November 2012 presentation - Argonaut Gold Inc.

November 2012 presentation - Argonaut Gold Inc.

November 2012 presentation - Argonaut Gold Inc.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Prodigy - Magino’s Flexibility<br />

Dec 2011<br />

Prodigy’s flagship asset is the Magino gold project<br />

(40 km northwest of Wawa, Ontario)<br />

On December 22, 2011, Prodigy released an updated<br />

Preliminary Economic Assessment (“PEA”):<br />

• Pre-tax NPV of C$939 mm and pre-tax IRR of 36%<br />

• LOM average gold production of 249k oz per year<br />

over 11 year mine life at cash costs of US$461/oz<br />

• LOM production of 2.6 million ounces at 1.15 g/t<br />

• Total development capital expenditures of C$404 mm<br />

with LOM sustaining capital expenditures of C$145<br />

mm<br />

• 20,000 tpd mill achieving 95% recoveries<br />

Resource Flexibility<br />

• Tremendous grade flexibility without the loss of<br />

significant ounces<br />

• Mine development that balances returns with scale<br />

• Multiple development scenarios have been evaluated<br />

by <strong>Argonaut</strong> management in assessing the merits of<br />

this transaction<br />

• Pre-feasibility study (2013 target) which will explore<br />

the development of Magino, focusing on a higher<br />

grade, lower scaled operation balancing returns for<br />

the project<br />

• Project funding through <strong>Argonaut</strong> cash flow<br />

PEA<br />

Cutoff<br />

Grade<br />

Indicated Resource<br />

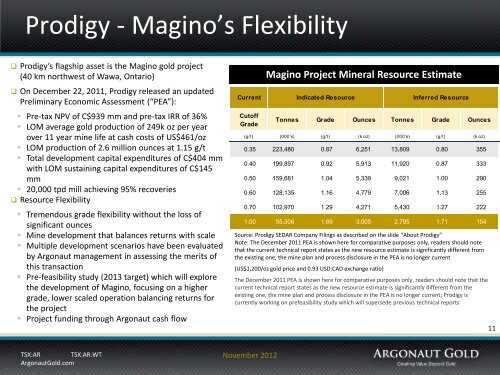

Magino Project Mineral Resource Estimate<br />

Source: Prodigy SEDAR Company Filings as described on the slide “About Prodigy”<br />

Note: The December 2011 PEA is shown here for comparative purposes only, readers should note<br />

that the current technical report states as the new resource estimate is significantly different from<br />

the existing one, the mine plan and process disclosure in the PEA is no longer current<br />

(US$1,200/oz gold price and 0.93 USD:CAD exchange ratio)<br />

Inferred Resource<br />

Tonnes Grade Ounces Tonnes Grade Ounces<br />

(g/t) (000's) (g/t) (k oz) (000's) (g/t) (k oz)<br />

0.35 67,555 1.00 2,176 54,242 0.99 1,721<br />

Current Indicated Resource Inferred Resource<br />

Cutoff<br />

Grade<br />

Tonnes Grade Ounces Tonnes Grade Ounces<br />

(g/t) (000's) (g/t) (k oz) (000's) (g/t) (k oz)<br />

0.35 223,480 0.87 6,251 13,809 0.80 355<br />

0.40 199,897 0.92 5,913 11,920 0.87 333<br />

0.50 159,681 1.04 5,339 9,021 1.00 290<br />

0.60 128,135 1.16 4,779 7,006 1.13 255<br />

0.70 102,970 1.29 4,271 5,430 1.27 222<br />

1.00 55,306 1.69 3,005 2,795 1.71 154<br />

The December 2011 PEA is shown here for comparative purposes only, readers should note that the<br />

current technical report states as the new resource estimate is significantly different from the<br />

existing one, the mine plan and process disclosure in the PEA is no longer current; Prodigy is<br />

currently working on prefeasibility study which will supersede previous technical reports<br />

11<br />

TSX:AR TSX:AR.WT<br />

<strong>Argonaut</strong><strong>Gold</strong>.com<br />

<strong>November</strong> <strong>2012</strong><br />

11