February 2012 - National Crop Insurance Services

February 2012 - National Crop Insurance Services

February 2012 - National Crop Insurance Services

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FEBRUARY <strong>2012</strong> • VOL. 45, NO. 1<br />

Explaining the Costs<br />

of the <strong>Crop</strong> <strong>Insurance</strong> Program<br />

Committee Sees Research<br />

First Hand<br />

Trade Talk 2011<br />

P U B L I C A T I O N O F N A T I O N A L C R O P I N S U R A N C E S E R V I C E S ®

Committed to you<br />

RCIS AGENTS GET OUR VERY BEST EVERY DAY—AND IT SHOWS. FROM OUR<br />

COMMITMENT TO BETTER TECHNOLOGY TO DEDICATED FIELD STAFF THAT KNOW<br />

THEIR CROPS AND THE PRODUCERS WHO GROW THEM. WE PARTNER WITH YOU<br />

TO INSURE AMERICA’S PRODUCERS. GO TO RCIS.COM TO LEARN MORE.<br />

We grow stronger every day—together SM<br />

Rural Community <strong>Insurance</strong> Agency, Inc., D/B/A RCIS. RCIS is an equal opportunity provider. © <strong>2012</strong> Rural Community <strong>Insurance</strong> Agency, Inc. All rights reserved.

TODAYPRESIDENT’S MESSAGE<br />

Isn’t there an<br />

App for that?<br />

Laurie Langstraat, Editor<br />

TODAY IS PROVIDED AS A SERVICE OF<br />

NATIONAL CROP INSURANCE SERVICES ®<br />

TO EDUCATE READERS ABOUT THE RISK<br />

MANAGEMENT TOOLS PRODUCERS USE<br />

TO PROTECT THEMSELVES FROM<br />

THE RISKS ASSOCIATED WITH<br />

PRODUCTION AGRICULTURE.<br />

TODAY is published quarterly–<strong>February</strong>, May,<br />

August, and November by<br />

<strong>National</strong> <strong>Crop</strong> <strong>Insurance</strong> <strong>Services</strong><br />

8900 Indian Creek Parkway, Suite 600<br />

Overland Park, Kansas 66210<br />

If you move, or if your address is incorrect,<br />

please send old address label clipped from recent issue<br />

along with your new or corrected address to<br />

Laurie Langstraat, Editor, at the above address.<br />

NCIS Website: http://www.ag-risk.org<br />

NCIS ® EXECUTIVE COMMITTEE<br />

Steve Rutledge, Chairman<br />

Ted Etheredge, Vice Chairman<br />

Tim Weber, Second Vice Chairman<br />

NCIS ® MANAGEMENT<br />

Thomas P. Zacharias, President<br />

P. John Owen, General Counsel<br />

James M. Crist, CFO/COO<br />

Frank F. Schnapp, Senior Vice President<br />

Mike Sieben, Senior Vice President<br />

Creative Layout and Design<br />

by Graphic Arts of Topeka, Inc., Kansas<br />

Winner of The Golden ARC Award<br />

Printed on recycled paper.<br />

Over the past twelve to eighteen months,<br />

many of us have been in the process of making<br />

the transition to the iPad or similar tablet-based<br />

computers. As we embrace this new technology,<br />

we have become increasingly exposed to the<br />

somewhat Brave New World of “applications,“<br />

commonly referred to as “apps.”<br />

So, what is an “app” - how do they work;<br />

what do they do? On a very basic level, apps are<br />

simply software designed to perform specific<br />

functions or computational operations. In the<br />

tablet environment, apps run the course of file<br />

management systems, office and personal<br />

productivity systems, calorie counters, etc. - you<br />

Tom Zacharias, NCIS President<br />

name it.<br />

Now, the stretch...what if we APPly this<br />

thought process to agricultural risk management and agricultural policy. Just suppose we<br />

needed to develop an infrastructure to provide financial stability and risk management<br />

tools for our nation’s farmers and ranchers. Suppose we wanted to combine the strengths<br />

of both the public and private sector to create such an infrastructure that would provide<br />

comprehensive risk management coverage to the majority of food and fiber crops found<br />

in the U.S. Hmm…let me think, isn’t there an app for that? Wow, Inspector Gadget?!?!<br />

What about the crop insurance program? Since the 1980s this public - private partnership<br />

has continually expanded to become the centerpiece of the agricultural safety net for U.S.<br />

farmers and ranchers.<br />

If this “app” is going to work, we would need to make sure that farmers get enrolled<br />

in the program, purchase adequate levels of coverage, and are aware of the various types<br />

of crop insurance products available. Isn’t there an app for that? Hmm...what about the<br />

nationwide network of state-licensed crop insurance agents? These hard working men<br />

and women scattered throughout rural America do just that. In 2011, the agency force<br />

enrolled more than 264 million acres, providing over $113 billion in crop insurance<br />

protection on over 1.1 million policies.<br />

Well, it just so happened that in 2011 we experienced major flooding and levee breaks<br />

along both the Mississippi and Missouri River systems. According to RMA, more than<br />

800,000 acres of cropland was flooded in 2011 in Missouri, Nebraska and Kansas (Rebecca<br />

Davis, Topeka RO - January 29, <strong>2012</strong>). More pervasive and more devastating, in terms of<br />

impacted acres than the flooding, was the widespread drought experienced in the<br />

Southwest and Southern Plains. With all of those flooded and drought-stressed acres covered<br />

by crop insurance, how are farmers going to get paid in a timely basis for their<br />

insured losses? Isn’t there an app for that? Hmm…How about the nationwide network of<br />

Continued on page 34<br />

CROP INSURANCE TODAY ® 1

VOL. 45, NO. 1<br />

FEBRUARY <strong>2012</strong><br />

Table of Contents<br />

1 Isn’t there an App for that?<br />

4 Explaining the Costs of the <strong>Crop</strong> <strong>Insurance</strong> Program<br />

12 NCIS Awards Two Scholarships<br />

4<br />

14 <strong>2012</strong> Spring Update Conference<br />

16 Committee Sees Research First Hand<br />

18 Trade Talk 2011<br />

20 Retirements: Ben Latham and Steve Harms<br />

22 In Memory of Patrick Flanagan<br />

24 In Memory of Marx M. Mannberger<br />

26 Step 5-Testing the Current Farm:<br />

Will the current farm be feasible in the future?<br />

16<br />

32 2011 Premiums: State Rankings<br />

38 Insurable <strong>Crop</strong>s: Locations & Plans<br />

Visit<br />

www.cropinsuranceinamerica.com<br />

26<br />

Copyright Notice<br />

All material distributed by <strong>National</strong> <strong>Crop</strong> <strong>Insurance</strong> <strong>Services</strong> is protected by copyright and other laws. All rights reserved.<br />

Possession of this material does not confer the right to print, reprint, publish, copy, input, transform, distribute or use same<br />

in any manner without the prior written permission of NCIS. Permission is hereby granted to Members in good standing of<br />

NCIS whose Membership Class (and service area, if membership is limited by service area) entitles them to receive copies<br />

of the enclosed or attached material to reprint, copy or distribute such NCIS copyrighted material in its present form<br />

solely for their own business use and solely to employees, adjusters or agents who are under contract with them, and<br />

as a condition to receiving such copies, such employees, adjusters and agents agree that they will not reprint, copy or<br />

distribute, or permit use of any such NCIS copyrighted material to or by any other person and/or company, or transform<br />

into another work such NCIS copyrighted material, without prior written permission of NCIS.<br />

© 2011 <strong>National</strong> <strong>Crop</strong> <strong>Insurance</strong> <strong>Services</strong>, Inc.

Making<br />

Cents<br />

of the<br />

Weather<br />

Weather forecasting is, by nature, inexact. Not even a trained meteorologist can<br />

accurately predict the weather with 100% certainty. On a daily basis, a farmer<br />

starts his morning with the goal of a successful harvest, but knows a devastating<br />

weather event seriously impacting production could instantly occur.<br />

This uncertainty means billions of dollars of crops are always at risk. This impacts<br />

not only the farmer’s livelihood, but food prices, fuel costs and national economies.<br />

Last year, crop insurance policies protected over $113 billion of crops. This makes<br />

good economic sense. Contact your ProAg agent to create a risk management plan<br />

that will provide you with the peace of mind and financial security you deserve.<br />

The Past, Present and Future of<br />

Agricultural Risk Management®<br />

Producers Ag <strong>Insurance</strong> Group, Inc., d/b/a ProAg ® , is a wholly owned subsidiary of<br />

CUNA Mutual Group. ProAg is an equal opportunity provider.<br />

© <strong>2012</strong> ProAg. All Rights Reserved.

