What Women Need to Know About Retirement - Wiser

What Women Need to Know About Retirement - Wiser

What Women Need to Know About Retirement - Wiser

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

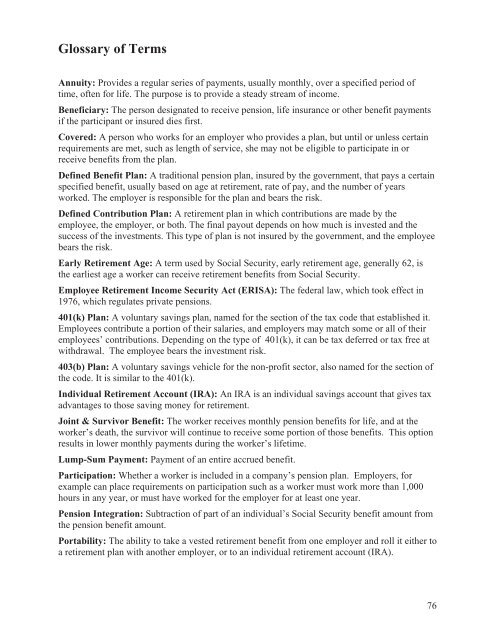

Glossary of Terms<br />

Annuity: Provides a regular series of payments, usually monthly, over a specified period of<br />

time, often for life. The purpose is <strong>to</strong> provide a steady stream of income.<br />

Beneficiary: The person designated <strong>to</strong> receive pension, life insurance or other benefit payments<br />

if the participant or insured dies first.<br />

Covered: A person who works for an employer who provides a plan, but until or unless certain<br />

requirements are met, such as length of service, she may not be eligible <strong>to</strong> participate in or<br />

receive benefits from the plan.<br />

Defined Benefit Plan: A traditional pension plan, insured by the government, that pays a certain<br />

specified benefit, usually based on age at retirement, rate of pay, and the number of years<br />

worked. The employer is responsible for the plan and bears the risk.<br />

Defined Contribution Plan: A retirement plan in which contributions are made by the<br />

employee, the employer, or both. The final payout depends on how much is invested and the<br />

success of the investments. This type of plan is not insured by the government, and the employee<br />

bears the risk.<br />

Early <strong>Retirement</strong> Age: A term used by Social Security, early retirement age, generally 62, is<br />

the earliest age a worker can receive retirement benefits from Social Security.<br />

Employee <strong>Retirement</strong> Income Security Act (ERISA): The federal law, which <strong>to</strong>ok effect in<br />

1976, which regulates private pensions.<br />

401(k) Plan: A voluntary savings plan, named for the section of the tax code that established it.<br />

Employees contribute a portion of their salaries, and employers may match some or all of their<br />

employees’ contributions. Depending on the type of 401(k), it can be tax deferred or tax free at<br />

withdrawal. The employee bears the investment risk.<br />

403(b) Plan: A voluntary savings vehicle for the non-profit sec<strong>to</strong>r, also named for the section of<br />

the code. It is similar <strong>to</strong> the 401(k).<br />

Individual <strong>Retirement</strong> Account (IRA): An IRA is an individual savings account that gives tax<br />

advantages <strong>to</strong> those saving money for retirement.<br />

Joint & Survivor Benefit: The worker receives monthly pension benefits for life, and at the<br />

worker’s death, the survivor will continue <strong>to</strong> receive some portion of those benefits. This option<br />

results in lower monthly payments during the worker’s lifetime.<br />

Lump-Sum Payment: Payment of an entire accrued benefit.<br />

Participation: Whether a worker is included in a company’s pension plan. Employers, for<br />

example can place requirements on participation such as a worker must work more than 1,000<br />

hours in any year, or must have worked for the employer for at least one year.<br />

Pension Integration: Subtraction of part of an individual’s Social Security benefit amount from<br />

the pension benefit amount.<br />

Portability: The ability <strong>to</strong> take a vested retirement benefit from one employer and roll it either <strong>to</strong><br />

a retirement plan with another employer, or <strong>to</strong> an individual retirement account (IRA).<br />

76