Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

US: Setup for Auctions with Spread Curve Flatteners<br />

• In general, 2y Tsy tends to cheapen relative<br />

to the long end going into the auction and<br />

reverse direction post auction (2s10s, 2s30s<br />

flatteners followed by steepeners).<br />

• 5y and 7y notes have a tendency to move<br />

almost in line with the long end going into the<br />

auctions and to richen relative to the long end<br />

post auctions (5s10s, 5s30s steepeners).<br />

• There is a clear trend of belly spread<br />

widening relative to the front end and long end<br />

spreads throughout the auction.<br />

• STRATEGY: Consider paying 5y spreads vs<br />

10y spreads. Also consider paying 5y spreads<br />

vs 2y and 10y spreads for a higher average<br />

move which comes with higher volatility.<br />

With 2y, 5y and 7y auctions taking place next week,<br />

we highlight auction-based systematic trades which<br />

we have been recommending in the past issues of<br />

our weekly publication.<br />

While doing this analysis, we look at auctions since<br />

Jan 2010 (total of 12 auctions) and keep the issues<br />

fixed through each auction (i.e. always use the<br />

current issue pre auction which becomes old<br />

post auction) so that there is no spurious roll<br />

effect.<br />

Outright treasury curve behaviour around<br />

auctions<br />

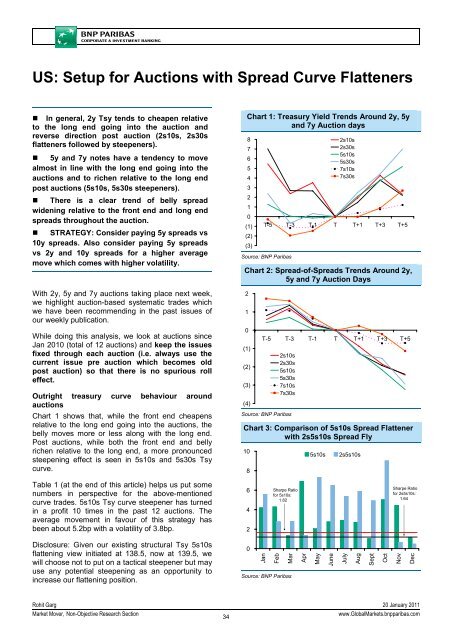

Chart 1 shows that, while the front end cheapens<br />

relative to the long end going into the auctions, the<br />

belly moves more or less along with the long end.<br />

Post auctions, while both the front end and belly<br />

richen relative to the long end, a more pronounced<br />

steepening effect is seen in 5s10s and 5s30s Tsy<br />

curve.<br />

Chart 1: Treasury Yield Trends Around 2y, 5y<br />

and 7y Auction days<br />

8<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

(1)<br />

(2)<br />

(3)<br />

2s10s<br />

2s30s<br />

5s10s<br />

5s30s<br />

7s10s<br />

7s30s<br />

T-5 T-3 T-1 T T+1 T+3 T+5<br />

Source: <strong>BNP</strong> Paribas<br />

Chart 2: Spread-of-Spreads Trends Around 2y,<br />

5y and 7y Auction Days<br />

2<br />

1<br />

0<br />

(1)<br />

(2)<br />

(3)<br />

(4)<br />

T-5 T-3 T-1 T T+1 T+3 T+5<br />

2s10s<br />

2s30s<br />

5s10s<br />

5s30s<br />

7s10s<br />

7s30s<br />

Source: <strong>BNP</strong> Paribas<br />

Chart 3: Comparison of 5s10s Spread Flattener<br />

with 2s5s10s Spread Fly<br />

10<br />

8<br />

5s10s<br />

2s5s10s<br />

Table 1 (at the end of this article) helps us put some<br />

numbers in perspective for the above-mentioned<br />

curve trades. 5s10s Tsy curve steepener has turned<br />

in a profit 10 times in the past 12 auctions. The<br />

average movement in favour of this strategy has<br />

been about 5.2bp with a volatility of 3.8bp.<br />

6<br />

4<br />

2<br />

Sharpe Ratio<br />

for 5s10s:<br />

1.82<br />

Sharpe Ratio<br />

for 2s5s10s:<br />

1.64<br />

Disclosure: Given our existing structural Tsy 5s10s<br />

flattening view initiated at 138.5, now at 139.5, we<br />

will choose not to put on a tactical steepener but may<br />

use any potential steepening as an opportunity to<br />

increase our flattening position.<br />

0<br />

Jan<br />

Feb<br />

Mar<br />

Source: <strong>BNP</strong> Paribas<br />

Apr<br />

May<br />

June<br />

July<br />

Aug<br />

Sept<br />

Oct<br />

Nov<br />

Dec<br />

Rohit Garg 20 January 2011<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

34<br />

www.Global<strong>Market</strong>s.bnpparibas.com