Economic Models - Convex Optimization

Economic Models - Convex Optimization

Economic Models - Convex Optimization

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

110 Chirstophe Deissenberg and Pavel Ševčík<br />

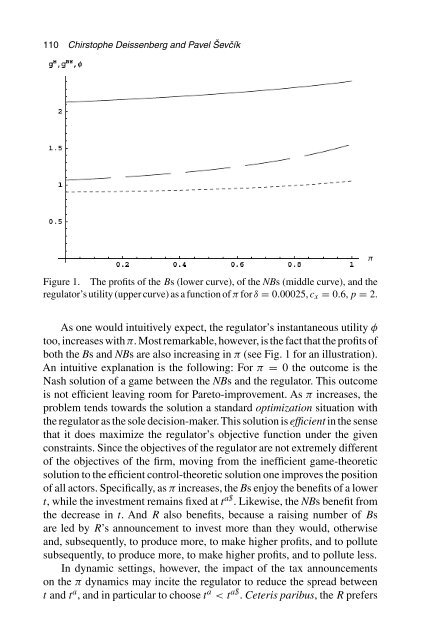

Figure 1. The profits of the Bs (lower curve), of the NBs (middle curve), and the<br />

regulator’s utility (upper curve) as a function of π for δ = 0.00025, c x = 0.6, p = 2.<br />

As one would intuitively expect, the regulator’s instantaneous utility φ<br />

too, increases with π. Most remarkable, however, is the fact that the profits of<br />

both the Bs and NBs are also increasing in π (see Fig. 1 for an illustration).<br />

An intuitive explanation is the following: For π = 0 the outcome is the<br />

Nash solution of a game between the NBs and the regulator. This outcome<br />

is not efficient leaving room for Pareto-improvement. As π increases, the<br />

problem tends towards the solution a standard optimization situation with<br />

the regulator as the sole decision-maker. This solution is efficient in the sense<br />

that it does maximize the regulator’s objective function under the given<br />

constraints. Since the objectives of the regulator are not extremely different<br />

of the objectives of the firm, moving from the inefficient game-theoretic<br />

solution to the efficient control-theoretic solution one improves the position<br />

of all actors. Specifically, as π increases, the Bs enjoy the benefits of a lower<br />

t, while the investment remains fixed at t a$ . Likewise, the NBs benefit from<br />

the decrease in t. And R also benefits, because a raising number of Bs<br />

are led by R’s announcement to invest more than they would, otherwise<br />

and, subsequently, to produce more, to make higher profits, and to pollute<br />

subsequently, to produce more, to make higher profits, and to pollute less.<br />

In dynamic settings, however, the impact of the tax announcements<br />

on the π dynamics may incite the regulator to reduce the spread between<br />

t and t a , and in particular to choose t a