Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

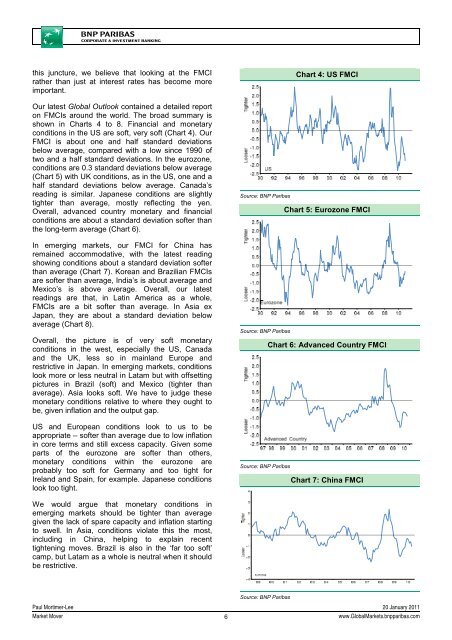

this juncture, we believe that looking at the FMCI<br />

rather than just at interest rates has become more<br />

important.<br />

Our latest Global Outlook contained a detailed report<br />

on FMCIs around the world. The broad summary is<br />

shown in Charts 4 to 8. Financial and monetary<br />

conditions in the US are soft, very soft (Chart 4). Our<br />

FMCI is about one and half standard deviations<br />

below average, compared with a low since 1990 of<br />

two and a half standard deviations. In the eurozone,<br />

conditions are 0.3 standard deviations below average<br />

(Chart 5) with UK conditions, as in the US, one and a<br />

half standard deviations below average. Canada’s<br />

reading is similar. Japanese conditions are slightly<br />

tighter than average, mostly reflecting the yen.<br />

Overall, advanced country monetary and financial<br />

conditions are about a standard deviation softer than<br />

the long-term average (Chart 6).<br />

In emerging markets, our FMCI for China has<br />

remained accommodative, with the latest reading<br />

showing conditions about a standard deviation softer<br />

than average (Chart 7). Korean and Brazilian FMCIs<br />

are softer than average, India’s is about average and<br />

Mexico’s is above average. Overall, our latest<br />

readings are that, in Latin America as a whole,<br />

FMCIs are a bit softer than average. In Asia ex<br />

Japan, they are about a standard deviation below<br />

average (Chart 8).<br />

Overall, the picture is of very soft monetary<br />

conditions in the west, especially the US, Canada<br />

and the UK, less so in mainland Europe and<br />

restrictive in Japan. In emerging markets, conditions<br />

look more or less neutral in Latam but with offsetting<br />

pictures in Brazil (soft) and Mexico (tighter than<br />

average). Asia looks soft. We have to judge these<br />

monetary conditions relative to where they ought to<br />

be, given inflation and the output gap.<br />

US and European conditions look to us to be<br />

appropriate – softer than average due to low inflation<br />

in core terms and still excess capacity. Given some<br />

parts of the eurozone are softer than others,<br />

monetary conditions within the eurozone are<br />

probably too soft for Germany and too tight for<br />

Ireland and Spain, for example. Japanese conditions<br />

look too tight.<br />

Source: <strong>BNP</strong> Paribas<br />

Source: <strong>BNP</strong> Paribas<br />

Source: <strong>BNP</strong> Paribas<br />

Chart 4: US FMCI<br />

Chart 5: Eurozone FMCI<br />

Chart 6: Advanced Country FMCI<br />

Chart 7: China FMCI<br />

We would argue that monetary conditions in<br />

emerging markets should be tighter than average<br />

given the lack of spare capacity and inflation starting<br />

to swell. In Asia, conditions violate this the most,<br />

including in China, helping to explain recent<br />

tightening moves. Brazil is also in the ‘far too soft’<br />

camp, but Latam as a whole is neutral when it should<br />

be restrictive.<br />

Source: <strong>BNP</strong> Paribas<br />

Paul Mortimer-Lee 20 January 2011<br />

<strong>Market</strong> Mover<br />

6<br />

www.Global<strong>Market</strong>s.bnpparibas.com