Economic Models - Convex Optimization

Economic Models - Convex Optimization Economic Models - Convex Optimization

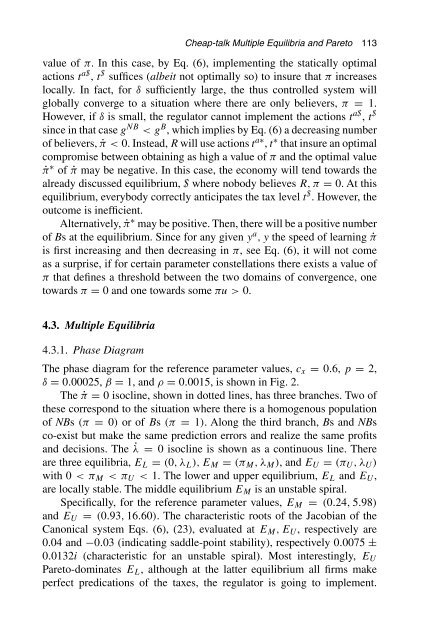

Cheap-talk Multiple Equilibria and Pareto 113 value of π. In this case, by Eq. (6), implementing the statically optimal actions t a$ , t $ suffices (albeit not optimally so) to insure that π increases locally. In fact, for δ sufficiently large, the thus controlled system will globally converge to a situation where there are only believers, π = 1. However, if δ is small, the regulator cannot implement the actions t a$ , t $ since in that case g NB

114 Chirstophe Deissenberg and Pavel Ševčík Figure 2. Phase diagram of the canonical system, c x = 0.6, p = 2, δ = 0.00025, β = 1, and ρ = 0.0015. E U Table 1. Profits, welfare, and taxes at E U and E L , c x = 0.6, p = 2, δ = 0.0025, β = 1, p = 0.0015. g φ t a t E U 1 2.25 1.07 0.12 E L 0.98 2.18 N.A. 0.62 The Pareto-superiority of E U is illustrated in Table 1 (remember that at the equilibrium g N = g NB ). The situation captured in Fig. 2 (an unstable equilibrium surrounded by two stable ones) implies the existence of a threshold such that it is optimal for R to follow a policy leading in the long-run towards the stable equilibrium E L = (0,λ L ), whenever the initial value π 0 of π is inferior to the threshold value, π 0

- Page 85 and 86: 62 Dipak R. Basu and Alexis Lazarid

- Page 87 and 88: 64 Dipak R. Basu and Alexis Lazarid

- Page 89 and 90: 66 Dipak R. Basu and Alexis Lazarid

- Page 91 and 92: This page intentionally left blank

- Page 93 and 94: 70 Andrew Hughes Hallet have, there

- Page 95 and 96: 72 Andrew Hughes Hallet other. The

- Page 97 and 98: 74 Andrew Hughes Hallet success in

- Page 99 and 100: 76 Andrew Hughes Hallet with a hori

- Page 101 and 102: 78 Andrew Hughes Hallet control inf

- Page 103 and 104: 80 Andrew Hughes Hallet Table 2. Fi

- Page 105 and 106: 82 Andrew Hughes Hallet country 13

- Page 107 and 108: 84 Andrew Hughes Hallet Given this

- Page 109 and 110: 86 Andrew Hughes Hallet 5.4. Instit

- Page 111 and 112: 88 Andrew Hughes Hallet Substitutin

- Page 113 and 114: 90 Andrew Hughes Hallet This is alw

- Page 115 and 116: 92 Andrew Hughes Hallet (d) Since E

- Page 117 and 118: 94 Andrew Hughes Hallet Table 3. Ex

- Page 119 and 120: 96 Andrew Hughes Hallet restraint m

- Page 121 and 122: 98 Andrew Hughes Hallet HM Treasury

- Page 123 and 124: 100 Andrew Hughes Hallet γ/(β −

- Page 125 and 126: 102 Chirstophe Deissenberg and Pave

- Page 127 and 128: 104 Chirstophe Deissenberg and Pave

- Page 129 and 130: 106 Chirstophe Deissenberg and Pave

- Page 131 and 132: 108 Chirstophe Deissenberg and Pave

- Page 133 and 134: 110 Chirstophe Deissenberg and Pave

- Page 135: 112 Chirstophe Deissenberg and Pave

- Page 139 and 140: 116 Chirstophe Deissenberg and Pave

- Page 141 and 142: 118 Chirstophe Deissenberg and Pave

- Page 143 and 144: This page intentionally left blank

- Page 145 and 146: 122 Nikitas Spiros Koutsoukis 2. Mo

- Page 147 and 148: 124 Nikitas Spiros Koutsoukis GRAI

- Page 149 and 150: 126 Nikitas Spiros Koutsoukis (3) U

- Page 151 and 152: 128 Nikitas Spiros Koutsoukis The m

- Page 153 and 154: 130 Nikitas Spiros Koutsoukis lower

- Page 155 and 156: 132 Nikitas Spiros Koutsoukis Some

- Page 157 and 158: 134 Nikitas Spiros Koutsoukis We be

- Page 159 and 160: This page intentionally left blank

- Page 161 and 162: 138 Victoria Miroshnik 2. Corporate

- Page 163 and 164: 140 Victoria Miroshnik Japanese NC

- Page 165 and 166: 142 Victoria Miroshnik process shou

- Page 167 and 168: 144 Victoria Miroshnik National cul

- Page 169 and 170: 146 Victoria Miroshnik A1 A2 A3 D1

- Page 171 and 172: 148 Victoria Miroshnik Fujino, T (1

- Page 173 and 174: This page intentionally left blank

- Page 175 and 176: 152 Anna-Maria Mouza of salaries of

- Page 177 and 178: 154 Anna-Maria Mouza Table 2. final

- Page 179 and 180: 156 Anna-Maria Mouza Table 4. Worki

- Page 181 and 182: 158 Anna-Maria Mouza 3.2.2. Personn

- Page 183 and 184: 160 Anna-Maria Mouza where X 43 , a

- Page 185 and 186: 162 Anna-Maria Mouza Thus, the tota

Cheap-talk Multiple Equilibria and Pareto 113<br />

value of π. In this case, by Eq. (6), implementing the statically optimal<br />

actions t a$ , t $ suffices (albeit not optimally so) to insure that π increases<br />

locally. In fact, for δ sufficiently large, the thus controlled system will<br />

globally converge to a situation where there are only believers, π = 1.<br />

However, if δ is small, the regulator cannot implement the actions t a$ , t $<br />

since in that case g NB