Praveen Ranjan AGM RBI, Ranchi - Department of Industry ...

Praveen Ranjan AGM RBI, Ranchi - Department of Industry ...

Praveen Ranjan AGM RBI, Ranchi - Department of Industry ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Praveen</strong> <strong>Ranjan</strong><br />

<strong>AGM</strong><br />

<strong>RBI</strong>, <strong>Ranchi</strong><br />

Reserve bank <strong>of</strong> India, <strong>Ranchi</strong>

Structure <strong>of</strong> presentation<br />

• Restructuring and asset classification<br />

• Rehabilitation <strong>of</strong> sick units<br />

Reserve bank <strong>of</strong> India, <strong>Ranchi</strong>

Asset classification ‐ MSME<br />

Standard assets<br />

Micro and Small – 0.25% <strong>of</strong> the loan amount.<br />

Medium – 0.40% .<br />

SubStandard Assets<br />

Secured – 15%<br />

Unsecured – 25%<br />

Doubtful – 100% for unsecured portion. 25‐40 for<br />

secured portion<br />

Reserve bank <strong>of</strong> India, <strong>Ranchi</strong>

Restructuring guidelines<br />

• On August 27, 2008, comprehensive guidelines on<br />

Restructuring issued. Current guidelines on<br />

restructuring have been consolidated vide Master<br />

Circular – Income recognition and asset classification<br />

norms – July 1, 2012.<br />

• The current circular harmonizes prudential norms<br />

across all categories <strong>of</strong> restructuring i.e corporate,<br />

retail, SME, infrastructure.<br />

Reserve bank <strong>of</strong> India, <strong>Ranchi</strong>

General Principles<br />

(a) Banks may restructure Accounts classified as<br />

Standard/Sub‐standard/Doubtful. Loss Assets<br />

cannot be restructured.<br />

(b) restructuring/rescheduling retrospectively is not<br />

allowed.<br />

(c) Asset classification status on date <strong>of</strong> approval,<br />

relevant for deciding a.c. after restructuring<br />

(d) Formal consent/application <strong>of</strong> debtor<br />

Reserve bank <strong>of</strong> India, <strong>Ranchi</strong>

(e) Viability should be established<br />

(f) Borrowers indulging in frauds/malfeasance ineligible<br />

for restructuring<br />

(g) BIFR cases ineligible unless BIFR approves<br />

Reserve bank <strong>of</strong> India, <strong>Ranchi</strong>

Asset Classification upon<br />

restructuring<br />

(a) Accounts classified ‘Standard’ be classified ‘Sub‐<br />

Standard’ upon restructuring<br />

(b) NPA, upon restructuring would slip into lower<br />

category. with reference to pre‐restructuring<br />

repayment schedule<br />

(c) All restructured accounts classified NPA eligible for<br />

upgradation to standard after ‘satisfactory<br />

performance’ during ‘specified period’. period. If no S.P. a.c.<br />

by pre‐restructuring repayment schedule.<br />

Reserve bank <strong>of</strong> India, <strong>Ranchi</strong>

(d) Any additional finance can be treated as standard<br />

upto end <strong>of</strong> specified period.<br />

Reserve bank <strong>of</strong> India, <strong>Ranchi</strong>

Provisioning Norms<br />

(a) Restructured Standard advances –2% for first<br />

two years<br />

(b) Restructured t NPA –as per normal provisioning ii i<br />

norms<br />

(c) Restructured NPA after upgradation to standard<br />

–2% in the first year.<br />

(d) Provision for erosion in fair value <strong>of</strong> advance<br />

Reserve bank <strong>of</strong> India, <strong>Ranchi</strong>

Special Asset Classification Status<br />

• package implemented within 90 days <strong>of</strong> approval –<br />

• Upon restructuring, standard will not be downgraded to<br />

SS S.S. and S.S./Doubtful S will not deteriorate, if SP is seen<br />

during specified period, provided<br />

• Dues to bank are fully secured by tangible security,<br />

except SSI borrowers with o/s upto Rs.25 lakhs and<br />

infrastructure<br />

• Unit, if infrastructure, becomes viable in ten years and<br />

others in seven years<br />

Reserve bank <strong>of</strong> India, <strong>Ranchi</strong>

• Repayment period, including moratorium not to<br />

exceed 15 years in case <strong>of</strong> infrastructure and 10 years<br />

in case <strong>of</strong> others.<br />

• Promoters sacrifice/additional funds should be<br />

minimum 15% <strong>of</strong> banks sacrifice – 50% upfront and<br />

15% within ihi a period <strong>of</strong> one year.<br />

• Personal guarantee by promoter except when unit<br />

faces external factors<br />

• Restructuring is not a repeat Restructuring.<br />

Reserve bank <strong>of</strong> India, <strong>Ranchi</strong>

Restructuring <strong>of</strong> SME under Consortium<br />

financing‐Multiple Banking<br />

• Simple Mechanism<br />

• Board approved policy for restructuring <strong>of</strong> SMEs<br />

• Bank with the largest exposure to work out<br />

restructuring package along with the second largest<br />

bank<br />

• Implementation within 90 days <strong>of</strong> receipt <strong>of</strong> requests.<br />

