Paper - F.5 : STRATEGIC FINANCIAL ... - Surana college

Paper - F.5 : STRATEGIC FINANCIAL ... - Surana college

Paper - F.5 : STRATEGIC FINANCIAL ... - Surana college

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

-<br />

lllllllllllllllllllllllllllllllllll<br />

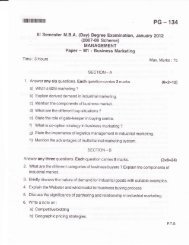

IV Semester M.B.A. Degree Examination, June 20ll<br />

(2007-08 Scheme)<br />

Nlanagement<br />

<strong>F.5</strong> : <strong>STRATEGIC</strong> <strong>FINANCIAL</strong> MANAGEMENT<br />

pc - 01s<br />

Time : 3 Hours Max. Marks : 75<br />

SECTION _ A<br />

1. Answer any six of the following sub-questions. Each carries two<br />

marks.<br />

( Zx6=12)<br />

a) What is a conglomerate<br />

b) What is spin-off ?<br />

c) What do you understand by ESOP ?<br />

d) Define operating free cash flow.<br />

e) What is balanced score card ?<br />

D What are cost drives ?<br />

g) Define value creation.<br />

h) What do you mean by hostile takeover ?<br />

i) What is prison pill ?<br />

SECTION _ B<br />

Answer any three of the following questions. Each question carries eight<br />

marks.<br />

(3x8=24)<br />

2. $Ihat are the key steps in Marakan approach to value based management ?<br />

3. Discuss the various forms of corporate restructuring.<br />

P.T.O.

PG - 015<br />

r't<br />

lll]ffitilililililIilililtililil]<br />

4. Acme Limited is considering a capital project for which the following information<br />

is available.<br />

Investment outlay : 1000 Debt Equity ratio : 1 :1<br />

Project life<br />

5 years Depreciation (for tax puqpose) : Straight line<br />

Salvage value<br />

zero Tax rate<br />

:407o<br />

Annual revenue<br />

2000 Annual cost (excluding<br />

Cost of equity<br />

l87o depreciation interest and taxes) : 1400<br />

Cost of debt after tax<br />

I0Vo<br />

a) Calculate the EVA of the project over its life<br />

b) Compute the NPV of the project.<br />

5. Rajesh International earns a return on equity of 2|Vo.Its dividend payout ratio<br />

is 0.40. Equity shareholders of Rajesh require a return of !8%o.The book value<br />

per share is Rs. 50.<br />

a) what is the market price per share, according to Marakon model ?<br />

b) If the return on equity falls to 22bo,what should be the payout ratio to<br />

ensure that the market price per share remains unchanged ?<br />

6. Discuss the key drivers of free cash flows.

I l|ililil ilil ilil ililt ilflt ilil iltr<br />

-J-<br />

PG - 015<br />

SECTION _ C<br />

Answer any two questions. Each question carries 12 marks.<br />

(2x12=24)<br />

7' Televista Corporation is expected to grow at a higher rate for 4 years; thereafter<br />

the growth rate will fall and stabilise at a lower level. The following information<br />