TODAYcrop insurance<br />

Explaining the Costs<br />

of the <strong>Crop</strong> <strong>Insurance</strong> Program<br />

By Keith Collins and Frank Schnapp, NCIS<br />

This article examines the information<br />

typically presented to the public on the<br />

costs of the Federal crop insurance program.<br />

Government presentations, the<br />

source of most program cost data, range<br />

from simple to very complex. We believe<br />

that many presentations lead to misunderstanding<br />

of the role of payments made to<br />

approved insurance providers (AIPs), the<br />

companies that deliver the program to producers.<br />

Confusion about the financial data<br />

may lead to misunderstandings of the costs<br />

and benefits of the program to producers,<br />

taxpayers and the companies.<br />

A couple of examples illustrate the<br />

issue of interpreting program financial<br />

data. While the risks of underwriting gains<br />

and losses are shared between the government<br />

and the companies, the underwriting<br />

gains and losses of the government are seldom,<br />

if ever, presented. Often when the<br />

AIPs have a large underwriting gain, the<br />

government has one as well, which<br />

reduces the cost of the crop insurance program<br />

to the taxpayer. Another source of<br />

confusion is the vaguely labeled “administrative<br />

and operating expense reimbursement”<br />

that is paid to the companies to<br />

cover their costs to deliver the program,<br />

such as agent commissions, office space,<br />

equipment, etc. However, these payments,<br />

while a cost to the government, do not<br />

fully reimburse companies for their delivery<br />

expenses. Moreover, these payments,<br />

which are often seen as a subsidy to the<br />

AIPs, are more properly viewed as a subsidy<br />

to producers. This article presents<br />

financial data on the crop insurance program<br />

to help clarify these ambiguities.<br />

Federal Budget<br />

Presentations of <strong>Crop</strong><br />

<strong>Insurance</strong> Program Costs<br />

The Federal government presents data<br />

on the costs of Federal programs, including<br />

the crop insurance program, in a number<br />

of ways. To provide some background for<br />

those searching government data bases for<br />

crop insurance data, the following primary<br />

concepts are used in the Federal budget<br />

presentations:<br />

4 FEBRUARY <strong>2012</strong>

• Budget Authority: The authority of the<br />

Executive Branch to commit funds of<br />

the Federal Treasury. Congress provides<br />

this authority to agencies to spend<br />

funds to carry out programs as provided<br />

in law through annual appropriations<br />

acts and other legislation that<br />

authorizes spending.<br />

• Program Level: The gross value of all<br />

financial assistance provided to the<br />

public through a program. This assistance<br />

may be in several forms: grants;<br />

guaranteed or direct loans; cost-sharing;<br />

research, technical assistance or other<br />

services; or, in-kind benefits such as<br />

commodities. Program level may<br />

exceed actual spending when assistance<br />

provided does not result in<br />

spending. An example is a loan guarantee<br />

program where the program level is<br />

the value of all loans guaranteed, but<br />

the actual Federal spending may only<br />

be the payments made to lenders for a<br />

few defaulted loans.<br />

• Outlays: The actual cash spent from<br />

the Federal Treasury to meet the funding<br />

commitments of agencies. Outlays<br />

are less than budget authority when the<br />

agency does not spend all the funding<br />

it is authorized to spend in a fiscal year<br />

(FY). This may happen for a variety of<br />

reasons, such as ineligibility of expected<br />

beneficiaries or spending that is paid<br />

out over several fiscal years. Outlays are<br />

further divided into discretionary outlays<br />

and mandatory outlays.<br />

• Discretionary outlays: Cash spent<br />

under authority of the annual appropriations<br />

acts developed by the<br />

Congressional appropriations committees<br />

as part of the yearly appropriations<br />

process.<br />

• Mandatory outlays: Cash spent<br />

that is not controlled by the annual<br />

appropriation process. Mandatory<br />

outlays generally cannot be<br />

increased or decreased in a given<br />

year without a change in substantive<br />

law by the authorizing committees<br />

that have jurisdiction over the governing<br />

statute.<br />

For crop insurance, the data on these<br />

financial concepts are variously presented<br />

on a crop year, fiscal year, calendar<br />

year and reinsurance year basis for the<br />

Risk Management Agency (RMA) and the<br />

Federal <strong>Crop</strong> <strong>Insurance</strong> Corporation<br />

(FCIC). There are four important sources<br />

of budget information for the crop insurance<br />

program. The first of these is RMA<br />

itself, which presents tables on their<br />

website for crop years and fiscal years<br />

for “Government Costs of the <strong>Crop</strong><br />

<strong>Insurance</strong> Program, 2002-2011” with<br />

additional tables for “Premium and<br />

Other Income.” These are available at<br />

http://www.rma.usda.gov/aboutrma/<br />

budget/costsoutlays.html. The tables<br />

show direct outlays and some of direct and<br />

indirect income flows that relate to outlays.<br />

A second source is the USDA Office<br />

of Budget and Program Analysis<br />

(OBPA), which publishes the Budget<br />

CROP INSURANCE TODAY ® 5

Summary and Annual Performance<br />

Plan of all USDA agencies at<br />

http://www.obpa.usda.gov/budsum/<br />

FY12budsum.pdf. Summary data are presented<br />

for budget authority, program level<br />

and outlays. The third source is detailed<br />

budget explanations of each agency’s budget<br />

at http://www.obpa.usda.gov/explan_<br />

notes.html. The fourth source is the<br />

President’s Budget, available from the<br />

Office of Management and Budget. The<br />

crop insurance accounts are presented in<br />

detail in the Appendix to the Budget at<br />

http://www.whitehouse.gov/sites/<br />

default/files/omb/budget/fy<strong>2012</strong>/assets/<br />

agr.pdf. In addition, there are other<br />

sources, such as FCIC financial reports.<br />

These sources present an array of data<br />

that are made very complicated by use of<br />

alternative time periods and budget concepts.<br />

In some cases, a single table will<br />

mix crop year, fiscal year and budget concepts.<br />

A fiscal year includes data from two<br />

crop years, so it may be difficult to relate<br />

a fiscal year’s program costs to how natural<br />

disasters or price changes for one crop<br />

year show up in the data. Timing of payments<br />

and receipts also affect fiscal year<br />

data. To simplify our discussion here, we<br />

focus primarily on data closely associated<br />

with a crop year.<br />

The difference between the three<br />

budget concepts also needs to be considered.<br />

Because the crop insurance<br />

program has authority to spend funds as<br />

necessary to operate the program, “budget<br />

authority” is usually determined by<br />

and thus very similar to outlays. The<br />

concept of “program level” is essentially<br />

gross indemnities plus payments to<br />

companies, i.e., the gross assistance<br />

before producer-paid premiums are<br />

considered. The goal in this discussion<br />

is to present the cost of the crop insurance<br />

program as “outlays,” that is, direct<br />

spending associated with delivering the<br />

program and paying claims for the<br />

annual cycle of planting and harvesting<br />

a crop. In reality, some small level of<br />

outlays may be obligated in the crop<br />

year but paid out during the next crop<br />

year, or some outlays within a crop year<br />

may be for obligations made during the<br />

prior crop year.<br />

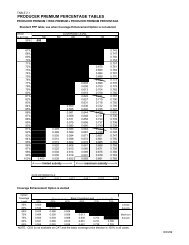

Table 1.<br />

<strong>Crop</strong> <strong>Insurance</strong> Program Government Costs (million dollars)<br />

FY 2010 FY 2011 1/<br />

Discretionary<br />

RMA Operating Expenses 80 80<br />

Mandatory<br />

Delivery and Other Administrative Expenses 2/ 1,430 1,393<br />

Gross Indemnities 3,118 7,588<br />

Underwriting Gains 3/ 2,448 999<br />

Transfer to Agricultural Management Assistance Program -6 -6<br />

Program Level 6,996 9,980<br />

Less Producer Paid Premium and Other Fees -2,449 -2,986<br />

Budget Authority, Discretionary and Mandatory 4,627 7,074<br />

Outlays 4/ 4,784 7,069<br />

1/ Estimate based on initial FY 2011 Continuing Resolution.<br />

2/ Includes research, development and other expenses.<br />

3/ Payments to approved private insurance companies.<br />

4/ Outlays are from the USDA Budget Summary and Annual Performance Plan (p. 121). Outlays differ from budget<br />

authority for the following reasons. The FY 2010 outlay exceeds the budget authority because unpaid obligations<br />

from FY 2009 were paid out in FY 2010, and these exceeded the unpaid obligations from FY 2010 carried into FY<br />

