The Target of Fiscal Restructuring<br />

• When drawing up plans for fiscal<br />

rehabilitation, assumptions about the nominal<br />

growth rate and the nominal interest rate are<br />

very important: assuming the interest rate will<br />

stay below the growth rate creates the condition<br />

of dynamic inefficiency, wherein bubble<br />

formation is common; assuming that the<br />

interest rate will stay above the growth rate is<br />

the conservative way of not exposing state<br />

finances to such unnecessary risk.<br />

• If the public debt is not that great, the goal<br />

of fiscal restructuring could be merely achieving<br />

a primary balance surplus, as that would stop<br />

the debt-to-GDP ratio from climbing.<br />

• But Japan’s public debt is so huge that the<br />

target should be to steadily lower the debt-to-<br />

GDP ratio, something that requires a primary<br />

balance surplus of 1-2% of GDP.<br />

• That said, the debt-to-GDP ratio (stock<br />

indicator) will continue to creep higher until the<br />

primary balance (flow indicator) turns positive.<br />

In the meantime, the market, if its attention is<br />

directed to the debt-to-GDP ratio, could judge<br />

that fiscal discipline is lacking, leading to<br />

upward pressure on yields.<br />

• Thus, while it is appropriate to set the debtto-GDP<br />

ratio as the ultimate target of fiscal<br />

restructuring, it is important that the primary<br />

balance be concurrently made a medium-term<br />

target and to encourage the market to focus<br />

more on the latter.<br />

Hatoyama government mulls plans for fiscal<br />

restructuring<br />

In Japan: Recommendations for Fiscal Reform in last<br />

week’s <strong>Market</strong> <strong>Mover</strong>, we indicated that the<br />

Hatoyama government is considering a framework<br />

for medium-term fiscal spending and a strategy for<br />

long-term fiscal management. With respect to the<br />

framework for spending, I argued that “pay-as-yougo”<br />

must be the guiding principle to ensure that only<br />

new spending programmes that are fully-financed are<br />

included in the budget for FY 2011 through 2013 (if<br />

the programmes cannot be fully financed, they<br />

should be subject to micro-level vetting just like other<br />

spending requests). As for the fiscal management<br />

strategy, we stated that the long-term goal should be<br />

to achieve a sufficiently large primary surplus (say 1-<br />

Chart 1: Public Debt and Primary Fiscal Balance<br />

(Central + Local governments, % of Nominal GDP)<br />

4<br />

2<br />

0<br />

-2<br />

-4<br />

-6<br />

-8<br />

-10<br />

primary fiscal balance<br />

1981<br />

19922002<br />

20022007<br />

2009<br />

2010<br />

40 60 80 100 120 140 160 180<br />

long-term national debt, end of previous fiscal year<br />

Source: MOF, Cabinet office, <strong>BNP</strong> Paribas<br />

Note(1) National debt trough FY2008: end-of-year statements; FY 2009:<br />

supplementary budget basis. (2) Primary balance: Cabinet Office estimates.<br />

4<br />

2<br />

0<br />

-2<br />

-4<br />

-6<br />

-8<br />

-10<br />

Chart 2: GDP and Nomura-BPI (JGB) (%)<br />

NOMURA-BPI(JGB)<br />

00 01 02 03 04 05 06 07 08 09<br />

Source: Bloomberg, <strong>BNP</strong> Paribas<br />

Nom inal GDP (% y/y)<br />

2%) to ensure that the public debt (as a share of<br />

GDP) is steadily falling.<br />

According to government estimates, the deficit in the<br />

primary balance of the central and local governments<br />

combined in FY 2010 should be 7.1% of GDP, and<br />

the timeframe for achieving a primary surplus of<br />