available:<br />

Base Year (year 0) Information<br />

Revenues<br />

EBIT<br />

Capital expenditure<br />

Depreciation<br />

Working Capital as a percentage of revenues<br />

Corporate tax rate (for all time)<br />

Paid up equity capital (Rs l0 per)<br />

= Rs. 1600 million<br />

= Rs. 240 miilion<br />

= Rs. 200 million<br />

= Rs. 120 million<br />

= 25 percent<br />

= 35 percent<br />

= Rs. 180 million<br />

Market value of debt<br />

= Rs. 600 million<br />

Inputs for the High Growth period<br />

Length of the high growth period<br />

= 4 years<br />

Growth rate in revenues, depreciation, EBIT<br />

and capital expenditure<br />

Working capital as a percentage of revenues<br />

Cost of debt<br />

Debt equity ratio<br />

= 20 percent<br />

= 25 percent<br />

= 15 percent<br />

= 1.5: I

PG - 015<br />

Iil]il] lililil illililil|llll llll<br />

Risk-freerate<br />

Market risk premium<br />

= 12 percent<br />

= 7 Percent<br />

Equity beta = 1.25<br />

Inputs for the Stable Growth Period<br />

Expected growth rate in revenues and EBIT =<br />

10 percent<br />

Capital expenditures are offset by depreciation<br />

Working capital as a percentage of revenues = 25 percent<br />

Cost of debt<br />

Debt-equity ratio 1.1<br />

Risk-freerate<br />

=<br />

14 percent (Pre-tax)<br />

12 percent<br />

Market risk premium<br />

= 6 Percent<br />

Equity beta = 1.00<br />

Calculate the value of the firm.<br />

8. Unique Steel Ltd. is contemplating to acquire Sema Mainframe Ltd. The<br />

following information is available in respect of companies.<br />

Unique Steel Ltd.<br />

Sema Mainframe<br />

No. of Equrty shares 10,00,000 6,00,000<br />

Earnings after tax (Rs.) 50,00,000 18,00,000<br />

Market value per share (Rs.) 20 13

I|ililillililililllilililtilililt<br />

-5-<br />

PG - 01s<br />

i) What is the present EPS of both the companies ?<br />

ii) What would be the new EPS for Unique Steel Ltd., if the proposed merger<br />

takes place by exchange of equity shares and the exchange ratio is based on<br />

the current market prices ?<br />

iii) What should be the exchange ratio, if Sema Mainframe wants to ensure the<br />

same earnings to members as before merger takes place ?<br />

9. Define strategic financial management. Explain the scope and constituents of<br />

strategic financial management.<br />

SECTION _ D<br />

Case Study :<br />

10. The Profit and Loss Account and Balance Sheet of Hitech<br />

(1x15=15)<br />

Limited for three<br />

years (Year 1, Year 2 andYear 3) are given below :<br />

Profit and Loss Account<br />

Net sales<br />

Income from marketable securities<br />

Non-operating income<br />

Total income<br />

Cost of goods sold<br />

Selling and general administration expenses<br />

I<br />

350<br />

350<br />

200<br />

45<br />

Rs. in Million<br />

400 460<br />

10 15<br />

5 10<br />

4r5 485<br />

230 27A<br />

50 55

PG - 01s<br />

-6- Iil|lililililililililtililtilililil<br />

Depreciation<br />

20<br />

25<br />

30<br />

Interest expenses<br />

20<br />

24<br />

28<br />

Total costs and expenses<br />

285<br />

329<br />

383<br />

PBT<br />

65<br />

86<br />

t02<br />

Tax provision<br />

20<br />

26<br />

32<br />

PAT<br />

45<br />

60<br />

70<br />

Dividend<br />

20<br />

30<br />

40<br />

Retained earnings<br />

25<br />

30<br />

30<br />

Balance Sheet<br />

123<br />

Equity capital<br />

Reserves and surplus<br />

Debt<br />

Total<br />

Fixed assets<br />

' Investments<br />

Net current assets<br />

Total<br />

130 150 150<br />

90 120 1s0<br />

150 180 210<br />

370 450 510<br />

250 300 325<br />

60 90 100<br />

60 60 85<br />

370 450 510<br />

The tax rate for Hitech Limited is 40 percent. During year Zthe firm made a rights<br />

issue of Rs. 20 million at par.

lffilllllllllllllllllllllllllll .7_ pc _ ors<br />

a) Calculate tle following for years 2 and 3<br />

r) EBIT<br />

ii) Taxes on EBIT<br />

iii) NOPLAT<br />

iv) Net investment<br />

v) Operating free cash flow<br />

vi) Net operating cash flow<br />

vii) Free cash flow to the firm.<br />

b) Give the break-up of the financing flow for years 2 and,3.<br />

I .) Calculate the following key drivers of FCF for years 2 and 3<br />

.\<br />

I<br />

i) Invested capital<br />

l^<br />

...<br />

I<br />

ii) ROIC<br />

iii) Growth rate.

![[GST] FRAMEWORK IN INDIA - Surana college](https://img.yumpu.com/37452041/1/184x260/gst-framework-in-india-surana-college.jpg?quality=85)