2011. For FY 2011, the level of unpaid obligations carried into FY <strong>2012</strong> is estimated to be $5 million more than the<br />

level of unpaid obligations carried into FY 2011 from FY 2010.<br />

<strong>Crop</strong> <strong>Insurance</strong> Program<br />

Outlays<br />

As an example of a crop insurance program<br />

cost presentation by USDA, consider<br />

the data in USDA’s Budget Summary and<br />

Annual Performance Plan (p. 30) used to<br />

explain RMA’s budget proposed by the<br />

administration for FY <strong>2012</strong>. Table 1 shows<br />

cost data for FYs 2010 and 2011.<br />

While Table 1 provides an overview<br />

of the costs of the crop insurance program,<br />

it does not explicitly provide data<br />

on payments to the companies, subsidies<br />

to producers or underwriting gains of the<br />

government. The data presented make it<br />

difficult to understand the distribution of<br />

the program costs among the program<br />

participants. However, other government<br />

tables provide additional information. In<br />

addition, the accounting firm Grant<br />

Thornton, LLP publishes an annual report<br />

on the profitability and effectiveness of<br />

the crop insurance industry using data<br />

obtained from the AIPs. Using these alternative<br />

sources, Table 2 was constructed<br />

to provide greater insight into the program<br />

outlays, the distribution of program<br />

benefits and costs, and the relationship of<br />

the costs to crop year production performance.<br />

RMA agency and related<br />

administrative cost data are not included.<br />

Most of the data presented are RMA reinsurance<br />

report data but crop year data<br />

are also used.<br />

Because government and private data<br />

sources do not report all variables for the<br />

same time periods and include different<br />

cost components, total program outlays in<br />

Table 2, which use reinsurance data and<br />

crop year data may differ slightly from<br />

other presentations. Some presentations<br />

include RMA administrative costs (e.g.,<br />

salaries, IT costs, etc.) and other income<br />

(e.g., interest, transfers from other appropriations,<br />

etc.) and other expenses (e.g.,<br />

research costs from mandatory funding).<br />

These categories are very small in comparison<br />

with the items presented in Table<br />

2. Even variables in government sources<br />

that are presented for the same time period<br />

and appear to include the same components<br />

sometimes differ across sources,<br />

and not enough detail is presented to<br />

explain the differences.<br />

Focus on the last column of Table 2,<br />

program outlays. We first discuss outlays as<br />

typically presented: cost items that are<br />

direct spending by the government. Such<br />

spending items are payments to producers,<br />

which are net indemnities (defined as gross<br />

indemnities, column (3), minus farmer-paid<br />

premium, column (2)) plus payments<br />

made to AIPs. We then examine alternative<br />

presentations.<br />

6 FEBRUARY <strong>2012</strong>

Table 2.<br />

<strong>Crop</strong> <strong>Insurance</strong> Program Outlays (million dollars)<br />

Gross Producer Gross Loss UNDERWRITING GAINS PRODUCER SUBSIDIES AIP Actual Program<br />

Year Premium Share of Indemnities Ratio Gross AIP FCIC For For A&0 Outlays<br />

(1) Premium (3) (4) (5) Share 1/ Share Premium AIP A&0 Expenses (8) + (9) – (7)<br />

(2) (6) (7) (8) (9) (10) (11)<br />

2001 2,978 1,206 2,965 1.00 12 346 -334 1,772 636 816 2,741<br />

2002 2,909 1,168 4,058 1.39 -1,149 -48 -1,101 1,741 628 826 3,470<br />

2003 3,434 1,392 3,259 0.95 176 377 -201 2,042 736 900 2,980<br />

2004 4,186 1,709 3,291 0.79 895 691 203 2,477 894 1,021 3,167<br />

2005 3,945 1,601 2,341 0.59 1,604 915 689 2,344 833 990 2,488<br />

2006 4,709 2,027 3,551 0.75 1,158 822 336 2,682 962 1,159 3,308<br />

2007 6,547 2,724 3,465 0.53 3,082 1,572 1,510 3,823 1,335 1,565 3,648<br />

2008 9,832 4,141 8,719 0.89 1,113 1,095 18 5,691 2,013 2,173 7,686<br />

2009 8,949 3,522 5,216 0.58 3,733 2,298 1,435 5,427 1,619 2,130 5,611<br />

2010 7,592 2,882 4,235 0.56 3,357 1,919 1,438 4,710 1,371 1,815 4,643<br />

Total 55,081 22,372 41,100 0.75 13,981 9,987 3,993 32,709 11,027 13,394 39,742<br />

1/ After net book quota share.<br />

The data in this table are taken from publicly available sources. <strong>Crop</strong> year and reinsurance year data are used; as a result, aggregated numbers may differ slightly from other presentations.<br />

Sources by column number:<br />

■ Columns (1), (3), and (6) are reinsurance data from RMA Reinsurance Reports accessed on 1/3/12, available online at http://www.rma.usda.gov/tools/reinsurance.html. Column<br />

(4) is (3) divided by (1). Column (5) is column (1) minus column (3). Column (7) is column (5) minus column (6), and represents the AIP share of underwriting gains on a reinsurance<br />

year basis and adjusted for quota share.<br />

■ Column (2) is column (1) less column (8), where column (8) is from the RMA <strong>National</strong> Summary of Business Reports, available online at http://www.rma.usda.gov/data/sob.html.<br />

■ Column (9) is from an RMA table "<strong>Crop</strong> year government cost of federal crop insurance," available online at http://www.rma.usda.gov/aboutrma/budget/cycost2002-11.pdf.<br />

■ Column (10), actual expenses as a percent of gross premium, is from Grant Thornton, LLP, "Federal <strong>Crop</strong> <strong>Insurance</strong> Program Profitability and Effectiveness Analysis, 2010<br />

Update," January 13, 2011, available online at http://www.ag-risk.org/NCISPUBS/SpecRPTS/GrantThornton/Grant_Thornton_Report-2010_FINAL.pdf. The reported expense<br />

shares are for calendar years and were multiplied by gross premium for the corresponding reinsurance year (e.g., 2009 expense share multiplied by 2009 gross premium). The average<br />

expense share for 2005-09, 23.9%, was used to estimate actual expenses for 2010.<br />

