Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ECB: Bark or Bite?<br />

• The ECB has signalled increased anxiety<br />

over the upside risks to inflation.<br />

• How labour costs and inflation expectations<br />

evolve will be key to whether this translates into<br />

‘early’ increases in the refinancing rate.<br />

• The assessment of labour cost trends in the<br />

January Monthly Bulletin was similar to that in<br />

December, i.e. relatively benign.<br />

• Broad money and bank lending data do not<br />

signal a pressing need for rate hikes either.<br />

• The key risks to our call of the ECB on hold<br />

through 2011 are persistently high commodity<br />

prices and a ‘normalisation’ approach to policy.<br />

The ECB press conference on 13 January revealed<br />

increased anxiety over upside risks to inflation.<br />

Below we discuss the probability that this increased<br />

concern over inflation prospects will translate into an<br />

‘early’ policy tightening.<br />

Shifting risks<br />

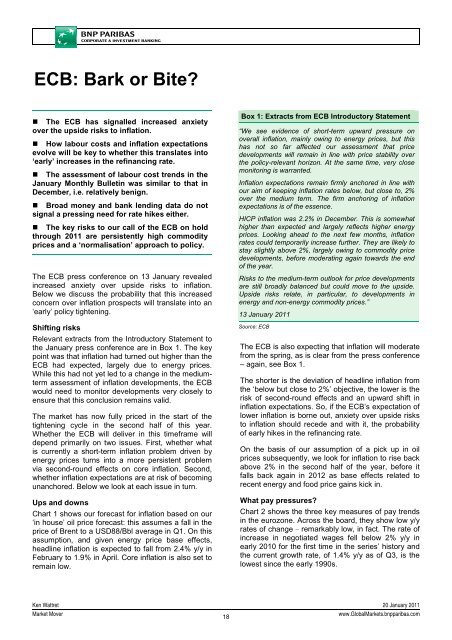

Relevant extracts from the Introductory Statement to<br />

the January press conference are in Box 1. The key<br />

point was that inflation had turned out higher than the<br />

ECB had expected, largely due to energy prices.<br />

While this had not yet led to a change in the mediumterm<br />

assessment of inflation developments, the ECB<br />

would need to monitor developments very closely to<br />

ensure that this conclusion remains valid.<br />

The market has now fully priced in the start of the<br />

tightening cycle in the second half of this year.<br />

Whether the ECB will deliver in this timeframe will<br />

depend primarily on two issues. First, whether what<br />

is currently a short-term inflation problem driven by<br />

energy prices turns into a more persistent problem<br />

via second-round effects on core inflation. Second,<br />

whether inflation expectations are at risk of becoming<br />

unanchored. Below we look at each issue in turn.<br />

Ups and downs<br />

Chart 1 shows our forecast for inflation based on our<br />

‘in house’ oil price forecast: this assumes a fall in the<br />

price of Brent to a USD88/Bbl average in Q1. On this<br />

assumption, and given energy price base effects,<br />

headline inflation is expected to fall from 2.4% y/y in<br />

February to 1.9% in April. Core inflation is also set to<br />

remain low.<br />

Box 1: Extracts from ECB Introductory Statement<br />

“We see evidence of short-term upward pressure on<br />

overall inflation, mainly owing to energy prices, but this<br />

has not so far affected our assessment that price<br />

developments will remain in line with price stability over<br />

the policy-relevant horizon. At the same time, very close<br />

monitoring is warranted.<br />

Inflation expectations remain firmly anchored in line with<br />

our aim of keeping inflation rates below, but close to, 2%<br />

over the medium term. The firm anchoring of inflation<br />

expectations is of the essence.<br />

HICP inflation was 2.2% in December. This is somewhat<br />

higher than expected and largely reflects higher energy<br />

prices. Looking ahead to the next few months, inflation<br />

rates could temporarily increase further. They are likely to<br />

stay slightly above 2%, largely owing to commodity price<br />

developments, before moderating again towards the end<br />

of the year.<br />

Risks to the medium-term outlook for price developments<br />

are still broadly balanced but could move to the upside.<br />

Upside risks relate, in particular, to developments in<br />

energy and non-energy commodity prices.”<br />

13 January 2011<br />

Source: ECB<br />

The ECB is also expecting that inflation will moderate<br />

from the spring, as is clear from the press conference<br />

– again, see Box 1.<br />

The shorter is the deviation of headline inflation from<br />

the ‘below but close to 2%’ objective, the lower is the<br />

risk of second-round effects and an upward shift in<br />

inflation expectations. So, if the ECB’s expectation of<br />

lower inflation is borne out, anxiety over upside risks<br />

to inflation should recede and with it, the probability<br />

of early hikes in the refinancing rate.<br />

On the basis of our assumption of a pick up in oil<br />

prices subsequently, we look for inflation to rise back<br />

above 2% in the second half of the year, before it<br />

falls back again in 2012 as base effects related to<br />

recent energy and food price gains kick in.<br />

What pay pressures?<br />

Chart 2 shows the three key measures of pay trends<br />

in the eurozone. Across the board, they show low y/y<br />

rates of change – remarkably low, in fact. The rate of<br />

increase in negotiated wages fell below 2% y/y in<br />

early 2010 for the first time in the series’ history and<br />

the current growth rate, of 1.4% y/y as of Q3, is the<br />

lowest since the early 1990s.<br />

Ken Wattret 20 January 2011<br />

<strong>Market</strong> Mover<br />

18<br />

www.Global<strong>Market</strong>s.bnpparibas.com