• To keep the board informed<br />

Reserve bank <strong>of</strong> India, <strong>Ranchi</strong>

Rehabilitation <strong>of</strong> Sick Units<br />

• Restructuring if properly implemented would prevent<br />

a unit from turning sick.<br />

• A unit is considered d as sick ik when any <strong>of</strong> the borrowal<br />

accounts <strong>of</strong> the unit remains substandard for more<br />

than 6 months, or<br />

• there is erosion in the net worth due to accumulated<br />

cash losses to the extent <strong>of</strong> 50% <strong>of</strong> its net worth during<br />

the previous accounting year and the unit has been in<br />

commercial production for at least two years.<br />

Reserve bank <strong>of</strong> India, <strong>Ranchi</strong>

• Comprehensive Guidelines for rehabilitation <strong>of</strong> sick<br />

units – January 16, 2002<br />

• Warning signals for sickness ik –<br />

a) Continuous irregularities in cash credit/overdraft<br />

accounts such as inability to maintain stipulated<br />

margin on continuous basis or drawings frequently<br />

exceeding sanctioned limits, periodical interest<br />

remaining unrealized;<br />

b) Outstanding balance in cash credit account<br />

remaining i continuously at the maximum;<br />

Reserve bank <strong>of</strong> India, <strong>Ranchi</strong>

c) Failure to make timely payment <strong>of</strong> installments <strong>of</strong><br />

principal and interest on term loans;<br />

d) Complaints from suppliers <strong>of</strong> raw materials, il water,<br />

power, etc. about non‐ payment <strong>of</strong> bills;<br />

e) Non‐submission or undue delay in submission or<br />

submission <strong>of</strong> incorrect stock statements and other<br />

control statements;<br />

f) Attempts to divert sale proceeds through accounts<br />

with other banks;<br />

Reserve bank <strong>of</strong> India, <strong>Ranchi</strong>

g) Downward trend in credit summations;<br />

h) Frequent return <strong>of</strong> cheques or bills;<br />

i) Steep decline in production figures;<br />

j) Downward trends in sales and fall in pr<strong>of</strong>its;<br />

k) Rising level <strong>of</strong> inventories, which may include large<br />

proportion <strong>of</strong> slow or non‐moving items;<br />

l) Delay in meeting commitments t towards payment <strong>of</strong><br />

installments due, crystallized liabilities under LC/BGs,<br />

etc.<br />

Reserve bank <strong>of</strong> India, <strong>Ranchi</strong>

Liberalisation <strong>of</strong> rehabilitation<br />

<strong>of</strong> SMEs<br />

• January 16, 2002 guidelines withdrawn vide September<br />

12, 2011 circular<br />

• Banks given complete freedom to formulate policy<br />

regarding rehabilitation <strong>of</strong> sick units<br />

• Rehabilitation Policy to be approved by Board <strong>of</strong> the<br />

bank<br />

• Freedom given so as to increase the support provided<br />

to SME sector<br />

Reserve bank <strong>of</strong> India, <strong>Ranchi</strong>

Discretionary concessions<br />

• Waiver <strong>of</strong> interest dues on cash credit and term loans<br />

• Reduction <strong>of</strong> interest – below base rate allowed<br />

• Funding <strong>of</strong> interest due to bank for some time<br />

• Concessional interest on working capital<br />

• Contingency loan assistance<br />

• Funding for start up expenses and margin for working<br />

capital<br />

• 50% <strong>of</strong> promoters contribution to be brought upfront<br />

and rest within one year<br />

Reserve bank <strong>of</strong> India, <strong>Ranchi</strong>

Important Points<br />

• Rehabilitation/restructuring not a matter <strong>of</strong> right<br />

• Banks to exercise their commercial judgement<br />

• Banks to consider viabilty <strong>of</strong> units<br />

• Sacrifices to be decided by banks as per their<br />

commercial il judgement.<br />

• If not found viable –exit routes through SARFAESI<br />

Reserve bank <strong>of</strong> India, <strong>Ranchi</strong>

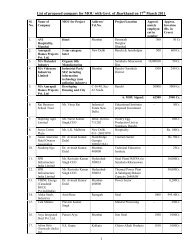

Data on Sick units ‐ Major Banks<br />

Jharkhand (September 2011)<br />

Bank Group<br />

No. <strong>of</strong> Units<br />

Amount Outstanding<br />

( In Rs. lakhs)<br />

SBI 623 906.32<br />

BOI 0 0<br />

PNB 316 1884<br />

Canara Bank 1 426<br />

JGB 148 159<br />

VGB 0 0<br />

Total <strong>of</strong> all banks 1115 4124.08<br />

Reserve bank <strong>of</strong> India, <strong>Ranchi</strong>

Thank You<br />

Reserve bank <strong>of</strong> India, <strong>Ranchi</strong>