CROP INSURANCE TODAY ® 7

Typical presentation<br />

Outlays = net indemnities + AIP underwriting<br />

gains + payments made to AIPs<br />

on behalf of producers for program<br />

delivery (A&O payments)<br />

Using column numbers:<br />

(11) = (3) - (2) + (6) + (9)<br />

This aggregation highlights, for example,<br />

that increases in farmer paid premiums<br />

(2) reduce program costs and increases in<br />

AIP underwriting gains (5) increase them.<br />

However, program outlays may be<br />

obtained by aggregating the data in the<br />

table several different ways. The different<br />

ways chosen can be used to illustrate<br />

which activities add to, or reduce, crop<br />

insurance program costs.<br />

Alternative presentation #1<br />

Outlays = gross indemnities - gross premiums<br />

+ AIP underwriting gains + producer<br />

premium subsidies + payments<br />

made to AIPs on behalf of<br />

producers for program delivery<br />

(A&O payments)<br />

Using column numbers:<br />

(11) = (3) - (1) + (6) + (8) + (9)<br />

Although premium subsidies are not<br />

direct spending by the government, this<br />

aggregation shows the important role of<br />

premium subsidies and A&O subsidies<br />

paid on behalf of the producer in the total<br />

cost of the program. This presentation also<br />

highlights a common error in evaluating<br />

the cost of the program. Critics tend to<br />

focus on the revenue paid to the AIPs, (6)<br />

+ (9), disregarding the large premium subsidies<br />

to producers. The ability for AIPs to<br />

earn the underwriting gains shown in (6)<br />

comes about from the gross underwriting<br />

gains for the program itself as shown in (5).<br />

These gains are shared between the AIPs<br />

and FCIC.<br />

Alternative presentation #2<br />

Outlays = producer premium subsidies +<br />

payments made to AIPs on behalf of<br />

producers for program delivery<br />

(A&O payments) - FCIC underwriting<br />

gains<br />

Using column numbers:<br />

(11) = (8) + (9) - (7)<br />

This aggregation is used in the heading<br />

for column (11) of Table 2. The aggregation<br />

shows how positive FCIC underwriting<br />

gains reduce program outlays. This ability<br />

of the government to reduce its cost via<br />

underwriting gains is generally not considered<br />

in discussions of the performance of<br />

the program.<br />

Insights from <strong>Crop</strong><br />

<strong>Insurance</strong> Program Cost<br />

Data<br />

Several conclusions may be drawn<br />

from the data presentation in Table 2 that<br />

may not be generally reported when crop<br />

insurance program costs are presented in<br />

discussions about crop insurance.<br />

• The crop insurance companies do<br />

not receive all the crop insurance<br />

program underwriting gains, particularly<br />

in recent years. For background,<br />

underwriting gains are part of<br />

the gross income of AIPs. Gross income<br />

must be high enough to cover gross<br />

expenses and a profit. The profit must<br />

be sufficiently high to provide a competitive<br />

rate of return (net return on<br />

retained premium, assets or equity) to<br />

ensure private sector participation in<br />

the program. Otherwise, private investments<br />

in crop insurance would migrate<br />

to more profitable industries over time.<br />

Underwriting gains are not profit; they<br />

are gross income that contributes to<br />

profits. In any year, underwriting gains<br />

8 FEBRUARY <strong>2012</strong>

may be positive or negative. To offset<br />

years with low or negative gains, gains<br />

must be high—above average—in other<br />

years to ensure that AIPs earn a competitive<br />

rate of return over time. Since<br />

2001, the crop insurance companies<br />

have received 71 percent of the underwriting<br />

gains generated by the program.<br />

Over the past five years (2006-10), the<br />

industry has received just 62 percent of<br />

the underwriting gains.<br />

• The government receives a high<br />

share of underwriting gains. The<br />

share of underwriting gains not<br />

received by the AIPs—29 percent of<br />

gains over the past 10 years and 38 percent<br />

of the gains over the past five<br />

years—went to FCIC.<br />

• Government underwriting gains<br />

reduce the cost of the crop insurance<br />

program. These gains represent<br />

a benefit to the Treasury and taxpayers<br />

that is not identified in most government<br />

accounts of program costs.<br />

• Total program cost is usually less<br />

than the total of premium subsidies,<br />

AIP underwriting gains and<br />

delivery payments to companies.<br />

This emphasizes that the combined<br />

payments to companies and premium<br />

subsidies to producers overstate the<br />

commitment of the taxpayer to the program.<br />

The true cost to taxpayers also<br />

needs to take into consideration the<br />

excess of premiums over indemnities<br />

as indicated in (5). An illustration of the<br />

cash flows is presented in Figure 1.<br />

• Producer subsidies include payments<br />

made to companies on behalf<br />

of producers to pay program delivery<br />

expenses. In insurance markets<br />

generally, a purchaser of insurance<br />

pays a premium for protection that<br />

includes two components: a risk<br />

premium, which covers expected<br />

losses due to insured risks, and an<br />

expense load, which covers delivery<br />

costs including sales, loss adjustment<br />

and other administrative<br />

costs. Under the crop insurance program,<br />

producers receive a subsidy that<br />

covers on average about 60 percent of<br />

the risk premium and a subsidy that<br />

covers 100 percent of the expense load.<br />

Figure 1. The Financial Flows Underlying <strong>Crop</strong> <strong>Insurance</strong> for 2008<br />

Subsidies<br />

for Premium, $5.7 bil.,<br />

and A&O, $2.0 bil.<br />

Producers<br />

Indemnities,<br />

$8.7 bil.<br />

Consider data for 2010, a year in which<br />

producers paid $2.9 billion in premiums.<br />

In an unsubsidized market,<br />

assuming the same premium rates as in<br />

2010, had producers purchased the<br />

same level of coverage, they might<br />

have paid a total premium of $9.4 billion<br />

($7.6 billion in risk premium and<br />

$1.8 billion in expense load, columns<br />

(1) and (10)), assuming 2010’s actual<br />

delivery expenses. The $2.9 billion producers<br />

actually paid amounted to only<br />

31 percent of the premium that might<br />

have prevailed in an unsubsidized market.<br />

Of course, actual delivery expenses<br />

in a free market are unknown, and<br />

2010’s actual expenses are used as a<br />

proxy for the free market delivery cost.<br />

• Producer subsidies account for the<br />

bulk of crop insurance program<br />

costs and benefits. Alternative presentation<br />

#1 showed that program costs<br />

are equal to gross indemnities less<br />

gross premiums plus AIP underwriting<br />

gains plus producer premium subsidies<br />

plus producer A&O subsidies. For the<br />

past five years, program outlays averaged<br />

$5 billion. Premium and delivery<br />

expense subsidies to producers averaged<br />

$5.8 billion, as compared an average<br />

of $1.5 billion in AIP underwriting<br />

RMA<br />

Total Premium,<br />

$9.9 bil.<br />

A&O Payment,<br />

$2.0 bil.<br />

Underwriting<br />

Gain, $1.1 bil.<br />

AIPs<br />

gains. AIP underwriting gains were<br />

paid out of the $2.5 billion in average<br />

underwriting gains for the program,<br />

with the government retaining the<br />

remaining gains.<br />

• Producer subsidies for A&O do not<br />

cover the actual delivery costs of<br />

companies. Discussions of the program<br />

often treat the producer A&O<br />

subsidy as a benefit to the AIPs or even<br />

as an additional source of profit. In<br />

reality, the existence of the A&O subsidy<br />

is simply a consequence of the<br />

way the government accounts for its<br />

costs. In a typical insurance program,<br />

policyholders would pay for the cost of<br />

delivery as part of their premium.<br />

Under the Federal crop insurance program,<br />

FCIC pays this cost directly to<br />

AIPs on behalf of producers. This<br />

works to the benefit of taxpayers and<br />

to the disadvantage of AIPs in that payments<br />

have been below actual delivery<br />

expenses by an average of over $250<br />

million per year during 2005-2009.<br />

Although the 2011 Standard<br />

Reinsurance Agreement will cap agent<br />

compensation at the total A&O payment,<br />

it is likely that total delivery costs<br />

will continue to exceed the A&O subsidy<br />

to producers.<br />

CROP INSURANCE TODAY ® 9

INSURANCE<br />

ADVANTAGE<br />

If you protect your corn acres with a <strong>Crop</strong> Hail policy 1 and Green Snap Lodging 2<br />

wind protection endorsement through RCIS ® , you could qualify for free Extra Harvest<br />

Expense coverage by using Headline AMP fungicide or Headline ® fungicide.<br />

Headline AMP and Headline are leaders in providing excellent disease control<br />

and Plant Health benefits that help growers protect their yields.<br />

Offer not available in all states. For full terms and conditions<br />

and to learn which other offers you may be eligible for, visit<br />

GROWERSADVANTAGE.BASF.US<br />

or talk to your BASF Authorized Retailer. Different qualifying conditions apply for each offer.<br />

1<br />

Underwritten by Fireman’s Fund <strong>Insurance</strong> Company, 777 San Marin Drive, Novato, CA.<br />

2<br />

This product is not available in all states.<br />

Always read and follow label directions. Headline is a registered trademark and Headline AMP<br />

is a trademark of BASF. RCIS is a registered trademark of Rural Community <strong>Insurance</strong> Agency.<br />

