Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

EUR: Liquidity is No Stress<br />

• The reserve maintenance period started with<br />

a lower level of liquidity, fuelling concerns of<br />

potential tension on eonia.<br />

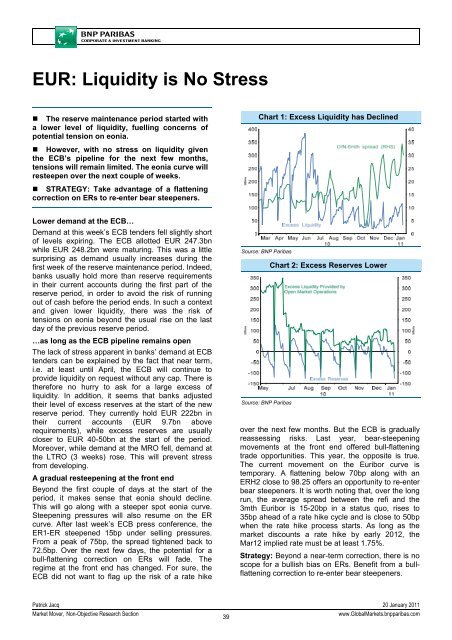

Chart 1: Excess Liquidity has Declined<br />

• However, with no stress on liquidity given<br />

the ECB’s pipeline for the next few months,<br />

tensions will remain limited. The eonia curve will<br />

resteepen over the next couple of weeks.<br />

• STRATEGY: Take advantage of a flattening<br />

correction on ERs to re-enter bear steepeners.<br />

Lower demand at the ECB…<br />

Demand at this week’s ECB tenders fell slightly short<br />

of levels expiring. The ECB allotted EUR 247.3bn<br />

while EUR 248.2bn were maturing. This was a little<br />

surprising as demand usually increases during the<br />

first week of the reserve maintenance period. Indeed,<br />

banks usually hold more than reserve requirements<br />

in their current accounts during the first part of the<br />

reserve period, in order to avoid the risk of running<br />

out of cash before the period ends. In such a context<br />

and given lower liquidity, there was the risk of<br />

tensions on eonia beyond the usual rise on the last<br />

day of the previous reserve period.<br />

…as long as the ECB pipeline remains open<br />

The lack of stress apparent in banks’ demand at ECB<br />

tenders can be explained by the fact that near term,<br />

i.e. at least until April, the ECB will continue to<br />

provide liquidity on request without any cap. There is<br />

therefore no hurry to ask for a large excess of<br />

liquidity. In addition, it seems that banks adjusted<br />

their level of excess reserves at the start of the new<br />

reserve period. They currently hold EUR 222bn in<br />

their current accounts (EUR 9.7bn above<br />

requirements), while excess reserves are usually<br />

closer to EUR 40-50bn at the start of the period.<br />

Moreover, while demand at the MRO fell, demand at<br />

the LTRO (3 weeks) rose. This will prevent stress<br />

from developing.<br />

A gradual resteepening at the front end<br />

Beyond the first couple of days at the start of the<br />

period, it makes sense that eonia should decline.<br />

This will go along with a steeper spot eonia curve.<br />

Steepening pressures will also resume on the ER<br />

curve. After last week’s ECB press conference, the<br />

ER1-ER steepened 15bp under selling pressures.<br />

From a peak of 75bp, the spread tightened back to<br />

72.5bp. Over the next few days, the potential for a<br />

bull-flattening correction on ERs will fade. The<br />

regime at the front end has changed. For sure, the<br />

ECB did not want to flag up the risk of a rate hike<br />

Source: <strong>BNP</strong> Paribas<br />

Source: <strong>BNP</strong> Paribas<br />

Chart 2: Excess Reserves Lower<br />

over the next few months. But the ECB is gradually<br />

reassessing risks. Last year, bear-steepening<br />

movements at the front end offered bull-flattening<br />

trade opportunities. This year, the opposite is true.<br />

The current movement on the Euribor curve is<br />

temporary. A flattening below 70bp along with an<br />

ERH2 close to 98.25 offers an opportunity to re-enter<br />

bear steepeners. It is worth noting that, over the long<br />

run, the average spread between the refi and the<br />

3mth Euribor is 15-20bp in a status quo, rises to<br />

35bp ahead of a rate hike cycle and is close to 50bp<br />

when the rate hike process starts. As long as the<br />

market discounts a rate hike by early 2012, the<br />

Mar12 implied rate must be at least 1.75%.<br />

<strong>Strategy</strong>: Beyond a near-term correction, there is no<br />

scope for a bullish bias on ERs. Benefit from a bullflattening<br />

correction to re-enter bear steepeners.<br />

Patrick Jacq 20 January 2011<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

39<br />

www.Global<strong>Market</strong>s.bnpparibas.com