Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

also means that, the more peripherals suffer, the<br />

more core will have to bear the burden.<br />

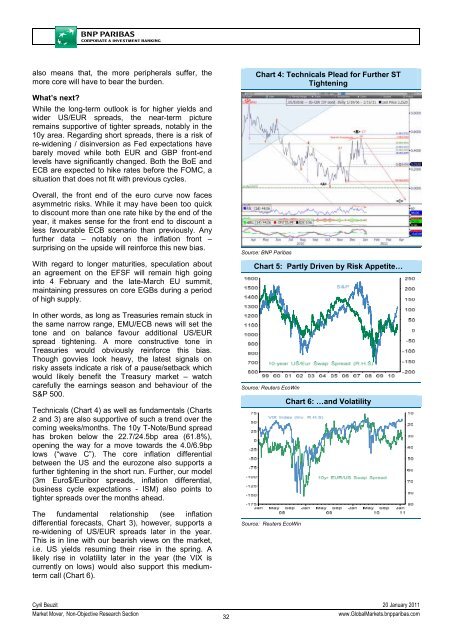

Chart 4: Technicals Plead for Further ST<br />

Tightening<br />

What’s next?<br />

While the long-term outlook is for higher yields and<br />

wider US/EUR spreads, the near-term picture<br />

remains supportive of tighter spreads, notably in the<br />

10y area. Regarding short spreads, there is a risk of<br />

re-widening / disinversion as Fed expectations have<br />

barely moved while both EUR and GBP front-end<br />

levels have significantly changed. Both the BoE and<br />

ECB are expected to hike rates before the FOMC, a<br />

situation that does not fit with previous cycles.<br />

Overall, the front end of the euro curve now faces<br />

asymmetric risks. While it may have been too quick<br />

to discount more than one rate hike by the end of the<br />

year, it makes sense for the front end to discount a<br />

less favourable ECB scenario than previously. Any<br />

further data – notably on the inflation front –<br />

surprising on the upside will reinforce this new bias.<br />

With regard to longer maturities, speculation about<br />

an agreement on the EFSF will remain high going<br />

into 4 February and the late-March EU summit,<br />

maintaining pressures on core EGBs during a period<br />

of high supply.<br />

In other words, as long as Treasuries remain stuck in<br />

the same narrow range, EMU/ECB news will set the<br />

tone and on balance favour additional US/EUR<br />

spread tightening. A more constructive tone in<br />

Treasuries would obviously reinforce this bias.<br />

Though govvies look heavy, the latest signals on<br />

risky assets indicate a risk of a pause/setback which<br />

would likely benefit the Treasury market – watch<br />

carefully the earnings season and behaviour of the<br />

S&P 500.<br />

Technicals (Chart 4) as well as fundamentals (Charts<br />

2 and 3) are also supportive of such a trend over the<br />

coming weeks/months. The 10y T-Note/Bund spread<br />

has broken below the 22.7/24.5bp area (61.8%),<br />

opening the way for a move towards the 4.0/6.9bp<br />

lows (“wave C”). The core inflation differential<br />

between the US and the eurozone also supports a<br />

further tightening in the short run. Further, our model<br />

(3m Euro$/Euribor spreads, inflation differential,<br />

business cycle expectations - ISM) also points to<br />

tighter spreads over the months ahead.<br />

The fundamental relationship (see inflation<br />

differential forecasts, Chart 3), however, supports a<br />

re-widening of US/EUR spreads later in the year.<br />

This is in line with our bearish views on the market,<br />

i.e. US yields resuming their rise in the spring. A<br />

likely rise in volatility later in the year (the VIX is<br />

currently on lows) would also support this mediumterm<br />

call (Chart 6).<br />

Source: <strong>BNP</strong> Paribas<br />

Chart 5: Partly Driven by Risk Appetite…<br />

Source: Reuters EcoWin<br />

Source: Reuters EcoWin<br />

Chart 6: …and Volatility<br />

Cyril Beuzit 20 January 2011<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

32<br />

www.Global<strong>Market</strong>s.bnpparibas.com