©2011 BASF Corporation. All Rights Reserved. APN 11-01-088-0031<br />

10 FEBRUARY <strong>2012</strong>

An Alternative Perspective on the<br />

Government’s Role<br />

The presentation of government outlays in support of the<br />

Federal crop insurance program, as described above, could easily<br />

be misinterpreted. Table 2 describes the program as though the<br />

government was the risk bearer and the AIPs were merely a<br />

means for delivering the program to producers. The reality is quite<br />

different: AIPs actually take the lead role in bearing the risk. As<br />

such, AIPs are entitled to an economically fair return or profit due<br />

to their willingness to risk their own capital in the program. Rather<br />

than being the risk bearer, FCIC is more accurately described as<br />

participating in the program as a reinsurer. FCIC is not the only<br />

reinsurer active in the program—private sector reinsurers are also<br />

heavily involved. The difference is that AIPs have the ability to<br />

negotiate both the structure and cost of reinsurance with their<br />

reinsurers, whereas their ability to negotiate with FCIC is extremely<br />

limited. FCIC’s involvement as a reinsurer comes about for two<br />

distinct reasons. First, the terms of the SRA require AIPs to issue<br />

policies to all eligible producers. However, many producers would<br />

find it difficult to obtain insurance for various reasons in a fully<br />

private insurance market. To satisfy the social objective of making<br />

insurance available to all eligible producers, AIPs have been willing<br />

to insure these risks, but only under the condition that FCIC<br />

provide reinsurance protection due to the likelihood that these<br />

risks will be unprofitable. The second reason is to address the possibility<br />

of widespread losses due to drought or other weather<br />

events that are beyond the capacity of the insurance industry to<br />

absorb. This was an important issue in the early years of the program<br />

but is much less important today, as private sector reinsurers<br />

have gained familiarity with the program. Even though the<br />

need for or benefit of reinsurance through FCIC is relatively limited,<br />

FCIC still takes a large share of the potential underwriting<br />

gains. While it might be possible for AIPs to obtain more favorable<br />

terms from private sector reinsurers than from FCIC, this option is<br />

not available to them. However, if FCIC did not participate as a<br />

reinsurer, the taxpayer cost of the program could be expressed<br />

more directly as the total producer premium subsidies in (8) and<br />

(9). From this perspective, the government’s role in the crop insurance<br />

program is more clearly understood as ensuring the functioning<br />

of the market by providing financial support to producers and<br />

providing incentives to AIPs to ensure that protection is available<br />

to all eligible producers.<br />

<br />

<br />

<br />

<br />

INSURANCE ADVANTAGE is just one of the<br />

innovative offers BASF has created to help<br />

growers like you improve yield potential, manage<br />

your fields, save money and minimize risk.<br />

Other offers include HEADLINE ADVANTAGE,<br />

INVESTMENT ADVANTAGE and FINANCE<br />

ADVANTAGE. They have been developed<br />

especially by BASF, because no one puts more<br />

on the line for the American grower than BASF.<br />

Not all offers are available in all states.<br />

Different qualifying conditions apply for<br />

each offer. For full terms and conditions,<br />

visit GROWERSADVANTAGE.BASF.US.<br />

Conclusion<br />

In conclusion, the components of the public costs of the Federal<br />

crop insurance program are not easy to find and may be interpreted<br />

in various ways, depending on how the components are aggregated<br />

and described. Various interpretations may be seen in media<br />

articles that emphasize the importance of different components,<br />

such as payments to companies or producer premium subsidies.<br />

Hopefully, this article will further the understanding of how different<br />

financial flows in the crop insurance program interact to<br />

explain overall program costs.<br />

CROP INSURANCE TODAY ® 11

TODAYcrop insurance<br />

NCIS Awards<br />

Two Scholarships<br />

In the fall of 2011, NCIS began awarding<br />

two college scholarships to students<br />

enrolled at an 1890 Land-Grant University.<br />

The purpose of the scholarships is to help<br />

students further their education but also<br />

expose them to the business of crop<br />

insurance.<br />

Paige Liggens<br />

The first recipient is Paige Liggens, a<br />

student from Langston University in<br />

Langston, Oklahoma. Miss Liggens is a junior<br />

majoring in Natural Resource<br />

Management. She is very active on and off<br />

campus with various organizations, clubs,<br />

performance groups and community service.<br />

Miss Liggens also mentors children<br />

through local schools and sports programs.<br />

“Miss Liggens shows great interest in<br />

learning and is enthusiastic in classroom<br />

question and discussion sessions,” said Dr.<br />

Steve Zeng, chair of the Department of<br />

Agriculture & Natural Resources. “I strongly<br />

endorse her for this scholarship because<br />

she has demonstrated scientific intelligence,<br />

sound study habits, hard-working<br />

nature and team-oriented skills.”<br />

Miss Liggens is extremely appreciative<br />

of this tremendous scholarship and said<br />

“By awarding me the <strong>National</strong> <strong>Crop</strong><br />

<strong>Insurance</strong> <strong>Services</strong> scholarship, you all<br />

have lightened my financial burden, which<br />

allows me to focus more on the important<br />

aspects of school i.e. learning and studying.<br />

12 FEBRUARY <strong>2012</strong><br />

Megan Sullivan<br />

Your generosity has inspired me to help others<br />

give back to the community. I hope one<br />

day I will be able to help students achieve<br />

their goals just as you have helped me.”<br />

Miss Liggens had to delay her dream of<br />

obtaining a college education for a few<br />

years after high school graduation. She<br />

worked several jobs to help support her<br />

family and save money for tuition.<br />

Langston University, established in<br />

1987, is named after John Mercer Langston,<br />

a black educator from Virginia who organized<br />

the first department of law at Howard<br />

University. Langston University offers several<br />

degrees including agriculture and<br />

applied science, business, education and<br />

nursing. Over 3,000 students attend the<br />

university.<br />

Megan Sullivan is the recipient of the<br />

second NCIS scholarship. Miss Sullivan is a<br />

junior at Alcorn State University majoring in<br />

Homeland Security Science Technology<br />

with a concentration in Geographic<br />

Information Science.<br />

“Miss Sullivan’s leadership qualities are<br />

outstanding and she is able to initiate discussions,<br />

ideas, and constructive suggestions,”<br />

said Dr. Yaw Twumasi, assistant<br />

professor, GIS and Remote Sensing. “She<br />

possesses excellent oral and written communication<br />

skills.”<br />

Born in Vicksburg, Mississippi, Miss<br />

Sullivan is the oldest of three children. She<br />

has always enjoyed learning and after earning<br />

her bachelors would like to pursue a<br />

master’s degree. She has had several<br />

opportunities to participate in programs<br />

that further her education. Recently she<br />

participated in the NASA Langley<br />

Aerospace Research Summer Scholarship<br />

(LARSS) Project where she researched GIS<br />

techniques in environmental safety and climate<br />

change throughout the U.S. Her goal<br />

is to become a GIS programmer/analyst<br />

specializing in agricultural science.<br />

Alcorn State University is the oldest<br />

public historically black land-grant university<br />

founded in 1871. More than 3,800 students<br />

attend this university with three campuses<br />

located in Southeast Mississippi.<br />

Students can receive undergraduate and<br />

graduate degrees in seven different schools<br />

including arts and sciences, agriculture and<br />

applied sciences, nursing and education.

FMH Mobile<br />

m.fmh.com<br />

Complete Farm <strong>Insurance</strong> Solutions<br />

From growing season to harvest, and all the areas in between,<br />

protection against the many perils that can impact a farming<br />

operation is vital.<br />

That’s why Farmers Mutual Hail delivers an easy “one-stop shop”<br />

risk management package for all of your clients’ farming needs<br />

including multi-peril and crop hail insurance, as well as auto,<br />

farm property, and liability.<br />

Put your trust in the strong tradition of excellent claims service<br />

and unmatched financial security of Farmers Mutual Hail, a<br />

proven leader in the industry since 1893.<br />

Contact your Local Farmers Mutual Hail Agent Today!<br />

www.fmh.com<br />

Farmers Mutual Hail <strong>Insurance</strong> Company of Iowa is an<br />

equal opportunity provider and prohibits discrimination<br />

in all its programs and activities. © <strong>2012</strong> Farmers Mutual<br />

Hail <strong>Insurance</strong> Company of Iowa. All rights reserved.

