Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Key Data Preview<br />

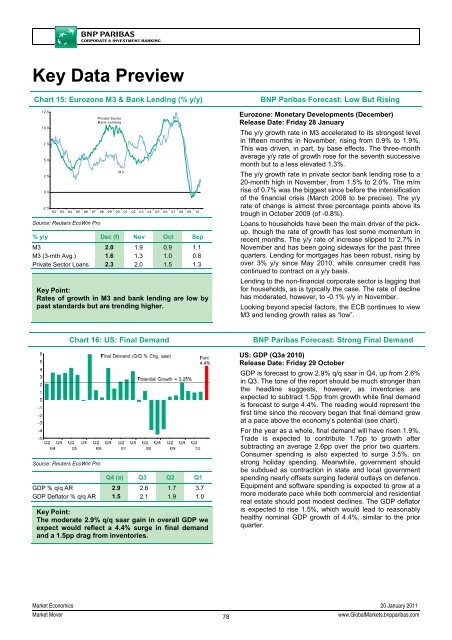

Chart 15: Eurozone M3 & Bank Lending (% y/y)<br />

12.5<br />

10.0<br />

7.5<br />

5.0<br />

2.5<br />

0.0<br />

Private Sector<br />

Bank Lending<br />

M3<br />

-2.5<br />

92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10<br />

Source: Reuters EcoWin Pro<br />

% y/y Dec (f) Nov Oct Sep<br />

M3 2.0 1.9 0.9 1.1<br />

M3 (3-mth Avg.) 1.6 1.3 1.0 0.8<br />

Private Sector Loans 2.3 2.0 1.5 1.3<br />

Key Point:<br />

<strong>Rate</strong>s of growth in M3 and bank lending are low by<br />

past standards but are trending higher.<br />

<strong>BNP</strong> Paribas Forecast: Low But Rising<br />

Eurozone: Monetary Developments (December)<br />

Release Date: Friday 28 January<br />

The y/y growth rate in M3 accelerated to its strongest level<br />

in fifteen months in November, rising from 0.9% to 1.9%.<br />

This was driven, in part, by base effects. The three-month<br />

average y/y rate of growth rose for the seventh successive<br />

month but to a less elevated 1.3%.<br />

The y/y growth rate in private sector bank lending rose to a<br />

20-month high in November, from 1.5% to 2.0%. The m/m<br />

rise of 0.7% was the biggest since before the intensification<br />

of the financial crisis (March 2008 to be precise). The y/y<br />

rate of change is almost three percentage points above its<br />

trough in October 2009 (of -0.8%).<br />

Loans to households have been the main driver of the pickup,<br />

though the rate of growth has lost some momentum in<br />

recent months. The y/y rate of increase slipped to 2.7% in<br />

November and has been going sideways for the past three<br />

quarters. Lending for mortgages has been robust, rising by<br />

over 3% y/y since May 2010, while consumer credit has<br />

continued to contract on a y/y basis.<br />

Lending to the non-financial corporate sector is lagging that<br />

for households, as is typically the case. The rate of decline<br />

has moderated, however, to -0.1% y/y in November.<br />

Looking beyond special factors, the ECB continues to view<br />

M3 and lending growth rates as “low”.<br />

Source: Reuters EcoWin Pro<br />

Chart 16: US: Final Demand<br />

Q4 (a) Q3 Q2 Q1<br />

GDP % q/q AR 2.9 2.6 1.7 3.7<br />

GDP Deflator % q/q AR 1.5 2.1 1.9 1.0<br />

Key Point:<br />

The moderate 2.9% q/q saar gain in overall GDP we<br />

expect would reflect a 4.4% surge in final demand<br />

and a 1.5pp drag from inventories.<br />

<strong>BNP</strong> Paribas Forecast: Strong Final Demand<br />

US: GDP (Q3a 2010)<br />

Release Date: Friday 29 October<br />

GDP is forecast to grow 2.9% q/q saar in Q4, up from 2.6%<br />

in Q3. The tone of the report should be much stronger than<br />

the headline suggests, however, as inventories are<br />

expected to subtract 1.5pp from growth while final demand<br />

is forecast to surge 4.4%. The reading would represent the<br />

first time since the recovery began that final demand grew<br />

at a pace above the economy’s potential (see chart).<br />

For the year as a whole, final demand will have risen 1.9%.<br />

Trade is expected to contribute 1.7pp to growth after<br />

subtracting an average 2.6pp over the prior two quarters.<br />

Consumer spending is also expected to surge 3.5%, on<br />

strong holiday spending. Meanwhile, government should<br />

be subdued as contraction in state and local government<br />

spending nearly offsets surging federal outlays on defence.<br />

Equipment and software spending is expected to grow at a<br />

more moderate pace while both commercial and residential<br />

real estate should post modest declines. The GDP deflator<br />

is expected to rise 1.5%, which would lead to reasonably<br />

healthy nominal GDP growth of 4.4%, similar to the prior<br />

quarter.<br />

<strong>Market</strong> <strong>Economics</strong> 20 January 2011<br />

<strong>Market</strong> Mover<br />

78<br />

www.Global<strong>Market</strong>s.bnpparibas.com