TODAYcrop insurance<br />

<strong>2012</strong><br />

Spring Update Conference<br />

The <strong>2012</strong> Spring Update Conference<br />

held November 9-10, 2011, had a record<br />

attendance. It was easy to see why when<br />

you looked at the agenda and saw the<br />

guest speakers and topics covered.<br />

Michael Scuse, USDA Acting Under<br />

Secretary for Farm and Foreign Ag<br />

<strong>Services</strong>, was the first guest speaker to<br />

address the packed conference room. “The<br />

future for American agriculture and rural<br />

communities is bright. The most important<br />

thing we can do is to provide them [farmers]<br />

with the very best crop insurance<br />

product we can,” he said.<br />

This national conference is designed for<br />

NCIS training contacts and company training<br />

personnel, with the overall objective to<br />

provide trainers with updated technical<br />

information and training materials needed<br />

to prepare and conduct their company<br />

spring training for the <strong>2012</strong> crop year.<br />

In addition to covering the myriad of<br />

updates to policies and procedures, this<br />

conference also addressed recent major<br />

announcements by the Risk Management<br />

Agency. Trend Adjusted Actual Production<br />

History (APH) was released by RMA in<br />

mid-October for corn and soybean policies<br />

in select counties in 14 Midwestern states.<br />

Dr. Bruce Sherrick, from the University of<br />

Illinois where Trend Adjusted APH was<br />

developed, presented aspects of the<br />

research and analysis that went into the<br />

product’s development and provided several<br />

examples that company trainers can<br />

use when explaining the new program to<br />

agents.<br />

RMA also recently introduced several<br />

new pilot programs for the industry. As the<br />

developer of a few of these, Alex<br />

Michael Scuse, Deputy Under Secretary,<br />

USDA<br />

Offerdhal, with Watts & Associates,<br />

explained the new popcorn revenue and<br />

specialty soybean revenue pilot programs.<br />

Ron Lundine, with RMA, discussed the new<br />

pistachios, olives and camelina policies.<br />

NCIS staff, including Chris Lindsay, Lisa<br />

Cain, Michael O’Connor, Dean Strasser,<br />

Lynnette Dillon, Loretta Sobba and Don<br />

Hutsell presented changes on the <strong>Crop</strong><br />

<strong>Insurance</strong> Handbook, other crop policies<br />

and procedural changes – including crophail,<br />

actuarial updates, Written Agreement<br />

Handbook, the Loss Adjustment Manual,<br />

and a handful of other topics.<br />

With the deadline of the Congressional<br />

Super Committee approaching shortly after<br />

the conference, NCIS invited Mary Kay<br />

Thatcher, American Farm Bureau<br />

Federation, to speak on the status of the<br />

<strong>2012</strong> Farm Bill. At that time, the ranking<br />

members of the House and Senate<br />

Agriculture Committees were working<br />

Dr. Bruce Sherrick, University of Illinois<br />

feverishly to write what was, in essence,<br />

the <strong>2012</strong> Farm Bill in the hopes of presenting<br />

it to the Super Committee for inclusion<br />

in their final legislation to reduce the federal<br />

deficit by $1.2 trillion dollars. Miss<br />

Thatcher gave a quick overview of the proposals<br />

that were introduced by various<br />

farm organizations in the hopes that the<br />

crop insurance program would be maintained<br />

or strengthened. (Ultimately the<br />

Super Committee did not reach an agreement<br />

on their proposal by the statutory<br />

deadline so Farm Bill discussions will continue<br />

with the hopes that a new legislation<br />

will be finalized prior to the expiration of<br />

the current 2008 Farm Bill in September<br />

<strong>2012</strong>.)<br />

Dr. James Hipple, RMA Strategic Data<br />

Acquisition and Analysis (SDAA), provided<br />

an overview of the large claim forensic<br />

remote sensing that is being conducted to<br />

promote program integrity. Through the<br />

14 FEBRUARY <strong>2012</strong>

use of satellite imagery, a series of compliance-related<br />

activities are being pursued to<br />

aid the AIPs in loss verification.<br />

Michael Hand, Deputy Administrator,<br />

RMA Compliance Division, discussed a<br />

litany of current compliance issues and<br />

highlighted lessons learned from conducting<br />

large claims and routine data mining<br />

reviews. He also looked ahead to challenges<br />

for <strong>2012</strong> compliance, including<br />

more and better data for internal and external<br />

content, and the continuing Federal<br />

budget constraints.<br />

The conference ended with a panel discussion<br />

on miscellaneous issues and Q&A<br />

with representatives from RMA and NCIS.<br />

This time is used for conference presenters<br />

to supply answers to questions that came<br />

up during their presentation and needed<br />

further study or clarification from RMA.<br />

Participants at the <strong>2012</strong> Spring Update Conference<br />

Errors and Omission <strong>Insurance</strong><br />

For Your Agency<br />

Full lines of coverage including MPCI <strong>Crop</strong> <strong>Insurance</strong><br />

We will work diligently to offer you quotes with<br />

reputable companies at competitive prices<br />

To obtain a quote for your agency call 1-800-769-6015<br />

American <strong>Insurance</strong> <strong>Services</strong>, LLC.<br />

Premium financing is available<br />

We have over 35 years experience in all lines of insurance<br />

www.tomstanleyinsurance.com<br />

CROP INSURANCE TODAY ® 15

TODAYcrop insurance<br />

Committee Sees Research<br />

First Hand<br />

By Therese Stom, NCIS<br />

In November of 2011, the NCIS <strong>Crop</strong>-<br />

Hail Actuarial & Statistics (A&S) Committee<br />

traveled to Chandler, Arizona, for an offsite<br />

meeting. The <strong>Crop</strong>-Hail A&S Committee<br />

generally meets twice a year and is responsible<br />

for the review of crop-hail actuarial<br />

methodologies, crop-hail statistical reporting<br />

techniques and state insurance department<br />

filing requirements.<br />

While in Arizona the Committee had the<br />

opportunity to go beyond the meeting<br />

room and see firsthand what goes on in the<br />

field. Sam Wang of the Maricopa Ag Center<br />

provided a tour of cotton fields at the<br />

research center. Mr. Wang briefed the<br />

group on some of the research currently<br />

being conducted. Due to the difference in<br />

the cotton growing season, there had been<br />

concern that the loss adjusting charts for<br />

cotton may not be accurate for the Arizona<br />

area since the original research for the<br />

Committee member Dale Farnham (far left) and Tom Vetter, ProAg and member of the NCIS<br />

<strong>Crop</strong>-Hail Policy, Procedure and Loss Adjustment Committee, listen to Dr. Wang (far right)<br />

describe current research projects.<br />

16 FEBRUARY <strong>2012</strong>

Dean Clarke, Rachel Henke, Brian Gugat, Mary Sutton and Mike Hargrove<br />

Frank Schnapp, NCIS (far left), Mary Wandro and Kendall Jones<br />

charts were conducted in Arkansas and<br />

Mississippi. Research is being conducted<br />

on the limb removal and cutoff portions of<br />

the charts.<br />

Committee members attending the<br />

meeting included: Jim Aldeman,<br />

American Farm Bureau <strong>Insurance</strong>; Dean<br />

Clarke, Great American; Dale Farnham,<br />

Farmers Mutual Hail; Brian Gugat, Rain<br />

and Hail; Mike Hargrove, ARMtech;<br />

Rachel Henke, NAU Country; Kendall<br />

Jones, ProAg; Mary Sutton, RCIS; and,<br />

Mary Wandro, Grinnell Mutual. Members<br />

unable to attend were: Greg Livingston,<br />

John Deere Risk Protection; and, Geoff<br />

Redman, ADM.<br />

Therese Stom, NCIS and staff liaison to the<br />

<strong>Crop</strong>-Hail A&S Committee<br />

CROP INSURANCE TODAY ® 17

TODAYcrop insurance<br />

Trade Talk<br />

2011<br />

The 67th annual convention of the<br />

<strong>National</strong> Association of Farm Broadcasting<br />

(NAFB) was held in Kansas City, MO,<br />

November 9-11, 2011. The “centerpiece<br />

event” of the convention is Trade Talk.<br />

Trade Talk affords company and organization<br />

participants access to member broadcasters<br />

to discuss the issues and topics that<br />

are important to them.<br />

NCIS participated in Trade Talk this<br />

year and met with several broadcasters to<br />

discuss crop insurance and its strengths as<br />

the linchpin of the farm safety net.<br />

“It was a good use of our time,” said<br />

Laurie Langstraat, NCIS. “Not only did we<br />

visit with several farm broadcasters, it<br />

allowed us the opportunity to network<br />

with our peers from other commodity and<br />

farm organizations.”<br />

“We have heard again and<br />

again from producers that<br />

crop insurance is the best risk<br />

management tool available.”<br />

Miss America 2011, Teresa Scanlan, spokesperson for “The Hand That Feeds U.S.” stopped by to<br />

visit our booth. The crop insurance industry is a proud supporter of THTFUS, and we welcomed<br />

the opportunity to visit with Miss America, who is helping to promote the importance of agriculture.<br />

In the picture, left to right: Laurie Langstraat, Keith Collins, Miss America, and Tom Zacharias.<br />

-Senators Frank Lucas<br />

and Pat Roberts<br />

“I’m very opposed to cutting<br />

more from crop insurance.”<br />

-Representative<br />

Collin Peterson<br />

“Most farmers now see crop<br />

insurance as a primary tool<br />

for risk management.”<br />

-USDA Chief Economist,<br />

Joseph Glauber<br />

Keith Collins (left) visits with a farm broadcaster during Trade Talk.<br />

18 FEBRUARY <strong>2012</strong>

The NCIS booth at Trade Talk featured several positive quotes from key congressional and USDA representatives.<br />

come<br />

grow<br />

with us...<br />

Hudson <strong>Crop</strong> is a unit of Hudson <strong>Insurance</strong><br />

Group, the US <strong>Insurance</strong> Division of<br />

Odyssey Re Holdings Corp. OdysseyRe<br />

operates through 18 offices<br />

worldwide with $3.5 billion in<br />

policyholders’ surplus. Hudson<br />

<strong>Insurance</strong> Company is rated “A”<br />

(Excellent) XV by A.M. Best<br />

and is widely licensed.<br />

With an exclusive strategic<br />

relationship with Growers<br />

<strong>National</strong> Cooperative*,<br />

Hudson <strong>Crop</strong> is a rapidly<br />

growing company,<br />

committed to providing our<br />

farmers and their agents<br />

with the best service our<br />

industry can offer.<br />

*GNC is not available in all states<br />

Hudson <strong>Crop</strong><br />

www.hudsoncrop.com<br />

Hudson <strong>Insurance</strong> Group is an equal opportunity provider.<br />

For career opportunities, contact:<br />

Dan Gasser, <strong>National</strong> Sales Manager<br />

Doug Nelson, <strong>National</strong> Claims Manager<br />

866-450-1445<br />

CROP INSURANCE TODAY 19

TODAYcrop insurance<br />

Ben Latham<br />

Retirements<br />

Jess “Ben” Latham III, will retire from<br />

The ProAg <strong>Insurance</strong> Group in early <strong>2012</strong>.<br />

Ben is a graduate of the University of<br />

Texas and West Texas State University. He<br />

started his career in crop insurance in 1972<br />

as an agent in Amarillo, Texas. In 1974, he<br />

went to work as a hail adjuster for his<br />

grandfather’s company, which was started<br />

in 1926. In 1979, he was promoted to Vice<br />

President of Marketing for the company,<br />

then a regional crop-hail insurer mostly in<br />

the state of Texas. In the late 1980s, they<br />

moved into the MPCI market.<br />

As the company began to grow, they<br />

put together a business plan to expand<br />

into other states. During the 1990s, Ben,<br />

his brother, and his two sons worked on<br />

establishing other offices, growing through<br />

the 2000s to five regional offices and 450+<br />

employees in 42 states. During that time,<br />

Ben served as COO and CEO and enjoyed<br />

Steve Harms<br />

Steve Harms, Rain and Hail L.L.C.,<br />

retired in early January <strong>2012</strong>, after almost<br />

37 years of service. Steve had been the<br />

Chairman of the Board of Rain and Hail<br />

<strong>Insurance</strong> Service, Inc. since 2005, and also<br />

served as President of the Company since<br />

2001.<br />

Steve began his career with Rain and<br />

Hail as an adjuster in 1973 and throughout<br />

his career there served in several different<br />

positions such as Field Supervisor,<br />

Claims/Quality Control Manager, Division<br />

Manager, Executive Vice President,<br />

President and Chairman of the Board.<br />

Steve was also a member of many industry<br />

committees during his time with Rain<br />

working with reinsurance and especially<br />

new employees.<br />

“We have been very fortunate to have<br />

put together an excellent management<br />

team that is with us today at The ProAg<br />

<strong>Insurance</strong> Group,” said Ben. “Along with<br />

its parent company, CUNA Mutual, they<br />

will continue carrying on the family tradition.”<br />

During his tenure with The ProAg<br />

<strong>Insurance</strong> Group, Ben was very active in<br />

industry activities and served on several<br />

Boards, including: <strong>National</strong> <strong>Crop</strong> <strong>Insurance</strong><br />

<strong>Services</strong> (member and Chairman);<br />

American Association of <strong>Crop</strong> Insurers<br />

(member and Chairman); and, the<br />

International Association of <strong>Crop</strong> Insurers.<br />

Ben was also very active in his community,<br />

serving on several boards for local<br />

hospitals, churches and other educational<br />

institutions.<br />

and Hail. He is a proven leader within the<br />

agricultural insurance world and had<br />

served as Chairman of both <strong>National</strong> <strong>Crop</strong><br />

<strong>Insurance</strong> <strong>Services</strong> (NCIS) and American<br />

Association of <strong>Crop</strong> Insurers (AACI).<br />

Steve’s personal life is full of interests,<br />

activities and friends, but his greatest joy<br />

and accomplishment is his family. Steve<br />

and his wife, Diane, have four daughters<br />

and one son. He enjoys time with his<br />

grandchildren as well as hunting and fishing.<br />

We wish Steve all the best in his retirement<br />

and we thank him for his years of<br />

service and many contributions to the crop<br />

insurance industry.<br />

Ben and his wife, Connie, have three<br />

children; Benson, Brandon and Jessica. We<br />

wish Ben all the best in his retirement and<br />

we thank him for his years of service and<br />

many contributions to the crop insurance<br />

industry.<br />

20 FEBRUARY <strong>2012</strong>

ADM <strong>Crop</strong> Risk <strong>Services</strong><br />

Give your customers and prospects what they want.<br />

connect<br />

1902<br />

Give them ADM <strong>Crop</strong> Risk <strong>Services</strong>.<br />

Your customers and prospects want more than crop insurance.<br />

They want industry-leading customer service.<br />

Whether it’s our rapid response time or the ability to quickly and<br />

accurately process claims, ADM can help you provide your crop<br />

insurance clients with exceptional customer service. The type of<br />

proactive service that helps them better manage their bottom line.<br />

It’s just one of the many ways ADM <strong>Crop</strong> Risk <strong>Services</strong> can help make<br />

you a preferred resource for crop coverage—and so much more.<br />

To learn more about the benefi ts of becoming an ADM <strong>Crop</strong> Risk<br />

<strong>Services</strong> agent, visit admcrs.com.<br />

For customers around the world, ADM draws on its resources—its people, products, and market<br />

perspective—to help them meet today’s consumer demands and envision tomorrow’s needs.<br />

888-5ADMCRS | www.admcrs.com<br />

© <strong>2012</strong> Archer Daniels Midland Company ADM <strong>Crop</strong> Risk <strong>Services</strong><br />

ADM <strong>Crop</strong> Risk <strong>Services</strong> is an equal opportunity provider. The products and services described here are written by ADM <strong>Insurance</strong> Company or American Alternative <strong>Insurance</strong> Corporation, both of which are reinsured to Agrinational<br />

<strong>Insurance</strong>. The insurance products described here are subject to availability and qualifications. Other terms, conditions, and exclusions may apply. ADM <strong>Insurance</strong> Company and American Alternative <strong>Insurance</strong> Corporation are not<br />

licensed in all states. Not all products are available in all states. This does not constitute an offer of any product in any jurisdiction.

TODAYOBITUARIES<br />

In Memory<br />

Patrick “Pete” Flanagan, 69, passed away<br />

at his home in Fort Benton, MT, on<br />

December 27, 2011, after a long battle with<br />

cancer.<br />

Pat was born December 30, 1941 in<br />

Forsyth, Montana to Pat and Edna<br />

Flanagan. He grew up on a farm with two<br />

older sisters, Patricia (Trick) Groombridge<br />

and Margaret (Muzz) Noctor. He was a first<br />

generation Irishman who embraced his heritage,<br />

including a trip to his father’s homestead<br />

in Ireland. Pat graduated from Forsyth<br />

High School as an outstanding athlete and<br />

forever friend. He went to school at NMC<br />

and EMC on athletic scholarships and graduated<br />

with a History/Coaching degree. His<br />

first job took him to Willow Creek, where<br />

he met and married Walleyne Murphy on<br />

December 27, 1966.<br />

Together the Flanagans taught and<br />

coached at Willow Creek, Hysham, Stanford<br />

and Fort Benton where they made their<br />

home. After getting his Master’s degree at<br />

MSU, Pat touched the lives of many as a<br />

school counselor and psychologist. He<br />

especially enjoyed the company of his<br />

teaching colleagues and later his students<br />

and players as friends. Pat was a wellloved<br />

teacher, coach, counselor and friend.<br />

22 FEBRUARY <strong>2012</strong><br />

After retirement in 1992, Pete went to<br />

work as a crop insurance adjuster for<br />

Agro<strong>National</strong>. He loved his job and the<br />

people with whom he worked. He made<br />

many lasting friendships and was a highly<br />

respected adjuster. Pat learned the skills<br />

needed to adjust both crop-hail and MPCI<br />

claims, later becoming a valued claims<br />

supervisor based on his leadership abilities.<br />

“His commitment and passion for teaching,<br />

mentoring and helping people will be<br />

long remembered by those he touched,”<br />

said Kim Gibson, Agro Branch Manager and<br />

Vice President, NAU Country. “Pat was a<br />

great example of ‘you get what you give’<br />

and he gave us all so much; he will be greatly<br />

missed.”<br />

Pat became very active in NCIS regional/state<br />

committee functions in 1997 and<br />

served as Chairman of the Montana<br />

Regional/State Committee in 2004-2005. He<br />

always devoted time and effort for these<br />

committee activities and felt that by working<br />

with the industry as a whole we were all<br />

better served than putting yourself or individual<br />

company ahead of the industry.<br />

“Pat demonstrated time and again that<br />

he was very committed to seeing that the<br />

Montana Committee remains viable and<br />

strong,” said Dean Strasser, NCIS and staff<br />

liaison to the Montana Regional/State<br />

Committee. “He placed a high value on<br />

attendance at the Committee’s regularly<br />

scheduled meetings and loss adjuster<br />

schools. Hardly a meeting went by that his<br />

name was not mentioned because he volunteered<br />

to take on a task or report on an<br />

issue.”<br />

Pat, an avid sports fan, was a lifelong<br />

Dodger supporter. He and his son were on<br />

a quest to visit ballparks and scored eight.<br />

He enjoyed skiing, fishing and hunting and<br />

bagged a 6 by 7 bull on opening day this<br />

fall. Pat was a wonderful “builder;” building<br />

a home, a cabin, a redwood canoe, a<br />

gazebo and a lifetime of memories and<br />

friendships.<br />

Time spent with his children Casey,<br />

Bridget, grandchildren Killian 16, Will 14,<br />

Connor 10 and many friends were deeply<br />

cherished and will be greatly missed.<br />

Friendship, loyalty, laughter and love were<br />

the gifts Pat gave and continues to give.<br />

As his best buddy Connor said, “He had a<br />

good run.”<br />

A Celebration of Life was held December<br />

30, 2011 on Pat’s 70th birthday. The family<br />

suggests gifts to local charities: Chouteau<br />

County Cancer Support Group, PO Box 674;<br />

The Dedman Foundation, PO Box 1282; or,<br />

ICC Restoration, PO Box 849, all of Fort<br />

Benton Montana 59442.

TODAYOBITUARIES<br />

In Memory<br />

Patrick “Pete” Flanagan, 69, passed away<br />

at his home in Fort Benton, MT, on<br />

December 27, 2011, after a long battle with<br />

cancer.<br />

Pat was born December 30, 1941 in<br />

Forsyth, Montana to Pat and Edna<br />

Flanagan. He grew up on a farm with two<br />

older sisters, Patricia (Trick) Groombridge<br />

and Margaret (Muzz) Noctor. He was a first<br />

generation Irishman who embraced his heritage,<br />

including a trip to his father’s homestead<br />

in Ireland. Pat graduated from Forsyth<br />

High School as an outstanding athlete and<br />

forever friend. He went to school at NMC<br />

and EMC on athletic scholarships and graduated<br />

with a History/Coaching degree. His<br />

first job took him to Willow Creek, where<br />

he met and married Walleyne Murphy on<br />

December 27, 1966.<br />

Together the Flanagans taught and<br />

coached at Willow Creek, Hysham, Stanford<br />

and Fort Benton where they made their<br />

home. After getting his Master’s degree at<br />

MSU, Pat touched the lives of many as a<br />

school counselor and psychologist. He<br />

especially enjoyed the company of his<br />

teaching colleagues and later his students<br />

and players as friends. Pat was a wellloved<br />

teacher, coach, counselor and friend.<br />

22 FEBRUARY <strong>2012</strong><br />

After retirement in 1992, Pete went to<br />

work as a crop insurance adjuster for<br />

Agro<strong>National</strong>. He loved his job and the<br />

people with whom he worked. He made<br />

many lasting friendships and was a highly<br />

respected adjuster. Pat learned the skills<br />

needed to adjust both crop-hail and MPCI<br />

claims, later becoming a valued claims<br />

supervisor based on his leadership abilities.<br />

“His commitment and passion for teaching,<br />

mentoring and helping people will be<br />

long remembered by those he touched,”<br />

said Kim Gibson, Agro Branch Manager and<br />

Vice President, NAU Country. “Pat was a<br />

great example of ‘you get what you give’<br />

and he gave us all so much; he will be greatly<br />

missed.”<br />

Pat became very active in NCIS regional/state<br />

committee functions in 1997 and<br />

served as Chairman of the Montana<br />

Regional/State Committee in 2004-2005. He<br />

always devoted time and effort for these<br />

committee activities and felt that by working<br />

with the industry as a whole we were all<br />

better served than putting yourself or individual<br />

company ahead of the industry.<br />

“Pat demonstrated time and again that<br />

he was very committed to seeing that the<br />

Montana Committee remains viable and<br />

strong,” said Dean Strasser, NCIS and staff<br />

liaison to the Montana Regional/State<br />

Committee. “He placed a high value on<br />

attendance at the Committee’s regularly<br />

scheduled meetings and loss adjuster<br />

schools. Hardly a meeting went by that his<br />

name was not mentioned because he volunteered<br />

to take on a task or report on an<br />

issue.”<br />

Pat, an avid sports fan, was a lifelong<br />

Dodger supporter. He and his son were on<br />

a quest to visit ballparks and scored eight.<br />

He enjoyed skiing, fishing and hunting and<br />

bagged a 6 by 7 bull on opening day this<br />

fall. Pat was a wonderful “builder;” building<br />

a home, a cabin, a redwood canoe, a<br />

gazebo and a lifetime of memories and<br />

friendships.<br />

Time spent with his children Casey,<br />

Bridget, grandchildren Killian 16, Will 14,<br />

Connor 10 and many friends were deeply<br />

cherished and will be greatly missed.<br />

Friendship, loyalty, laughter and love were<br />

the gifts Pat gave and continues to give.<br />

As his best buddy Connor said, “He had a<br />

good run.”<br />

A Celebration of Life was held December<br />

30, 2011 on Pat’s 70th birthday. The family<br />

suggests gifts to local charities: Chouteau<br />

County Cancer Support Group, PO Box 674;<br />

The Dedman Foundation, PO Box 1282; or,<br />

ICC Restoration, PO Box 849, all of Fort<br />

Benton Montana 59442.

TODAYOBITUARIES<br />

In Memory<br />

Marx M. Mannberger, long-time NCIS<br />

employee, passed away on December 24,<br />

2011, at the age of 83.<br />

Marx began his career with the <strong>Crop</strong><br />

Hail <strong>Insurance</strong> Actuarial Association<br />

(CHIAA) in 1956 and retired from NCIS in<br />

1998. During his tenure with NCIS he held<br />

several positions, including assistant to the<br />

director of data processing; data processing<br />

customer support; data processing<br />

administrator; and, vice president of data<br />

processing.<br />

Marx is survived by his daughter,<br />

Melanie Cravens of Dresden, TN; one son,<br />

Mike Mannberger of Greenfield, TN; three<br />

grandchildren; and, three great-grandchildren.<br />

He was preceded in death by his<br />

daughter, Melia Mannberger.<br />

INDUSTRY<br />

NCISAWARDS<br />

Under the direction of its Board of<br />

Directors, <strong>National</strong> <strong>Crop</strong> <strong>Insurance</strong><br />

<strong>Services</strong> has developed two national<br />

awards to be given to individuals who<br />

achieve excellence in the criteria set out by<br />

the awards.<br />

The first award is the Outstanding<br />

Service Award. This award, primarily for<br />

agents, has actually been in existence since<br />

2001 and has been awarded to several<br />

excellent individuals. The purpose of this<br />

award is to promote exceptional service<br />

industry-wide, and encourage outstanding<br />

outreach efforts to all farmers, especially<br />

limited-resource farmers, by highlighting<br />

an individual who has demonstrated<br />

exceptional service.<br />

The newest award established is the<br />

Industry Leadership Award. This award,<br />

targeted primarily to members of the NCIS<br />

regional/state crop insurance committees,<br />

was created to formally recognize individuals<br />

who are directly involved in the crop<br />

insurance industry and who consistently<br />

serve the industry by providing outstanding<br />

leadership. Company employees at both<br />

the field and management level are eligible<br />

to be nominated.<br />

The criteria for both awards are:<br />

1. Strong personal and business ethics.<br />

2. Demonstrated service above and<br />

beyond to the crop insurance industry.<br />

3. Represents themselves, their company,<br />

and the crop insurance industry well.<br />